New at Airwallex: December Edition

Shannon Scott

Chief Product Officer

This month, we’re helping businesses simplify operations and get more from their funds. The WebApp now features an AI Assistant to guide businesses through setup and their first transactions. Business accounts can add NZD funds via direct debit, while admins can enforce late submission policies for expenses. Merchants with Mexican entities can now accept Visa, Mastercard, Discover, and Diners Club payments in MXN. Developers can also integrate faster with the MCP Server and new Org and multi-account APIs. Here’s what’s new:

Business Accounts

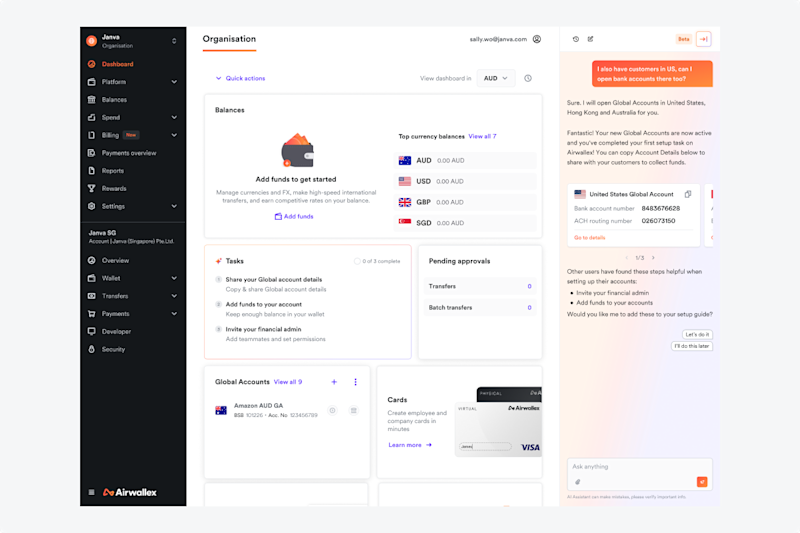

Early accessGet started faster with the new AI Assistant in the WebApp

We’re introducing an AI-powered assistant in the Airwallex WebApp to help new customers get up and running quickly. The assistant understands your business context, guides you through onboarding, answers questions in real time, and can perform actions on your behalf – such as opening new Global Accounts or enabling payment methods you want to accept.

It tailors setup guides to your goals, navigates you to the right place, and provides answers to your specific needs. With 24/7 concierge-style support, completing your first transactions and managing day-to-day financial tasks is faster and easier than ever.

Add funds via NZD direct debit

New Zealand business account customers can now add NZD funds to their wallet via direct debit by linking an external NZ bank account. Platform customers can also fund their Connected Accounts using direct debit. Deposits settle in 2-3 days via the Bulk Electronic Clearing System (BECS).

Additional releases:

Streamline transfer approvals: Authorised users can now create and approve transfers in a single action, streamlining your transfers process. Just head to account settings to enable self-approval or multi-step approval.

Pennylane Bank Feed: Connect your Airwallex account to Pennylane to automate reconciliation and reduce manual data entry. Choose which wallet currencies to sync, set a start date, and run scheduled transaction syncs for accurate, up-to-date financial records.

Priority ERP Bank Feed (early access): For businesses in Israel, the new Priority ERP Bank Feed integration enables automated, multi-currency transaction syncing directly between Airwallex and Priority ERP. This removes manual reconciliation steps, helping finance teams close the books faster and with greater accuracy.

Spend

Early accessEnforce expense discipline with late submission policies

Admins can now set a late submission policy to keep employee expenses on track. Define submission deadlines and, if needed, automatically freeze cards when expenses are overdue. Late submission policies apply to employee cards, and admins can exempt individual cards as needed.

Submit and approve spend requests on the Airwallex mobile app

Employees can now submit card requests and track their request status directly from the Airwallex mobile app. Approvers can review and approve incoming spend requests on the go, helping to keep workflows moving without delays.

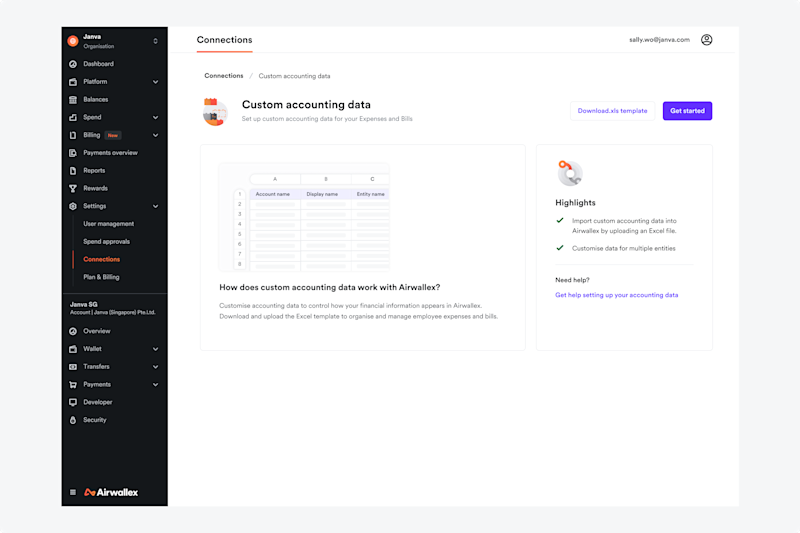

Configure accounting data uniquely for each entity

You now have more granular control over accounting configurations at the entity level. With enhanced Custom Accounting File Upload, you can tailor all accounting attributes including Chart of Accounts, Tax Rates, and Custom Fields for each legal entity in your organisation using a downloadable Excel template.

Additional releases:

AI-powered tax rate suggestions for Expenses: Airwallex Expenses now scans uploaded receipts and automatically suggests the correct tax rate, reducing manual entry and improving accuracy.

Set approval rules for Bills matched to POs: Bill Pay customers using Airwallex Purchase Orders can now configure distinct approval conditions based on whether a bill is matched to a PO. This allows simpler, faster approvals for matched bills while retaining stronger controls where needed.

Automate user onboarding with Deel: Deel is now available as an HRIS integration, joining our network of 30+ providers. You can sync users directly from Deel to Airwallex to keep employee data accurate across the full lifecycle — quickly onboard new users, update key details, and revoke access when someone leaves.

Payments

Early accessAccept card payments in Mexico with Airwallex Payments

Merchants with Mexican legal entities can now accept Visa, Mastercard, Discover, and Diners Club payments through Airwallex Payments. All transactions are processed and settled in MXN.

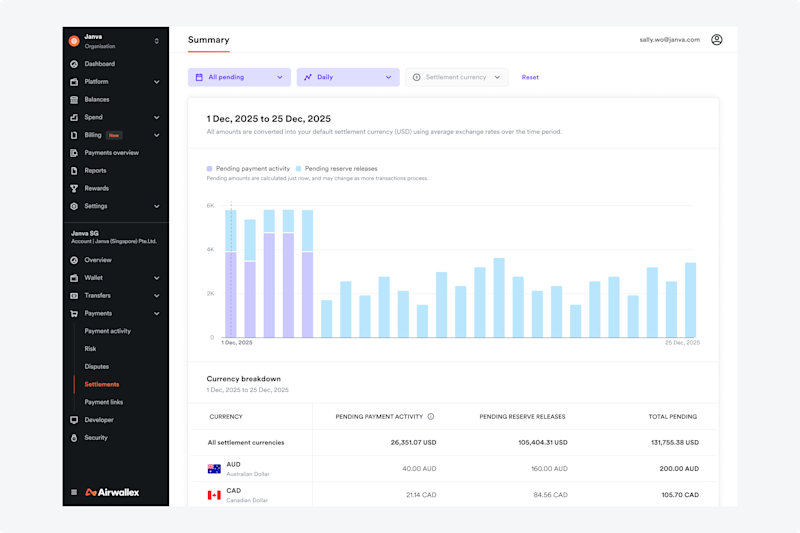

Early accessGain clearer insights with the new settlements dashboard

Get a consolidated view of both historical and future settlements to better plan and manage cash flow. Key features include:

Unified view of payment activity and reserve releases

Breakdowns by currency and settlement status

Trend analysis by day, week, or month

Custom date ranges and flexible filtering

Additional releases:

Manage Shopify Payment Plugins from Connections: You can now manage your Airwallex Payments Plugin for Shopify directly from the Connections tab in the Airwallex WebApp. From here, you can upload your logo and customise which payment methods shoppers see, all in one place. Learn more here.

Automatic Currency Conversion and partial capture support on Magento: Automatic Currency Conversion (ACC) is now available for WeChat Pay, Touch ’n Go, Kakao Pay, GCash, DANA, and Alipay on Magento, allowing shoppers to pay in their preferred currency for a more localised checkout experience. You can also now capture partial amounts of authorised payments made using cards, Express Checkout (Apple Pay and Google Pay), Klarna, and Afterpay. This supports workflows like partial order fulfilment, so you only charge for items shipped. Learn more here.

Developer Experience

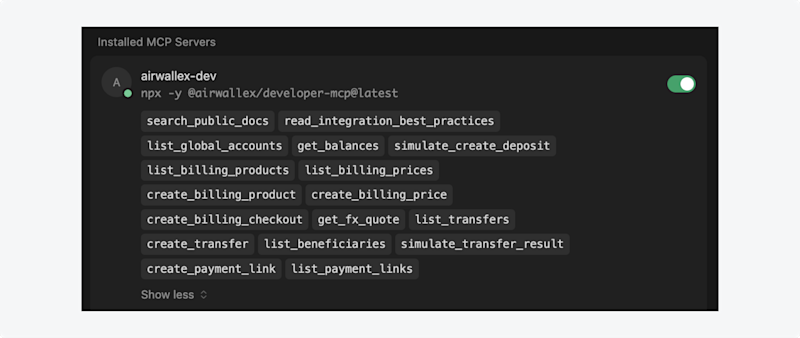

Accelerate integrations with Airwallex’s Developer MCP Server

Developers can now build faster and more accurately using Airwallex’s Developer Model Context Protocol (MCP) Server. By connecting your coding agent to the MCP Server, it can:

Generate integration-ready code directly in your coding environment

Troubleshoot issues using contextual API knowledge and real-time guidance

Create sandbox resources and simulate transactions without leaving your IDE

This reduces reliance on manual documentation, prevents hallucinated code, and shortens time to go-live. Learn more here.

Simplify integration management with organisation-level and multi-account API keys and webhooks

We have introduced organisation-level and multi-account API keys and webhooks. Organisation-level API keys and webhooks allows API access to organisation-level resources such as Billing and Spend. Multi-account API keys and webhooks introduces a new method of managing your API keys and webhooks in addition to the existing per-account approach, simplifying integration management for complex businesses with multiple accounts.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

Interested in helping us build the future of finance? Join our Product team here

View this article in another region:AustraliaCanada - EnglishCanada - FrançaisChinaEuropeIsraelNew ZealandSingaporeUnited KingdomUnited States

Shannon Scott

Chief Product Officer

Shannon Scott is the Chief Product Officer at Airwallex. Shannon is responsible for Airwallex's product strategy and roadmap, spanning financial infrastructure, business software, and embedded finance solutions.