Vendor payouts funded by the platform's customers

In this model, payouts are funded directly by platform's customers, eliminating the need for the platform to fund vendor payouts thereby keeping the platform out of the funds flow.

Airwallex will perform KYC on the platform's customers, who will be onboarded and provided with connected accounts. Under this model, customers' funds are held in their own name. This means that the platform is not required to hold customers' funds, thereby avoiding the need for the platform to obtain its own financial licenses.

Let's imagine a fictitious platform named VendorPayOS. One of their customers is ImportCo and ImportCo's employees need to use the VendorPayOS platform to make payouts to vendors.

| Platform | VendorPayOS, a platform offering intake-to-pay/spend management services to its customers. |

| Customer | A company / employer who uses VendorPayOS to process vendor payouts. Example customers featured in this guide include ImportCo and MarCo. |

| End User | An employee of ImportCo / MarCo responsible for making payments to vendors through the VendorPayOS platform. |

| Vendor | The vendor that ImportCo / MarCo is buying goods or services from. |

Specific requirements may apply based on the jurisdictions to which you want to deliver services. Always speak to a member of the Airwallex team if you are considering implementing our Global Treasury solution.

Funds flow

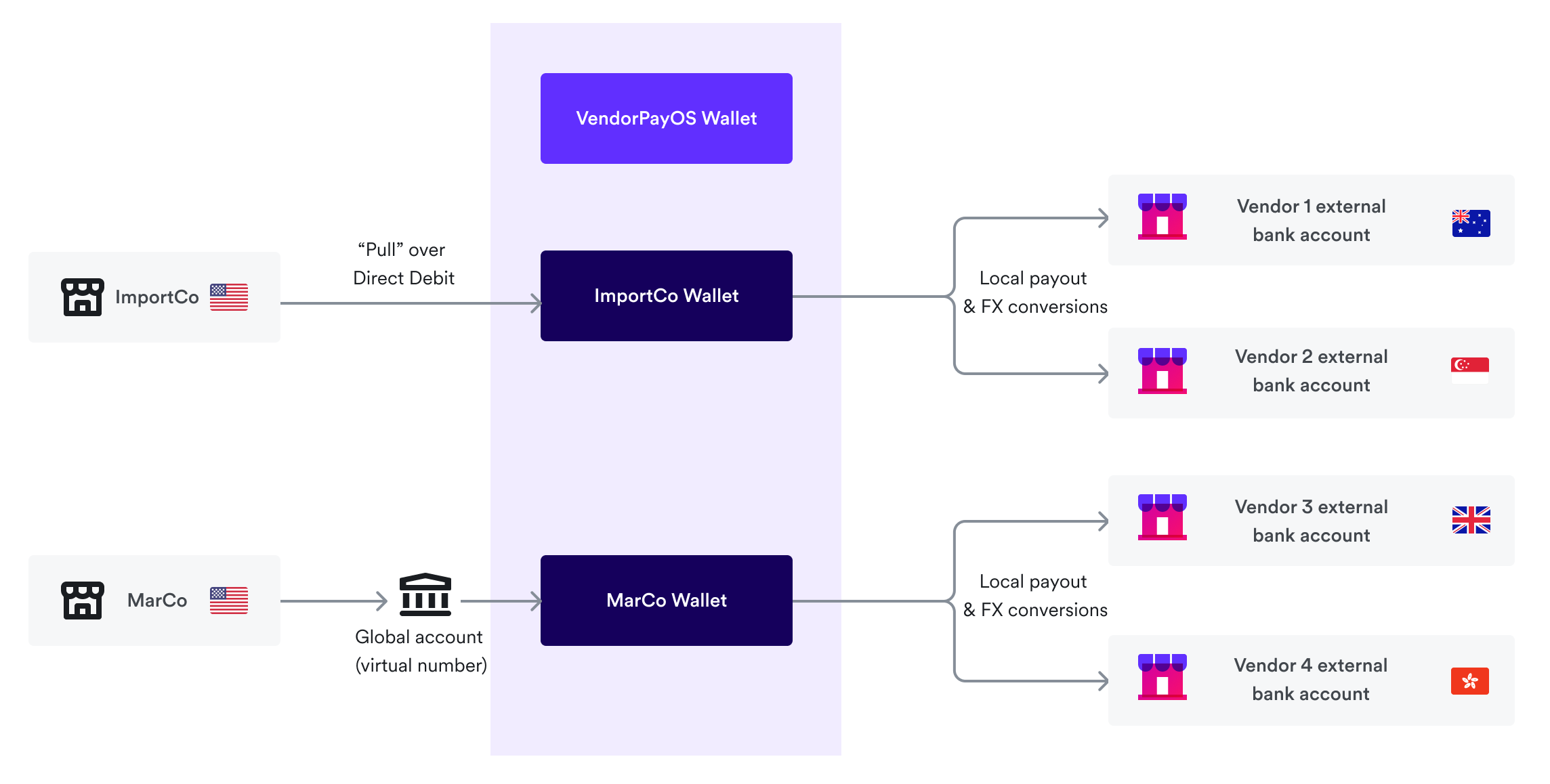

The diagram below shows the funds flow for a platform looking to integrate with Airwallex's Global Treasury solution for vendor payouts.

The steps in the flow of funds are described in more detail below. Note that you can potentially initiate multiple operations at the same time - our teams will help you understand the options available in more detail.

Fund the Wallet

Each of customers' connected accounts, e.g., ImportCo's connected account, needs to be funded in order to power vendor payouts. This can be done through a number of different methods:

- Global Accounts and bank transfer: VendorPayOS can create unique virtual account numbers in the name of ImportCo for each currency ImportCo operates in. ImportCo can then send funds over local and SWIFT payment rails into the Wallet from their external bank. There are no limits to how often customers can fund their connected account Wallets in this way.

- Linked Accounts and direct debit: VendorPayOS can complete a one-time linkage of ImportCo's external bank account to their connected account with Airwallex. This allows funds to be pulled in over direct debit, avoiding the need for ImportCo to ‘push' funds from their bank account to Airwallex. Please note that applicable limits are in place to mitigate the risk of direct debit recalls.

Hold funds in the Wallet [Optional]

ImportCo and all other VendorPayOS's customers can receive their own Wallets and funds in multiple currencies can be held in this Wallet if necessary. These funds are held in the name of ImportCo, not VendorPayOS.

Convert funds and manage FX risk [Optional]

If funds need to be paid to vendors in a different currency to the funds held in the Wallet, ImportCo can specify a source currency in the Wallet to be converted. This allows for vendor payouts to be made in more than 50 currencies globally.

In addition, Airwallex has multiple products that can provide the platform's customers with more certainty when it comes to dealing with FX rates, such as Quotes, post funding, and Funding Source. Most relevant in this use case is the Funding Source feature.

For example, if a vendor invoices ImportCo in a currency that is not ImportCo's home currency, the Funding Source feature allows ImportCo to lock in a specific FX rate tied to the invoice and at the same time fund the Wallet with the necessary amount. This way ImportCo will know the exact cost in their home currency up-front and can rest assured that the vendor will always receive the correct amount in their home currency. Currently a Linked Bank Account (via Direct Debit) is the only supported funding source.

Process payouts

In this integration model where vendor payouts are funded by ImportCo and other customers, funds will move from each of customers' connected accounts to the external bank accounts of the vendors who are receiving the payout, over Airwallex's payout rails.

- Payouts: Trigger payouts to vendors using Airwallex's Payout APIs. Airwallex's network of local clearing systems supports payouts to vendors in multiple countries and currencies, with country-specific delivery time taken into consideration to ensure the payouts arrive in time.

- Batch payouts: This feature may be used to trigger multiple invoice payouts across currencies and countries as one instruction. Batch payouts can also be funded via Direct Debit.

- Beneficiaries: Airwallex offers the possibility to optionally save beneficiaries for future reference. Beneficiaries should be saved as soon as details become available, to facilitate name screening.