Gain access to shoppers on Klarna

Klarna is a popular Buy Now Pay Later payment method available in more than 20 countries. With Klarna, the shopper can choose to:

- Pay now: Pay the whole amount instantly by card, direct debit, or other funding sources.

- Pay later: Pay after the goods have been delivered, e.g., in 30 days.

- Pay in parts: Pay in several (3 or 4) installments over time.

- Financing: Term loans provided by Klarna.

Before approving the payment, Klarna performs risk checks on the shopper.

Payment method properties

| Features | Klarna |

|---|---|

| Payment type | Buy Now Pay Later |

| Available for businesses registered in | AU, HK, SG, EEA, CH, UK, US, NZ |

| Activation time for onboarding | 2-7 business days |

| Shopper regions (typically used by payers from) | AT, BE, FI, FR, DE, GR, IE, IT, NL, PT, ES, DK, NO, PL, SE, CH, GB, CZ, US, CA, AU |

| Processing currencies | Dependent on the shopper region: AT, BE, FI, FR, DE, GR, IE, IT, NL, PT, ES: EUR DK: DKK NO: NOK PL: PLN SE: SEK CH: CHF GB: GBP CZ: CZK US: USD CA: CAD AU: AUD NZ:NZD |

| Settlement currencies | Payments will be settled like-for-like, or in your default settlement currency if your account does not support settling the processing currency. |

| Settlement schedule | 8 business days from payment capture |

| Session timeout | 30 min |

| Recurring Payment | See the integration guide for details |

| Refunds | within 180 days |

| Partial Refunds | within 180 days |

| Disputes (chargebacks) | within 180 days |

| Placing a hold (delayed/manual capture) | up to 28 days |

| Descriptor (what the payer will see in their transaction history) | Your registered business name |

Choose the integration method that best suits your needs

Airwallex has built a range of integration methods that allow you to choose the one best suited for your business. Get started with minimal integration effort or customize the payment flow to your needs.

| Online payments via your own website/app | Online payments via ecommerce plugins | Payment links & Invoice Integrations |

|---|---|---|

| Hosted Payment Page Drop-in Element Embedded Elements Mobile SDK Native API Subscription APIs | Shopify WooCommerce SHOPLINE Shoplazza Magento | Payment Links Xero Invoice |

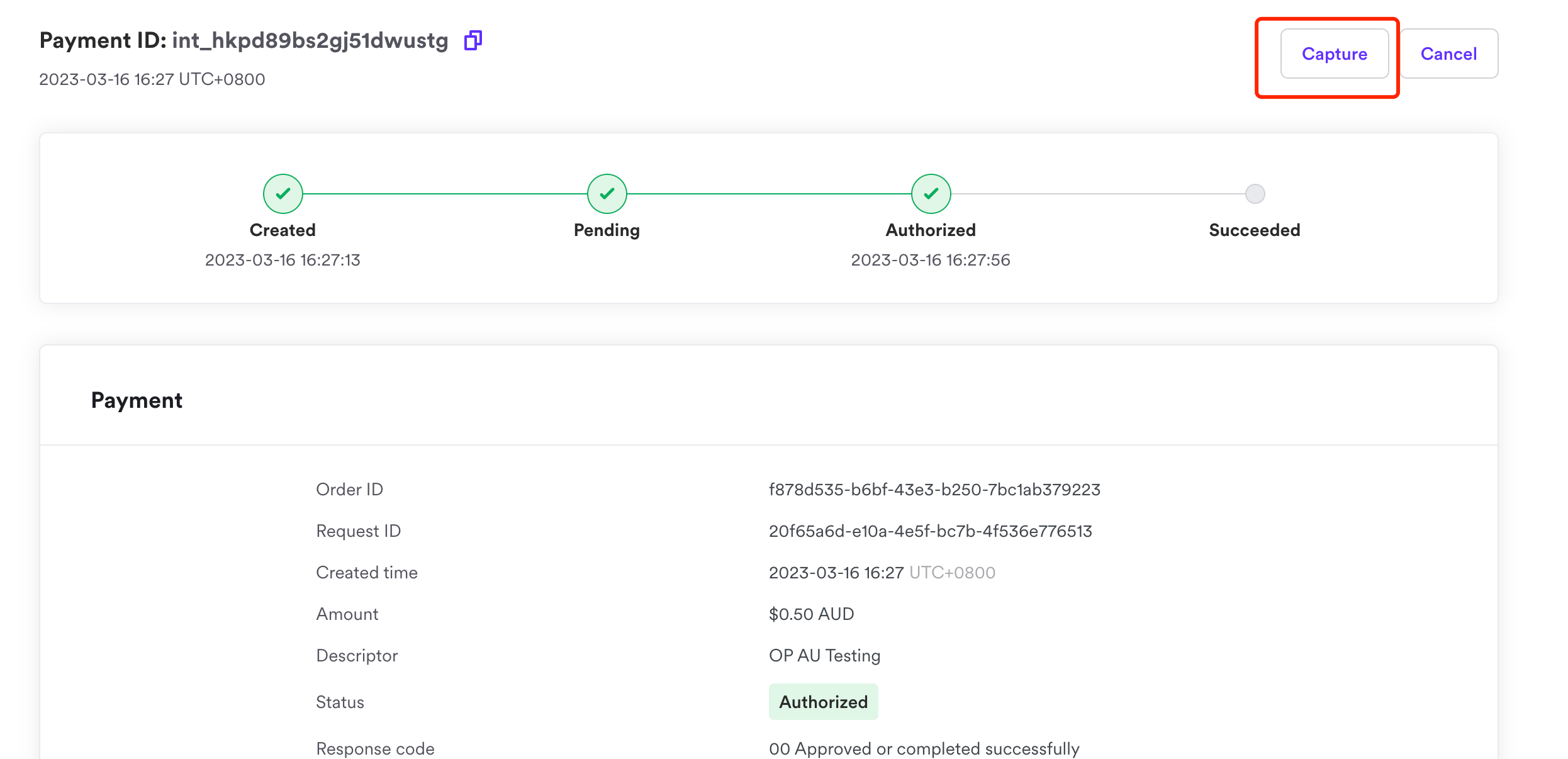

Capture Klarna payments and update shipping information

After you ship the goods and services to your customers, you must manually capture Klarna payments within 28 days after authorization. You can do this through Webapp or API call. If the manual capture is not performed within 28 days, the authorization will expire.

If you are using Shopify plugin, manual capture is configured on Shopify store level that will apply to Klarna and all other payment methods. After configuration, manual capture should be initiated on your Shopify admin page. Please refer to the Shopify documentation on manual capture .

You are also strongly recommended to share shipping information after the order is fulfilled. The shopper can track their order in the Klarna app and is less likely to raise disputes. See the integration guide for more details and instructions.

Manage Klarna disputes

A customer can raise a dispute within 180 days of the original transaction. The best way to resolve the dispute is to communicate directly with your customer to try and solve the issue together. If you can’t reach a solution, then Klarna would step in to help solve the dispute. See Klarna’s dispute flow for more details and instructions on handling Klarna disputes.

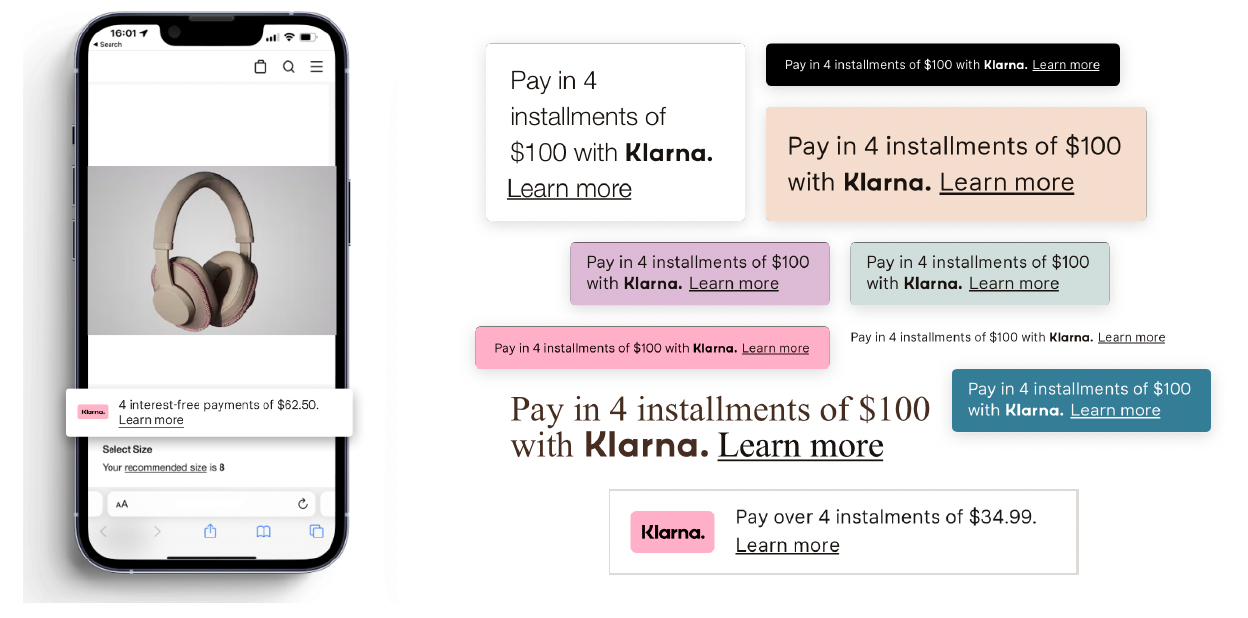

Utilize Klarna On-Site Messaging (OSM)

OSM is a customized promotional information tool. After integrating Klarna OSM into your website or mobile app, shoppers can find Klarna's flexible payment options at checkout. OSM is a great way to inform shoppers about these payment benefits in advance.

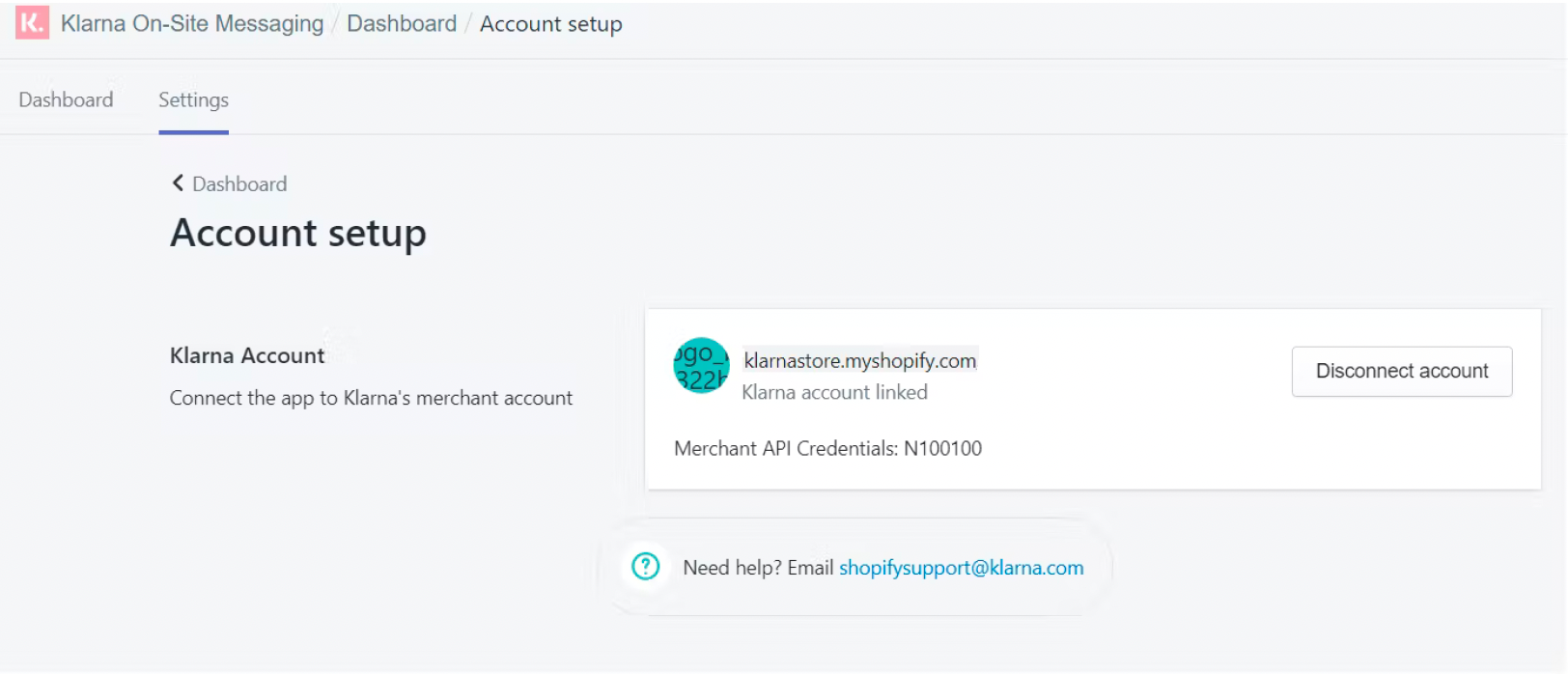

To enable OSM on your website or mobile app, if you are a Shopify merchant, the Klarna OSM app is available on the Shopify App Store . Please contact your Airwallex account manager or [email protected] for your merchant id, and connect it to your Shopify app.

If you are an API merchant, please contact your Airwallex account manager or [email protected] to access your installation snippet. Add the snippet in your website's source code, preferably right after the opening <body> tag.

1<!DOCTYPE html>2<html>3 <head>4 <title>My store</title>5 </head>6 <body>7 <script8 async9 data-environment="production"10 src="https://js.klarna.com/web-sdk/v1/klarna.js"11 data-client-id="{{your-data-client-id}}">12 </script>13 </body>14</html>

Insert placement code snippets where you want the messaging to appear. You can find all placement code snippets and their styles via Klarna Docs - Placements . Optionally, you can customize OSM placement styles following Klarna’s instructions: Klarna Docs - Customize placements with CSS .