MODIFI simplifies transactions with Airwallex

Find out how global commerce platform for business payments, MODIFI, took advantage of Airwallex’s Global Accounts to transfer money across multiple regions with export financing opportunities for businesses.

MODIFI helps businesses manage international trade through its innovative digital platform, enabling sellers to receive payments instantly and offering buyers the option to pay up to 180 days later. The company now serves over 1,500+ businesses across more than 54 countries, spanning the major trading regions of Europe, Asia, and America.

Industry

FinTech

Company size

100+ employees

Location

Amsterdam, Netherlands

MODIFI helps businesses manage international trade through its innovative digital platform, enabling sellers to receive payments instantly and offering buyers the option to pay up to 180 days later. The company now serves over 1,500+ businesses across more than 54 countries, spanning the major trading regions of Europe, Asia, and America.

The Challenge

Liquidity that benefits both trade parties - where sellers get paid instantly and buyers pay up to 180 days later - is the main value MODIFI provides their B2B clients. However when dealing with larger buyers, they quickly noticed a problem when collecting payments.

MODIFI funds the seller upfront for a small fee. This helps improve cash flow for sellers and improves buyer-seller relationships resulting in growth and expansion.

Although getting paid by smaller buyers was straightforward enough, when dealing with larger buyers, the buyers’ systems don’t allow payment to third parties - so they have to pay the seller into an account in the seller’s name. They couldn’t pay MODIFI directly.

Sven Bauer

Chief Operating Officer, MODIFI

“Customers of global trade solutions expect a smooth, fast and flexible experience. MODIFI was looking for a reputable and reliable partner that could accommodate cross-border payments at scale, while being easy to implement and operate within the MODIFI platform.”

MODIFI needed a solution that:

enabled them to set up accounts in the seller’s name

helped them receive payments vial local payment rails (rather than the inefficient and costly SWIFT system)

improved payment visibility

worked across multiple currencies and geographies

The Solution

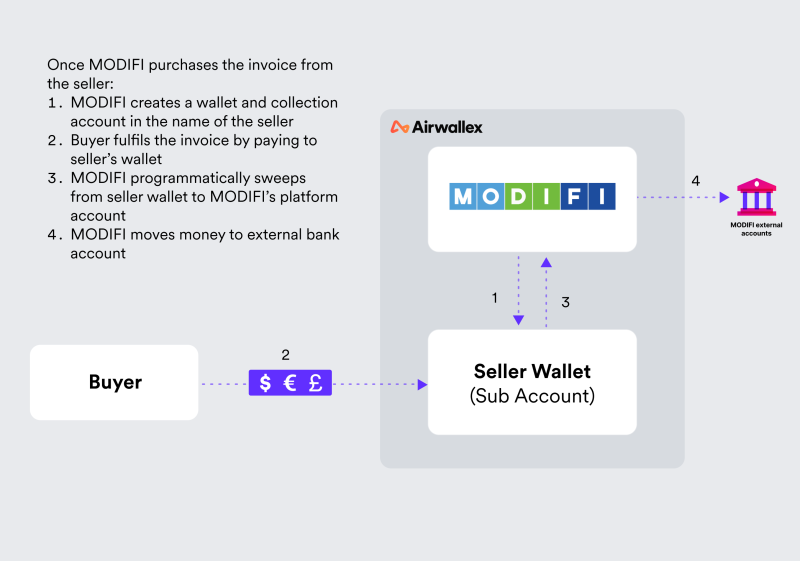

Airwallex’s Global Accounts are embedded into the MODIFI platform and essentially act as collection accounts for MODIFI. These accounts can be created instantly in their client’s name via API, and simplify the collection process and operations for MODIFI.

Airwallex Global Accounts are multi-currency, meaning MODIFI can collect payments from buyers around the world without being subject to unnecessary FX fees.

The Result

Accounts can now be in the seller’s name

By creating accounts in the seller’s name, buyers can meet their contractual obligations, and MODIFI remains in complete control of the payments process, tracking the payment means more visibility and less risk.

Leveraging local rails lessens the reliance on SWIFT

Processing SWIFT payment transfers is expensive. At Airwallex, 93% of all payments are done through local payment rails. This means MODIFI can now enjoy faster and cheaper payments globally.

Sven Bauer

Chief Operating Officer, MODIFI

“Airwallex is our payments partner of choice when it comes to removing the friction associated with traditional financing. By using Airwallex, we offer exporters a seamless solution which eases trade bottlenecks and liquidity issues. Airwallex is a key partner in our mission to deliver finance to companies seeking sustainable growth.”

API-first phased integration to suit MODIFI’s needs

We worked with MODIFI to implement a solution that best suits their specific challenges, with access to the comprehensive suite of Airwallex APIs to make integration as smooth as possible.

A problem solved globally

Fixing this seemingly small problem now means MODIFI can work effortlessly with exporters across the globe, offering a simplified financing and collection process for both buyers and sellers utilising MODIFI platform.

Ready to explore your global potential with Airwallex?

Disclaimer: The information contained herein is factual information only and is not intended to imply any recommendation or opinion about a financial product.