PayTo - BETA

PayTo is currently available in beta testing program. Please reach out to your Airwallex Account Manager or [email protected] if you would like to join the beta.

Collect instant Direct Debit payments with PayTo

PayTo is a real-time Direct Debit payment method in Australia, designed for both one-time and recurring payments. To collect with PayTo, you first present a payment agreement for your customer to authorize in their banking app.

As an alternative to BECS Direct Debit, PayTo allows you to collect high-value payments with low chargeback risk and receive instant payment confirmation.

Payment method properties

| Payment method type | Direct debit |

|---|---|

| Available for businesses registered in | AU |

| Activation time for onboarding | Instant to T+7 (may vary based on your business profile) |

| Shopper regions (typically used by payers from) | AU |

| Processing currencies | AUD |

| Settlement currencies | AUD |

| Settlement schedule | T+0 |

| Minimum transaction amount | 5 AUD |

| Maximum transaction amount | 10Mn AUD |

| Session timeout | NA |

| Recurring payment | |

| Refunds | |

| Partial Refunds | |

| Disputes (chargebacks) | |

| Descriptor (what the payer will see in their transaction history) | Your registered business name. |

| Payments for Platforms support |

Choose the integration method that best suits your needs

Airwallex has built a range of client-side integration methods that allow you to manage your UI, minimize your implementation effort, and allow you to get to market quickly.

| Online payments via your own website/app | Online payments via ecommerce plugins | Payment links & Invoice Integrations |

|---|---|---|

| Hosted Payment Page Drop-in Element Embedded Elements Mobile SDK Native API Subscription APIs | Shopify WooCommerce SHOPLINE Shoplazza Magento | Payment Links Xero Invoice |

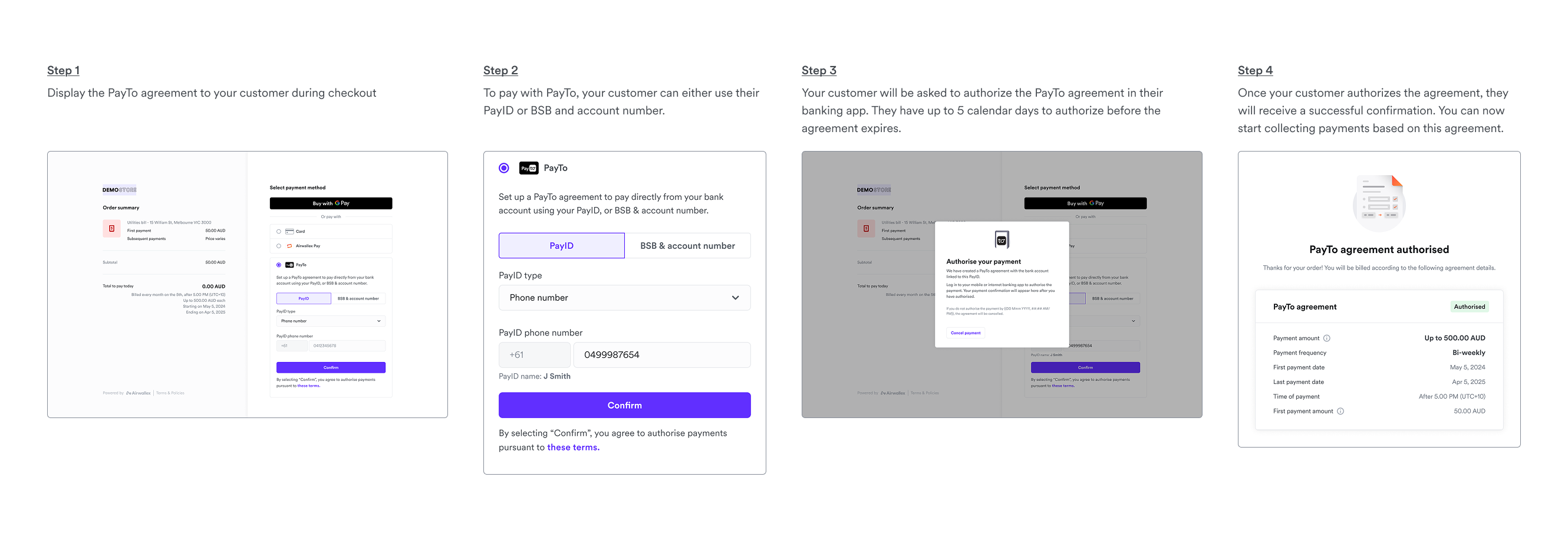

How PayTo works

Step 1. Display the PayTo agreement during checkout

PayTo has specific agreement terms. We recommend getting familiar with these terms, as they will affect whether an agreement can be formed and how payments are collected.

Learn more about PayTo agreement terms here.

Step 2. Customer confirms their PayID account

Your customer will be asked to confirm their PayID name. If they choose to pay via BSB & Account number, we will validate whether their bank supports PayTo.

Step 3. Customer authorizes the agreement in their banking app

Customers will receive a request from their bank to authorize the PayTo agreement. This request may appear as a push notification or email.

By default, your customers have up to 5 calendar days to authorize the agreement before it expires. Please contact your Account Manager if you would like to customize this timeframe (maximum: 5 calendar days).

Step 4. Agreement is confirmed, and payments can begin

Once your customer authorizes the agreement, they will receive a confirmation. You can then begin collecting payments based on this agreement.

PayTo agreement terms

Defining payment terms in a PayTo agreement

PayTo agreements are primarily defined by the payment schedule and payment amount type. To create a payment agreement, you must specify the agreement terms as outlined in the Payment Consent API’s terms of use.

If you do not specify any terms, the agreement will be treated as a one-off payment. Your customer will still need to authorize the agreement, but it cannot be reused for future payments.

Payment schedule

| Usage | Terms | Description |

|---|---|---|

| Key terms | Merchant trigger reason | You can choose either:

|

Payment schedule.period_unit | Required when | |

Payment schedule.period | Required when

| |

| Optional terms | First payment date | The earliest date a payment can be requested. Payments before this date are not allowed. |

Last payment date | The last date a payment can be requested. Payments after this date are not allowed. | |

Total billing cycles | The total number of payments allowed for this agreement. | |

Billing cycle charge date | The specific day of the month when payments are allowed. |

Payment amount

| Usage | Terms | Description |

|---|---|---|

| Key terms | Payment amount type | This term must be either:

|

Payment amount | This depends on the

| |

Max payment amount | The maximum amount that can be charged for a single payment. | |

| Optional terms | First payment amount | The fixed amount for the first payment only. It will not apply to other payments (e.g. one-time registration fee). |

PayTo Agreement Validation

Some banks apply additional controls to protect their customers. As a result, your PayTo agreement may be automatically declined by the customer’s bank, sometimes without the customer being notified.

| Institution | Controls |

|---|---|

| ANZ | Rejects any agreement with a value over $25,000 AUD |

| Westpac | Rejects any agreement with a value over $25,000 AUD |

| CBA | Rejects any agreement that does not specify a maximum payment amount |

The list is not an exhaustive list of controls. Banks may not disclose their fraud controls to ensure their effectiveness. As a result, we recommend that you:

- Always set a maximum limit, ideally below $25,000 AUD.

- Define a fixed payment schedule if possible.

Managing authorized PayTo agreements

Cancel an authorized agreement

Both you and your customers can cancel an authorized PayTo agreement at any time. Once an agreement is canceled, you will receive a notification.

You will not be able to collect any further payments under a canceled agreement. To resume collecting payments from the same customer, you must create a new agreement.

Edit an authorized agreement terms

Editing an active PayTo agreement is currently not supported. If you need to make changes (e.g. update the payment limit or frequency), you must first cancel the existing agreement and then create a new one with the updated terms.