Push vs. pull payments: What’s the difference?

Airwallex Editorial Team

Key takeaways:

Push and pull payments are two distinct methods for initiating payments.

Pull payments occur when the recipient initiates the transaction and “pulls” the money from the payer, such as through subscription payments. Customers may prefer them for their convenience, and businesses may choose them for the predictable cash flow they provide.

Push payments occur when the payer initiates the transaction and “pushes” the money to the recipient, such as when they authorize a retail purchase. Push payments reduce errors and disputes since customers initiate them.

When it comes to how your business gets paid, the key difference between push and pull payments lies in who initiates the transaction. This might seem like a minor difference in payment method, but it can impact everything from your cash flow and customer experience to how you manage fraud risk and processing fees.

Understanding the pros and cons of each method can help you develop a more efficient payment strategy and choose the right payment service provider. To help you decide what’s best for your business, we’ll break down the key differences between the two payment methods and explore when to use each one.

But first, here’s a quick overview of how push and pull payments stack up:

| Push payments | Pull payments |

|---|---|---|

Initiator | The customer (payer) | The merchant (payee) |

Examples | Bank transfers, online purchases, cash payments | Direct debits, subscription billing, buy now, pay later options like Klarna |

Fraud risk | Higher | Lower (higher chargebacks possible) |

Reversibility | Irreversible | Often reversible |

Speed | Typically faster | Depends on the processor and method |

Cost | Lower fees | Higher processing fees |

What are push payments?

A push payment is when a customer, or payer, initiates a payment to your business, the payee. This payment processing method has a key feature that sets it apart from pull payments: Customers can control the amount, payment method, and regularity.

Push payments are generally fast, making them ideal for quick, one-off transactions. However, there is a higher risk of fraud due to potential unauthorized transactions or disputes. This situation can lead to chargeback fees and decreased customer trust.

The good news is that our platform can help you mitigate this risk, with fraud management tools, AI-driven analytics, multi-layered authentication, and adherence to regulatory compliance.

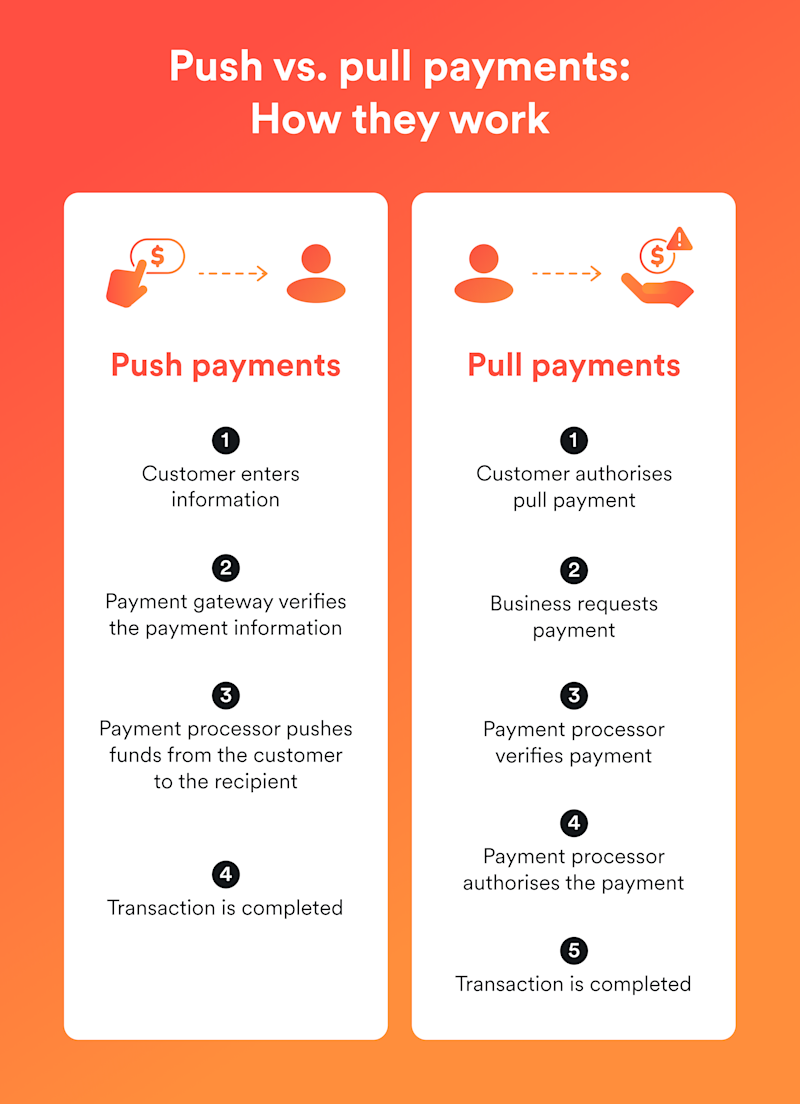

How are push payments processed?

The push payment process involves a series of steps that ensure secure, fast, and efficient transactions. Here’s a breakdown of an online payment:

The customer enters their payment information, and your payment gateway captures it.

Your payment gateway verifies the payment information with the customer’s bank and authorizes the transaction.

Your payment processor takes over and moves the money from the customer’s bank account to your business account. This could happen instantly or take a few days.

Both you and your customer receive notifications that the transaction is complete.

Push payment examples and use cases, such as bank transfers

Push payments are ideal for one-time payments, large transactions, and real-time transfers. Customers can appreciate the control and security that come with purchasing a new product or service, while your business can benefit from faster processing times.

Pros and cons of push payments

One of the biggest advantages of push payments for businesses is that they often have real-time processing, which can help improve cash flow. Once the customer initiates the payment, you quickly receive your funds – no waiting for a billing cycle or approval process

On the other hand, push payments can be inconvenient for your business if you typically rely on subscription billing. Since the customer must initiate the transaction, your cash inflow relies on them remembering to make the payment each period.

What are pull payments?

A pull payment occurs when the payee, your business, initiates a payment from the payer, the customer. You control the payment process, making it easier to collect subscription payments on time every period.

You can automate pull payments and set repeated transactions on a predictable schedule, improving your cash flow. However, you’ll need to build up customers’ trust in your business, since they have to authorize you to withdraw funds directly from their accounts.

How are pull payments processed?

Pull payments let your business take control of the payment process by “pulling” the funds from the customer’s bank account. Here is an example of an online payment:

The customer signs an agreement to authorize the payment request. This agreement usually outlines the terms, including the amount, frequency, and conditions.

Your business submits the signed agreement to its payment processor.

Your business initiates the pull request through the payment processing system on the agreed date.

The payment processor verifies the transaction and authorizes it if everything looks good. The funds are transferred from the payer’s account.

Both the customer and your business receive notifications of successful payment processing once the transaction is completed.

The biggest benefit of pull payments is that after the customer signs the initial agreement, you can skip the first two steps for future transactions.

Pull payment examples and use cases, such as direct debits

Pull payments are most useful for recurring transactions and subscription billing. You might already have one set up for your automatic bill payments or streaming platforms like Netflix and Spotify.

This payment method frees customers from having to authorize transactions every time payment is due. As a business, this payment method helps provide a predictable cash flow from ongoing services.

Pros and cons of pull payments

The biggest benefit of pull payments is that your business can easily automate them, so customers never have to make manual recurring payments after the initial setup is complete.

The convenience of “setting it and forgetting it” makes customers less likely to cancel their subscription services. This approach can help your business retain more customers for longer and reduce administrative costs.

One major drawback of pull payments is the risk of chargeback fees. Since these payments are initiated by your business, often for recurring subscriptions or ongoing services, customers may dispute them if they forget about the charge or struggle to cancel. This type of “friendly fraud” can result in costly chargebacks, even when the payment was entirely legitimate.

Push vs. pull payments: 4 things to consider

Whether you choose push or pull payments depends on your business needs. Understanding these factors can also help you choose the right payment service provider.

1. Transaction frequency of business payments

The first thing to consider is transaction frequency. Push payments offer more security and real-time processing, which is ideal for one-time payments. But depending on your business, you might also benefit from automated pull payments, which reduce the risk of missed payments and customer churn.

If you run a subscription-based business, pull payments can work well with your business model, as you rely on keeping customers long-term, for a recurring service. That compares to an eCommerce business that relies on one-time purchases.

With Airwallex, you can manage subscriptions and recurring payments with ease, thanks to features like smart retry logic and automated reminders for missed payments, which help you reduce churn and maintain steady revenue.

2. Cash flow management

A payment’s initiation method can also impact cash flow management and forecasting. For example, since pull payments offer predictable results, they can help your business maintain a steady flow of available funds and avoid cash shortages.

3. Customer experience and convenience

The more satisfied your customer is, the more likely they are to return. Both push and pull payments offer customer benefits that ultimately benefit your business.

Push payments give customers control and flexibility over when and how they pay, increasing their satisfaction with your business. With pull payments, there are fewer manual tasks for both you and the customer, resulting in reduced effort and fewer missed payments.

4. Fraud risks and failed payments

Regardless of the payment method you use, reducing fraud risk can help protect your revenue, minimize failed payments, and enhance customer satisfaction. Understanding the risks associated with pull and push payments can help you safeguard your business against them.

Push payments typically carry a higher risk of fraud. That’s because fraudsters can more easily target customers who initiate the payments.

Pull payments typically carry a lower risk of fraud, as customers sign an agreement specifying the amount and frequency of payments, and only need to provide payment details once. But recurring payments can still increase the risk of “friendly fraud” – chargebacks from customers who forgot about or no longer want to pay for an ongoing service, but cancellation is too difficult.

Regardless of the payment method you choose, utilizing a payment processor with built-in fraud detection tools can help minimize your risk of fraud and prevent chargebacks.

Accept push and pull payments via 160+ local payment methods

When deciding whether to use push or pull payments, consider what is best for your business model, the nature of your transactions, and the overall customer experience. Push payments are great for real-time processing and one-off purchases, while pull payments are ideal for secure and convenient subscription payments.

With Airwallex, your business can accept payments for one-off transactions or recurring payments with subscription management. Unlike traditional payment service providers, we support a wide range of payment methods, including cards, digital wallets (e.g., Google Pay), buy now, pay later options (e.g., Klarna), and direct debit. Plus, you can accept subscription payments globally in more than 130+ currencies.

Frequently asked questions

Are pull or push payments better?

Both have their unique benefits. Push payments are helpful in making quick one-off payments, while pull payments are ideal for recurring subscription payments.

What is an example of a push and pull payment?

An example of a push payment is when a customer uses a credit card to buy a product online. A pull payment occurs when your business automatically “pulls” a payment from the customer’s bank account, such as through a subscription payment.

Are pull or push payments safer?

Generally speaking, pull payments are more secure, especially for cross-border transactions such as bank or international wire transfers, as customers sign an agreement specifying the amount and frequency of payments and only need to provide payment details once. When evaluating security, it’s essential to consider the risks and associated potential costs.

View this article in another region:AustraliaNew ZealandSingaporeGlobal

Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

Posted in:

Online payments