Westpac Foreign Currency Account: a comparison

Westpac’s foreign currency account is an easy-to-use banking option for businesses that do a medium-to-high volume of international trade. And, in today’s increasingly borderless world, this number is growing every day.

If your business contracts your work out overseas—say in IT, or the engineering spaces—then these Westpac multi-currency accounts are a dependable option. They’re ideal for eCommerce businesses who source their products and stock overseas. And if you’re a growing business with plans to scale internationally, then they’re going to deliver what you need.

A detailed look at Westpac foreign currency accounts

Key features

No monthly account fees

Low transaction fees

12 currency options offered, with more available in-branch upon request

Access to Westpac foreign currency accounts through Westpac Live netbanking

Overdrafts available on eligible foreign currencies, along with overdraft protection

Free invoicing tool that allows business users to create, send, track, and reconcile invoices

Limitations of your account

While there are many benefits to holding a foreign currency account with Westpac, there are also a number of limitations to take into consideration.

A foreign currency account with Westpac offers a strong base level of service, but doesn’t offer as many banking service options as other banks. While it offers many of the currencies that an Australian business would most likely use, it doesn’t have as much range of currencies as other banks’ offerings.

One key thing to remember is that Westpac foreign currency accounts are based in Australia, and use an Australian BSB. While this makes it easier to set up your account, what this means for your transactions is that they’re made using the SWIFT network. With the steps involved to transfer currency information between banks, this may deliver slower transfer times, and the potential SWIFT transfer fees apply for both the sender and receiver mean you’re not guaranteed to receive the full amount in your account. Westpac’s netbanking app, Westpac Live, isn’t as robust as other banks’ netbanking offerings, so some types of transactions must be completed in person at your local branch.

Like other banks, Westpac doesn’t yet provide cards in foreign currencies. You’re still required to make all international payments either using the Westpac App, or via a branch.

Fees and rates

When it comes to costs, Westpac foreign currency accounts are a flexible option for business users as they don’t charge you any monthly account fees. However, there are a number of different types of transaction fees to be aware of:

$10 fee per outgoing foreign currency transfer made via Westpac netbanking

$20 fee per outgoing foreign currency transfer made via Westpac’s Corporate Online

$20 fee per outgoing AUD transfer

$32 per outgoing transfer, both for AUD and foreign currencies, made at a branch

$12 per incoming payment received, both in AUD and foreign currencies

$25 on refunds or cancellations

While the Westpac website discusses interest rates on positive bank balances, the current interest rates appear to be 0% for all currencies.

Interest rates apply to any overdraft attached to your Westpac foreign currency accounts. These vary from 2.20% to 6.70%, depending on the currency.

A current FX rate calculator is available on the Westpac business banking website. This also includes a clear fee denomination. However, the fees noted on this site are for Westpac online banking only. International payments made in a branch are liable to receive higher fees, so it pays to check this prior to making your payments.

There is also little mention of the FX rates used by Westpac, which may be different from the true interbank FX rate. You can view our FX savings comparison across the big 4 banks here.

Opening a Westpac foreign currency account

Westpac has made it easy to open a multi-currency account, and claim that you can open an account in just 10 minutes.

To open a foreign currency account with Westpac, you’ll first need to have an eligible Westpac AUD bank account. Then, you’ll need to meet the following requirements:

Aged 18 or older, and can provide official ID verification and proof of address (such as your passport, drivers license, or birth certificate)

Provide documentation to prove you’re a sole trader, or the director of an Australian business LLC, trust, partnership, or co-operative

Provide your ACN and/or ABN

Provide your tax file number, and any foreign tax details that may be relevant

Business structures other than a sole trader or company may be required to visit a Westpac branch in person to open a Westpac foreign currency account. To be sure, check with your nearest Westpac branch to confirm your requirements

Once you have all this information, the Westpac website will guide you through the foreign currency account setup process.

Supported currencies

Westpac multi-currency accounts support the following international currencies:

- Canadian Dollar: CAD

- Chinese Yuan RMB: CNY

- Danish Kroner: DKK

- Euro: EUR

- Great British Pound: GBP

- Hong Kong Dollar: HKD

- Japanese Yen: JPY

- New Zealand Dollar: NZD

- Norwegian Kroner: NOK

- Singapore Dollar: SGD

- South African Rand: ZAR

- United States Dollar: USD

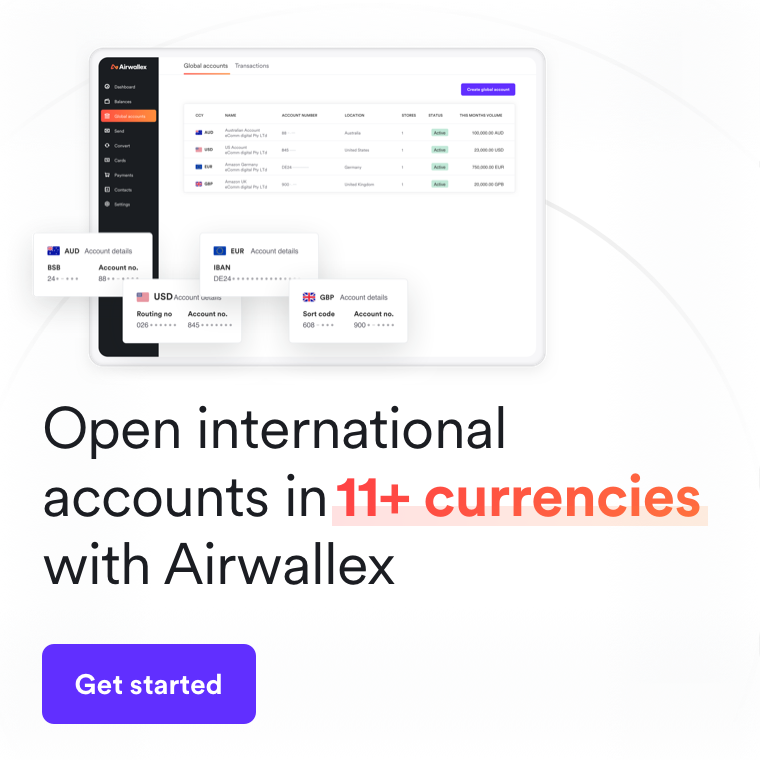

Airwallex foreign currency accounts are a powerful alternative to traditional business banking

Airwallex's international business payments help streamline how you do business with your international clients and suppliers. You get more functionality and more speed, without the limitations faced by the current banking system.

Key features

You don’t need an existing account to access your Global Account. Set up your Airwallex global account straight away, and you’re ready to begin sending and receiving foreign currencies immediately

You’re able to create different accounts in 11 different foreign currencies. Our network allows you to make international money transfers to 130 countries, in over 34 different currencies. You’re able to receive local payments in 4 currencies, meaning you don’t pay international payment fees on these currencies, and receive 7 currencies via the SWIFT network, fee-free.

You can integrate your global account directly to your Xero account for automated reconciliation. Each foreign currency gets its own individual bank feed, so everything is readily available when you need it.

Our multi-currency debit cards allow you to pay in foreign currencies anywhere VISA is accepted. You can create multiple cards, with immediate access to your funds. Assign users to each card, and set spending limits, so you get better oversight over where your money is going. to access and use your multi-currency funds immediately.

Fees and rates

Unlike the banks, we don’t charge you any transaction fees or monthly account fees. You can use your Airwallex global account as often or as little as you need—there absolutely no fees to send or receive payments through our network. And if you have to use the SWIFT network, all you’ll pay is a flat $10 fee.

There are no fees on our international business debit cards either, so you can assign them to as many staff as you need.

However, other fees and charges may apply, which you can find on our website.

When you’re exchanging funds from one currency to another, we’re able to offer competitive wholesale FX rates—just 0.3% or 0.6% above the interbank FX rate. We value transparency in everything we do, so you can check the exact FX rate you’re looking for before you book your payment.

Supported currencies

As well as AUD, Airwallex Global Accounts support the following international currencies:

USD US Dollar

EUR Euro

CAD Canadian Dollar

CHF Swiss Franc

CNY Chinese Yuan

GBP British Pound

HKD Hong Kong Dollar

SGD Singapore Dollar

Airwallex global accounts are made for a borderless world

And as your business grows its horizons, we’re there for you too. Our global accounts are designed to make it as easy as possible to send and receive foreign currencies.

Looking for a better way to manage business funds? Contact us today to book a demo for your Airwallex Business Account.

Related article:

---

References

https://www.westpac.com.au/business-banking/bank-accounts/foreign-currency-account/

https://www.westpac.com.au/business-banking/biz-invoice/features-benefits/foreign-currency-account/

https://www.westpac.com.au/business-banking/bank-accounts/foreign-currency-account/#tab2

https://www.westpac.com.au/business-banking/bank-accounts/foreign-currency-account/#tab3

https://www.westpac.com.au/business-banking/services/foreign-exchange-rates/

https://www.westpac.com.au/business-banking/bank-accounts/foreign-currency-account/

Last updated as of January 2021

Our products and services are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221 (Airwallex). This article is provided for general information purposes only and is correct at the time of publication but may change. This article does not take into account your objectives, financial situation or needs. Airwallex is not providing you with any legal, financial or tax advice. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs and obtain your own legal, financial or tax advice. Please read and consider the Product Disclosure Statement available on our website before using our service.

Airwallex provides third-party links for general informational purposes only. Airwallex does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Airwallex accepts no responsibility for the accuracy, legality, or content on these sites.

Posted in:

Business banking