Push vs. pull payments: What’s the difference?

Airwallex Editorial Team

Key takeaways:

Push and pull payments are two different ways to initiate payments.

Pull payments occur when the recipient initiates the transaction, and the recipient “pulls” the money from the payer, such as through subscription payments. Customers may prefer them for their convenience, and businesses for the predictable cash flow that it provides.

Push payments occur when the payer initiates the transaction and “pushes” the money to the recipient, such as when they authorise a retail purchase. Push payments reduce errors and disputes since customers initiate them.

When it comes to how your business gets paid, the key difference between push and pull payments lies in who initiates the transaction. This might seem like a small difference in payment method, but it can affect everything from your cash flow and customer experience to how you handle fraud risk and processing fees.

Understanding the pros and cons of each method can help you build a more efficient payment strategy and help you choose the right payment service provider. To help you decide what’s best for your business, we’ll break down the key differences between the two payment methods and explore when to use each one.

But first, here’s a quick overview of how push and pull payments stack up:

| Push payments | Pull payments |

|---|---|---|

Initiator | The customer (payer) | The merchant (payee) |

Examples | Bank transfers, online purchases, cash payments | Direct debits, subscription billing, buy now, pay later options like Klarna |

Fraud risk | Higher | Lower (higher chargebacks possible) |

Reversibility | Irreversible | Often reversible |

Speed | Typically faster | Depends on the processor and method |

Cost | Lower fees | Higher processing fees |

What are push payments?

A push payment is when a customer, or payer, initiates a payment to your business, the payee. This payment processing method has a key feature that sets it apart from pull payments: Customers can control the amount, payment method, and regularity.

Push payments are generally fast, making them ideal for quick, one-off transactions. However, there’s a higher fraud risk due to potential unauthorised transactions or disputes. This situation can lead to chargeback fees and decreased customer trust.

The good news is that our platform can help you mitigate this risk, with fraud management tools, AI-driven analytics, multi-layered authentication, and adherence to regulatory compliance.

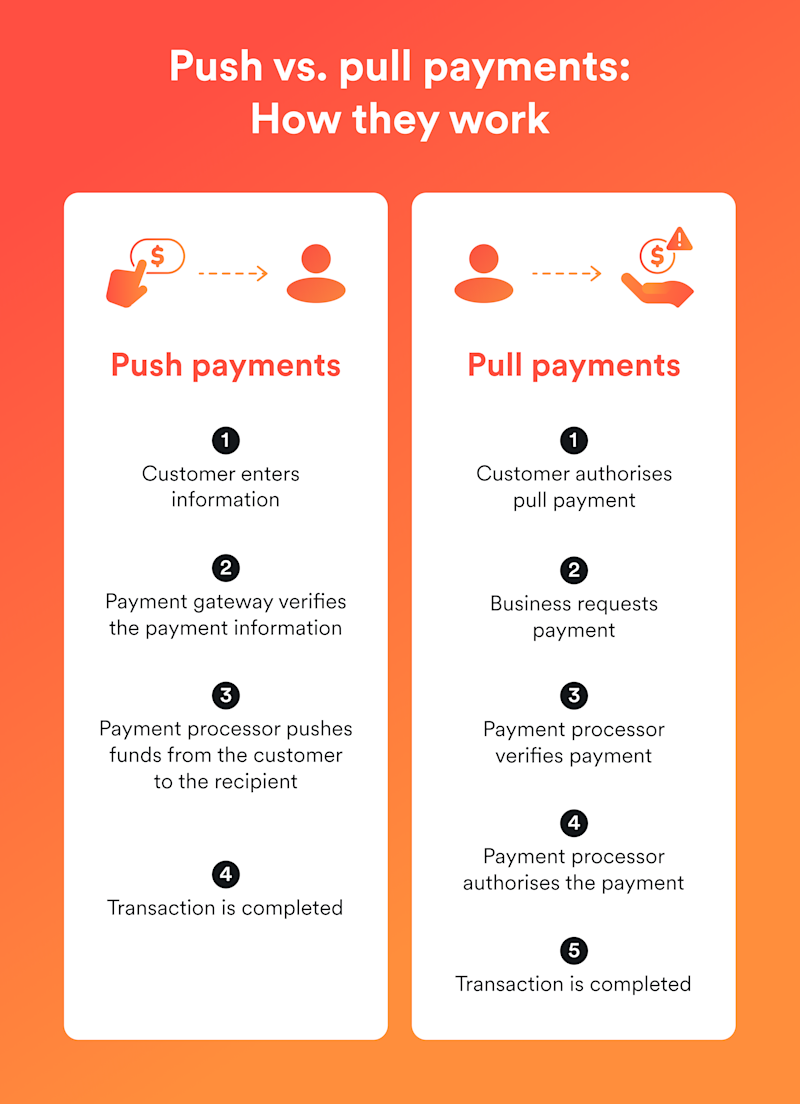

How are push payments processed?

The push payment process involves a series of steps that ensure secure, fast, and efficient transactions. Here’s a breakdown of an online payment:

The customer enters their payment information, and your payment gateway captures it.

Your payment gateway verifies the payment information with the customer’s bank and authorises the transaction.

Your payment processor takes over and moves the money from the customer’s bank account to your business account. This could happen instantly or take a few days.

Both you and your customer receive notifications that the transaction is complete.

Push payment examples and use cases, such as bank transfers

Push payments are ideal for one-time payments, large transactions, and real-time transfers. Customers can appreciate the control and security when purchasing a new product or service, while your business can benefit from faster processing times.

Pros and cons of push payments

One of the biggest advantages of push payments for businesses is that they often have real-time processing, which can help improve cash flow. Once the customer initiates the payment, you quickly receive your funds – no waiting for a billing cycle or approval process

On the other hand, push payments can inconvenience your business if you usually rely on subscription billing. Since the customer has to initiate the transaction, your cash inflow relies on them remembering to pay each period.

What are pull payments?

A pull payment is when your business, the payee, initiates a payment from the customer, the payer. You control the payment process, making it easier to collect subscription payments on time every period.

You can automate pull payments and set repeated transactions on a predictable schedule, improving your cash flow. However, you’ll need to build up customers’ trust in your business, since they have to authorise you to withdraw funds directly from their accounts.

How are pull payments processed?

Pull payments let your business take control of the payment process by “pulling” the funds from the customer’s bank account. Here is an example of an online payment:

The customer signs an agreement to authorise the payment request. This agreement usually outlines the terms, including the amount, frequency, and conditions.

Your business submits the signed agreement to its payment processor.

Your business initiates the pull request through the payment processing system at the agreed date.

The payment processor verifies the transaction and authorises it if everything looks good. The funds are transferred from the payer’s account.

Both the customer and your business receive notifications of successful payment processing once completed.

The biggest benefit of pull payments is that after the customer signs the initial agreement, you can skip the first two steps for future transactions.

Pull payment examples and use cases, such as direct debits

Pull payments are most useful for recurring transactions and subscription billing. You might already have one set up for your automatic bill payments or streaming platforms like Netflix and Spotify.

This payment method frees customers from having to authorise transactions every time payment is due. And as a business, this payment method helps provide predictable cash flow from ongoing services.

Pros and cons of pull payments

The biggest benefit of pull payments is that your business can easily automate them, so customers never have to make manual recurring payments after the initial setup.

The convenience of “setting it and forgetting it” makes customers less likely to cancel their subscription services. This approach can help your business keep more customers for longer and save on admin costs.

One major drawback is the risk of chargeback fees. Since these payments are initiated by your business, often for recurring subscriptions or ongoing services, customers may dispute them if they forget about the charge or find it hard to cancel. This kind of “friendly fraud” can lead to costly chargebacks, even when the payment was completely legitimate.

Push vs. pull payments: 4 things to consider

Whether you choose push or pull payments depends on your business needs. Understanding these factors can also help you choose the right payment service provider.

1. Transaction frequency of business payments

The first thing to consider is transaction frequency. Push payments offer more security and real-time processing, which is ideal for one-time payments. But depending on your business, you might also benefit from automated pull payments, which reduces the risk of missed payments and customer churn.

If you run a subscription-based business, pull payments can work well with your business model, as you rely on keeping customers long-term, for a recurring service. That compares to an eCommerce business that relies on one-time purchases.

With Airwallex, you can manage subscription and recurring payments with ease, thanks to features like smart retry logic and automated reminders for missed payments, helping you reduce churn and keep your revenue steady.

2. Cash flow management

A payment’s initiation method can also impact cash flow management and forecasting. For example, since pull payments offer predictable results, they can help your business maintain a steady flow of available funds and avoid cash shortages.

3. Customer experience and convenience

The more satisfied your customer is, the more likely they are to return. Both push and pull payments offer customer benefits that translate into benefits for your business.

Push payments give customers control and flexibility over when and how they pay, increasing their satisfaction with your business. With pull payments, there are fewer manual tasks for both you and the customer, reducing effort and missed payments.

4. Fraud risks and failed payments

Regardless of the payment method you use, reducing fraud risk can help you protect your revenue, reduce failed payments, and improve customer satisfaction. And knowing the risks of pull and push payments can help you guard your business against them.

Push payments typically carry a higher risk of fraud. That’s because fraudsters can more easily target customers who initiate the payments.

Pull payments typically carry a lower risk of fraud since customers sign an agreement on the amount and frequency of payments and only have to provide payment details once. But recurring payments can still increase the risk of “friendly fraud” – chargebacks from customers who forgot about or no longer want to pay for an ongoing service, but cancellation is too difficult.

No matter which payment method you choose, a payment processor with in-built fraud detection tools can help you minimise fraud risk and prevent chargebacks.

Accept push and pull payments via 160+ local payment methods

When deciding whether to use push or pull payments, determine what’s best for your business model, the nature of your transactions, and the overall customer experience. Push payments are great for real-time processing and one-off purchases, while pull payments are ideal for secure and convenient subscription payments.

With Airwallex Billing, you can generate one-off or recurring invoices automatically. Set up and manage subscriptions with flexible pricing models, no code or engineering needed. Plus, you can maximise payment collection with automated retries and customer reminders.

Accept payments globally via 160+ payment methods, including digital wallets (e.g. Google Pay), BNPL (e.g. Klarna), and direct debit. You can settle these funds like-for-like in 20+ currencies into a multi-currency wallet, saving on FX fees.

Frequently asked questions

Are pull or push payments better?

Both have their unique benefits. Push payments can be useful for quick one-off payments, while pull payments are great for recurring subscription payments.

What is an example of a push and pull payment?

An example of a push payment is when a customer uses a credit card to buy a product online. A pull payment occurs when your business automatically “pulls” a payment from the customer’s bank account, such as through a subscription payment.

Are pull or push payments safer?

Generally speaking, pull payments are more secure, especially for cross-border payments like bank or international wire transfers, since customers sign an agreement on the amount and frequency of payments and only have to provide payment details once. When evaluating security, it’s important to weigh the risks and potential costs associated with those risks.

View this article in another region:AustraliaNew ZealandSingaporeUnited States

Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

Posted in:

Online payments