When you open a UK bank account, you’ll receive a sort code and bank account number. The sort code identifies the bank and branch where you opened your account, while the bank account number identifies your unique bank account. You may be able to find these printed on your debit card, but not always.

Financial institutions in the UK use sort codes and bank account numbers to facilitate money transfers. To receive payment via bank transfer as an individual or business, you’ll need to share these details with the sender. You can also set up direct debits with your sort code and bank account number.

Here, we’ll look at what sort codes and bank account numbers are and what they are used for.

What is a sort code?

A sort code is a six-digit number that indicates the bank and the branch where you opened an account. The first digits identify the bank, while the latter digits identify the branch. Every UK bank account has a sort code and a unique bank account number. Some banks and financial institutions are online-only and don’t have brick-and-mortar branches. For these banks, every customer will have the same sort code. Six-digit sort codes in the UK date back to 1957, resulting from the industry becoming more automated.

Sort codes ensure financial transactions are accurate and efficient. Financial institutions use sort codes to validate bank and branch details to route payments accurately to the recipient's account. This helps to prevent delays, errors, and misdirected funds.

What is a bank account number?

A bank account number identifies your bank account and is always unique. If you have several accounts – for example, a savings account and a current account – they will have different account numbers, even if you hold them with the same bank.

UK bank account numbers are eight digits long. Some are seven digits, but a zero is added to the front of the number to standardise the length.

Where can I find my sort code and bank account number?

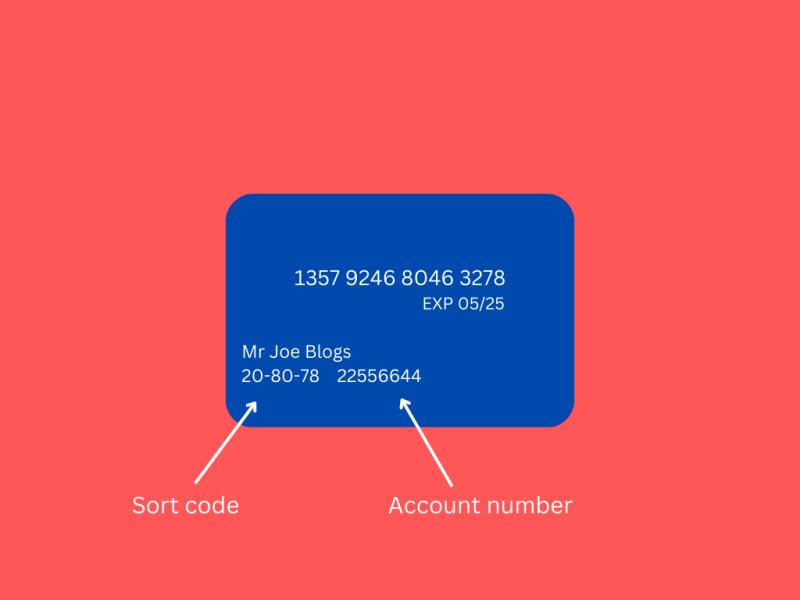

You can usually find your sort code and bank account number on a debit card. The sort code is a six-digit number, often grouped in pairs, while the bank account number is an eight-digit number, on either the front or back of the card.

But don’t confuse your sort code and bank account number with the 16-digit number on your card. This longer number, along with the card’s expiry date and CVV, is used for online payments. As fraudsters usually target this information, you should only share it with trusted vendors during secure transactions.

Not all cards display sort codes and bank account numbers. For example, Airwallex Borderless Cards don't include bank details because these multi-currency cards enable customers to spend in different currencies via a single card.

If your card doesn’t show your sort code and bank account number, you’ll also be able to find them via your mobile banking app, bank statements, and cheque book.

When is a sort code and bank account number required?

Banks and financial institutions use sort codes and bank account numbers to route funds accurately during various financial transactions, including:

Domestic transfers in the UK: The sender must provide the recipient’s sort code and bank account number during wire transfers. These details identify the exact bank and branch that holds the recipient's account.

International transfers to UK accounts: When an individual or business outside the UK makes a transfer to a UK bank account, they usually have to provide the recipient’s sort code and bank account number, along with the SWIFT/BIC code. But, banks and financial institutions may sometimes ask for the recipient’s IBAN (International Bank Account Number) instead. If you’re looking for a faster way to accept and send payments around the world, try Airwallex.

Direct debits in the UK: Direct debit is an automated payment method which lets businesses, such as utility providers and subscription services, collect recurring payments from their customers. To set up a direct debit in the UK, the payee will need to provide their sort code and bank account number. Financial institutions use these details to debit funds accurately from the payee’s account to the recipient’s account.

How do sort codes, SWIFT/BIC codes, and IBANs differ?

During money transfers, it’s easy to be confused by the different codes you may be required to provide. Here’s a breakdown:

| Sort Code | SWIFT/BIC Code | IBAN |

|---|---|---|---|

Purpose | Identifies the bank and branch that holds the UK bank account | Identifies the bank, location, country, and branch that holds the bank account | Identifies an individual bank account |

Format | 6 digits (e.g. 20-30-40) | 8 or 11 alphanumeric characters (e.g. NWBKGB2L) | Up to 34 alphanumeric characters (e.g. GB29NWBK60...) |

Usage | Domestic transfers, direct debits within the UK | International transfers using the SWIFT network | International transfers, primarily within Europe and some other countries |

Is it safe to share your sort code and bank account number?

Yes, it’s safe to share your sort code and bank account number. You’ll need to share these details whenever you want someone to transfer money into your UK account or set up a direct debit.

You can set up direct debits for automatic payments, like bills or subscription fees. Only companies vetted by the Direct Debit Scheme can use your sort code and bank account number to take money from your account, so your funds are always protected.

For businesses, include your sort code and bank account number on your invoices so customers can pay you via bank transfer. Alternatively, Airwallex customers can include a Payment Link in their invoices to get paid instantly.

Are sort codes and bank account numbers the same in the Republic of Ireland?

Sort codes are no longer used in the Republic of Ireland. Instead, transactions in Ireland are processed using an IBAN (International Bank Account Number).

An IBAN has 34 characters: both numbers and letters. It identifies the bank, the specific account, and the branch’s geolocation.

What happens if I use an invalid or incorrect sort code?

If you used an invalid sort code during a wire transfer, the payment will likely be rejected, delayed, or not processed at all.

If you think you may have used an incorrect sort code, contact your bank or financial institution immediately.

Sort codes are used with bank account numbers to identify the recipient’s bank account, so it’s unlikely that an incorrect sort code alone will send money to the wrong account. But, problems can arise if both sort code and bank account numbers are wrong.

Manage money globally with Airwallex

With Airwallex Global Accounts, you can open a British Pound account with local bank details, including a sort code and bank account number. Your UK clients can pay into your account using these details without forced currency conversions. Our Global Accounts are multi-currency accounts offering 20+ currencies, so you can receive and send money internationally at zero transaction fees.

Besides helping businesses manage transfers, our suite of modern financial solutions can simplify and reduce the costs of your financial operations. These solutions include payment acceptance in multiple currencies, AI-powered expense management tools, and time-saving API integration solutions.

View this article in another region:AustraliaNew ZealandUnited KingdomUnited StatesGlobal

Shermaine Tan

Manager, Growth Marketing

Shermaine spearheads the development and execution of content strategy for businesses in Singapore and the SEA region at Airwallex. Leveraging her extensive experience in eCommerce, digital payment solutions, business banking, and the cross-border industry, she provides invaluable insights that guide businesses through the complexities of global commerce. Specialising in crafting relevant and engaging content that resonates with business owners, her work is designed to drive growth and innovation within the fintech and business economy space.

Posted in:

TransfersShare

- What is a sort code?

- What is a bank account number?

- Where can I find my sort code and bank account number?

- When is a sort code and bank account number required?

- How do sort codes, SWIFT/BIC codes, and IBANs differ?

- Is it safe to share your sort code and bank account number?

- Are sort codes and bank account numbers the same in the Republic of Ireland?

- What happens if I use an invalid or incorrect sort code?

- Manage money globally with Airwallex