New at Airwallex: October Edition

Shannon Scott

Chief Product Officer

We’re helping you get more from your funds with Yield in Singapore, move money faster with higher-value transfers to Thailand, and send with confidence in the UK using Confirmation of Payee. You can also streamline spend management with AI-powered receipt matching and offer a faster, smoother checkout with PayNow. Here’s what’s new:

Business Accounts

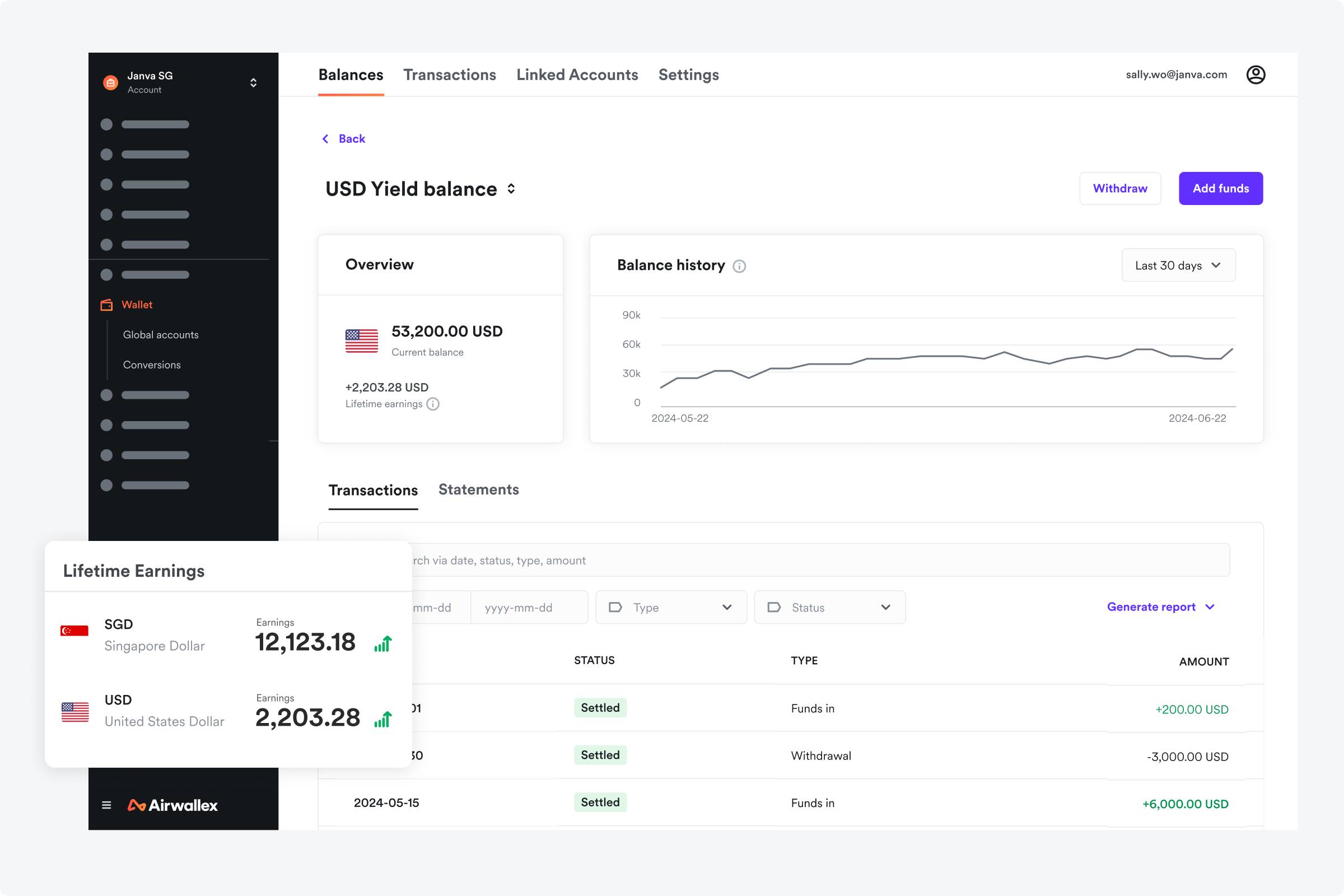

Yield now available for businesses in Singapore

Airwallex Yield (offered by Airwallex Capital) is now available for all businesses in Singapore. You can earn up to 1.48% on SGD and 4.11% on USD*. With no lock-up periods and full liquidity, you can move funds between cash and Yield accounts at any time. And for immediate access to funds you can now make instant withdrawals for a small fee.* Learn more here.

*Indicative rate is based on the historical annualised rate of the underlying funds as of September 16, 2025, net of Airwallex fees. Instant Withdrawals is provided by Airwallex (Singapore) Pte. Ltd.

Avoid FX conversions with new currencies for cards

For businesses in Europe, card transactions now directly support Danish Krone (DKK), Norwegian Krone (NOK), Swedish Krona (SEK), and Polish Zloty (PLN). Card transactions in these currencies will be debited directly from the corresponding currency balance, if available, and can be set as the card’s primary currency, helping avoid unnecessary FX conversions. Learn more here.

Send higher-value transfers to Thailand

Customers can now create local THB same-day transfers with no maximum transaction limit. With this enhancement, we have also expanded our supported beneficiary banks in Thailand to include Bank of America, Government Housing Bank, Mega International Commercial Bank, Land and Houses Bank, The Thai Credit Retail Bank, and Islamic Bank of Thailand.

Stronger security with UK Confirmation of Payee (CoP)

UK CoP is now available for transfers to UK local bank accounts across WebApp, mobile, and API. Customers can now send funds with confidence by verifying that the bank account details match the intended recipient before a transfer is created, helping to reduce errors and prevent fraud.

WebApp/mobile: Receive name-matching results for UK recipients in real-time before creating a transfer.

API: A new Verify a beneficiary account endpoint allows customers to programmatically perform bank account verification for UK and Vietnam bank accounts (with more regions to come).

Additional releases:

Transfer via Airwallex Pay (mobile): You can now create transfers via Airwallex Pay directly on iOS and Android.

QuickBooks Bank Feed (UK): Customers with UK accounts can sync Wallet transactions and currencies directly to QuickBooks, eliminating manual data entry. Learn more here.

Spend

Eliminate manual receipt work with AI-powered matching

Cut down on time spent chasing receipts with AI-powered receipt matching. Employees can forward their receipts to [email protected] or quickly upload their receipts via the WebApp or mobile. Our AI will automatically match receipts to the correct card expense. Employees can also create reimbursements with any unmatched receipts.

Additional releases:

Employee fields: department, location and employment type: You can now capture key employee attributes in user profiles, including department, location, and employment type. This enables more flexible Spend approval workflows with dynamic approvers and better user filtering in User Management.

Independent approval workflows for card expenses and reimbursements: Configure separate approval rules by expense type, allowing different controls for each based on your internal policies.

Sync expenses with ease: To help speed up your month-end close, you can now sync card expenses to your accounting provider from any status - not just upon approval. If details change after syncing, simply resync to keep everything up to date.

Schedule transfers for bill payments: Take control of your cashflow by scheduling bill payments via transfers up to 180 days in advance. Funds will be deducted from your selected wallet on the scheduled transfer date. If your transfer involves currency conversion, the exchange rate will be confirmed on the scheduled date.

Automatically import bills: Enable automatic imports of unpaid bills from NetSuite, Xero, or Quickbooks. Once activated, Airwallex will periodically fetch new bills, reducing manual work for your finance team and helping you get to payment faster.

Payments

Offer a faster, improved PayNow experience in Singapore

PayNow, one of Singapore’s most popular payment methods, now delivers an even better experience when powered by Airwallex. Transactions settle faster, support higher payment limits, and for Singapore-based businesses, your business name is displayed in your customer’s transaction records. Airwallex’s hosted payment page now displays PayNow QR codes within the checkout (replacing the previous redirect flow) to provide a faster, more seamless checkout. For custom checkout integrations, you can also embed QR codes on your page, reducing friction and making it easier for customers to pay. Learn more here.

Additional releases:

Settle card payments in 8 new currencies: Customers with UK and NL accounts can now settle Visa and Mastercard transactions directly in AED, CZK, HUF, JPY, RON, SGD, TRY, and ZAR. Funds are deposited like-for-like into your wallet balance, helping you avoid unnecessary FX conversions on card transactions. See the full list of supported settlement currencies here.

QuickBooks Payments Feed (early access): Sync Payments transaction details like fees, refunds, and disputes automatically from Airwallex to QuickBooks for faster reconciliation, eliminating manual uploads and categorisation.

Developer Experience

Early accessFind answers faster with the AI Docs Widget

You can now ask questions directly on Airwallex Docs. The AI widget intelligently searches content to provide immediate, context-specific answers, making it easier to find information on products, APIs, integrations, and other technical topics. This helps you resolve issues faster and simplifies the overall Docs experience.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

View this article in another region:AustraliaCanada - EnglishCanada - FrançaisChinaEurope - EnglishEurope - NederlandsIsraelNew ZealandSingaporeUnited KingdomUnited States

Shannon Scott

Chief Product Officer

Shannon Scott is the Chief Product Officer at Airwallex. Shannon is responsible for Airwallex's product strategy and roadmap, spanning financial infrastructure, business software, and embedded finance solutions.