Aspire vs Airwallex: Airwallex gets you global

Airwallex outperforms Aspire with a wider global network of local payment systems and multi-currency accounts. The result: High-speed transfers, lower costs, and lesser complexities. Discover why ambitious businesses are choosing Airwallex as their partner to go global. Open your account instantly today.

3 reasons why businesses choose Airwallex over Aspire

Save more, pay local, scale global

Get local bank details in 20+ currencies vs Aspire’s 5, so you can hold, receive and pay, without SWIFT transfers. Access free local transfers to 120+ countries, compared to Aspire’s 50+.

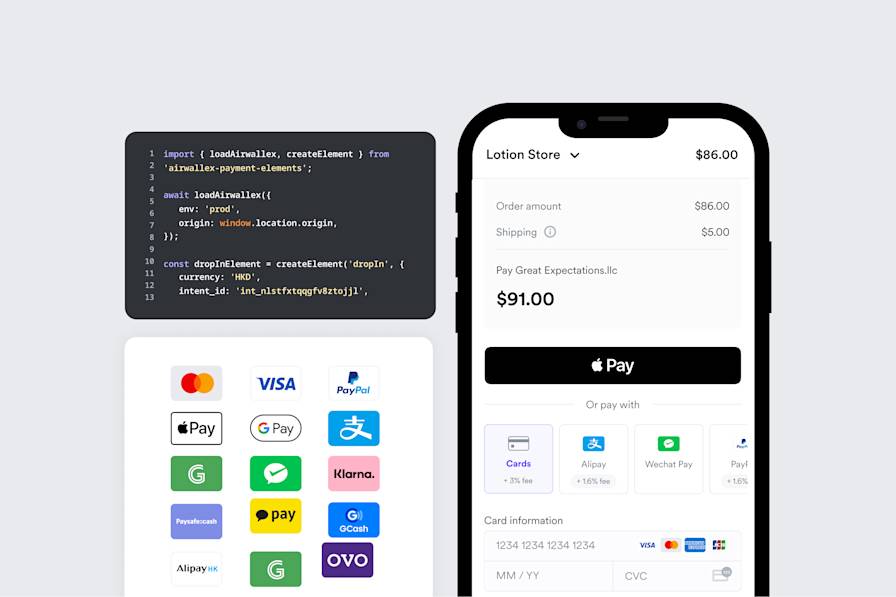

Accept payments from around the world

Enjoy fast, flexible settlement in multiple currencies and improve conversions with 160+ preferred local payment methods. Aspire provides a less extensive set of payment methods and is more focused on SMEs.

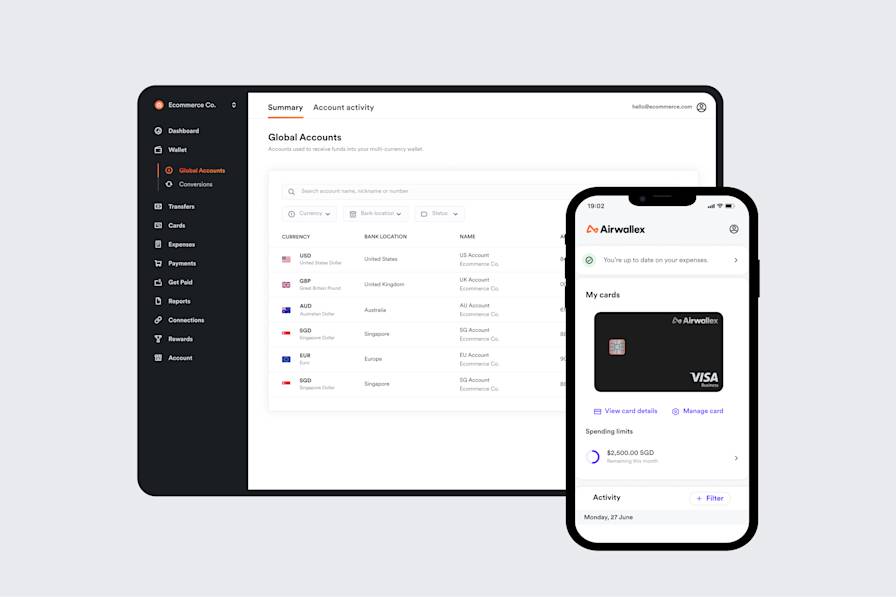

Do much more with an all-in-one financial platform

Aspire offers multiple financial tools for SMEs, but Airwallex takes it further. From multi-currency accounts, FX & transfers, corporate cards, expense management, to a full payment gateway, Airwallex delivers wider coverage and advanced integrations.

An end-to-end platform engineered for global scale

Aspire gives SMEs a set of financial tools, but they’re still fragmented, relying on third-party integrations. Airwallex takes it much further with one unified platform, taking the complexity out of global finance.

Hold, send, and receive payments like a local, without forced conversions. Enjoy fast international transfers and market-leading FX rates. Serve customers and pay suppliers across a much wider global payout coverage.

Join Singapore businesses like Love, Bonito, EU Holidays, and Igloohome already using Airwallex as an important growth engine.

Compare Aspire and Airwallex features

Aspire can get you started, but why settle when Airwallex delivers more to fulfill your business ambition? Aspire ties you to costly delays, limited currency options, and expensive SWIFT transfers. Airwallex, on the other hand, gives you SWIFT-free and same day local transfers, comprehensive payment acceptance, and cashback on all spend.

Don’t limit your business potential. Choose a partner built for growth, not limits.

Save on transaction fees with Airwallex

Airwallex offers lower transaction fees.

What local businesses are saying about Airwallex

“When we set our sights beyond Singapore, we knew expansion wouldn’t be easy. Navigating new markets and managing finances across different countries was overwhelming. But I quickly realised that growth is about having the right people and the right tools to support you at every step – and that's how Airwallex came to the rescue.”

Rachel Lim

Co-founder, Love, Bonito

“Airwallex’s global network made sending and receiving international payments easy. We avoid cross-border fees by paying overseas suppliers in their local currency. Sometimes, transfers are even done within the day.”

Alan Ang

Director and Co-founder, EU Holidays

“We’ve used Airwallex as our financial platform for more than 2 years, and every transaction we have made has always been successful. Like Igloohome, Airwallex is solving real problems and we're glad we found a financial partner in them."

Anthony Chow

CEO and Founder of Igloohome

“When we spend S$100, our balance reflects S$99 — thanks to the cashback from the Airwallex Corporate Card. This records our expenses as a positive gain, helping us stretch our budget further. In just two years, we've saved over S$30,000 with Airwallex.”

Dominic Ong

CFO, Endowus

“Airwallex is a great partner to help you get to new markets. Their platform makes global payments so much easier. And if you ever need help getting started, Airwallex’s support team is amazing and really understands what an eCommerce brand needs.”

Jenny Kwang

Founder of J&Co Jewellery

FAQs about upgrading from Aspire

How much are Aspire’s fees in Singapore?

Aspire’s transfer fees vary depending on the currency account. Airwallex removes the complexity and bypasses the SWIFT network, offering transparent and offer lower fees for businesses dealing with multiple currencies and regions.

What alternative solutions to Aspire are there?

There are several alternatives to Aspire, including Stripe, Wise, and Paypal. However, Airwallex stands out as the all-in-one financial platform for businesses, with wider global coverage, multi-currency support, competitive pricing, like-for-like settlement. It also offers a comprehensive suite of solutions including payment acceptance, FX and transfers, and spend management tools.

Who can open an Airwallex Business Account in Singapore?

To be eligible for a business account, your company must meet these requirements:

Your company must be an officially registered and active business. This means it must be fully incorporated and in good standing.

Your company must be registered in an eligible country.

Your company doesn't operate in unsupported industries.

Your company cannot be on a sanctions list, be a shell bank, or be a bearer share entity.

For more information, click here.

How does an Airwallex Business Account help businesses save on transaction fees?

An Airwallex Business Account can be used to avoid unnecessary conversion fees and to save on everyday expenses. Collect payments from your international customers in their preferred currency and pay global suppliers and employees, or hold funds in a foreign currency until FX rates are favourable for conversion.

All comparisons and information reflect Airwallex’s own research using public documentation as of 28 August, 2025, and have not been independently validated.

This publication does not constitute legal, tax, or professional advice from Airwallex, nor does it substitute seeking such advice, and makes no express or implied representations, warranties, or guarantees regarding content accuracy, completeness, or currentness. Product features, pricing and other details are subject to change. Airwallex does not guarantee the continued accuracy of this information and is not responsible for any inaccuracies that may arise from such changes. This publication is not intended to be relied on for the purpose of making a decision about a financial product. Users are encouraged to conduct their own verification and seek their own advice.

Indicative rate is based on historical annualised rate of underlying funds as of 2 September, 2025, net of Airwallex fees and assumes subscription to the Accelerate tier at SGD 399/ month. Click here to learn more.

Yield is not a savings or deposit product. Investments involve risks, including the possible loss of principal amount invested. Past performance is not indicative of future results. You should seek advice from a financial adviser before making any investment decision. In the event that you choose not to seek advice from a financial adviser, you should consider whether the investment is suitable for you. Screenshots of the product are for illustrative purposes only.

If you would like to request an update of the content in this publication, feel free to contact us at [email protected]. Airwallex meets the highest international security standards including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements. We hold your money with leading global financial institutions. Your funds are always safeguarded in line with the local regulations where Airwallex operates. For more information on how we keep your funds safe, click here.

Airwallex (Singapore) Pte. Ltd. (201626561Z) is licensed as a Major Payment Institution and regulated by the Monetary Authority of Singapore. Airwallex Capital (Singapore) Pte. Ltd. (“Airwallex Capital”) is licensed as a Capital Markets Services License holder under the Securities and Futures Act 2001 by the Monetary Authority of Singapore (License No. CMS101830). The MAS has not reviewed this information. For more details, you can refer to the MAS website here.