2025 Research: Why outdated reimbursement processes are causing more harm than you think

The Airwallex Editorial Team

In this article

What are the most common types of employee expenses?

How much are employees spending on expenses?

What challenges are there for employees when it comes to expenses and reimbursement?

How Airwallex offers a solution to solve the reimbursement pain for both employees and employers

For a lot of employees, handling work-related expenses isn’t just necessary work admin – it can be a hidden financial strain that quietly chips away at their personal finances.

Whether it’s a last-minute train ticket to that crucial client meeting, a hotel stay after a long day of travel, or picking up the tab for a business lunch, these costs can really add up. And even though reimbursement is supposed to come through snappily, it often feels slow, confusing, or inconsistent, leaving employees out of pocket and stressed.

Today, and especially for businesses that are growing rapidly, traditional expense systems just don’t cut it anymore. What should be a simple and supportive process can quickly turn into a source of friction – not only affecting employee well-being but also chipping away at trust in their employer.

For employers, this trust gap can undermine team morale, reduce engagement, and even lead to higher staff turnover. On top of that, inefficient reimbursement processes can create unnecessary administrative burdens, introduce compliance risks, and make it harder to track and control company spending (let alone forecasting!) — all of which can hinder a business’s ability to scale smoothly.

That’s why we decided to dive deep into the state of expense reimbursement in Australia.

In this article, we’ll share our findings, highlight the most common expense challenges, and discuss how smarter spend management solutions, like those offered by Airwallex, can help businesses tackle this growing issue.

About the research

We surveyed 500 Australian employees in 2025 to uncover the real-world impacts of outdated processes – from the emotional toll of fronting costs to the broader effects on productivity and morale.

What are the most common types of employee expenses?

Employee expenses are business-related costs accrued as part of an employee's role. The Australian Tax Office (ATO) considers expenses to be anything incurred wholly and exclusively in the performance of the duties of the employment. Businesses often outline an expenses policy that explains to employees what they can and cannot claim. This helps them be tax-compliant but also minimises the risk of expense claims being rejected.

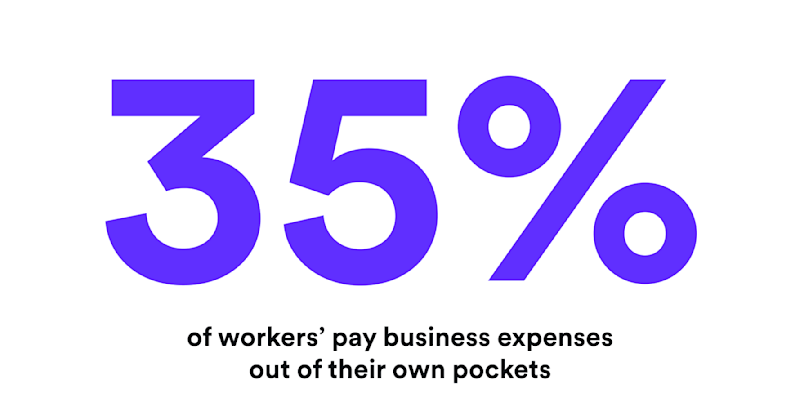

Of those surveyed, over a third (35%) of Australian workers admitted they are expected to cover business-related expenses out of their own pocket before being reimbursed. Employees who travel for work (19%) were the most likely to face this, followed by team leaders and supervisors (17%) as well as middle managers and senior executives (both 17%). Even employees attending training or events (14%) reported having to pay the expenses upfront.

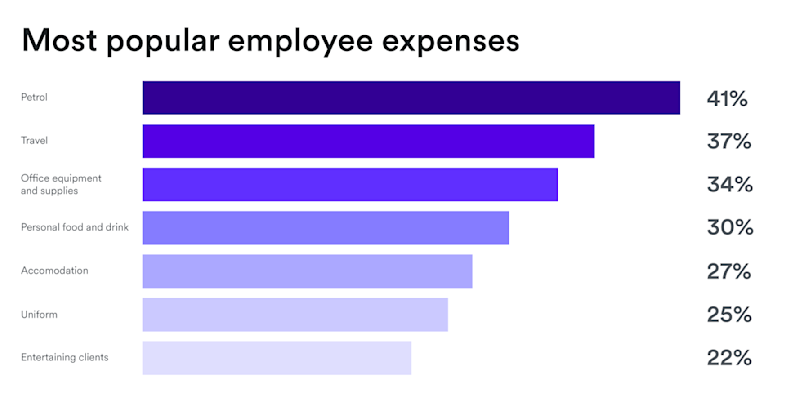

When asked what types of expenses they most often cover out of their own pockets, petrol (41%) and travel costs such as flights, trains or cabs (37%) topped the list. A third said they personally pay for office equipment and supplies (34%), while others pointed to everyday costs like food and drink (30%) and accommodation (27%).

How much are employees spending on expenses?

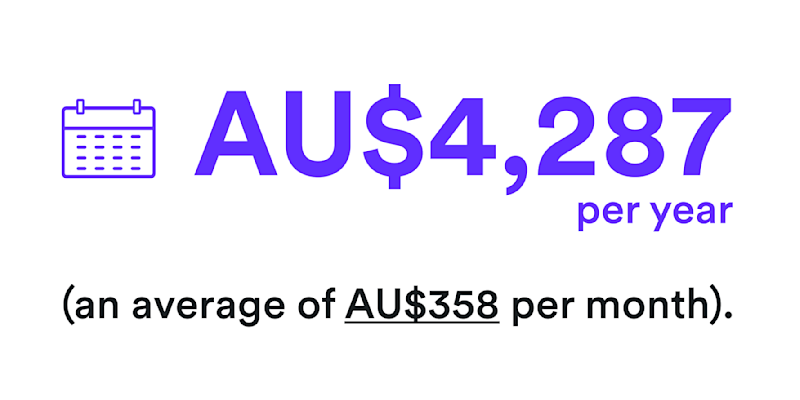

The amount an employee spends on expenses over the course of a year averages AU$4,287 (or an average of AU$358 per month). This increases to almost AU$7,000 per year for 9% of those who work in micro and small enterprises, according to our research.

According to the data, three-quarters (70%) of respondents spend up to AU$5,000 annually on business-related costs out of their own pocket. A further 18% report spending up to AU$15,000, while 5% say they exceed AU$20,000 in annual expenses before being paid back.

Among all the service sectors, Financial Services leads in high out-of-pocket spending for employees with more than one in ten (11%) workers reporting out-of-pocket costs over $20,000, followed by IT/Computing (10%) and Manufacturing (7%).

What challenges are there for employees when it comes to expenses and reimbursement?

Based on survey data, there are 10 key issues employees face when it comes to expenses and reimbursement.

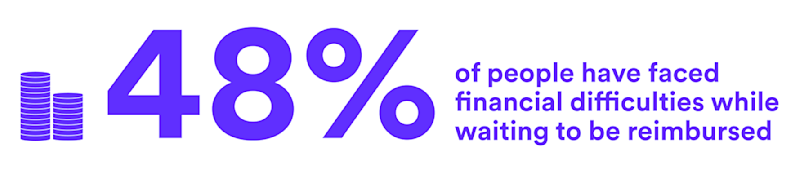

1. 48% of people have faced financial difficulties while waiting to be reimbursed

Waiting for expenses to be paid back can have a number of ramifications for employees. One of which is the prospect of encountering financial difficulties. Nearly half (48%) of surveyed employees have faced financial difficulties waiting to be reimbursed, which increases to 56% for those who have to pay for their expenses on a weekly basis.

The frequency of financial hardships due to expenses cannot be understated, with 22% saying they have faced financial difficulty due to work event expenses on more than one occasion. Younger workers, in particular, are most acutely affected by the impact of work event expenses, with 56% of participants aged between 18 and 27 also experiencing financial strain from this.

2. Workers in large firms are also facing financial difficulties

Despite working in an established large firm, 22% of people said they faced financial difficulty when waiting for their reimbursements. With 20% accruing AU$2,999 in annual expenses, any delays in receiving high-value expenses can cause financial strain irrespective of the firm’s size.

3. Only 26% of the people are reimbursed within a week

When it comes to reimbursing expenses, there's a disconnect between expectations and reality.

41% of people surveyed agreed their company waits too long to pay back the expenses, with only 6% saying they are reimbursed on the same day.

Most expenses (24%) are usually paid back within two weeks, but 9% said they have to wait for three to four weeks while 3% claimed even longer, saying they had to wait over a month for their employer to pay them back.

4. 42% of people have used credit cards to cover their expenses

When it comes to how employees cover their expenses, 42% of surveyed employees stated that they use their credit cards to pay for their expenses, compared to just 10% who had cash available to cover costs.

Using a credit card to pay for expenses can be risky, however. If a credit card provider charges interest or the employee gets a late payment charge because their reimbursement is not in sync with their balance due date, the employee may be reimbursed less than the amount they paid out.

5. 41% of employees working in micro and small businesses are using their savings money to cover expenses

Dipping into savings has become a routine affair to cover for expenses for those working in the small and micro businesses (41%). This is seen most prominently in the 18-27 age category, with 27% taking money out of their savings and 13% using their overdraft.

However, for employees without access to an overdraft or available savings, help is sought from friends and family, with one in 10 of the surveyed participants having to ask others for financial support to cover their expense overheads.

6. Employees are having to miss work events and quit their roles due to expectations around paying for expenses upfront

When employees are expected to cover their expenses upfront, social and career-ending implications exist. 17% of people said they had either missed a company event or a trip to avoid paying for expenses upfront, and 5% of those aged between 18 and 27 have had to quit their roles as a result.

Even among all age groups, those who didn’t quit, 34% admitted they had considered leaving their company due to poor expense systems.

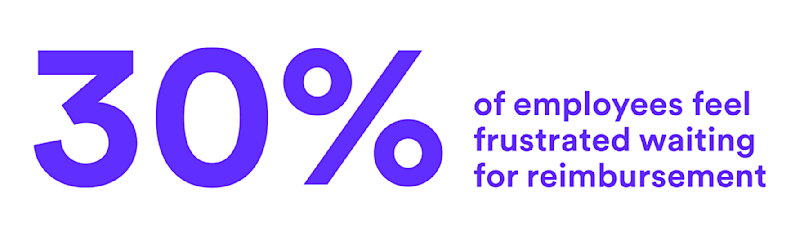

7. 30% of employees feel frustrated waiting for reimbursement

For employees who pay expenses monthly, 30% said they feel frustrated while waiting to be reimbursed. This figure shoots up to 52% for those working in micro and small businesses, with 54% feeling anxious while waiting.

8. 80% of workers in the Northern Territory claimed that they are expected to pay the expenses upfront

Regional variations exist when it comes to expectations around expenses. Unlike in other areas, 80% of workers in the Northern Territory stated that all employees in their firms were expected to cover their costs upfront.

On the other hand, only 21% of employees in South Australia claimed that all employees are expected to pay the expenses out of their pockets before being reimbursed.

9. Northern Territory workers are facing the most financial strain from expenses

For employees in the Northern Territory, (60%) said they had faced difficulties relating to expenses. This is followed by New South Wales-based employees at 34% – something that intersects with the point above regarding the expectations that exist for Northern Territory workers to pay upfront for their costs.

10. 71% of employees want a better reimbursement system in place

Participants also thought that better methods need to be in place to pay employees back. Over 70% of people said there needs to be a better way to get their money reimbursed.

So, what can businesses do to address the pain points employees and employers feel?

How Airwallex offers a solution to solve the reimbursement pain for both employees and employers

At Airwallex, problems related to expenses and reimbursement can be remedied – whether it's Corporate Cards for business expenses or reimbursement/employee cards, Airwallex can address your business's spend management challenges.

We're able to offer this thanks to our in-house capability to efficiently collect reconciliation information from our underlying proprietary financial infrastructure, which seamlessly interlinks payments data with the WebApp.

Here are the top benefits Airwallex can offer:

Virtual and physical cards: Giving employees flexibility in how they pay for expenses allows them to complete their roles without having to devote time to managing them. Corporate Cards not only remove the need for reimbursement but also offer speed, visibility, and control, meaning both employees and employers are kept informed at all stages.

Instant employee reimbursements: Paying employees back in a timely manner relieves the stress and financial burden some may encounter. It allows your business to save time on financial admin and ensures accuracy when it comes to up-to-date cash flow metrics.

Automated Expense Management: Integration with accounting software such as Xero, QuickBooks, Netsuite, and many more, eliminates the manual labour of tracking, approving, and reconciling expenses, meaning your business saves time and resources on automated activities.

Multi-currency payments: For global companies, Airwallex business accounts offer competitive exchange rates and a range of currency options – a perfect fit for employees with overseas expenses. Our cards are multi-currency, which means employees can spend in the currency of the country they’re in without having foreign exchange charges added to their transactions. The spend pulls directly from the corresponding currency account, or auto-converts at the interbank rate where the currency is not held.

There are also benefits for employers. In addition to being quick and speedy, we use the best available foreign exchange rates (known as the interbank rate). There are also no hidden international transaction fees, which offers your business transparency on how much is being paid out at any given time.

Flexible spending controls: At Airwallex, we understand that different roles require different parameters on what they can and can't spend on work expenses. Spending limits can be arranged, and real-time tracking means you can monitor overspending and have up-to-date figures that shape your spend management objectives.

Sometimes, finance teams can feel cautious or worried about using Corporate Cards, as there is a risk of losing control over employee spending.

Airwallex takes care of these concerns by offering wide-ranging flexibility on how cards are used, as we are the card issuer. This can include setting up cards quickly and freezing them. Finance teams have the flexibility to set spending limits on an individual and operational basis and can choose how the cards can be used and where payments can be made.

Methodology

An online survey of 500 Australian workers who have paid for a business expense using their own money in the last year was conducted between 25th July to 31st July 2025 by Opinium. Data was collected adhering to established guidelines to ensure ethical and accurate data collection.

View this article in another region:Hong Kong SAR - EnglishHong Kong SAR - 繁體中文SingaporeUnited Kingdom

The Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

Posted in:

Finance operations