Stop paying holding fees on your Wise account balance

Starting 20 April 2021, Wise will be charging a daily fee for holding large amounts in your balance for Australian businesses.

With Airwallex, our pricing is simple and transparent. Absolutely no holding fees on your balances - no matter how big or small.

The business account of choice for high growth brands and agencies

How does the new Wise holding fee work?

Wise is now charging a daily holding fee for Australian businesses with account balances above their free allowances. In Australia, that free allowance is 23,000 AUD.

If you go over your free allowance Wise will start charging the daily fee of 0.004% after 3 days of exceeding that limit.

For example: if you have 100,000 AUD in your account for a month, then you’ve exceeded the allowance by 77,000 AUD. So, you would pay 92.40 AUD at the end of the month as a fee (or 1,124.20 AUD in a year).

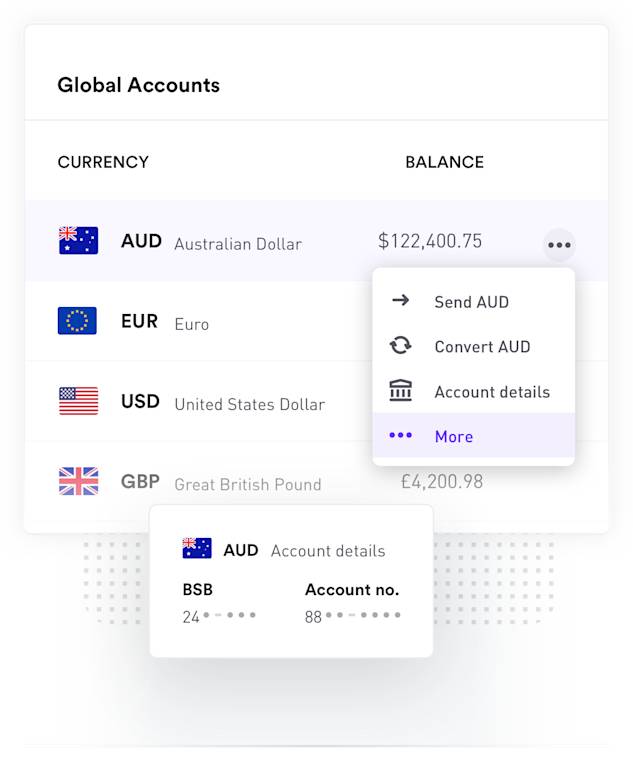

Zero holding fees with Airwallex. No matter the amount.

Airwallex business accounts come standard with no setup fees, no holding fees or card fees.

The only time you’re charged is when you make an FX conversion or international SWIFT payment. Even then, you get our market-leading FX rates - no matter the transaction amount.

How our fees compare against the Big Four Banks

With Airwallex, get access to our best rates, no matter the transaction amount. But don't take our word for it, check out how our rates stack up, below.

| monthly fee | FX (above interbank¹) | international transaction card fee | |

|---|---|---|---|

| FREE | 0.5% or 1.0% | FREE | |

| $10 AUD | 2.7% | 3% | |

| $10 AUD | 4% | 3% | |

| FREE with conditions | 3% | 3% | |

| FREE with conditions | 4% | 3% |

| monthly fee | |

|---|---|

| FREE | |

| $10 AUD | |

| $10 AUD | |

| FREE with conditions | |

| FREE with conditions |

| FX (above interbank¹) | |

|---|---|

| 0.5% or 1.0% | |

| 2.7% | |

| 4% | |

| 3% | |

| 4% |

| international transaction card fee | |

|---|---|

| FREE | |

| 3% | |

| 3% | |

| 3% | |

| 3% |

¹Where possible, we offer live exchange rates. Click here to find out more.

The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

See how our customers are finding Airwallex

Aiwallex is just so much simpler and more efficient than the business bank account that I had with CBA, with no fees and a rate that's consistently better than Transferwise. Handling and holding multiple currencies is seamless.

Edward Taylor

Founder of Rotor One Australia

"It’s crazy to me that we were being charged international FX fees by our big 4 bank for Facebook ad spend in AUD... Since adopting Airwallex virtual cards for our Facebook spend, we’ve been able to save $3,000 per month which now covers our agency fees! We’ve also started using virtual cards for our other business expenses and we’re making time and cost savings across the board. Love it.“

Jenny Le

Co-founder, Bubble Tea Club

“Airwallex is our one-stop shop for all our banking needs, in one easy-to-use interface. Without Airwallex, we would not have been able to scale our business as fast as what we’ve been able to achieve.”

Andrew Ford and Rosa-Clare Willis

Co-founders, Crockd

“Airwallex provides us with flexibility and cost savings in dealing internationally. We used Airwallex to receive our recent global fundraising round and pay international suppliers and are saving at least 5% per dollar transferred versus the big banks.”

George van Dyck

Finance Manager, Zoomo

Don’t lose out to hidden holding fees

The above estimations are calculated based on published rates from Wise. You can find more information on their holding fees here.

Our products and services are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221. Any information provided is for general information purposes only and does not take into account your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs. Please read and consider the Product Disclosure Statement before using our services.