New at Airwallex: January Edition

Shannon Scott

Chief Product Officer

This month, we’re helping businesses put their funds to work, get up and running faster, and improve payment performance end to end. We’ve expanded access to Yield across the European Economic Area, introduced new web and mobile onboarding experiences, and launched Optimize 360 to help merchants balance conversion, cost, and fraud through intelligent payment optimisation. Teams also gain more control with refreshed WebApp interfaces, flexible card controls, and new payment methods in the Middle East. Here’s what’s new:

Business Accounts

Earn returns on your balances with Airwallex Yield

Airwallex Yield helps businesses put idle funds to work by earning returns on cash balances. Funds are invested in high-quality, low-risk money market funds, offering multi-currency daily returns and flexible access with no lock-up periods. Withdrawals generally settle in 1–2 business days, and balances can be synced to accounting platforms like Xero.

Regional highlights:

European Economic Area (EEA): Available to customers across the EEA, including the Netherlands, for EUR, GBP, and USD balances. Learn more here.

United States (early access): US businesses can now earn returns on USD balances, allocate funds in a few clicks, and freely move money between cash and Yield balances. Learn more here.

Disclaimers:

EEA / Netherlands: Marketing communication. Not investment advice. Returns are variable and not guaranteed. Past performance and recent yield are not reliable indicators of future results. These balances are not safeguarded e-money and are not covered by the Dutch Deposit Guarantee Scheme; investors may be eligible for the Dutch Investor Compensation Scheme subject to applicable limits and eligibility. Provided by Airwallex Capital (Netherlands) B.V. (AFM licence no. 14006498). Access requires an account with Airwallex (Netherlands) B.V.

United States: Airwallex Yield brokerage services are offered through Airwallex Capital US LLC (“Airwallex Capital US”). Airwallex Capital US is a registered broker-dealer and member of FINRA/SIPC. Past performance does not guarantee future returns. Airwallex Capital US does not provide investment advice or recommendations, and this information does not take into account your investment profile or financial situation.

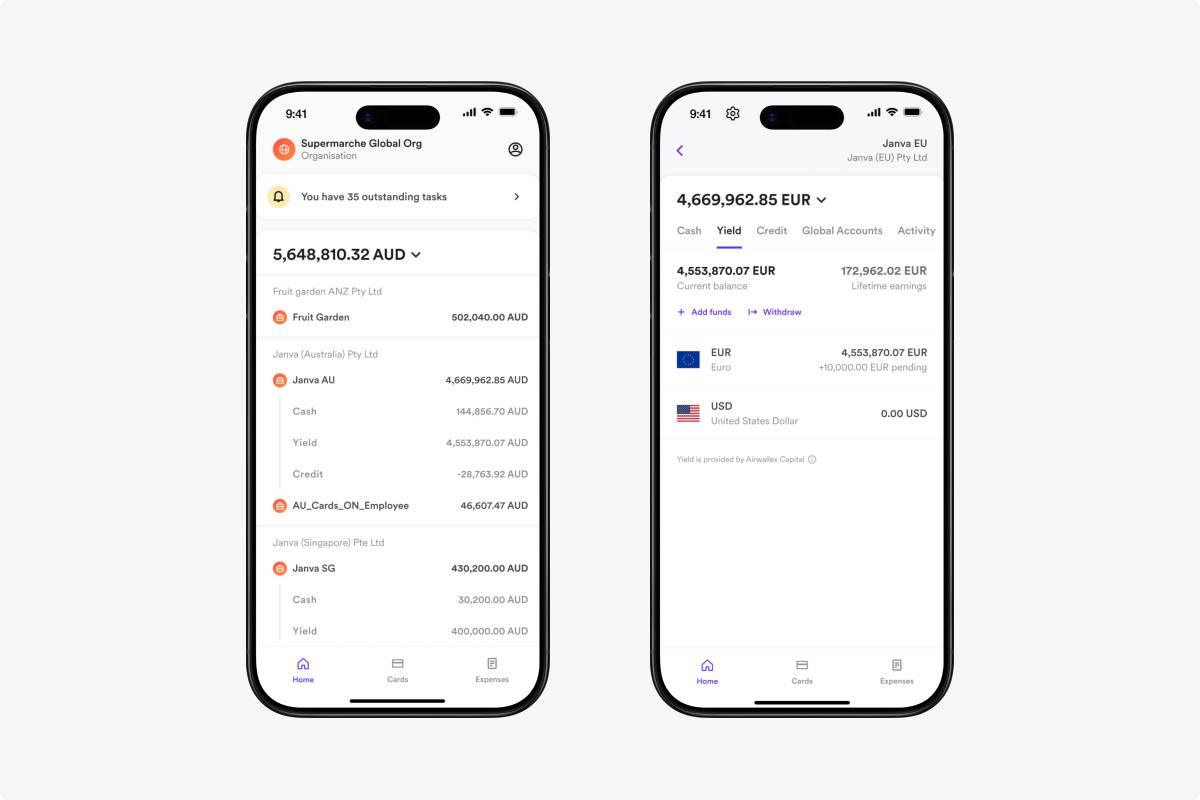

Manage your Yield balance on mobile

Yield customers can now view and manage their Yield balances directly in the Airwallex mobile app. Track earnings and transfer funds to and from Yield on the go, making it easier to put idle cash to work wherever you are.

Additional releases:

Mobile-native onboarding experience (early access): Customers can complete account creation directly within the Airwallex mobile app, from start to finish. The mobile-native experience offers intuitive navigation, in-app document and liveness checks, and seamless login throughout onboarding. This makes signing up faster, smoother, and better suited for on-the-go founders

Localised onboarding for Israel (early access): We’re rolling out a new Israel-specific onboarding flow for companies and sole traders. Customers are now onboarded under a dedicated Israel entity, aligned with local Anti-Money Laundering requirements, replacing the previous cross-border onboarding experience.

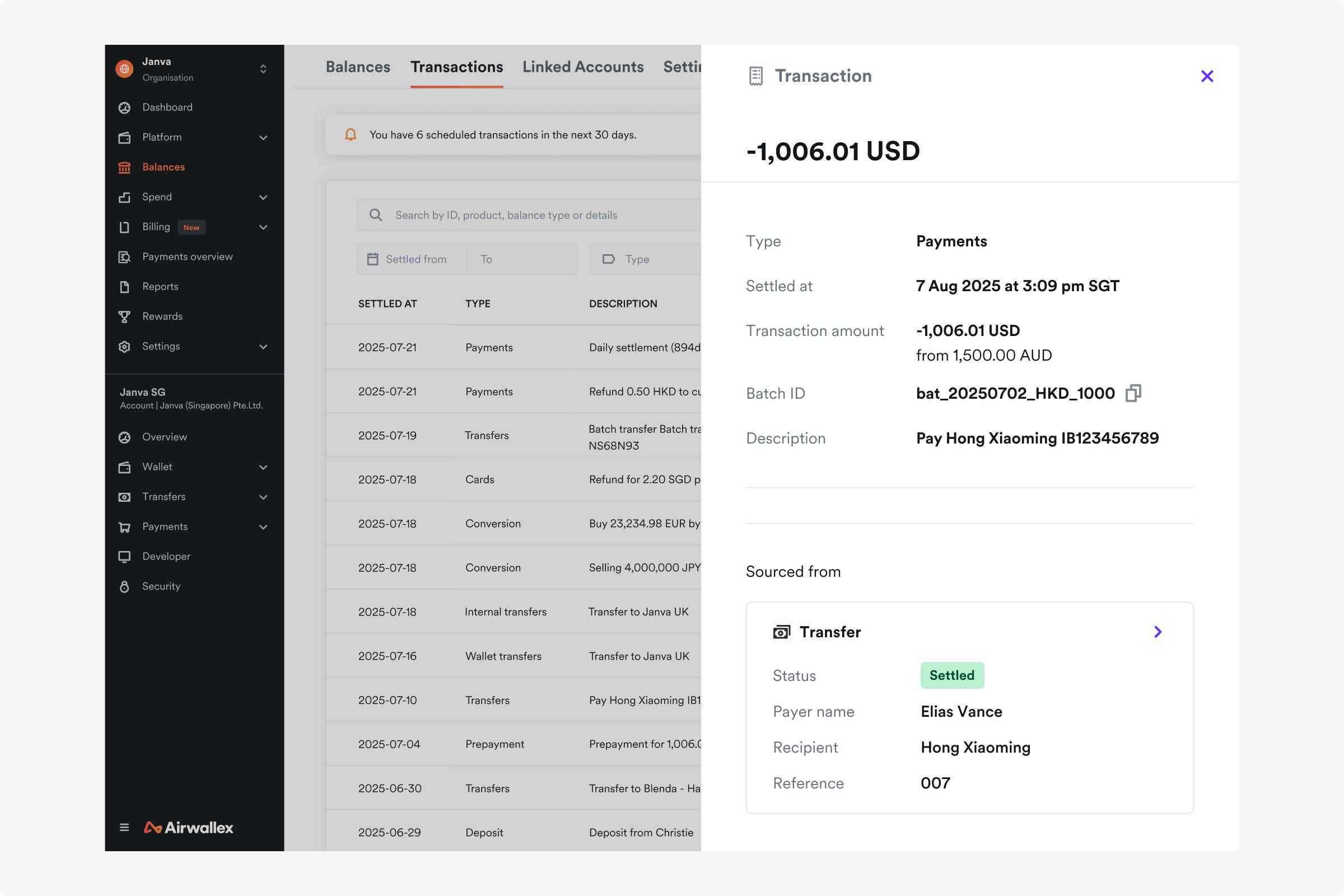

Refreshed transaction experience in the WebApp: A modernised design now makes key details easier to understand at a glance across more than 75 transaction types. You can also jump straight from a transaction to the full details in the relevant product area, helping you review activity faster without searching, switching tabs, or copying IDs.

Spend

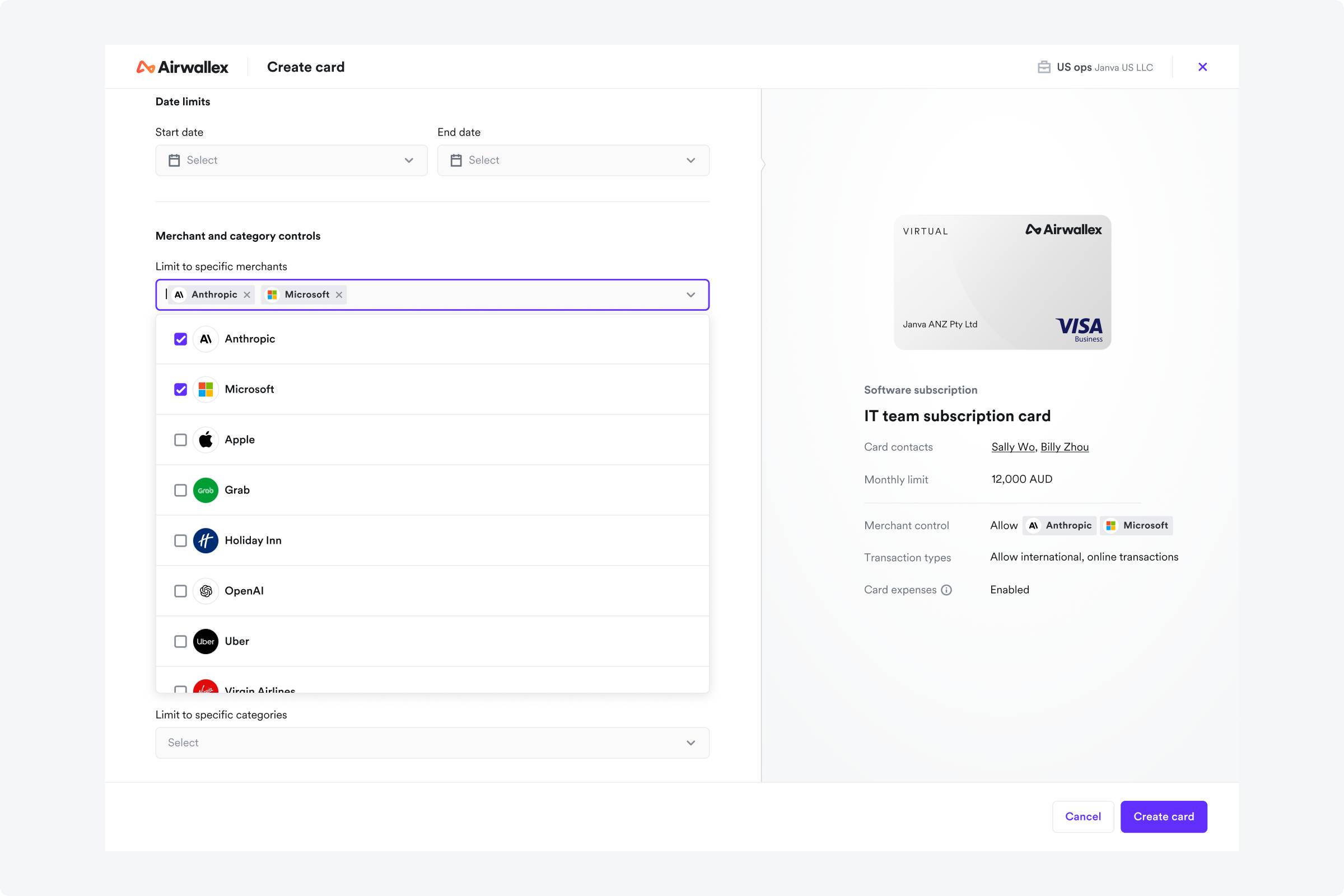

Early accessControl spend with merchant and category card controls

You can now set merchant-level and category-level controls on cards to better manage employee spend. Lock a card to specific merchants such as Meta or Amazon, or restrict spending to approved categories like travel. These controls make it easier to issue cards with confidence, reduce accidental misuse, and scale card usage across your team. Cardholders can also view applied controls directly from the card details page.

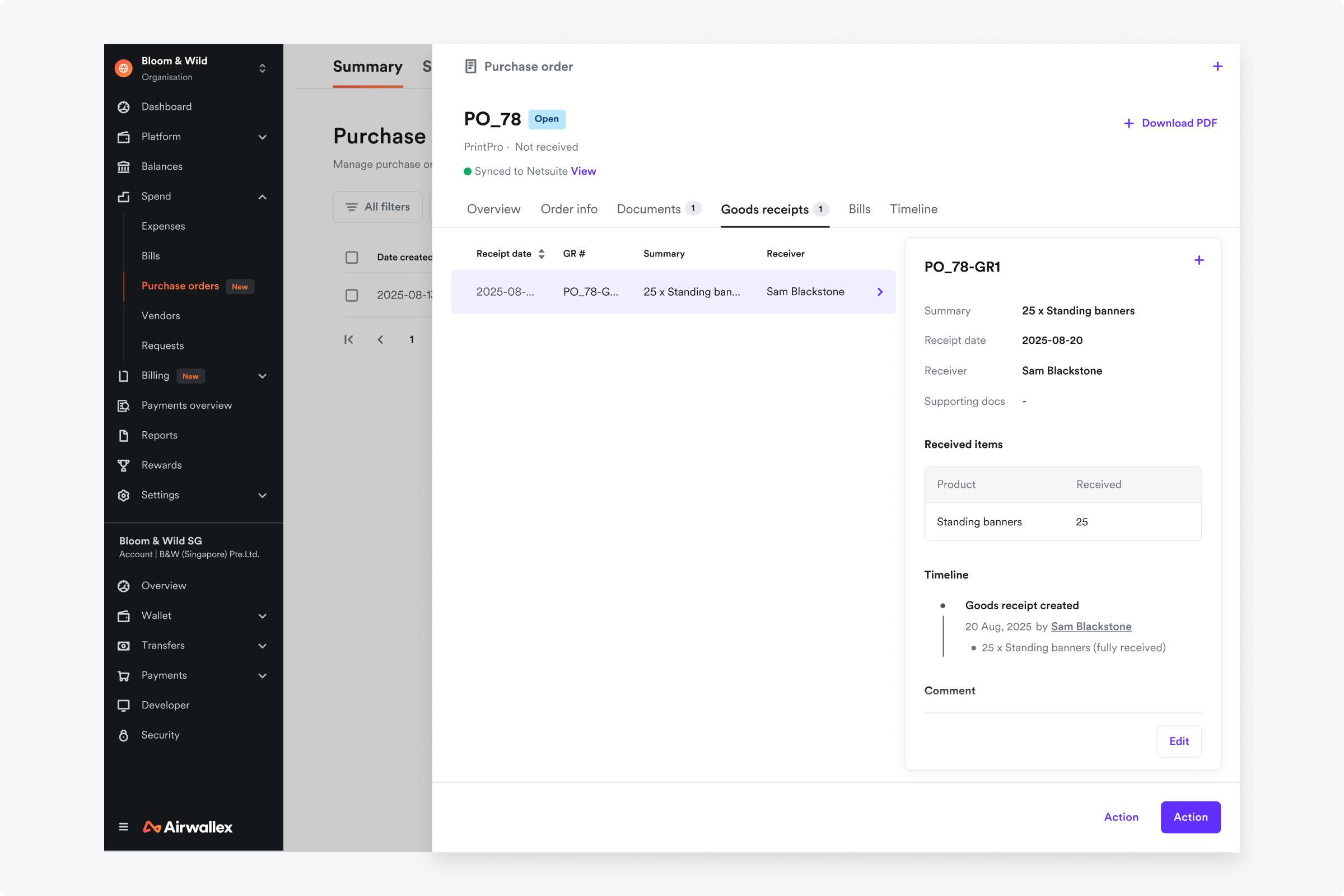

Prevent overbilling with 3-way matching for Purchase Orders

You can now enable 3-way matching in Airwallex by matching purchase orders, goods receipts, and invoices before bills are submitted and approved. This gives teams stronger controls to avoid paying for undelivered goods or services. Record full or partial receipts at the line-item level, and configure warnings, blocks, and tolerance thresholds for over-receiving or over-billing. Airwallex automatically matches invoices to the relevant PO and applies your configured 2-way or 3-way checks to support your approval workflows.

Keep vendor records in sync across systems

Vendor Management now supports two-way status syncing with your accounting provider. Updates to vendor statuses made in Xero, Quickbooks, or NetSuite (such as archiving or restoring a vendor) are automatically reflected in Airwallex, helping teams avoid discrepancies and keep records consistent across systems.

Payments

Early accessLocalise payments in Canada

Businesses with a Canadian entity can now activate payments on their Canadian Airwallex account to collect payments locally. This improves authorisation rates and reduces costs compared to collecting payments through a foreign entity.

As one of the first global acquirers with direct card-scheme contracts in Canada, Airwallex supports Visa, Mastercard, Apple Pay, and Google Pay, with like-for-like settlement across 13 major currencies for Visa and Mastercard. This helps minimise unnecessary FX conversions and improve cash flow.

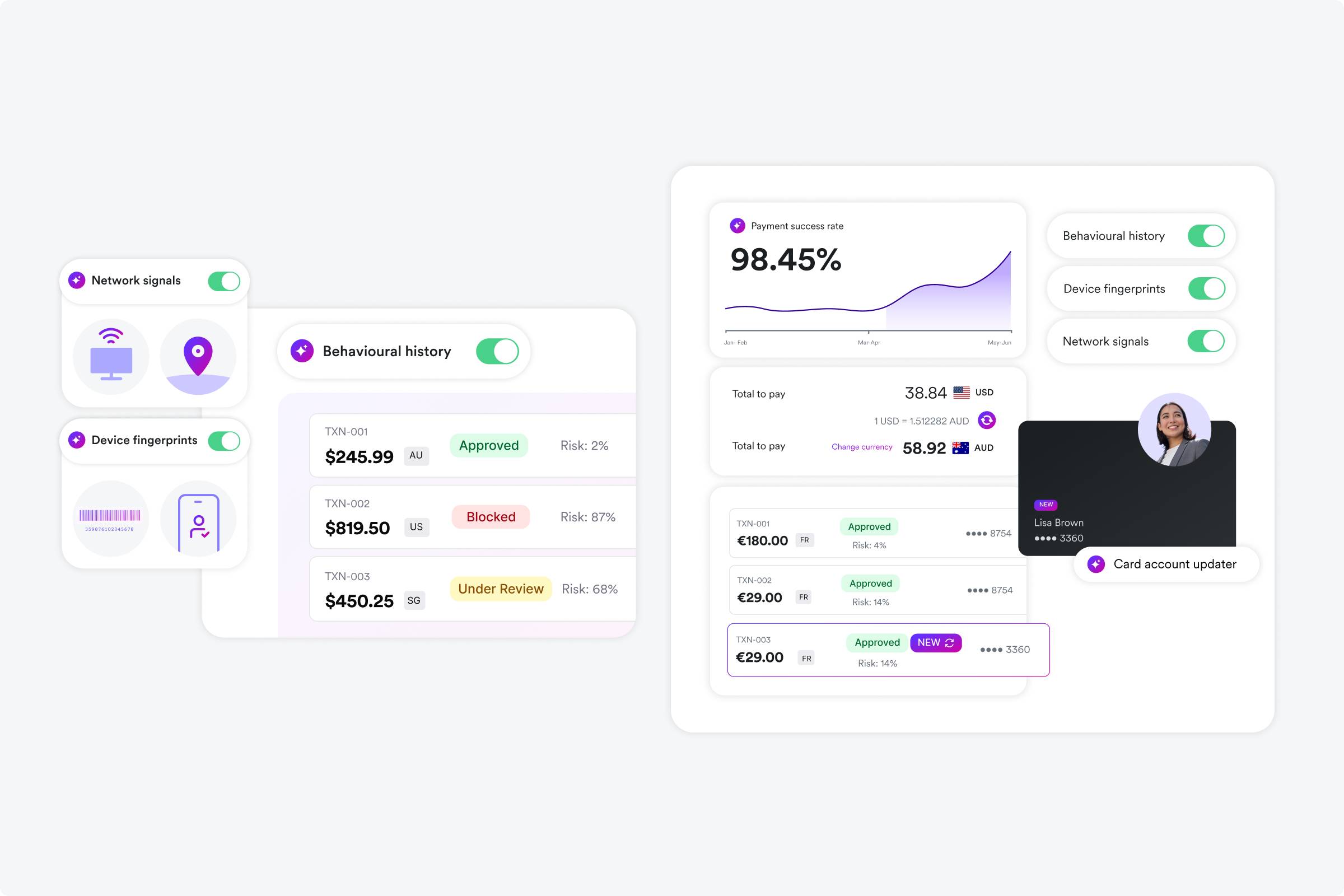

Unified payment optimisation with Optimize 360

Optimize 360 brings Airwallex’s existing payment optimisation capabilities together under a single, unified offering. Built into our payments stack and enabled automatically, it uses continuously learning models to optimise routing, retries, risk decisions, and authentication based on real-time transaction data and issuer behaviour. Optimize 360 also applies AI-driven risk decisioning, smart 3DS triggering, and tokenization strategies to reduce fraud without relying on manual rules or multiple PSPs. Learn more here.

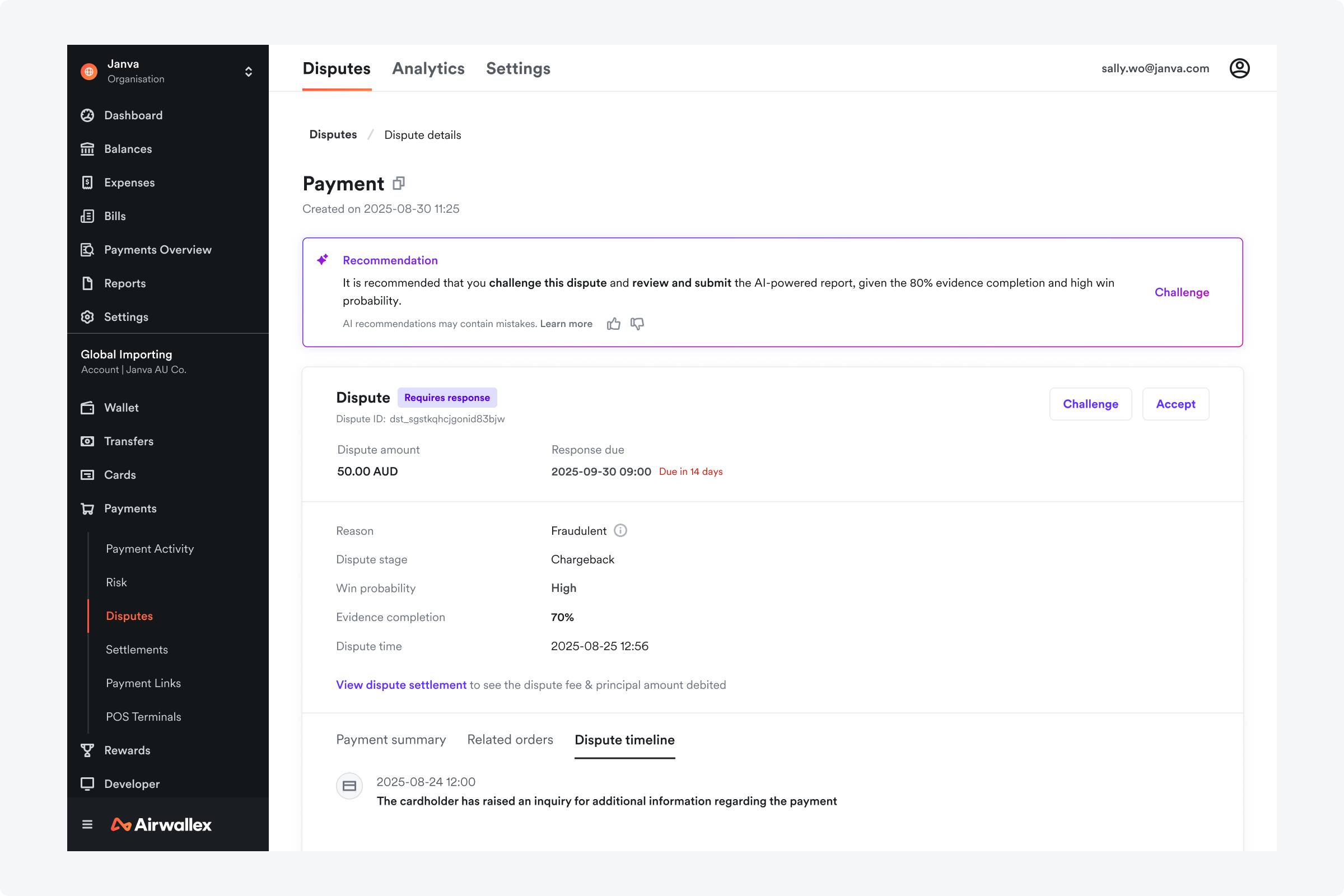

Automate dispute management and improve win rates

AI Dispute Automation helps businesses reduce manual work, speed up dispute handling, and recover more revenue. The feature auto-fills required data, generates scheme-compliant defence reports, and provides real-time AI recommendations with predicted win probability to guide whether to challenge or accept a dispute. By combining automation with AI guidance on the right evidence to submit, it helps teams work faster, gain clearer visibility, and increase dispute success rates with less manual effort.

Offer Tabby Buy Now, Pay Later in the Middle East

Tabby is now available as a payment method for merchants operating in Saudi Arabia and the United Arab Emirates. As the region’s most popular Buy Now, Pay Later option, Tabby lets shoppers split purchases into interest-free installments at checkout. Tabby is supported in the Airwallex Payments plugin for Shopify, making it easy to offer BNPL at checkout and reach over 20 million shoppers across the Middle East. Learn more here.

Additional releases:

QuickBooks Online Payments Feed: Automatically sync detailed sales, refund, fee, dispute, and net settlement data into QuickBooks Online to simplify reconciliation. With all transactions synced, your team can match settlements to bank feeds, code fees correctly, and close the books faster with fewer manual downloads, journals and errors.

NetSuite Online Payments Feed (early access): Send detailed payment, refund, fee, and batch settlement breakdowns into NetSuite as payment and deposit records for clearer transaction-level visibility. Paired with your NetSuite Bank Feed, it removes manual keying so you can reconcile deposits, route fees correctly, and maintain an accurate ledger with less effort.

POS payments and subscription free trials in WooCommerce: The Airwallex WooCommerce plugin now supports in-person payments through Airwallex POS Payments, helping merchants manage both online and offline sales from one platform. We’ve also added support for subscription free trials, allowing merchants to offer customers a trial period before billing begins making it easier to launch and grow subscription-based products.

New payment method activation statuses: We’ve introduced clearer payment method activation statuses to give you better visibility into where you are in the activation process and what to do next. The new statuses highlight when updates are required, show estimated timelines, and indicate when payment methods are under review. Learn more here.

Platform APIs and Embedded Finance

Launch and scale card programmes in Canada with greater speed and control

Card issuing in Canada is now fully supported through Airwallex, allowing platform customers to more easily launch and expand card programmes in the Canadian market. With Airwallex’s Issuing API, you can issue white-labeled virtual and physical cards, and support Apple Pay and Google Pay, all backed by Airwallex infrastructure. This unlocks greater speed and control for platforms looking to expand card issuing in North America.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

Interested in helping us build the future of finance? Join our Product team here

View this article in another region:ChinaHong Kong SAR - EnglishHong Kong SAR - 繁體中文

Shannon Scott

Chief Product Officer

Shannon Scott is the Chief Product Officer at Airwallex. Shannon is responsible for Airwallex's product strategy and roadmap, spanning financial infrastructure, business software, and embedded finance solutions.