New at Airwallex: July Edition

Airwallex Editorial Team

This month, we’re helping you get more from your capital and streamline spend management with Airwallex Yield in Singapore and the launch of Purchase Orders. You’ll also find expanded account coverage in Asia, improved payment insights, and greater control across cards and onboarding. Here’s what’s new:

Business Accounts

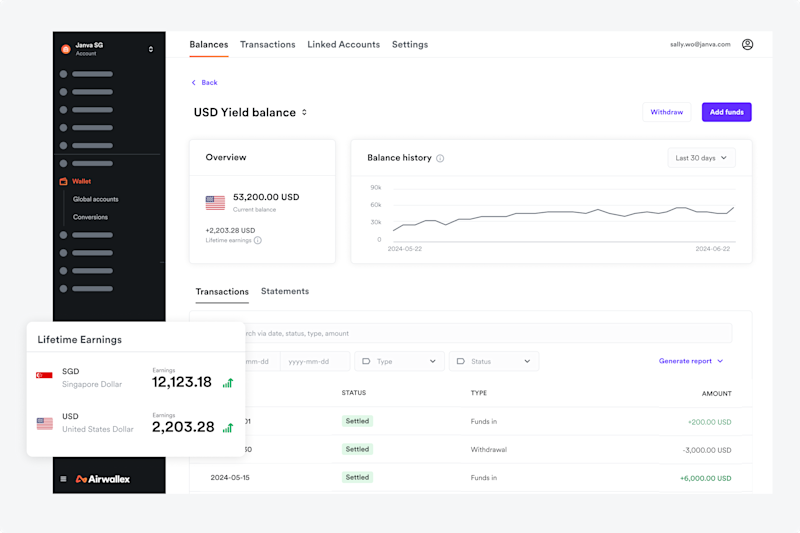

Early accessYield now available for businesses in Singapore

Airwallex Yield (offered by Airwallex Capital) is now available for select business in Singapore. Eligible customers can earn up to 1.39% on SGD and 3.81% on USD* by investing surplus funds in highly rated money market funds. With no lock-up periods and full liquidity, you can move funds between cash and Yield accounts at any time. Learn more here.

*Indicative rate is based on the historical annualised rate of the underlying funds as of 8 August 2025, net of Airwallex fees.

Expand your reach in Asia with Philippines PHP Global Accounts

Airwallex customers across all regions can now create Global Accounts in the Philippines with local banking details. This will allow customers to receive Philippine Pesos (PHP) via local transfer methods such as InstaPay and PESONet.

Additional releases:

Improved validation with Airwallex Pay: Airwallex Pay allows for instant and low-cost transfers between Airwallex customers, and now it’s even easier for businesses with non-English registered business names. When making a transfer, customers can now enter either name in the recipient form.

Accelerated multi-entity onboarding: Save time onboarding global entities with our new consolidated workflow. Instead of repeating business details for each region, you can now onboard multiple entities in one application flow. This update simplifies setup for customers launching in multiple markets or managing sub-brands.

Spend

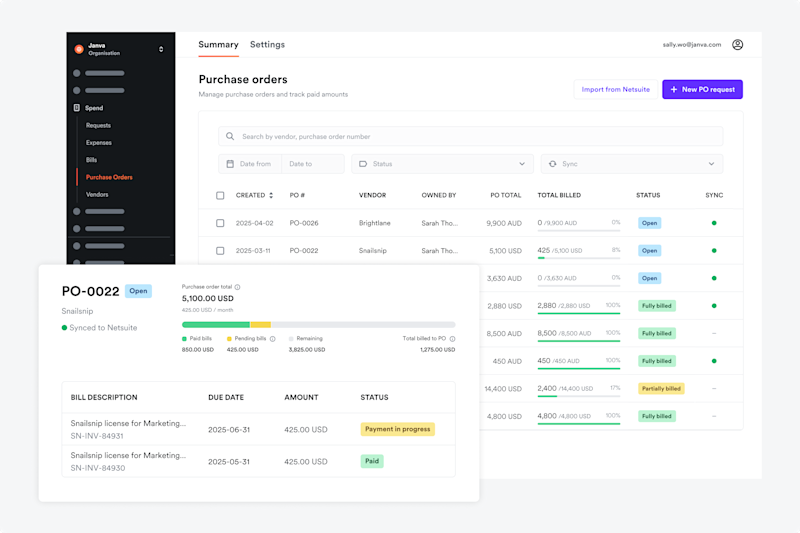

Track and control spend before it happens with Purchase Orders

Airwallex Spend now includes Purchase Orders, bringing structure and automation to your purchasing process. Employees can submit purchase order requests, and once reviewed and approved, each request instantly generates a PO with configurable controls and AI-powered line-item matching. Purchase Orders integrates with Bill Pay to deliver a seamless procure-to-pay experience.

Automate expenses with AI receipt matching

When cardholders email receipts, our AI now automatically matches them to the right transaction. You can also set global forwarding rules to capture receipts across your team with less effort. That means less manual work for employees and faster review for finance.

Track card deliveries in real time

All Airwallex cards now ship with tracking by default. You can monitor delivery progress in the WebApp, giving both employees and admins real-time visibility. Delivery confirmation has also been added to improve operational clarity, cut down on unnecessary card reissues, and help prevent fraud. Learn more here.

Payments

Stronger fraud protection for your Shopify store

The new Shopify Fraud Prevention App is now live. You can now screen every transaction in real time using Airwallex’s advanced fraud detection engine powered by richer behavioural and device data. The app is free, installs in minutes, and works seamlessly with your checkout flow. Visit the Shopify app store to get started.

Gain deeper visibility with new payment status insights

We’ve introduced two new payment statuses to give you a clearer picture of why a payment didn’t succeed.

Blocked: The payment was stopped by Airwallex’s fraud engine

Incomplete: The shopper didn’t complete the payment or failed authentication

These new labels provide more actionable insight into what went wrong and where.

Platform APIs and Embedded Finance

New webhook for OAuth disconnections: Ecosystem partners can now subscribe to a new webhook event that triggers when an end customer disconnects their OAuth app. This gives partners real-time visibility into their customers’ connection statuses, helping them update their app UI and deliver a smoother user experience.

Spend limit notifications: A new webhook is now available to help reduce card declines by alerting customers when spend limits are nearly reached. These real-time notifications give teams the visibility needed to proactively adjust limits and prevent transaction failures. Learn more here.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

Disclaimer: This information doesn’t take into account your objectives, financial situation, or needs. If you are a customer of Airwallex Pty Ltd (AFSL No. 487221) read the Product Disclosure Statement (PDS) for the Direct Services available here.

View this article in another region:Canada - EnglishCanada - FrançaisChinaHong Kong SAR - EnglishHong Kong SAR - 繁體中文New ZealandUnited StatesGlobal

Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.