Embedded Finance: What it is and how it works

David Beach

Senior Editor | Payments, banking, financial technology, and global commerce - EMEA

We live in an era of speed and convenience. As a result, customers today want and expect financial products and services to be built seamlessly into their everyday lives. 'Embedded finance' is the engine driving this shift, transforming how businesses and customers access and use financial services. Often referred to as embedded finance in banking or embedded finance platforms, it allows companies to integrate payments, lending, and other tools directly into non-financial apps and services. But what exactly is it, and how does it work?

This guide will break it down for you, explaining the ways that embedded finance can be used to unlock revenue opportunities and transform how you interact with customers.

What is embedded finance?

Embedded finance is the seamless integration of financial services or tools within non-financial products, platforms, or services. For example, a ride-sharing app that lets users split fares, earn rewards, and pay directly within the app is using embedded finance to simplify the payment experience and boost user engagement.

It leverages APIs (Application Programming Interfaces) and strategic partnerships to incorporate financial functionality, demonstrating how embedded finance uses APIs and partnerships to deliver seamless integration into everyday products and services, often in nearly invisible ways to the consumer.

This integration improves the user experience and demonstrates how embedded finance improves customer experience, opens up new revenue streams for businesses, and provides valuable data insights. It offers convenience for consumers, providing financial services exactly when and where they're needed.

How embedded finance works

Embedded finance works by letting businesses plug financial services directly into their existing products, without becoming a bank themselves. It uses APIs, licences, and compliance tools behind the scenes to make things like payments, loans, or insurance happen smoothly inside everyday platforms. So instead of sending a customer off to a separate provider, everything stays in one place, creating a seamless, trusted experience.

Here's how it all works under the hood:

1. Technical infrastructure

API integration: These tools allow different software systems to talk to each other, enabling smooth data and service flow between the business and its financial partners.

Cloud computing: Cloud systems support scale and performance, helping embedded finance run reliably no matter how many users or transactions.

2. Licensing and compliance

Financial licensing: Non-financial businesses use the licences of their embedded finance providers to operate legally.

KYC and AML: These checks ensure users are who they say they are, and help prevent financial crimes.

Data protection: Protecting customer information is critical, especially under regulations like GDPR.

PCI compliance: Required when processing card payments to ensure sensitive data is handled securely.

3. Seamless user experience

Integrated design: Finance tools are blended into apps and platforms to feel like a natural part of the experience.

Ease of use: Interfaces are built to make financial tasks quick and simple—even for non-experts.

Timely relevance: Finance features show up when the user needs them most, making them useful rather than disruptive.

4. Smart data flow and automation

Real-time processing: Transactions and updates happen instantly, so users don’t wait or wonder.

Secure sharing: Data moves safely between the platform, provider, and financial systems.

Analytics: Businesses can use what they learn from user behaviour to fine-tune offerings and suggest better financial products.

5. Revenue and growth models

Transaction fees: A slice of each payment made via the embedded finance system can become new revenue.

Subscription pricing: Some services are offered for a monthly or usage-based fee.

Data insights: The business can use anonymised data for product development or smarter marketing.

Each of these components works together to support the broader embedded finance ecosystem, helping businesses offer seamless, trusted, and revenue-generating financial services within the platforms people already use.

What are some examples of embedded finance?

To illustrate how embedded finance works, here are three simple, real-world examples

1. Retail checkout finance

A customer shopping online sees a 'Buy Now, Pay Later' option at checkout. With one tap, they can split the cost into interest-free instalments, all managed within the same app. The finance option is powered by an embedded finance provider but feels like part of the store experience.

2. Food delivery wallets

A food delivery app lets customers load funds into a digital wallet for faster checkout. They can also earn cashback or discounts when paying from the wallet. Users stay in-app, and the platform uses embedded finance to handle payments, incentives, and balances.

3. Ride-share driver payouts

Drivers for a ride-share platform get paid instantly to a debit card issued by the platform. These cards are backed by an embedded finance provider, allowing drivers to access earnings the same day and even use the card for fuel discounts.

These examples show how embedded finance creates smoother, more convenient experiences that drive loyalty and open up new ways for platforms to grow.

What are the different types of embedded finance?

Embedded finance means adding financial tools like payments, loans or insurance directly into the apps or platforms people already use. Instead of sending someone to a bank or another website, everything happens in one place. This makes it easier for people to pay, get covered, or access credit without leaving the app or platform they’re using. These are just a few examples of how embedded finance works in the real world—and below, we’ll look at the main types of embedded finance being used today.

🔸 Embedded payments are a widely recognised and a popular form of embedded finance. Key features include seamless checkout experiences, multiple payment options, real-time transaction processing, and recurring payment capabilities. Examples range from one-click purchasing on eCommerce platforms to in-app payments for ride-sharing services and automatic payments via IoT devices like smart fridges. For most embedded finance use cases, there's an element of embedded payments to move money on and off platform.

The benefits of embedded payments are significant, reducing cart abandonment rates for businesses, improving user experience and convenience for consumers, and enhancing security through tokenization and encryption.

🔸 Embedded credit and loan products provide various financing options at the point of need. Key features include instant credit decisions, flexible loan terms, and alternative credit scoring methods. Examples include Buy Now, Pay Later (BNPL) options in online stores, financing within B2B platforms, and microloans for small businesses via eCommerce dashboards.

🔸 Embedded insurance offers contextually relevant insurance products during the purchase journey of related goods or services. Key features include instant quotes and policy issuance, customised coverage based on user data, seamless claims processes, and usage-based insurance options. Examples include travel insurance during flight bookings, product protection plans for electronics, and pay-per-mile car insurance through connected vehicle apps.

🔸 Embedded investments integrate wealth management services into various platforms, making investing more accessible. Key features include fractional investing, robo-advisory services, automated savings tools, and access to diverse asset classes. Examples include round-up investing in personal finance apps, stock trading on social media, and crypto investing within payment apps. Embedded investments usually need some form of embedded payments to allow for account creation and fund top-up/withdrawal.

🔸 Embedded foreign exchange (FX) solutions offer currency conversion and international payment capabilities directly within platforms. Key features include real-time currency conversion, multi-currency wallets, international payment processing, and FX risk management tools. Examples include currency conversion in travel booking platforms, multi-currency accounts for eCommerce sellers, and integrated FX for payroll systems.

🔸 Embedded compliance is essential for enabling embedded finance by ensuring regulatory adherence. Key features include automated KYC processes, AML screening, transaction monitoring, and regulatory reporting tools. Examples include identity verification for account opening, automated sanctions screening for international transactions, and real-time transaction monitoring.

🔸 Embedded payroll integrates salary processing into broader business management platforms. Key features include automated salary calculations, tax withholding, employee self-service portals, and integration with time tracking and HR systems. Examples include payroll processing in accounting software, gig economy platforms with integrated payment systems, and embedded payroll in small business management apps.

Implementing these various embedded finance solutions requires careful consideration of regulatory requirements, technological capabilities, and user needs. If you're exploring embedded finance for your business, think about which type of embedded finance solution fits best with your goals and customers. Start small, then expand into more services as you grow.

The importance of embedded finance in 2025

Embedded finance is gaining traction as a major driver of innovation, customer experience, and business growth across industries. In Australia, adoption is accelerating rapidly. According to a 2024 report by Research and Markets, Australia's embedded finance market is projected to grow by over 28% annually, reaching AUD 4.55 billion by 2029. This growth is being driven by increasing demand from sectors like retail, travel, eCommerce, and B2B services.

This shift is reshaping how companies deliver payments, lending, and other financial services. By embedding financial tools directly into digital experiences, businesses can increase loyalty, improve user experience, and create new revenue streams. Here's why embedded finance matters now more than ever:

Advancements in technology

Increasing collaboration between fintechs, traditional banks, and non-financial entities is democratising embedded finance solutions and providing more competitive products in the market. Technology development has also made it more cost-effective to integrate financial services.

Evolving consumer expectations

Consumers expect seamless, integrated experiences across all aspects of their lives. They want to be able to manage their finances, make purchases, and access services without the need to navigate multiple platforms. Embedded finance enables tailored financial products based on user behaviour and context.

Expanding market opportunities

Embedded finance enables businesses to enter new territories, markets, and segments quickly, and differentiate themselves through unique financial offerings. Non-financial companies can tap into financial services revenue. This is particularly valuable for established digital platforms who need new ways to drive lifetime value from customers.

Improved financial inclusion

Embedded finance brings financial services to underserved populations, by democratising access to financial features for the underlying businesses. Simplified access to payments, credit, and investments provides convenience within the experience of trusted brands.

Data-driven insights

The data from financial products used in-platform provides deeper insights into customer behaviour. Better data improves risk assessment and forecasting for commercial trends, and can be used to drive the creation of more relevant financial products or even the upsell of new personalised offers.

Regulatory landscape evolution

Governments and regulatory bodies are becoming more supportive of embedded finance, recognising its potential to improve financial inclusion and innovation.

Competition and innovation

Competition = innovation. Embedded finance enables rapid adaptation to market changes and customer needs. Integrated financial services boost loyalty and increase the lifetime value of the customer, as unique financial offerings set businesses apart from competitors.

Three examples of embedded finance companies

Embedded finance companies come in all shapes and sizes. They'll often specialise in different areas. Here are three:

Airwallex | Stripe | Plaid | |

|---|---|---|---|

Overview | Global platform with embedded finance solutions across 60+ markets | Payments platform with card issuing and lending tools | Open banking infrastructure for data and identity access |

Key Offerings | Global Treasury, Payments for Platforms, BaaS, compliance tools | Stripe Connect, Issuing, Capital, Treasury | Bank account linking, transaction data, identity verification |

Strengths | Licences in 60+ markets, flexible APIs, FX optimisation | Fast integration, widely adopted by developers | Strong access to bank data and compliance frameworks |

Primary Use Cases | Global marketplaces, B2B platforms, fintechs with international growth | SaaS, eCommerce, platforms needing embedded finance | Fintech apps needing secure user data and onboarding tools |

Airwallex

Airwallex is a global financial platform that offers embedded finance solutions across borders.

Key offerings:

Global infrastructure: Financial licences in 60+ countries to support global businesses and enable expansion to new markets.

Payments for Platforms: To programmatically create connected accounts, automatically split funds, and enable a frictionless global pay-in and payout experience for customers.

Global Treasury: Multi-currency virtual accounts for collecting, holding, and sending money domestically and internationally with a competitive FX engine.

Banking as a Service: Non-financial businesses can offer full-featured financial services, including accounts and card issuing.

Customised experience: Businesses can retain their own UI and customise Airwallex components into their websites and apps.

Streamlined onboarding and compliance: Outsource KYC, AML, sanctions screening and identity verification requirements to Airwallex.

Stripe

Stripe is known for its online payments gateway but has expanded to offer embedded finance capabilities.

Key offerings:

Stripe Connect: Platform for marketplaces and platforms to manage multi-party payments.

Stripe Issuing: API for creating and managing virtual and physical payment cards.

Stripe Capital: Embedded lending solutions for platforms to offer financing to their users.

Stripe Treasury: Banking-as-a-Service offering for platforms to embed financial services.

Plaid

Plaid is an open banking provider, giving secure access to financial and identification data needed to onboard new customers and fund accounts.

Key offerings:

Account linking: APIs that allow apps to connect with users' bank accounts securely.

Transaction data: Access financial transaction data for analysis and insights.

Identity verification: Tools for verifying user identities and account ownership.

Balance checking: Real-time account balance information for various financial products.

Income verification: Income verification solutions for lending decisions.

Why consider Airwallex for embedded finance solutions?

Embedded finance has traditionally been implemented at a local level, with many providers focusing only on domestic services. But as more businesses adopt embedded finance, particularly those scaling internationally, the need for cross-border embedded finance solutions is growing fast.

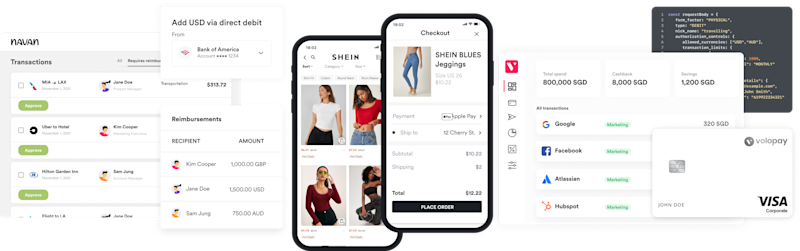

Airwallex offers a truly global embedded finance platform, holding financial licences in over 60 markets. Companies like Brex, Navan and SHEIN choose Airwallex to manage their international payments, treasury, and compliance from one place. With our infrastructure, businesses can maintain a consistent experience across markets and expand into new regions without having to manage multiple providers.

Airwallex's financial infrastructure has extensive global coverage, with financial licences in 60+ markets. Businesses such as Brex, Navan and SHEIN, are choosing to build with us for our global-by-default embedded finance. This means they only need to work with one provider for all of their markets, and can retain product consistency globally. They're also future-proofed if they wish to expand to new markets.

Our embedded finance solutions fall into three categories:

Global Treasury

This solution enables a platform’s customers to collect, store, and disburse funds worldwide. By tapping into fast, cost-effective local collections via 160+ payment methods, businesses can extend their platform to multiple geographies for customer ease and convenience. Likewise, our payout network allows their customers to send funds to 150+ countries. By bringing payments in-house, platforms can offer a convenient service which can be monetised by charging transaction fees or markups for FX and payouts.

Payments for Platforms

Programmatically create connected accounts with merchants or customers, automatically split funds, and offer a frictionless global payment acceptance and payouts. For the most part, this means embedding Airwallex Payments solutions into the checkout process to take advantage of our extensive currency and payment method acceptance. If a platform uses multiple payment service providers (PSP), we can easily work alongside or as a holding/settlement account to receive funds from multiple PSPs.

Banking as a Service

This service allows platforms to natively embed any traditional banking products such as accounts, cards, and borrowing within their products. Businesses who opt for this service range from trading platforms like Stake, to multi-currency funding platforms like TradeBridge, and corporate card solutions like Volopay.

Airwallex embedded finance use cases

To show how embedded finance works in practice, here are three real-world examples of businesses using Airwallex to solve complex global financial challenges. These case studies highlight how embedded finance tools can unlock faster payments, support international growth, and simplify operations for scaling platforms.

Navan: streamlining global reimbursements

Navan, a corporate travel and expense platform, needed to handle international reimbursements quickly and reliably for employees of global customers. Using Airwallex’s Global Treasury solution, Navan was able to automate employee reimbursements across multiple currencies and countries. A single API integration made it possible to manage local top-ups, mitigate FX risk, and send fast, affordable payouts using local payment rails.

Stake: enabling cross-border share trading

Digital trading platform Stake wanted to offer global share trading and seamless access to funds across regions. Airwallex’s Embedded Finance tools allowed Stake to collect, hold, convert, and pay out money in multiple currencies with one streamlined integration. This helped Stake reach new markets, accelerate new product development, and track large volumes of money movement in real time.

SHEIN: powering global marketplace payments

SHEIN, a global fashion e-commerce leader, required an end-to-end payment infrastructure to scale globally. With Airwallex’s Payments for Platforms, SHEIN could accept payments in various currencies and methods, avoid high FX fees through like-for-like settlements, and manage payouts to sellers around the world. This helped the brand scale quickly and deliver a smooth experience for buyers and sellers.

By choosing Airwallex for embedded finance services, you'll leverage our powerful, flexible, and globally oriented financial infrastructure. This lets you focus on your core competencies while offering sophisticated financial services to your customers in an intuitive way.

Embedded finance: Frequently asked questions

What is embedded finance in banking?

Embedded finance in banking refers to the integration of banking services like accounts, payments, or lending directly into non-banking platforms. Instead of sending users to a separate bank, businesses can offer these services in-app, streamlining the experience and increasing customer engagement.

How does embedded finance improve customer experience?

Embedded finance improves customer experience by reducing friction. Users can access payments, credit, insurance, or investment features right when and where they need them without switching platforms. This makes interactions faster, simpler, and more relevant.

What are some examples of embedded finance solutions?

Examples of embedded finance solutions include Buy Now, Pay Later at checkout, instant driver payouts, gig apps, and currency conversion within travel platforms. These solutions enhance convenience and often create new revenue opportunities for businesses.

Why is embedded finance important for marketplaces?

Embedded finance is essential for marketplaces because it enables faster payments, better trust, and a smoother buying and selling experience. Features like in-app wallets, split payments, and seller financing help platforms scale and differentiate from competitors.

What is the future of embedded finance in Australia?

The future of embedded finance in Australia looks strong, with the market projected to grow at over 28% annually through 2029. This growth is being driven by digital platforms in retail, travel, B2B, and fintech adopting embedded finance to improve experiences and drive new revenue.

Disclaimer: The information in this article is based on our own online research. Airwallex was not able to manually test each tool or provider. The information is provided for educational purposes only and a reader should consider the specific requirements of their business when evaluating providers. This research is reviewed annually. If you would like to request an update, feel free to contact us at [[email protected]]. This information doesn’t take into account your objectives, financial situation, or needs. If you are a customer of Airwallex Pty Ltd (AFSL No. 487221) read the Product Disclosure Statement (PDS) for the Direct Services available here.

View this article in another region:Canada - EnglishCanada - FrançaisNew ZealandSingaporeUnited KingdomUnited StatesGlobal

David Beach

Senior Editor | Payments, banking, financial technology, and global commerce - EMEA

David manages editorial content for the Airwallex community. He specialises in content that helps EMEA businesses navigate global and local payments, treasury, and banking.

Share

- What is embedded finance?

- How embedded finance works

- What are some examples of embedded finance?

- What are the different types of embedded finance?

- The importance of embedded finance in 2025

- Three examples of embedded finance companies

- Why consider Airwallex for embedded finance solutions?

- Airwallex embedded finance use cases