The business account built for fast-moving technology companies

High growth technology companies use Airwallex to save on their tech spend and scale without borders.

Airwallex powers high growth technology companies

Spend less on fees, invest more in growth

Save on global transfers

Send money globally with no transaction fees when using Airwallex's local payout rails.

Save up to 3% on non-AUD expenses

Eliminate international card transaction fees on technology costs and software subscriptions like Atlassian and Slack with virtual debit cards.

Avoid overblown budgets from currency fluctuations

Use our multi-currency wallet to convert and hold USD so your technology spend doesn't blow out your budget.

Expand your business beyond borders

Hold balances in 11+ currencies

Collect and hold currencies with your multi-currency wallet. Avoid double conversions and hedge against currency fluctuations.

Pay suppliers, vendors and employees internationally

Make single and batch payments into 130 countries, in 23 currencies and counting while accessing market-leading FX rates, cheaper than the banks¹.

Collect payments from overseas customers in their local currency

Open local accounts in the United States, the United Kingdom, Europe, Hong Kong and Australia to collect funds from customers in their primary currency.

¹The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

Save time on accounting with an Airwallex account

Quick and easy integration

Link Airwallex to your Xero account with just a few clicks.

Multi-currency transaction syncing

Automatically sync your multi-currency transactions to Xero, spend less time on tedious data entry.

Syncs hourly

Ensure your Xero transaction records are up to date for your accountant or bookkeeper.

Effortlessly manage your financial processes at scale

Add your team

Add additional users to your Airwallex merchant account. Assign roles and permissions to team members based on your internal processes.

One login, multiple businesses

Easily switch between multiple Airwallex accounts with single sign-in. Perfect for technology companies with accounts in multiple countries.

Make batch payments with ease

Make domestic or international batch payments with our batch payment capability.

Customer story

Tech business Mr Yum goes global with Airwallex

Airwallex provided a complete business account to seamlessly manage employee expenses with flexible spend controls, multi-currency collections and transfers at market-leading FX rates. To date, Airwallex has helped Mr Yum issue more than 30 cards in just a few clicks, launch in the UK 3 months faster, and save more than $50,000 on international transaction and FX related fees.

saved per on month on USD tech spend

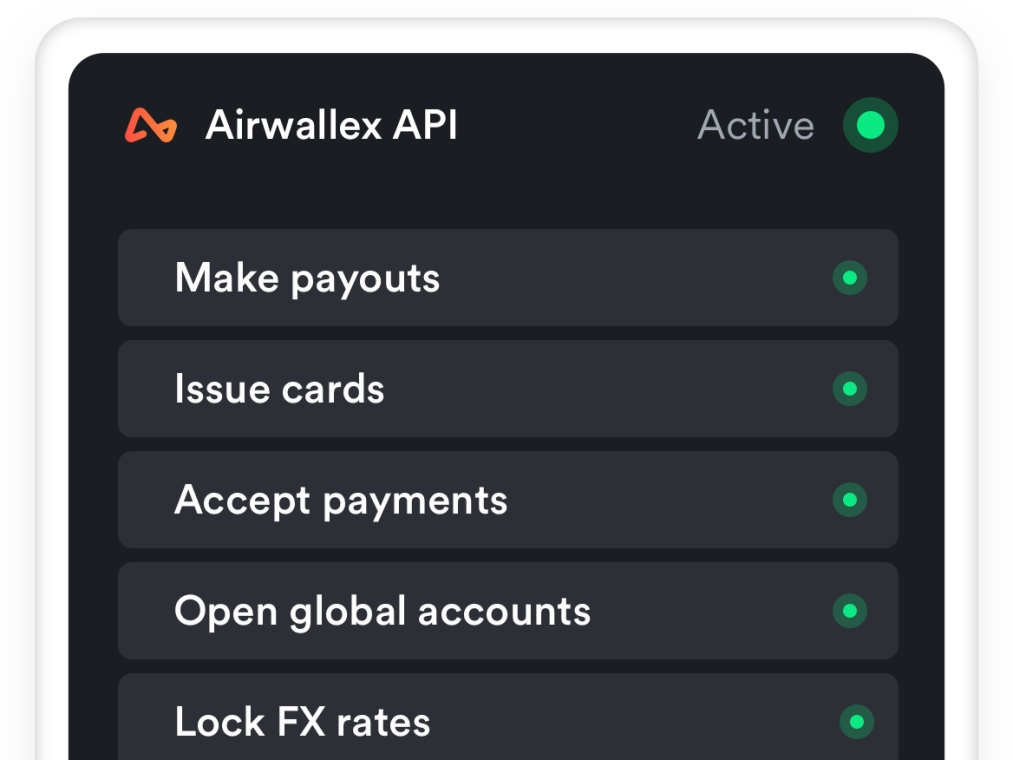

API Products

Grow internationally with our modern technology stack

Automate key financial processes across all functions of your business.

Security is at our core

Protected

We work with world-class security providers to ensure your funds and accounts are secure at all times.

Highest standards

Airwallex meets the highest international security standards including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements.

Security first

Our modern infrastructure allows us to implement best-in-class security controls which are monitored 24/7 to keep your account safe.

Compliant

Airwallex holds an Australian Financial Services Licence (AFSL No. 487221) and is regulated by the Australian Securities and Investment Commission (ASIC).