Top 6 payment gateway providers and services in the US

Erin Lansdown

Business Finance Writer - AMER

Key takeaways

Payment gateway providers offer payment gateways to help you accept and process customer payments.

A payment gateway encrypts and securely transmits your customer’s payment details to a payment processor, which then facilitates payment verification and approval, before the funds can be transferred to your bank account.

When evaluating providers, consider factors such as cost, like-for-like settlement, global coverage, and whether they integrate other financial tools, including treasury, payouts, and spend management.

Getting a customer to your checkout takes a lot of hard work. You've gone to great lengths to create and market your product or service, and now your potential buyer is ready to make a purchase. However, there's one more important step – ensuring you have a strong payment gateway so that the payment is processed successfully.

With numerous options available, it can be challenging to determine which payment gateway is best suited for your business. In this article, we're going to explore six of the top payment gateway providers to help you decide.

What is a payment gateway provider or service?

A payment gateway provider offers technology that enables merchants to accept and securely process customer payments made via credit card, debit card, digital wallet, or other electronic methods.

Payment gateways handle the behind-the-scenes payment processing that occurs after a customer completes a transaction. They encrypt and transmit sensitive financial information to the appropriate parties, helping ensure the transaction is verified, approved, and settled securely. While the term is most often used for eCommerce payments, payment gateways can also support in-person transactions through point-of-sale (POS) systems.

Regardless of the size of your business, a reliable payment gateway is crucial for providing a seamless and secure checkout experience – and for ensuring timely payments. The right provider goes beyond payment acceptance: It can help you reduce costs, expand globally, and simplify operations by consolidating payment, treasury, FX, and reporting into one unified platform.

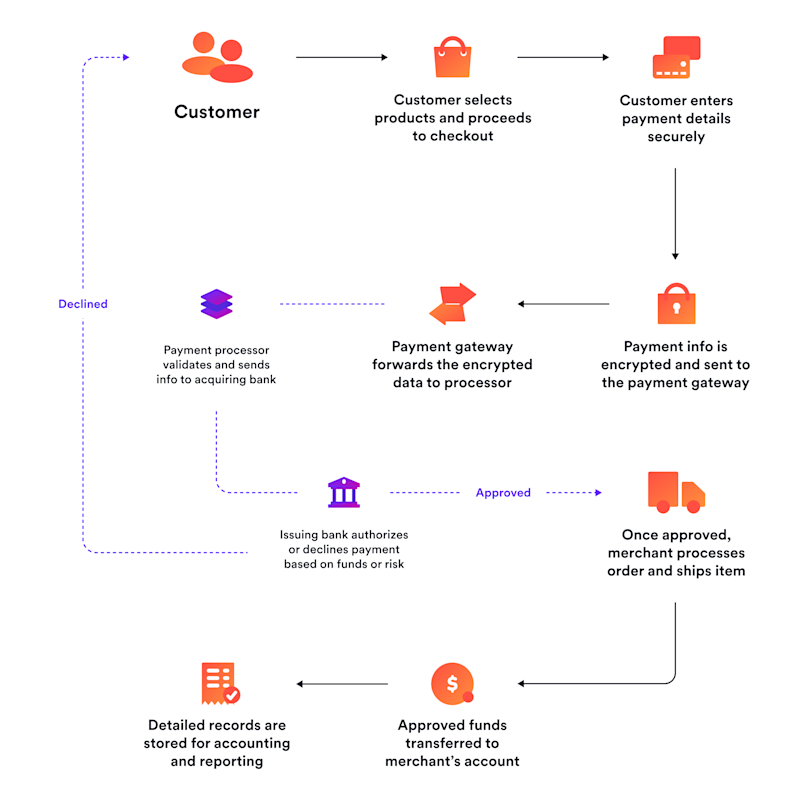

How does a payment gateway provider work?

A payment gateway provider ensures that your customers’ money gets safely from their credit card, debit card, or digital wallet to your bank.

The provider’s payment gateway encrypts and securely transmits your customer’s payment information to the payment processor. The payment processor then facilitates the verification and approval of the transaction, ensuring funds are transferred to your bank account. Many gateways also handle fraud detection and chargeback processing, protecting both you and your customers.

Here’s how payment gateways work behind the scenes after a customer makes a payment:

The customer submits their payment by entering their card details or selecting a local payment method, such as iDEAL or Alipay. The gateway collects this information and encrypts it for security purposes.

The gateway requests authorization: The payment data is sent through the payment processor’s network, which contacts the customer’s bank or card issuer to check the details and confirm funds are available.

The transaction is approved or declined: The customer’s bank responds. If approved, the transaction is confirmed in real time, and the customer is notified that the payment has been successful.

Funds are settled to your account: Once approved, the funds move from the customer’s account to your merchant account. Depending on your gateway and setup, this might take a few hours or days.

The top 6 payment gateway providers in 2025

Here are the current go-to payment gateway providers for US businesses:

Adyen: A global payments platform for enterprises that supports unified commerce, meaning you can accept payments across in-store, mobile, and online channels.

Airwallex: A global payment and financial platform with end-to-end infrastructure that offers global treasury, payment acceptance, global payouts, and spend management.

PayPal: A traditional payment platform that offers eCommerce integrations and supports a full range of payment options, including credit card payments and payment links.

Shopify: An eCommerce platform that offers integrated payment gateway functionality through Shopify Payments. While not a standalone gateway provider, Shopify enables seamless online and in-person payments for merchants using its platform.

Square: A payment platform combining POS software, hardware, and other tools to accept a wide range of payment types, both in-person and online.

Stripe: A developer-friendly platform that offers customizable payment infrastructure, including support for online payments, subscriptions, and marketplaces.

Top features to look for in a payment gateway provider

It can feel overwhelming when you start comparing digital payment providers. To help, we've compiled a list of the most important features to look out for:

Processing location: Some gateways process transactions directly on your website, while others redirect customers to a separate payment page. For the smoothest checkout experience, look for a gateway with onsite transactions.

Security: The gateway should be PCI DSS compliant and use the latest end-to-end encryption technology and fraud prevention tools to protect your data.

Integrations: The gateway should integrate easily (no code required) with your existing systems, such as accounting software or eCommerce platform.

Cost: Pricing varies across different platforms. Pay close attention to setup fees, transaction fees, and any long-term contracts that may be associated with the service. The best payment gateways offer flexible pricing plans and transparent costs, allowing you to select the option that best fits your business model.

Reporting: Look for software that offers insights into transaction data and customer behavior – these can help you optimize your sales strategy and forecasts.

Breadth of service: Some providers offer only a basic payment gateway, while others bundle additional financial tools, such as multi-currency accounts, cross-border transfers, expense management, and payout capabilities. Choosing a platform with these built-in features can help reduce reliance on multiple systems, centralize financial operations, and lower costs.

Global reach and LFL settlement: If you sell internationally, choose a gateway with broad global coverage and support for like-for-like (LFL) settlement. This means you can collect payments in your customer’s local currency and settle into your own accounts in the same currency, helping you avoid forced conversions and reduce FX costs.

Compare the top 6 payment gateway providers

Provider | Main features | Payment methods | Pricing |

|---|---|---|---|

Adyen | Full-stack global payments platform | Supports 100+ local payment methods; limited coverage in APAC1

| 🔸 Fixed processing fee of $0.13 plus payment method fee, which varies 🔸 Visa/Mastercard: $0.13 + Interchange + 0.60% 🔸 Amex: $0.13 + 3.95%2 |

Airwallex | Unified platform for payments, FX, global treasury, and spend management | Supports 160+ local payment methods – including UnionPay, GrabPay, iDEAL, and BNPL services like Klarna and Afterpay – across 180+ countries | 🔸 Domestic cards: 2.8% + $0.30 🔸 International: 4.3% + $0.30 🔸 No forced FX conversions 🔸 Interbank rates (IC++ pricing available) |

PayPal | Access to PayPal, Venmo, and strong mobile checkout options | Supports 20+ local payment methods3 | 🔸 Fee structure varies by transaction type 🔸 Domestic payments: 2.99% + $0.49 🔸 International payments: 4.49% + fixed fee4 |

Shopify Payments | Built-in gateway with native Shopify integration

| Supports 10+ local payment methods5 | 🔸Various plans and fees 🔸 Starts at 2.9% + $0.30 for online payments 🔸 International transactions: 3.9% + $0.30 🔸 Additional 1% fee for any third-party payment providers6 |

Square | POS hardware + software ecosystem for omnichannel commerce | Limited support is available for local payment methods outside major US card networks, and international coverage is also limited7 | 🔸 In-person: 2.6% + $0.10 🔸 Online: 2.9% + $0.30 🔸 Manual: 3.5% + $0.158 |

Stripe | Developer-friendly platform for subscriptions and marketplaces

| Supports 100+ local payment methods; limited like-for-like settlement in APAC and EMEA9 | 🔸 Domestic cards: 2.9% + $0.30 🔸 International cards: 4.4% + $0.30 + 1% currency conversion fee10 |

Key features of the top 6 payment gateway providers

Adyen

Adyen is a global payment gateway service provider known for its comprehensive platform and extensive global reach. It offers solutions for online, in-app, and in-store payments in over 200 countries.

Pros

Full POS suite to support in-person payments

Real-time transaction monitoring and detailed analytics

Direct acquirer in key markets (EU, UK, and US)

Cons

Funds must be transferred to an external bank account after settlement, with no built-in wallet or account functionality

Like-for-like settlement is limited to certain currencies and regions and often requires a local bank account

The platform is primarily built for mid-market and enterprise businesses, with limited focus on smaller companies

Airwallex

Airwallex is our end-to-end global financial platform that offers global treasury, FX and transfer solutions, and spend management tools, with competitive interbank fees. We help businesses accept payments with major card schemes and 160+ local payment methods across 180+ countries.

Pros

Unified global infrastructure for payments, FX, treasury, and spend

Like-for-like settlement across 14+ currencies

Automated currency conversion (ACC) in 25+ currencies

Interbank FX rates with no hidden markups or forced conversion

Dedicated local support and onboarding

Cons

Fully digital platform with no physical branches. It may not be suitable for businesses that prefer in-person support, but it can be ideal for digital-first companies.

PayPal

PayPal supports a wide variety of payment methods, including credit and debit cards, bank transfers, and PayPal balances. The platform also offers invoicing, subscription payments, and mobile payments.

Pros

Instant access to funds for eligible merchants through PayPal balance

Extensive marketplace and platform integrations (e.g., eBay, Shopify, WooCommerce)

Cons

Account holds and sudden freezes are common, especially for new or high-risk businesses, often without prior notice¹¹

Disputes and chargebacks are often resolved in favor of buyers, creating challenges for sellers¹²

Shopify Payments

Shopify Payments is the integrated payment gateway for Shopify stores, offering seamless checkout experiences both online and in-person. It supports multiple payment options, including credit card payments and digital wallets, with flexible plans.

Pros

Supports in-person payments with POS hardware

Transparent pricing and easy setup

Cons

Only available to Shopify store owners

Additional fees apply if using external payment gateways

Square

Square is known for its POS software that supports a full range of payment options, including in-person payments and alternative payment methods. It is well-suited for small to medium-sized businesses seeking a straightforward setup and flexible payment acceptance.

Pros

Free POS software with inventory and invoicing features

No monthly fees with competitive transaction fees

Cons

Limited advanced features compared to some competitors

Transaction fees may be higher for some payment types

Stripe

Stripe is a developer-first payment platform known for its flexible APIs and customizable payment workflows. It’s great for enabling businesses to build bespoke checkout and billing experiences, particularly for eCommerce and SaaS use cases. However, it primarily focuses on payment processing and lacks integrated treasury and FX capabilities, which can create added complexity and costs for global businesses.

Pros

Developer-friendly with extensive API documentation and flexible integrations

Broad support for credit cards and global digital wallets (e.g., Apple Pay, Google Pay)

Strong brand recognition and third-party ecosystem

Cons

Limited local payment method coverage outside the US, especially in APAC and emerging markets

No built-in multi-currency wallet or local payout capabilities (requires separate foreign bank accounts and manual setup)

Account support is often gated behind enterprise plans; dedicated service comes with added cost

Questions to ask when onboarding a payment gateway provider

Here's a set of questions you should ask before signing on the dotted line:

Can you support the payment methods my customers use? Determine if they accept your customers’ preferred payment methods, such as credit cards, Apple Pay, or Klarna.

What currencies and countries do you support? Ask about multi-currency support, cross-border payment capabilities, and any currency conversion fees, especially if you operate or plan to expand internationally.

What are the fees involved? Request a full breakdown of all possible fees, including transaction fees, monthly fees, and foreign transaction fees. This transparency helps you avoid hidden costs later on.

Can your payment gateway integrate with my existing setup? The payment gateway should integrate easily with your website, shopping cart, and accounting software to streamline operations and reduce manual work.

Can your system scale with my business growth? Choose a provider that can support your growth, so you won’t need to switch platforms or renegotiate contracts as you expand.

Do you support like-for-like (LFL) settlement? If you collect payments in multiple currencies, ask whether you can settle funds in the same currency they were received. LFL settlement can help reduce forced conversions and FX costs.

What additional features or services do you offer? Beyond basic payment acceptance, look for a provider that provides end-to-end financial tools, including foreign exchange, international transfers, same-day settlement, and spend management. These features can centralize your financial operations, reduce costs, and streamline the flow of money through your business. Fraud protection, analytics, and financial reporting tools are also essential value-adds to consider.

What security measures and certifications do you have in place? Ensure the provider meets industry standards, such as PCI DSS, and ask about their fraud prevention tools and data protection protocols.

Consider Airwallex, the online payment gateway solution for global businesses

Airwallex is more than a payment gateway. Our platform offers an end-to-end financial solution that enables you to receive, hold, manage, and spend multi-currency funds all in one place.

Expand your global reach by offering 160+ local payment methods. From no-code Payment Links and low-code eCommerce integrations to fully customizable API solutions, we help you build the checkout experience that you need to drive higher conversions.

Our Global Accounts offer you local bank details in over 20 currencies, enabling you to accept payments directly into your multi-currency Wallet. Settle funds like-for-like in the same currency your customers pay in, across 14+ major currencies. This way, you eliminate unnecessary currency conversions, keeping FX fees low. When you need to convert funds, do so at interbank rates for greater cost savings.

You want to grow your business without limits, and we’re built to help you do that. That’s why 150,000+ businesses trust us to process more than $150 billion in payments annually.

Frequently asked questions

What is a payment gateway provider?

A payment gateway provider facilitates safe and secure online transactions. It provides the technology that encrypts and transmits payment data from a customer to a merchant and their associated bank.

What factors should I consider when selecting a payment gateway solution?

It’s worth considering security credentials, supported payment methods, fees, currency support, integration with your current systems, transaction success rates, scalability, and the quality of customer support available.

How much does it cost to onboard a payment gateway solution?

Pricing varies widely across providers. Factors such as setup fees, monthly subscription charges, transaction fees, and currency conversion fees will impact the overall cost.

How safe are payment gateway services?

Most payment gateway services are safe. The best use advanced end-to-end encryption tools and are compliant with security standards like PCI DSS to prevent unauthorized access or fraud.

Sources

https://www.adyen.com/payment-methods-guides

https://www.adyen.com/pricing

https://www.paypal.com/us/business/accept-payments/payment-methods

https://www.paypal.com/us/webapps/mpp/merchant-fees

https://help.shopify.com/en/manual/payments/shopify-payments/local-payment-methods

https://www.shopify.com/pricing

https://squareup.com/help/ca/en/article/4956-international-availability

https://squareup.com/us/en/payments/our-fees

https://stripe.com/payments/payment-methods

https://stripe.com/pricing

https://www.paypal.com/us/brc/article/funds-availability

https://www.paypal.com/us/webapps/mpp/security/seller-protection

Disclaimer: We wrote this article in Q3 2025. The information was based on our own online research, and we were not able to manually test each tool or provider. The information is provided for educational purposes only, and readers should consider their business's specific requirements when evaluating providers. If you would like to request an update, feel free to contact us at [email protected].

View this article in another region:AustraliaMalaysiaUnited Kingdom

Erin Lansdown

Business Finance Writer - AMER

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

Share

- What is a payment gateway provider or service?

- How does a payment gateway provider work?

- The top 6 payment gateway providers in 2025

- Top features to look for in a payment gateway provider

- Compare the top 6 payment gateway providers

- Key features of the top 6 payment gateway providers

- Questions to ask when onboarding a payment gateway provider

- Consider Airwallex, the online payment gateway solution for global businesses