Compare Airwallex vs Commbank

Save more on your international business transactions¹ with an Airwallex global business account. Find out how you can spend less on FX, and more on growth.

¹The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

¹The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

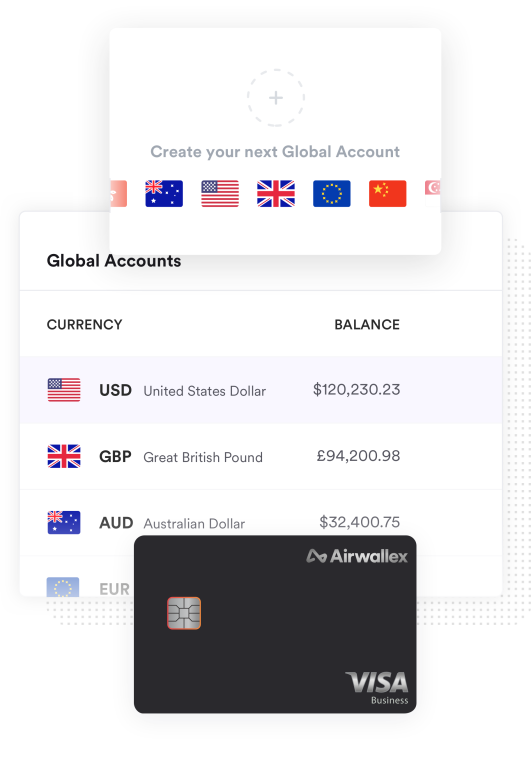

Transact like a true local

Set up US, UK, EU, HK and AU Global Accounts with local bank account details. Receive payments like a local - fast, in-full and without the international transfer fees.

Save on everyday business transactions

Eliminate expensive FX and international transaction fees on your bank transfers or card payments. No hidden fees, no matter the amount.

Put your expense management on autopilot

Empower your team with multi-currency employee cards. Simplify your bookkeeping and sync all your multi-currency transactions directly into Xero.

Speak to a human

Our local, Australian support team are on hand to help you set up your account, help you with any international transactions and tackle your questions.

Receive and pay your international customers like a true local with Global Accounts

Receive international payments via direct bank transfer

Make it easier for your customers to pay you in popular currencies like USD, EUR, GBP and AUD with dedicated local account details. Bypass the SWIFT network and get paid quicker.

Eliminate unnecessary international transfer fees

Skip the $11 fee per received international payment and $6 for each outgoing transfer charged by Commbank. Airwallex accounts incur $0 charges when sending and receiving payments.*

Transparent FX rates cheaper than Commbank¹

Get access to our interbank FX rates when converting your funds. Just pay 0.5% or 1% when booking a payment or withdrawing back into AUD.

*Where payments are made through Airwallex’s payment network there are no payment fees. However any payments made via the SWIFT network will still incur a payment fee from $10AUD. Click here for more information.

¹The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

Access your foreign currency funds on the go with Airwallex Borderless Visa cards

Create multi-currency employee cards in minutes

Instantly issue your global team with virtual multi-currency debit cards with dedicated login details. So you can use your funds immediately.

Eliminate international transaction fees

Pay directly with your foreign currency balance with no FX fees. Save up to 3% on suppliers or software subscriptions from int’l card fees.

Maintain full visibility and control

Set flexible card spend limits in your chosen currency that your team can track too, so you are always on budget. No matter the currency.

The business account built to grow with you

Simplify multi-currency bookkeeping with Xero

See your multi-currency bank transfers and card payments in a single place, including who made the card transaction. Synced hourly with Xero.

Powerful user permissions to scale your team

Give your team and account access with the right permissions. Have one set up payments while another approves for a streamlined workflow.

Save time with batch payments

Save time when paying your overseas employees or regular international payments with our batch payment capability.

How our fees compare to Commbank’s foreign currency account

With Airwallex, get access to our best rates, no matter the transaction amount. But don't take our word for it, check out how our rates stack up, below.

| Deposit fee | Monthly fee | FX (above interbank²) | International payment fee | |

|---|---|---|---|---|

| FREE* | FREE* | 0.5% or 1% | FREE* | |

| $11 | FREE with conditions | 5.2% | $6-$30 |

| Deposit fee | |

|---|---|

| FREE* | |

| $11 |

| Monthly fee | |

|---|---|

| FREE* | |

| FREE with conditions |

| FX (above interbank²) | |

|---|---|

| 0.5% or 1% | |

| 5.2% |

| International payment fee | |

|---|---|

| FREE* | |

| $6-$30 |

²Where possible, we offer live exchange rates. Click here to find out more. The above estimations are calculated based on published rates for Commonwealth Bank and what is included in their PDS documents. You can find more information on how we calculated our savings here.

Security is at our core

Protected

We work with world-class security providers to ensure your funds and accounts are secure at all times.

Highest standards

Airwallex meets the highest international security standards including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements.

Security first

Our modern infrastructure allows us to implement best-in-class security controls which are monitored 24/7 to keep your account safe.

Compliant

Airwallex holds an Australian Financial Services Licence (AFSL No. 487221) and is regulated by the Australian Securities and Investment Commission (ASIC).

You don't need a bank to run your business

Start winning new markets today. Open an account in minutes, and join thousands of businesses already using Airwallex to streamline their finances globally.