6 International payment methods for cross-border payments

Erin Lansdown

Business Finance Writer - AMER

Multiple channels exist to move money across borders and enable trade. However, navigating the maze of international payment methods often leads to risks, delays, and excessive fees, creating friction for US businesses trying to scale globally.

What are the key mechanisms facilitating affordable overseas transactions as global payment systems continuously advance? Which solutions help minimize complexity for collections and payouts across borders?

This article explores the infrastructure, risks, and regulations steering cross-border payment systems to uncover the ideal mix of speed, savings, and transparency essential for growth.

6 Types of international payment methods

Two of the most common international payment methods are traditional bank transfers and cards. We’ll take a brief look at each of these to help you understand the advantages and limitations of these types of cross-border payment systems.

International bank transfers

A bank transfer, also called a wire transfer, is a way of sending money electronically between two different banks or financial institutions.

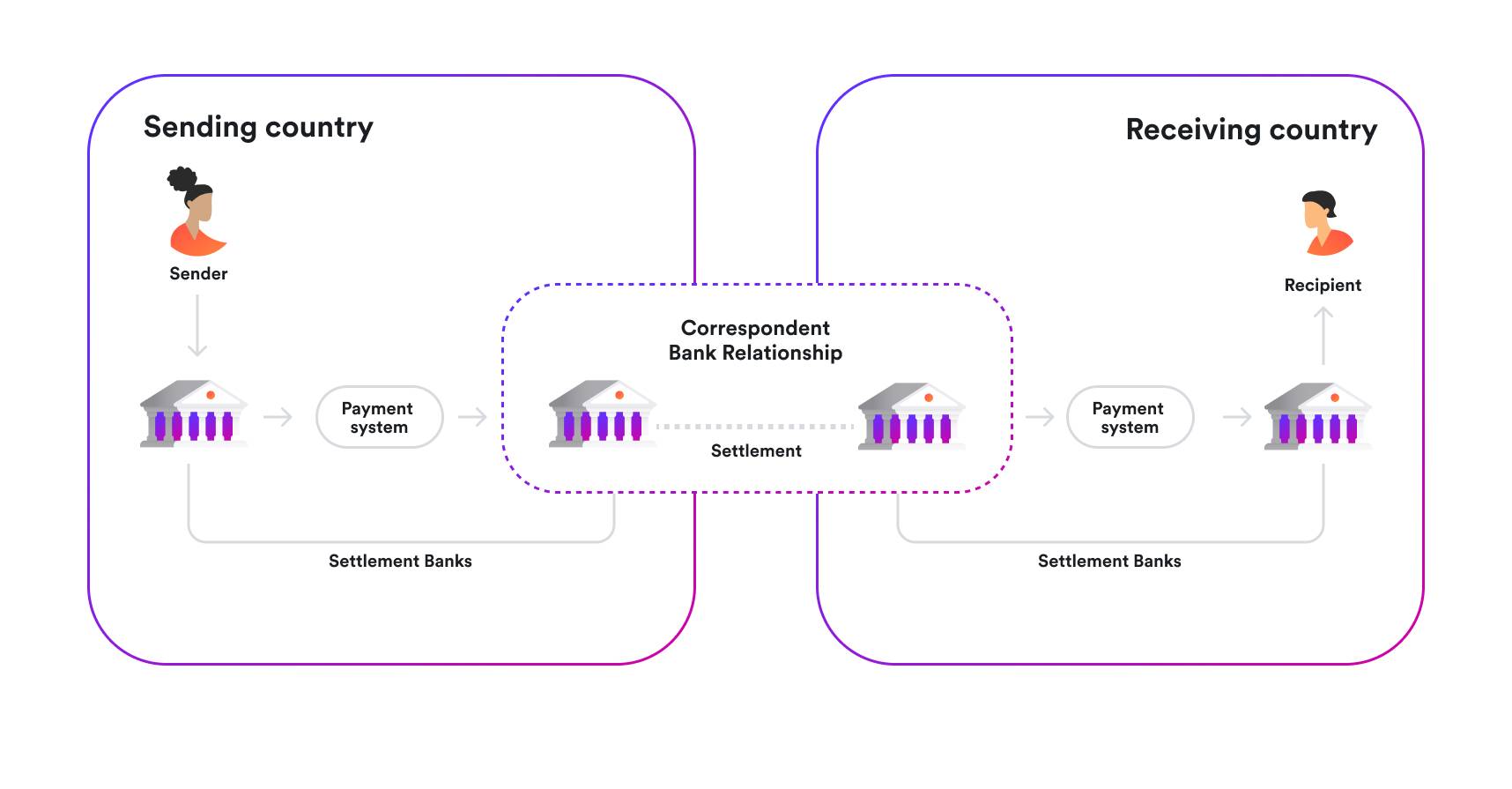

Wire transfers follow wire networks provided by correspondent banks to transmit funds. This network of banks handles the whole transaction from the first bank to the last, ensuring that local tax rules are followed along the way.

As one of many international payment methods, traditional bank transfers sent via correspondent banking networks are typically unsuitable for businesses conducting frequent or high-value international payments. Combining currency conversions and bank charges can make this method prohibitively expensive.

SWIFT payments

SWIFT payments were instrumental in creating standard financial messaging around the world in the late twentieth century – they’re not going anywhere, in much the same way that Slack won't replace postcards. They are frequently used internationally because they’re widely accepted and traceable. However, settlement is particularly slow, at 2–5 days, which makes it difficult for international businesses to manage their cash flow.

SWIFT payments are subject to various fees, including currency conversion fees. These rates are usually less competitive than those of multi-currency providers.

In summary, SWIFT payments can be expensive and variable, making them less attractive for businesses that require large volumes of transactions at speed.

Payment cards

Payment cards (both credit and debit cards) are one of the most convenient international payment methods. For example, a business may pay an overseas supplier using a credit or debit card.

Behind the scenes, card networks and acquirers charge transaction fees, change currencies, and comply with regulations.

Global card networks like Visa and Mastercard enable widespread card acceptance across countries, which is why you’ll often see phrases like “Accepted wherever you see Visa.” However, it’s important to understand how cross-border payments work, including credit and debit cards, because of factors like hidden costs when sending funds.

Merchants trying to navigate the best cross-border payment solution might lean towards credit cards because of their convenience. However, credit card processing is expensive, as it involves high fees to accept card payments, currency conversion fees, and credit checks, which might be prohibitive.

Typically, merchants who make a high volume of low-value international payments to suppliers might opt for virtual debit cards. For example, Airwallex's online travel agent customers use virtual cards to pay hotels and airlines around the world. For growing businesses, virtual cards are preferred over a physical card for business expenses because they can be uniquely and instantly issued per transaction, which makes reconciliation much easier for the finance team.

Card networks

Card networks operate card-based payments across different countries and currencies. They process and settle transactions between issuers, acquirers, merchants, and customers.

Card networks also set the rules, fees, and exchange rates for cross-border payments, if the card provider does not settle directly in the chosen currency. Visa, Mastercard, and American Express are all examples of card networks.

Card networks charge interchange, assessment, or network fees to cover the costs associated with running and maintaining their infrastructure. These fees vary widely depending on the type of card, the transaction amount, the payment channel, the geographic location, and other factors.

How do card network fees impact merchants’ earnings?

Card network fees can also trigger additional fees, such as cross-border payment fees, authorization fees, statement fees and incidental fees. These costs can quickly add up, but there are ways to avoid cross-border payment fees.

One way to offset the costs is to use virtual cards. Virtual cards typically incur lower fees than traditional payment cards, and are as secure if not more so than physical cards. An added benefit is that virtual cards can provide enhanced data on payments and remittances, giving the companies that use them greater transparency and cashflow visibility.

However, using cards for payments is a convenient and secure method of payment for both retail and business transactions. This is particularly true for businesses that need to make a high volume of payments to a large supplier base.

Online payment platforms

Online payment platforms leverage international payment gateways and payment processors to move funds.

Digital payment solutions like Airwallex, PayPal, Shopify Payments, and Worldpay enable US businesses to accept payments in foreign currencies, issue payouts, and automate key financial workflows. These platforms help make cross-border transactions more accessible and cost-effective, especially for small to mid-sized businesses.

In fact, the rise of online payment platforms has been one of the biggest developments in global payment methods in the last decade.

As one of the key B2B cross-border payment types, online payment platforms are advantageous because they can lower foreign transaction fees, currency exchange fees, and operational costs associated with traditional payment methods (such as wire transfers).

Online payment platforms can also help businesses optimize their cash flow and working capital by providing faster access to funds and clearer visibility of funds.

Payment rails: What they are and how they work

The fragmented payment landscape creates complexity for global businesses that must navigate customer payment preferences across markets, available infrastructure, local regulation, and low-cost international transfers.

What are payment rails?

Payment rails are the underlying infrastructure for international payment methods. Essentially, they are payment networks that allow global money movement between a payer and a payee.

Businesses that want to make low-cost international payments must navigate global and local payment rails to succeed in new markets.

Card networks, SWIFT wire transfers, and global platforms like Airwallex are global payment rails because they enable individuals and businesses to move funds securely, quickly, and conveniently across borders.

Local rails, on the other hand, are market-specific local payment methods. For example, Giropay is a widely used and trusted bank transfer service popular in German markets. In contrast, some international markets rely heavily on local bank transfer systems, such as PIX in Brazil or UPI in India.

If you're a US business, you're likely more familiar with payment systems like Fedwire, ACH, and the RTP® network for domestic transfers. Airwallex has built its global payments network on top of its local payments network. This means Airwallex uses a local rail to collect cost-effectively in the sending country, internally transfers the funds to its corresponding entity, and finally pays out in the local rail of the receiving country.

Who uses local rails?

Local payment rails are highly relevant to cross-border payments:

For eCommerce merchants, using local rails to accept customer payments can lead to higher authorization rates, improved customer satisfaction, and higher conversion rates because you’re offering them an experience with which they’re familiar.

Tapping into local payment rails enables businesses to accept local payment methods by aligning checkout options to the local market’s preferred payment methods.

Local payment rails generally have lower maintenance fees, which makes them cost-effective and often instant.

Using local payment rails makes customer payouts (e.g., customer refunds in local currencies) and international bill paying more cost-effective.

To access local rails, your business needs to have an account provided by a financial institution licensed to operate in that country, like an Airwallex Business Account.

The frictionless future of global transactions

International payment methods rely on underlying networks and intermediary banks to transfer funds. Yet traditional vehicles like wire transfers and cards have costly drawbacks at volume.

Online payment platforms solve many challenges through technological streamlining, transparency, flexible currency handling, and tapping into local payment rails crucial to overseas collections and payouts. Selecting the right mix balances compliance, fees, and cash flow control across borders.

View this article in another region:United Kingdom

Erin Lansdown

Business Finance Writer - AMER

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

Posted in:

Online payments