How does Airwallex work?

Erin Lansdown

Business Finance Writer - AMER

Airwallex is a modern financial platform that helps US businesses unlock global growth. From sending payouts across 200+ countries to accepting payments in 160+ local methods, we give companies of all sizes the tools to scale without borders.

Whether you're building a fast-growing eCommerce brand, running a SaaS company with international clients, or leading finance at an established enterprise, Airwallex helps simplify your financial operations, cut costs, and move faster.

In this article, we’ll walk you through what Airwallex does, how our products work, and how businesses across various industries – from travel and tech to logistics and retail – utilize our platform to drive success.

What kind of businesses use Airwallex?

Airwallex offers a range of products designed to support both growing businesses and global enterprises. Whether you’re a founder building a startup or a finance leader at a multinational company, our platform helps you move faster, operate globally, and scale with confidence.

Global HR leaders like Deel, travel companies like Tenon Tours, and eCommerce startups like Wayo all rely on Airwallex to manage and move money across borders.

No matter your size or sector, if you’re looking to expand, streamline, or simplify how your business moves money across borders – Airwallex is built for you.

Is Airwallex safe?

Yes, security is at the core of everything we do at Airwallex. We’re committed to keeping your business and financial data protected at every step.

We take a four-part approach to safeguarding your money:

Your funds are held with trusted US partner banks, and eligible balances are FDIC-insured up to $250,000 per customer through those institutions.

Our global infrastructure is equipped with advanced, 24/7 security monitoring and fraud detection systems to prevent threats before they occur.

We meet and exceed international security standards, including PCI DSS Level 1, SOC 2 Type II, and ongoing independent penetration testing.

In the US, Airwallex is licensed as a money transmitter in 43 states and partners with FDIC-member banks to ensure compliance with all relevant regulatory requirements.

With Airwallex, you can operate globally knowing your data, transactions, and funds are protected by enterprise-grade security.

Is Airwallex a bank?

Airwallex is not a bank. We’re a licensed financial technology company that partners with regulated US banks and local payment networks worldwide. This allows us to securely move money across borders and offer payments in local currencies.

How can I get started with Airwallex?

Getting started is easy. Sign up for a free global account by providing a few quick details.

Once you're set up, you can open multiple domestic and foreign currency accounts in minutes – no opening fees, no minimum transaction requirements.

If you’re part of a larger business with 500+ employees, reach out to our team of specialists to explore how Airwallex can support your global financial operations.

What does Airwallex do?

Airwallex helps US businesses manage money across borders – faster, smarter, and with fewer fees. Our all-in-one platform simplifies everything from collecting payments to controlling spend, so you can focus on growth.

Here’s what you can do with Airwallex:

Collect payments via Payment Links, eCommerce plugins, or our APIs

Hold and convert funds in multiple currencies with Global Accounts and market-leading foreign exchange (FX)

Pay vendors and teams around the world with fast, low-cost transfers

Issue corporate cards and manage team spend with built-in controls

Automate finance operations with Bill Pay, Expense Management, and software integrations

Build your own experience with our Embedded Finance tools and developer-friendly platform APIs

Whether you're expanding globally or streamlining operations, Airwallex gives you the infrastructure to move money like a local – anywhere in the world.

How can Airwallex help businesses navigate global payments?

Global payments can be more complex than they appear. Currency conversions, high fees, lengthy settlement times, and fragmented platforms can hinder your progress.

Airwallex removes this friction. We help US businesses accept payments from international customers, settle in local currencies, and avoid double conversions and hidden fees.

Built for modern businesses, Airwallex makes global payments feel as simple as domestic ones.

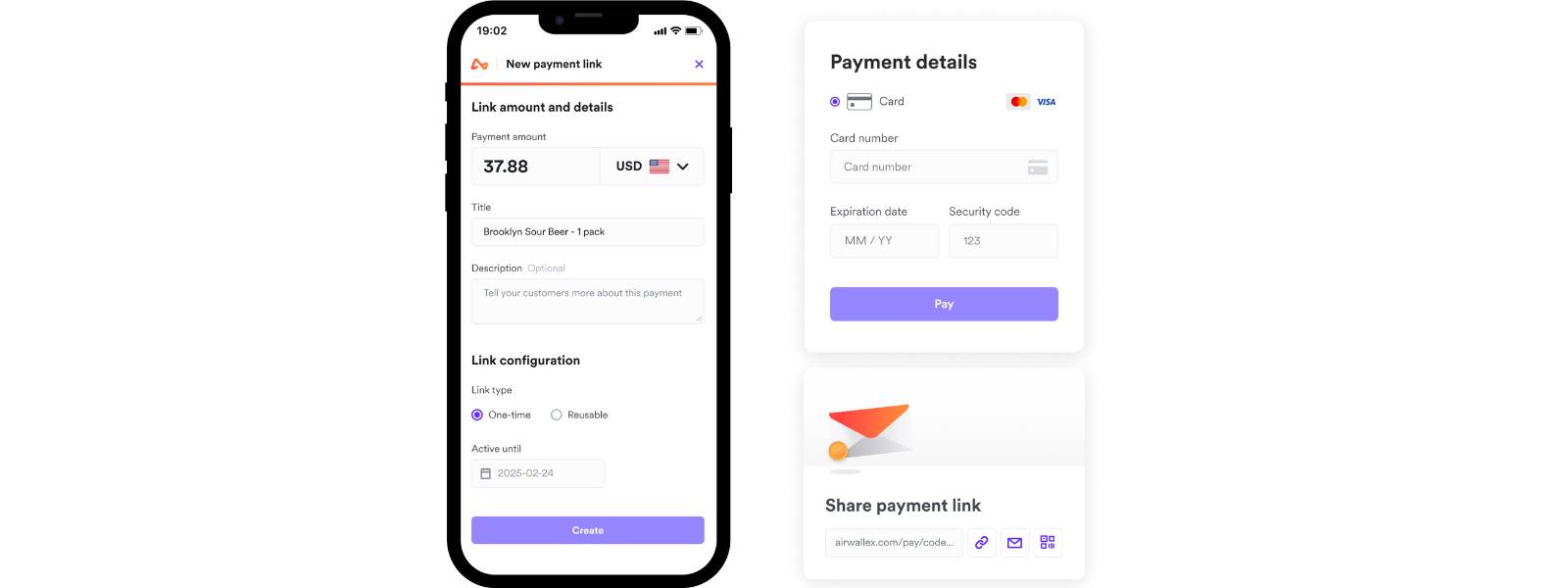

How do you set up payment links?

Not using a platform integration? No problem. You can easily create and share custom Payment Links – no coding or technical setup required.

Log in to your Airwallex account to create, customize, and send a link via email, social media, SMS, or even embed it in an invoice. You’ll be able to track incoming payments in real time, all from one place.

In the image below, you’ll see how simple it is to set up. On the left, you’ll enter the key payment details. On the right, your link is instantly generated – ready to share with your customers in just a few clicks.

You can then track your payments within Airwallex and get email notifications when you receive a successful payment.

Does the Airwallex payment platform accept Apple Pay?

Yes, Airwallex supports Apple Pay, so your customers can check out in seconds. We also accept Google Pay, PayPal, and major card networks like Visa, Mastercard, and American Express.

In total, we support over 160 secure online payment methods, so your customers can pay the way they prefer – with no friction and no extra steps.

How can Airwallex help businesses open Global Accounts?

Opening a bank account in another country typically involves paperwork, delays, and navigating complex regulatory requirements. With Airwallex, you can skip the admin and open local currency accounts in minutes without needing to visit a branch or set up a foreign entity.

Collect payments from customers in their local currency, then hold or spend those funds without forced conversions or added fees. You’ll get local bank details for each account, making it easier for customers to pay you, and for you to pay your suppliers.

The image below shows the Airwallex dashboard in action: a single view that allows you to manage multiple currency accounts, view real-time balances, and track transaction activity all in one place.

How can Airwallex help businesses manage FX and transfers?

Cross-border transfers can quietly erode your margins – slow delivery, hidden fees, and inflated exchange rates add up quickly.

Airwallex gives you the tools to move money globally with speed and transparency. Access interbank rates on 60+ currencies, with 100+ priced live on the spot market. Transfers are available to 150+ countries, with the full amount delivered – no hidden markups.

You can convert and send funds directly from your Global Accounts and track every transfer in real time. The view below shows how easy it is to manage FX in your Airwallex dashboard – see the rate, the amount, and the expected delivery time, all before you confirm.

You can also set up Batch Transfers, and pay up to 1,000 recipients in different countries in one go.

How can Airwallex help businesses pay bills?

Staying on top of vendor payments can become complicated, especially when invoices come from different countries, are in other currencies, and are received through various channels.

Airwallex Bill Pay helps simplify that process. You can upload, schedule, and pay bills from one place – no manual workarounds or spreadsheet tracking required.

Set up approval workflows, get notified when something requires review, and minimize errors with reduced manual data entry. You’ll also get access to competitive FX rates for international payments, and you can connect to tools like Xero, QuickBooks, and NetSuite to keep your books up to date automatically.

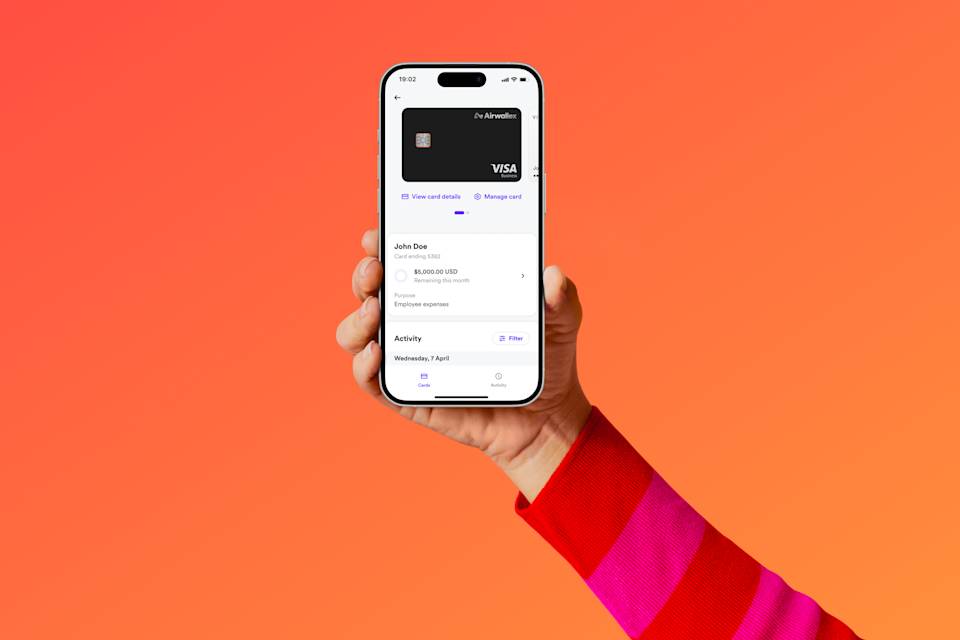

How can Airwallex help businesses issue company cards?

Businesses need company cards to manage day-to-day expenses, but setting them up can be time-consuming, and managing them at scale often adds complexity. Some employees end up waiting weeks to receive a card, while others rely on manual reimbursements.

Airwallex provides a faster and more flexible way to issue and manage company cards. You can generate virtual cards instantly and set up physical cards when needed. Both work at home and abroad, with support for Apple Pay and Google Pay.

From your dashboard, you can:

Set individual spending limits and merchant controls

Manage approval workflows

Issue, freeze, or cancel cards at any time

You’ll also have real-time visibility into spending, making it easier to stay on top of budgets, reduce administrative tasks, and give your team the tools they need to move quickly without losing oversight.

How can Airwallex help businesses manage expenses?

Tracking expenses is a necessary part of running a business, but it’s often manual, time-consuming, and frustrating for both employees and finance teams. Airwallex’s expense management tools are built into our platform and cards, allowing you to simplify the process from swipe to submission.

For employees: Submitting expenses is a quick and straightforward process. When using an Airwallex card, employees can upload receipts, enter details, and submit expenses directly through the mobile app – eliminating the need for spreadsheets or follow-up emails.

For finance teams: Track spending in real time, access transaction details instantly, and approve expenses from your desktop or mobile app. You can set up multi-level approval workflows to match your policies and integrate with your accounting software to speed up reconciliation.

Which software integrations does Airwallex offer?

Integrating your financial tools can help reduce manual work, minimize errors, and provide better visibility across your business. Airwallex offers a growing suite of integrations that connect with popular platforms across accounting, eCommerce, productivity, and CRM.

Whether you're looking to automate reconciliation, streamline expense management, or connect payments with your existing workflows, our integrations are designed to help you get more from your tech stack.

Some of the most commonly used integrations include Xero, NetSuite, QuickBooks, Shopify, and HubSpot. You can explore the full list of available integrations here.

What is embedded finance?

Embedded finance is the integration of financial services – like payments, accounts, or cards – directly into a company’s digital product or platform. It allows businesses to offer financial features natively within their customer experience, without needing to build everything from scratch or become a licensed financial institution.

Some traditional examples include retail credit cards offered by supermarkets or auto loans at a car dealership. These were often powered by banks behind the scenes.

Today, embedded finance is more accessible and flexible. Thanks to modern APIs and fintech infrastructure, businesses can integrate tools such as virtual wallets, branded cards, global accounts, and even lending services, all tailored to their customers' needs and branded as their own.

The next generation of embedded finance enables businesses to unlock new revenue streams, improve customer loyalty, and deliver greater value.

What are Airwallex’s embedded finance tools?

Airwallex offers a powerful set of embedded finance tools that help platforms and enterprise businesses deliver seamless financial experiences while growing revenue.

Here’s what’s included in our embedded finance stack:

Global Treasury

Enable your customers to collect, store, convert, and disburse funds worldwide through one integration.

Support local collections in 60+ countries and local payouts in 120+

Let users hold 20+ currencies and convert funds at interbank FX rates

Help customers avoid unnecessary conversion fees by collecting and paying in the same currency

Reduce operational overhead with built-in reconciliation and batch payout features

Rely on Airwallex’s global licensing (60+ licenses and registrations) to stay compliant across markets

This end-to-end infrastructure is designed to streamline money movement while giving you the flexibility to monetize FX, payout fees, and more.

Banking as a Service

Offer customers a fully integrated financial experience under your own brand. With Airwallex’s BaaS capabilities, you can enable:

Global accounts with local bank details

Multi-currency wallets and held balances

Branded virtual and physical cards

Lending features with flexible credit risk management

Payments for Platforms

Create a seamless pay-in and payout experience with built-in compliance and fund flow management. Our APIs allow you to:

Set up connected accounts programmatically

Split and route funds automatically

Settle in local currencies to reduce FX costs

Monetize payments by bundling with premium features or charging transaction fees

Stay compliant without needing PayFac registration

Whether you’re building a fintech product, expanding into new markets, or streamlining how your customers send and receive money, Airwallex gives you the infrastructure to embed finance.

What are Airwallex’s Platform APIs?

Airwallex’s Platform APIs give businesses the building blocks to embed financial services directly into their products and workflows. Designed for scale and flexibility, these APIs let you automate and manage payments, global accounts, FX, cards, and more—all through one integration.

Built with developers in mind, our Platform APIs come with clear documentation, reliable infrastructure, and support for complex, global use cases.

What you can do with Airwallex’s Platform APIs:

Accept payments from users in 180+ countries

Send funds to 200+ countries in 60+ currencies

Issue virtual and physical cards in 40+ countries

Maintain enterprise-grade reliability with 99.9% system uptime

Scale effortlessly, with over 54 million API requests processed daily

Designed for tech-forward businesses, our Platform APIs enable you to build smarter financial experiences and bring new capabilities to market more quickly.

How does the eCommerce industry use Airwallex?

For eCommerce brands, margins matter, and cross-border payments and FX fees can eat into them fast. Airwallex helps online sellers simplify payments, reduce costs, and manage international operations more efficiently.

New York–based product sourcing platform Wayo utilizes Airwallex to facilitate payments to global suppliers and enhance its checkout experience. By switching to Airwallex, Wayo significantly reduced FX costs on high-volume transactions and eliminated delays caused by blocked payments.

How does the travel industry use Airwallex?

Travel businesses often rely on a vast network of international vendors, and managing those relationships means sending fast and reliable payments across borders.

Tenon Tours, a Massachusetts-based travel company, uses Airwallex to streamline payments to more than 400 partners across Europe. With faster payouts, improved visibility, and significant savings on FX and transaction fees, their finance operations now run more smoothly at scale.

Read the Tenon Tours case study →

How does the SaaS industry use Airwallex?

SaaS companies need scalable financial tools that can keep up with global customer and partner growth. Airwallex helps streamline international payments, reduce overhead, and simplify financial operations – all through developer-friendly APIs and integrations.

Toronto-based PartnerStack uses Airwallex to manage global payouts to thousands of partners. With faster onboarding, real-time reconciliation, and lower FX fees, they’ve built a more reliable and cost-effective payment experience into their platform.

Read the PartnerStack case study →

Ready to simplify the way your business manages money?

Airwallex was built to help businesses break through borders by making global finance faster, more innovative, and more accessible. From streamlining payments to scaling operations across multiple markets, our platform provides you with the tools to grow with confidence.

View this article in another region:AustraliaNew Zealand

Erin Lansdown

Business Finance Writer - AMER

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

Posted in:

Finance operations