What is the SWIFT system? How it works and what it means for global payments

The Airwallex Editorial Team

Summary:

SWIFT is a messaging network that powers international bank transfers. It acts as a secure communication channel rather than a fund handler.

In the 1970s, SWIFT replaced the slow TELEX system and standardized "wire transfers," though it directs funds rather than handling them directly.

While multinational companies trust SWIFT, its multi-day transfer times and fees push modern businesses to seek faster, more cost-effective solutions.

US-headquartered multinational enterprises (MNEs) employ more than 44 million workers globally, spanning countries, continents, and currencies.¹ Managing global payroll, office expenses, and supplier partnerships requires fast, efficient currency exchanges to settle invoices and receive payments. Many businesses rely on the standardized SWIFT banking system to keep these transactions secure and consistent, which enables clear, cross-border communication between financial institutions.

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) system doesn’t actually transfer funds – it's a secure, standardized network that tells banks how to do it. But businesses need speed, lower costs, and fewer delays – and tech is stepping up.

In this article, we’ll explore what SWIFT is, how SWIFT transfers work, and new SWIFT alternatives for businesses.

Understanding the SWIFT network?

The SWIFT network is a secure messaging system that lets banks communicate payment instructions for international transfers. Founded in Brussels in the 1970s, the SWIFT system replaced the slower, less secure TELEX system and helped standardize global payments, giving rise to the term "wire transfer."

The SWIFT financial system doesn’t move money directly. Instead, it sends payment orders between financial institutions, and a unique SWIFT code identifies each one to ensure accuracy and security.

You might also hear the term BIC, which stands for Business Identifier Code, used interchangeably with SWIFT code – they both refer to the same unique identifier for financial institutions on the SWIFT network.

Today, over 11,000 institutions in 212 countries rely on SWIFT to support secure cross-border payments and other financial services.

How businesses use SWIFT day-to-day

Thousands of companies rely on SWIFT every day to optimize their core treasury activities from handling supplier invoices globally , running payroll located in other regions, and facilitating intercompany transfers between international entities.

The use of SWIFT’s messaging platform allows for Straight-Through Processing (STP), meaning that payments can be sent and received from one bank to the next via a network of correspondent banks securely and rapidly.

When you send payments, companies offer different fee model options like OUR (sender pays all fees), SHA (shared fees), and BEN ( recipient pays fees). These fee structures will be further explained later in this article.

SWIFT payment services

Beyond its core financial messaging for banks, SWIFT provides businesses with a range of valuable services,2 including:

Market infrastructure services to help businesses adapt to evolving community needs and financial regulations.

Financial crime compliance and cybersecurity support to maintain effective compliance with international sanctions, anti-money laundering (AML), and know-your-customer (KYC) requirements.

Corporate treasury, including cash management and financial risk management, to navigate the modern, global economy. In contrast, Airwallex’s Global Treasury solution is also available for your business, so you can collect, store, and disburse funds globally.

What SWIFT sanctions mean for your business

SWIFT is central to enabling international bank transfers, but its reach also intersects with global geopolitics. While SWIFT itself is a neutral organization, it’s subject to the laws of Belgium and the European Union (EU). That means when the EU imposes sanctions, such as disconnecting banks from sanctioned countries, SWIFT may be required to restrict access for those financial institutions.

What does this mean for your business? If you’re working with a company in a sanctioned country, your payments could be blocked, delayed, or even frozen, leaving your business stuck in the middle.

That’s why it's critical to work with a payment provider that takes compliance seriously. Providers like Airwallex are committed to complying with applicable international sanctions, including those issued by authorities in the US and EU. Its compliance teams monitor for restricted entities and proactively screen transactions to help businesses avoid regulatory risk.

Sanctions aren’t just headlines; they directly impact how money moves across borders. Because SWIFT operates under the jurisdiction of the EU and is overseen by central banks from the G10, the regulatory landscape for cross-border payments is constantly evolving.

The bottom line? When it comes to international payments, speed and transparency aren’t enough. You need a partner that embeds compliance into every transaction, so your business can operate confidently and securely across borders.

Who uses SWIFT?

As the dominant infrastructure for global banking, various businesses and individuals use SWIFT to transfer money overseas. This includes:

Banks

Cross-border businesses

International employers

Global franchises

Securities dealers

Asset management companies

Clearing houses

Depositories

Foreign exchange brokers

Now, businesses have other global transfer options, like Fedwire and Ripple. But when it comes to widespread use for international money movement, SWIFT is still the big player.

However, faster and more cost-efficient ways to send and receive money overseas will be key as your business pushes further into the global market.

For example, an Airwallex multi-currency business account is one such solution. It offers businesses same-day transfers, market-leading rates, and world-class security. You’ll also be able to trade in multiple currencies from a single platform.

How does the SWIFT network work?

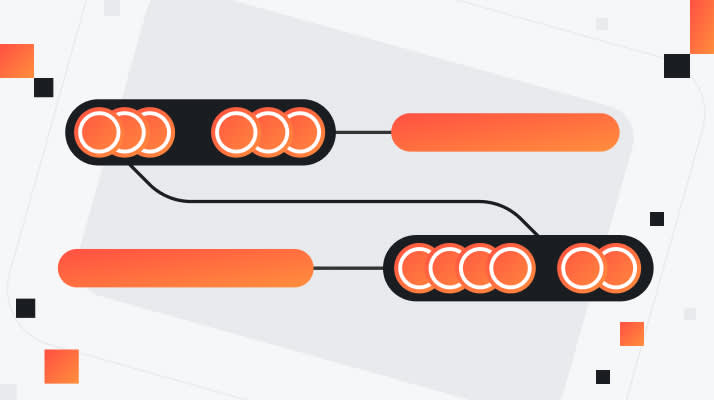

Think of the SWIFT network as a highly secure and efficient digital post office specifically for banks. It doesn't handle the actual money, but rather the information needed to move it from one account to another globally.

When you initiate a SWIFT payment – say, a US business paying a retail supplier in Germany – your bank drafts a standardized electronic message with key details:

The recipient's bank

The recipient’s bank account number

The transfer amount

This message then travels through the SWIFT network, passing through several intermediary banks. The SWIFT code enables the network to accurately identify and route the payment order to the correct destination bank.

Security is paramount within the SWIFT network. Messages are transmitted using sophisticated and encrypted communication channels, protecting sensitive financial information.

How to make a SWIFT payment

To make a SWIFT payment, you'll need a bank account with a SWIFT code and a few additional details, which we'll cover below.

1. Gather the needed banking information

To initiate a SWIFT transfer, you'll need the following details for both yourself and the recipient:

Your full name, address, and bank details

The recipient's full name (or business name) and address

The recipient's bank name and address

The recipient's bank's SWIFT code (BIC)

A SWIFT code consists of eight to eleven characters. These characters identify the bank sending the message and the bank receiving it. SWIFT codes are also known as Bank Identifier Codes (BICs).

Each element of a SWIFT code represents a piece of information:

A 4-letter bank code

A 2-letter country code

A 2-digit location code

A 3-digit branch code (SWIFT codes don’t always include this)

Note: SWIFT codes differ from International Bank Account Numbers (IBAN). A SWIFT code identifies the bank, while an IBAN pinpoints the individual bank account.

2. Request a transfer and consider fees

Once you have the recipient's SWIFT code and other details, you can request the transfer from your bank online or in person, similar to a standard bank transfer.

But make sure you understand how SWIFT payment fees work before you submit the payment. Given the international nature of the SWIFT payment system, there is no set table of fees, so it pays to check first. You can typically expect two types of fees:

Transaction fees. Your bank and any intermediary banks involved in routing the payment can charge these fees. Your bank may charge a fixed or variable fee.

Foreign exchange (FX) fees. If the transfer involves different currencies, an FX fee will apply. Banks' FX rates include their own charges on top of the interbank rate and can be up to 3.5%.

Tip: Discuss with your bank how these fees will be applied (paid by you, the recipient, or split) to ensure the correct amount reaches the recipient.

If you’re seeking more cost-effective international transfers, consider alternatives like Airwallex. These companies often offer lower FX rates and no transaction fees on international payments.

3. Confirm the recipient country and currency

Once you’ve arranged the transfer with your bank, they’ll ask you to confirm the recipient country and desired currency. Remember that you’ll have to pay FX rates if the recipient's currency is different from yours.

At this point, your bank and the recipient bank will arrange the transfer via SWIFT messages and will likely clear the transfer within one to five business days.

SWIFT system considerations

The SWIFT payment network has many advantages: It’s secure, transparent, and reliable. However, it also has a couple of disadvantages.

One major issue is business transfer delays. SWIFT transfers can take up to five days or more, especially when intermediary banks send them through multiple institutions. If your business manages payroll, supplier invoices, or urgent client payments, these delays can disrupt cash flow, strain vendor relationships, and slow down operations.

You can also face hidden fees with SWIFT. Different financial providers charge different fees when they process SWIFT transfers, which means determining the final cost of a SWIFT transaction can be difficult. So, hidden payment fees may impact both you and your recipient.

In the worst case, this might mean your recipient receives less money than they expect, which can cause friction between businesses and the people they need to pay.

If these are your concerns, modern solutions like Airwallex can help you complete international transactions quickly and with fewer fees. With Airwallex, your business can make fast (usually same-day), zero-fee money transfers globally – an easy and cost-effective way to pay global suppliers and staff, and accept global payments.

Business payment rails: SWIFT vs SEPA vs local

While SWIFT is the global standard, it is not considered the most effective tool for every international payment. Understanding the alternatives can help your business move money more efficiently and affordably. Today, financial infrastructure permits you to select the optimal mode of payment for each specific transaction.

SWIFT

SWIFT is the preferred choice for its unique global reach, with connectivity to bank in over 200 countries. You should use SWIFT when there are no local rails to be used for a region, or when the payment involves a currency conversion that is possible but too expensive locally. However, be aware that SWIFT transfers go through a network of correspondent banks, so it can take anywhere from a few days to reach its destination and the cost in fees is higher than local or SWIFT transfers.

SEPA

Single Euro Payments Area (SEPA) is a project aiming to facilitate bank transfers in euros. SEPA spans across 36 countries, including the Eurozone and various non-Eurozone participants. For one-time payments, you can use SEPA Credit Transfers (SCT) and for recurring payments: SEPA Direct Debits (SDD). For companies sending and receiving EUR payments in Europe, SEPA is usually faster and much cheaper than SWIFT, making it the preferred choice for intra-European transactions.

Local rails

Local payment rails are the domestic clearing systems that countries rely on for onshore bank-to-bank transfers, such as ACH in the United States, Faster Payments in the UK, or DuitNow in Malaysia.

With a global payment partner, your enterprise can tap into these networks and pay like a local. This eliminates the problems inherent in correspondent banking and leads to faster (often same-day) settlement times and significantly reduced fees. Airwallex, for instance, uses these networks to provide local fast payouts into over 120 countries.

Discover modern alternatives to SWIFT transfers

SWIFT transformed international payments, but it no longer meets the needs of many businesses today. High fees, slow speeds, and limited transparency can make SWIFT a tough fit for modern global operations.

That’s why more companies are turning to alternatives like Airwallex Transfers. You can send payouts to over 150 countries in 60+ currencies quickly, securely, and without the high costs of traditional bank wires. Batch transfer capabilities also let you simultaneously pay up to 1,000 recipients, using intuitive, no-code templates.

Unlike SWIFT, Airwallex is purpose-built for global businesses. An Airwallex Business Account lets you open local currency accounts with local banking details, so you can receive, hold, and send money via local rails – no overseas entity necessary.

And transfers are just the start. Airwallex offers a complete end-to-end financial platform that includes comprehensive Spend Management to issue cards, control expenses, and monitor team spending, as well as Global Accounts to accept payments like a local.

If you rely only on SWIFT for cross-border transfers, there’s a faster and more cost-effective way to move your money – and grow your business globally.

SWIFT frequently asked questions

Who owns the SWIFT banking system?

SWIFT’s 2,400 global shareholders own and control the organization, and they elect its Board of Directors, which includes 25 representatives from banks around the world.

SWIFT also employs an internal Executive Committee, which oversees the day-to-day operations, implements strategy, and ensures the organization meets its business and compliance objectives.

How do companies use SWIFT to make payments?

Companies initiate an international wire with their bank or payment provider by providing beneficiary's details (name, address, account/IBAN number, BIC/SWIFT), payment amount and currency, and the preferred fee structure (OUR/SHA/BEN).

The provider then transmits standardized SWIFT messages from the correspondent bank to the beneficiary's bank. These operations take an average of 1-5 business days across corridors, time zones, compliance processes, and intermediary banks.

For faster or lower-cost transfers, companies may use local rails (where supported) or SEPA for EUR within the Eurozone.

Do all banks use SWIFT?

Most banks have a SWIFT code, but it’s not a guarantee. Smaller banks and credit unions might not connect to the SWIFT network or use international routing codes. It’s a good idea to double-check that your bank and the recipient’s bank support SWIFT transfers.

How many banks are connected to the SWIFT network?

Over 11,000 financial institutions across 212 countries are connected to the SWIFT network to support international money transfers.

Is SWIFT used in the US?

Yes, the US uses SWIFT for international wire transfers. Most major American banks use the SWIFT network to send and receive funds across borders securely.

Sources:

https://www.bea.gov/news/2024/activities-us-multinational-enterprises-2022

https://www.swift.com/our-solutions/a-to-z

View this article in another region:AustraliaCanada - EnglishCanada - FrançaisEuropeNew ZealandSingaporeUnited KingdomGlobal

The Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

Posted in:

Online payments