Corporate Cards

Virtual Card

Pay securely online and on the go with the Airwallex virtual debit card. Create virtual cards for your employee and business expenses instantly, and spend globally in multiple currencies with no transaction fees.

Virtual Cards

What is an Airwallex virtual Visa card?

The Airwallex virtual card is a digital Visa debit card that exists on your phone and computer. You can create new virtual cards in an instant and use them immediately. Each card will be linked to your Airwallex account and will come with unique card details. You can create unlimited virtual employee and company cards and use them to spend in multiple currencies from held balances in your account. If you don’t have the right currency balance available, your virtual card will auto-convert at Airwallex’s market-leading exchange rates, and you won’t be charged any transaction fees when using your virtual card at home or abroad.

Instant virtual cards for multi-currencies in a tap

Create new virtual Visa debit cards for employees and expense channels in an instant. Spend your multi-currency card online and in-store via digital wallets with no domestic or international transaction fees.

Employee Cards

Create virtual employee cards for purchases like travel, client entertainment, and team offsites

Empower employees to spend globally on the go

Your employees can use their Airwallex virtual card on the move using Apple Pay and Google Pay.

Get full control over spending

Set spend limits for cards, restrict purchases by merchant type if necessary, and freeze or cancel cards instantly.

Gain real-time oversight on employee expenses

Get a full view of employee spending in the Airwallex app. Each card has a clear payment trail, making spend-tracking simple.

Company Cards

Create virtual company cards for expenses such as advertising, software subscriptions, and equipment

Keep track of company spending in one place

Get a real-time overview of corporate spend in the Airwallex app. Assign a virtual company card to each expense category for a simpler way to monitor spending.

Remove unnecessary risk

Set transaction limits for each card to eliminate the risk of accidental overspend. For added security on certain purchases, create single-use virtual cards that expire automatically once payment has been made.

Manage team budgets with transparency

Give multiple team members access to a shared card and get instant oversight on how their budget is being spent.

Expense Management

Expense management made easy

Get more from virtual cards when you activate built-in expense management. Automate your expense management workflows and free your team from the pain of manual reports. Your employees can upload receipts and submit expenses on the go via the Airwallex mobile app, you can design multi-layer approval workflows so expenses are signed off by the right team members, and you can sync expenses with your accounting software so your finance team can close the books faster each month.

Security

The Airwallex virtual card is safe and secure

Reduce the risk of card fraud

A virtual card cannot be lost or stolen, this greatly reduces the risk of card fraud, helping you keep your business safe.

Freeze or cancel virtual cards instantly

If you’re concerned that a card is being misused, or if a card is no longer needed, you can instantly freeze or cancel it in the Airwallex app. You can also create single-use virtual cards for added security.

Manage subscriptions with virtual cards

Pay for expenses such as subscriptions with a virtual card, then freeze or cancel the card when you want to end your subscription to ensure money isn’t taken from your account in error.

"The feature where we can monitor how much employees are spending on their Airwallex cards is incredibly useful to us. We get to have full visibility, as well as being able to set daily and per transaction budgets. With Airwallex’s authorisation process, it’s also easy for my team to put together all outgoings that I need to approve, so I can easily ask questions or reject payments."

Richard Li

Co-founder & CEO, July

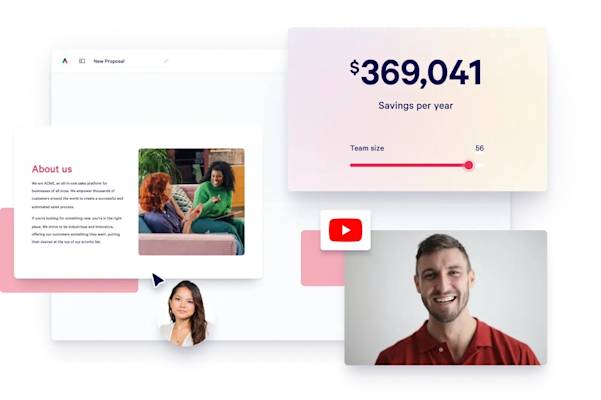

"With Airwallex, you just open up the app, sign in and you can just update any of the cards, or issue new cards there with a few clicks"

Adam Ingles

Finance Manager, Qwilr

“Airwallex’s website is transparent and easy to use. It’s allowed my team to self-serve and create what we need to suit our growing business and teams. Whether it’s logins or virtual card for a new employee, it’s easy to create and gives us the visibility and control we need.”

Tristan Cheal

Financial Controller, Clipchamp

“If you have staff, suppliers or customers overseas, then your business should be using Airwallex. It’s a fantastic product backed by a wonderful customer care team who will answer all your questions and ensure you get onboarded properly and know how to use the product.”

Dale Beaumont

Founder and CEO, Business Blueprint

"Having all our global SaaS subscriptions in one place has streamlined our finance processes and enabled better tracking and control of expenses. It’s even better knowing that Airwallex isn’t hitting us with any international transaction fees."

Warren Durling

Chief Operating Offer, Paloma

“The Airwallex Global Cards are incredibly convenient for business owners. I use them every day, either online or through my phone. It’s such an intuitive user experience and I have full visibility over what’s being spent on the cards and where - all in one simple system.”

Jon Tse

Co-founder, Karst

Best digital card Australia

Why the Airwallex virtual card is the best digital card in Australia

The Airwallex virtual debit card is the best choice for businesses in Australia because it allows you to spend in multiple currencies with no transaction fees at home or abroad. Your business can save money on international expenses such as software subscriptions, online advertising spend, and overseas travel. Create new virtual employee and company cards in an instant, and get a real-time overview of team spending with built-in expense management.

Frequently asked questions

How does a virtual Visa card work?

A virtual Visa card works in much the same way as a physical Visa card. You can sync your virtual Visa card to Apple and Google Pay and use it to make contactless payments on the go. You can also use your virtual card to pay for subscriptions and other everyday expenses.

Are virtual Visa cards safe?

Virtual Visa cards are safer than physical cards because there’s no risk of your card being lost or stolen. Virtual cards do not include account information, just a long number, expiry date and security code. So, it is much more difficult for fraudsters to access your account.

The business account owner can create and delete virtual cards in minutes, and set spending limits on a card-by-card basis. So if a card is misused it can be cut off easily.

What’s the difference between an Airwallex virtual Visa debit card and prepaid cards?

Unlike a prepaid card, you do not have to preload an Airwallex Visa debit card with money. Instead, your Airwallex virtual business card will draw funds directly from your Airwallex account balance. You can put spend limits on cards to ensure the funds in your account are protected.

You can use Airwallex Visa debit card like a multiple-currency card to pay for expenses in multiple currencies. Your card will automatically draw the correct currency from your balance. If you don’t have the correct currency in your account, Airwallex will auto-convert funds at the interbank exchange rate.

What are the benefits of a virtual card?

Virtual cards offer enhanced security since they have unique card numbers, which limits the exposure of your primary account information. You can also easily revoke the card if you suspect fraud or no longer need the card. Virtual cards also simplify expense tracking by providing a digital record for each transaction, allowing you to monitor it in real-time.

How do I get a virtual card?

Sign up with a provider, request a virtual card in your online account, set spending limits, and generate card details. Use it for online transactions and manage it via the provider’s platform. This process is quick and can be completed in minutes.

Who are the virtual cards ideally used for?

Virtual cards can be used by anyone who needs a secure payment option. They're particularly handy for business spend such as subscription services, travel bookings, and managing employee spending.

How many virtual cards can I create?

The number of virtual cards you can create depends on the policies of your card issuer or financial service provider. Some providers may allow you to create multiple virtual cards, while others might set limits. Check with your provider for specific details.