Key takeaways:

Batch transfers let you pay up to 1,000 recipients at once, across countries and currencies.

They streamline workflows, reduce errors, and save costs on FX and transaction fees.

Secure approval flows, validation, and compliance checks help protect your business.

Airwallex batch transfers offer access to local rails in 150+ countries and competitive FX.

Managing international payroll, supplier invoices, and contractor fees can drain time and resources. Airwallex batch transfers give finance teams a single, streamlined workflow to send up to 1,000 payments worldwide with speed, accuracy, and full visibility.

What is a batch transfer?

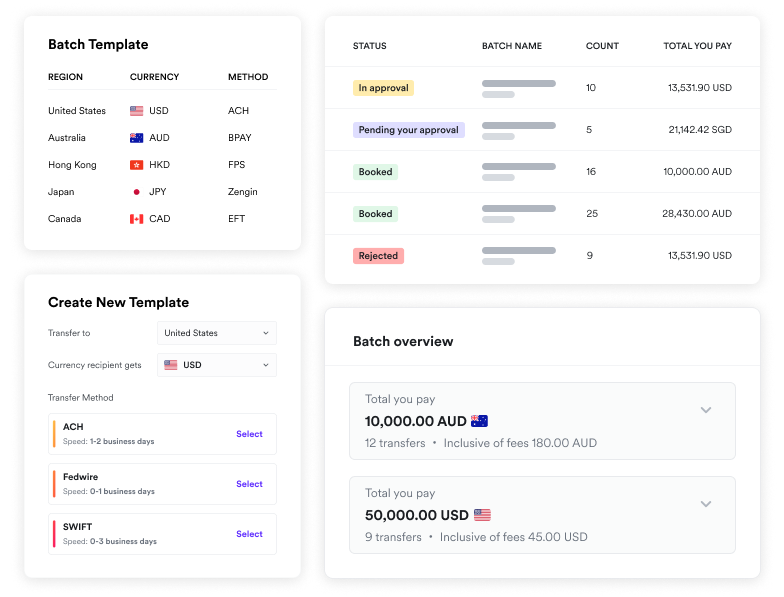

A batch transfer lets you send multiple payments at once across countries and currencies with a single upload, template, or API. Instead of creating transfers one by one, finance teams pull all the details into one file and send them together. The process includes built-in validation, FX handling, and approval flows, and supports up to 1,000 recipients in one go. Depending on the corridor, payments travel via local rails or the SWIFT network.

How do batch transfers work?

To complete a batch transfer through a platform like Airwallex, businesses typically follow these steps:

Prepare your payment file: Collect recipient banking details, currencies, and amounts in a template or export them from your ERP or payroll system.

Upload or integrate via API: Submit the file into your payments platform.

Validate details: The system checks for errors before release, flagging issues like invalid account numbers.

Approve: Apply multi-layer approval workflows based on your company policy before sending the batch.

Execute payments: Funds move via local rails or SWIFT. You can choose to fix the payment in the sender’s currency or the recipient’s.

Banks and financial institutions receive your instructions in a file and process them either on the same day or a future date, depending on what you request. For AUD payments, many businesses use ABA batch files under the BECS standard, and BPAY batch payments also apply domestically.

The Reserve Bank of Australia1 must approve all batch administrators before they process these transactions. Same‑day transfers to overseas recipients may face cut‑off times, sometimes as early as 11:00 am depending on the bank.

The challenges of paying out multiple recipients

Challenges of paying out to multiple recipients across the world include:

Challenges of paying out to multiple recipients across the world include:

Tedious processes: Keeping track of a large number of recipients’ payment amounts, banking details, and currencies, and transferring the information accurately to a banking portal can be a very laborious and error-prone process.

Inaccurate transfer amounts: Due to FX fluctuations and banking fees, the final amount a recipient receives can be less than originally agreed, causing dissatisfaction and requiring additional communication to amend mistakes.

Bounced or missed payments: When there are a large number of payments, it’s hard to stay on top of each individual one. A payer may only realise that a payment did not succeed after receiving a recipient’s complaint, and will then have to spend hours to retrace where the payment failed.

High, intransparent costs: With many destinations and currencies involved, having full visibility into FX rates and transfer costs across multiple payments is difficult to track.

Airwallex’s Batch Transfers feature is built to overcome these challenges, helping businesses and their finance teams simplify payment processes and save on cost.

What are the benefits of batch transfers for businesses?

Batch payments give growing companies clear advantages:

Efficiency: Consolidate hundreds of payments into one workflow, save time, and reduce repetitive data entry.

Error prevention: Validation systems flag incorrect details before execution, lowering the risk of failed transfers.

Accurate FX outcomes: Select “currency you pay” or “currency recipient gets” to guarantee exact landed amounts, with conversions and fees handled automatically.

Faster settlement: Use local payment rails where available for same-day arrival. SWIFT acts as a fallback where local rails aren’t available.

Security and governance: Apply role-based access and multi-layer approvals to meet internal controls.

How secure are batch transfers?

Batch transfers include multiple layers of protection at every stage:

Approval workflows: Set up multi-layer approvals so authorised reviewers sign off before releasing high-value batches.

Pre-execution validation: Spot errors before you send payments to reduce failed or misdirected transfers.

Regulated rails: Send payments through trusted networks like BECS/NPP domestically and SWIFT internationally, all under strict regulatory oversight.

Compliance and screening: Transactions go through AML/CTF checks across corridors.

Real-time status updates: Get instant notifications that keep your team informed without exposing sensitive data.

Tip: Use approval workflows mapped to payment value thresholds and separate duties to minimise risk for high-value batches.

How to do a batch payment with Airwallex

Airwallex makes it easy to send multiple payments in one go. Here’s how:

Download the template: Select payment destinations, currencies, and methods. The file shows all required fields.

Fill in details: Add payment data from your ERP, HR, or payroll system. Copy and paste in bulk or match columns with a VLOOKUP to reduce errors.

Upload and validate: Import the file into Airwallex. The system checks every field and flags issues before you submit.

Use ABA files for AUD: For domestic payouts in Australia, upload an ABA file exported directly from your ERP or payroll system. Support for SEPA, Bacs, and Giro files is coming soon.

Approve and send: Set multi-layer approval flows for added security. Payments only release after reviewers sign off.

You can find a more detailed step-by-step guide on how to do a batch transfer in our Help section.

Why choose Airwallex for transfers?

Airwallex batch transfers simplify global payouts by replacing slow, manual tasks with a single, streamlined workflow. Finance teams can upload one file, approve, and send up to 1,000 payments worldwide in minutes. No missed amounts, no hidden costs, and no chasing failed transfers.

With Airwallex you:

Pay multiple recipients at once

Consolidate global payroll, supplier invoices, and contractor fees into a single file. Upload Excel or ABA files for AUD payouts, with SEPA, Bacs, and Giro support rolling out.

Control FX outcomes

Choose how you pay and what recipients receive. Airwallex calculates conversions and applies fees upfront, so you stay in control of every landed amount.

Move money faster

Use local rails in 120+ countries to cut transfer times. 95% of funds land within hours or the same day*, backed by competitive FX rates.

Stay on top of payments

Get instant validation, real-time notifications, and approval flows that keep payroll and vendor payments on track.

Airwallex batch transfers give you speed, accuracy, and confidence to scale payments globally.

Get started with Batch Transfers today

Cut the busywork, save on fees, and send up to 1,000 payments worldwide in minutes. Airwallex Batch Transfers give you speed, control, and confidence in one streamlined workflow. Already a customer? Here’s a guide on how to create a batch transfer.

New to Airwallex? Sign up now and take global payments off your plate.

Batch transfer: frequently asked questions

Which banks support batch transfers?

In Australia, ABA batch files follow the BECS standard format used by major banks and many institutions. Customers can generate ABA files via ERP or payroll systems and upload them to supported portals, including Airwallex, for AUD payouts. Exact bank support depends on each institution’s internet banking setup, but most provide validators and approval workflows. Check your bank’s documentation for details.

Do batch transfers work outside Australia?

Yes. For non-AUD corridors, you can execute batch transfers through the Airwallex template or API. Payments route via local rails where available, or SWIFT where they aren’t. Formats like SEPA, Bacs, and Giro are rolling out progressively – check Airwallex’s payout network and documentation for current coverage.

What is batch payment processing?

Batch payment processing means collecting and executing multiple payment instructions together, rather than one at a time. It helps businesses improve efficiency, reduce manual work, and ensure accurate results across currencies and corridors.

Sources:

https://www.rba.gov.au/payments-and-infrastructure/rits/information-papers/enhanced-batch-processing-in-rits/overview.html

View this article in another region:Canada - EnglishCanada - FrançaisEuropeHong Kong SAR - EnglishHong Kong SAR - 繁體中文New ZealandSingaporeUnited KingdomUnited StatesGlobal

Posted in:

TransfersShare

- Key takeaways:

- What is a batch transfer?

- How do batch transfers work?

- The challenges of paying out multiple recipients

- What are the benefits of batch transfers for businesses?

- How secure are batch transfers?

- How to do a batch payment with Airwallex

- Why choose Airwallex for transfers?

- Get started with Batch Transfers today