Employer of Record (EOR) Aggregator payouts

Let's imagine a fictitious platform named PayrollOS. One of their customers is BizCo and BizCo's finance employees need to use the PayrollOS platform.

| Platform | PayrollOS, a platform offering payroll payouts for their local partners, who are the Employer Of Record (EOR) for employees. |

| Customer | A company who uses PayrollOS to process payroll for employees. Example customers featured in this guide include BizCo and MarCo. |

| In-Country Partner | The local partner that PayrollOS uses to employ and pay employees in different countries. |

Specific requirements may apply based on the jurisdictions to which you want to deliver services. Always speak to a member of the Airwallex team if you are considering implementing our Global Treasury solution.

Funds flow

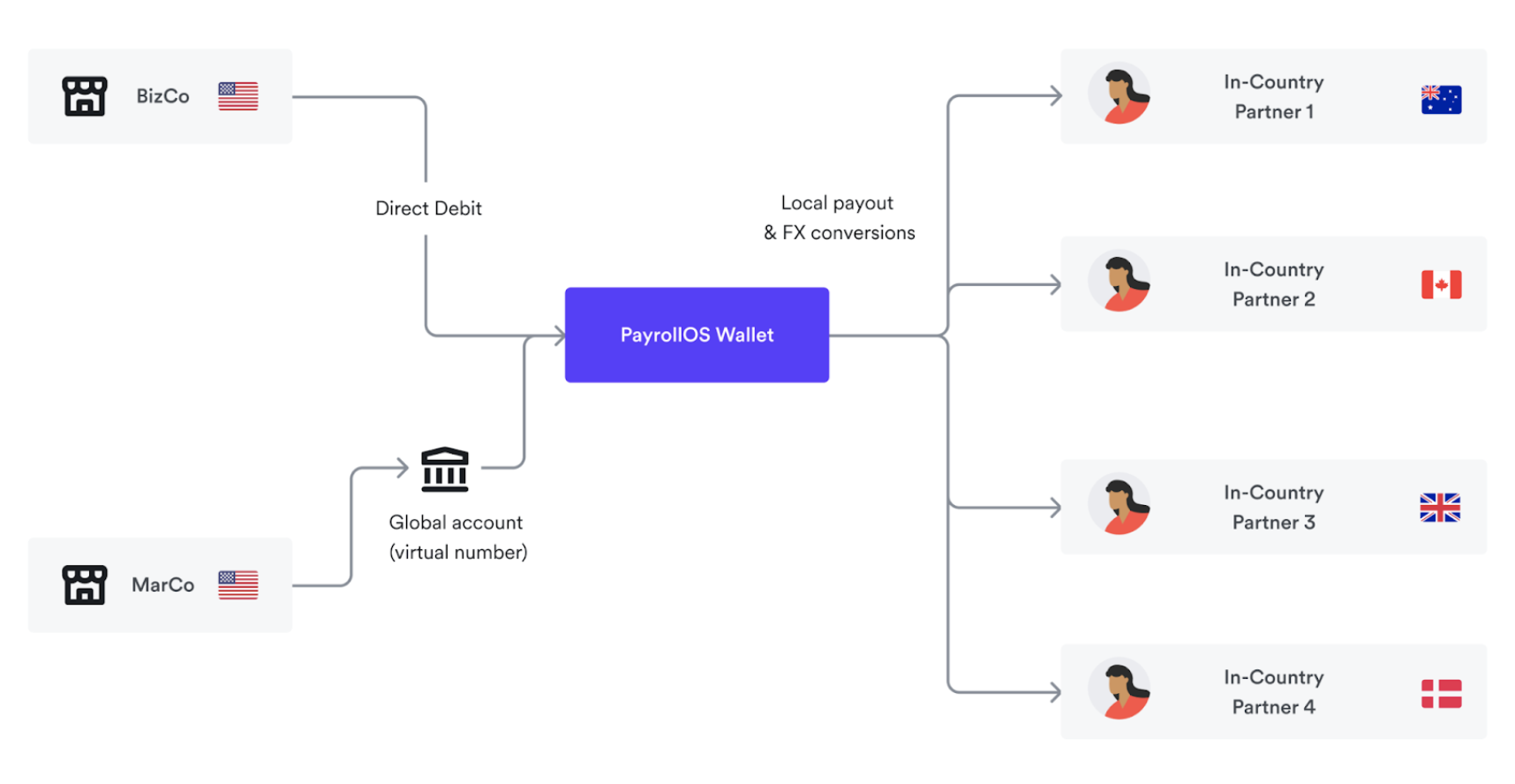

The diagram below shows the funds flow for a platform looking to integrate with Airwallex's Global Treasury solution for EOR Aggregator payouts.

The steps in the flow of funds are described in more detail below. Note that you can potentially initiate multiple operations at the same time - our teams will help you understand the options available in more detail.

Fund the Wallet

The platform Wallet needs to be funded in order to power payroll payouts and/or tax payouts. This can be done through a number of different methods:

- Global Accounts and bank transfer: PayrollOS can create unique virtual account numbers over API for each currency their customers operate in. These virtual account numbers enable funds to be received into their platform Wallet from a number of sources:

- External bank accounts owned by the platform

- External bank accounts owned by customers (e.g. BizCo), if the platform has instructed its customers to send repayments to the Airwallex Global Accounts.

There are no limits to how often the platform can fund the Wallet in this way.

- Direct debit as a payment method: PayrollOS can collect repayments from its customers through Airwallex Online Payments functionality as part of a managed checkout flow. Only one direct debit can be triggered per day per external customer, e.g., only one direct debit a day pulling from BizCo's external bank account. For more information on this payment method, please contact your Airwallex Account Manager.

Convert funds and manage FX risk [Optional]

If funds need to be paid to employees in a different currency to the funds held in the Wallet, BizCo can specify a source currency in the Wallet to be converted. This allows for payroll payouts to be made in more than 50 currencies globally.

- FX rate transparency: We recommend that platforms bill their customers based on the final FX rates achieved. To accommodate fluctuations in FX rates, platforms can collect a buffer (such as a deposit or larger direct debit) from companies to prevent disruptions in the payroll process. Airwallex will be implementing ongoing enhancements to streamline the orchestration of FX conversions within a payroll workflow.

- Monetization: Airwallex's application fees feature can enable platforms to tap into flexible monetization models for cross-border money movements, for example, marking up FX conversions.

Process payouts

In this integration model where payroll payouts are funded upfront by the platform (PayrollOS), funds will move from PayrollOS's Wallet to the external bank accounts of the in-country partners, over Airwallex's payout rails.

- Payouts: Trigger payouts to employees using Airwallex's Payout APIs. Airwallex's network of local clearing systems supports payouts to employees in multiple countries and currencies, with country-specific delivery time taken into consideration to ensure the payouts arrive in employees' bank accounts on the payroll day.

- Batch payouts: This feature may be used to trigger multiple payroll payouts across currencies and countries as one instruction. Batch payouts can also be funded via Direct Debit.

- Beneficiaries: Airwallex offers the possibility to optionally save beneficiaries for future reference. Beneficiaries should be saved as soon as the details become available, to facilitate name screening.