API card issuing: A new era in payment technology

Emerging card issuing technology is driving change and innovation across industries, empowering businesses of all kinds — from eCommerce platforms to ridesharing apps — to offer cutting-edge financial services to their customers.

Alternatively referred to as “API card issuing” or “modern card issuing”, this new trend in the world of embedded finance allows businesses to build their own card program, tailored to their specific use case. Increasingly, companies are choosing to issue their own payment cards to users, allowing them to spend money directly within platform, without ever moving it into a bank. A prime example being Uber, which now issues cards to its drivers, enabling them to collect and spend revenue all within a single app.

In this article, we'll dive into the different ways businesses can use card issuing to upgrade their product offering. We’ll also cover the card issuing product that Airwallex offers, and show you how our full stack solution and flexible APIs can help you go to market faster than competitors, and scale your card issuing program globally.

What is Card Issuing

Let’s briefly have a look at how traditional card issuing worked in the past.

Unless you were a business, such as a major bank, that had the necessary infrastructure and resources to issue your own cards, you needed to partner with various intermediaries to issue bespoke cards branded for your business.

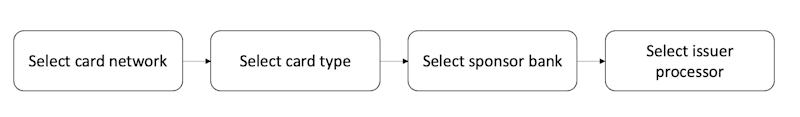

On a high level, this process would include the following steps:

Selecting the card network. This is the core of your payment infrastructure. The four major networks are Visa, MasterCard, American Express, and Discover.

Selecting the card type. The main card types available are credit cards, debit cards, and prepaid cards, each with their own unique features and benefits.

Selecting the sponsor bank. A sponsor bank is responsible for facilitating the transfer of funds from end consumers to merchants and for ensuring that payments are properly processed.

Selecting the issuer processor. An issuer processor is responsible for managing the issuance of cards, authorising or declining transactions, maintaining the system of record for cardholder data, communicating with settlement entities, and facilitating card issuing on behalf of the issuing bank, while connecting directly with networks to do so.

For many years, this traditional card issuing infrastructure effectively served the purpose of transferring money within certain limitations, but it never really provided a unique advantage for the business. Any customisation would require the business to start the process again, resulting in lengthy development cycles. This meant that any future adjustments to meet the evolving needs of the business would also require starting the process over, hindering the ability of innovators to respond to changes in the market.

What is API Card Issuing

To stay competitive and adapt to the fast-paced changes in the market, many businesses started embracing a digital-first approach to payment services. This shift has been driven by technologically advanced companies such as Uber and DoorDash, which have led the way in the development of distributed, fault-tolerant applications since the early 2010s. The resulting boom in the card issuing field has led to the emergence of a new phenomenon – card issuing using flexible Application Programming Interfaces (APIs).

Is this card issuing process totally different to the traditional one? Yes and No.

If we take a high-level look at the process of API card issuing, we can identify the following steps.

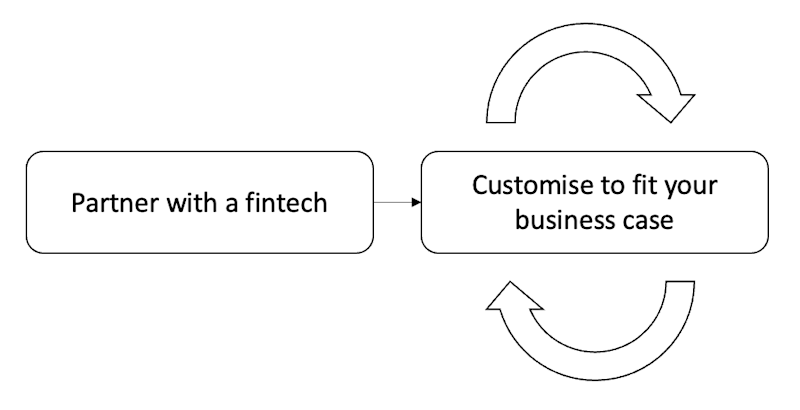

Partnering up with a full stack fintech partner. A full stack fintech partner takes on the burden of finding sponsor banks, issuing processors, selecting card types and dealing with KYC. Having a full stack solution allows you to create an account and issue a card without needing to find a bank sponsor, which is especially beneficial for startups. Airwallex offers a full stack card issuing solution.

Customising the card products to fit the business case. One of the main benefits of API card issuing is its ability to adapt to changing business needs without requiring a complete overhaul of the initial card issuing process.

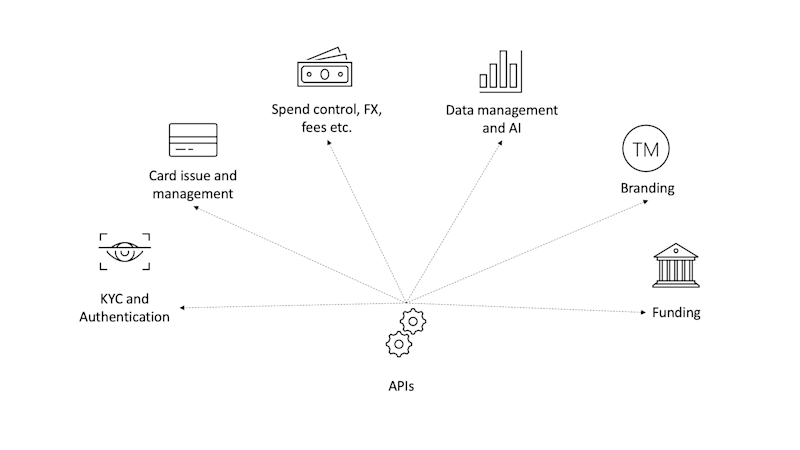

APIs are at the core of this new card issuing process. APIs play a vital role in embedded finance as a whole, especially in the context of Open Banking. So, how do these APIs enable such a high level of flexibility? Let's take a closer look.

Financial institutions have historically been required to follow the ISO 8583 standard for exchanging electronic messages about financial transactions. However, open APIs have broken this complex payment flow down into smaller, more easily understood APIs that use JSON data format, making it easier for developers to work with while still adhering to ISO 8583 requirements.

In the overall scope of card issuing, each function has its own dedicated API, such as handling KYC, issuing a card, or authorising a payment. These APIs can also work with customer data and use artificial intelligence to offer additional services that span beyond traditional finance, such as personalised spending advice and enhanced security by identifying suspicious transactions or unusual patterns. Open APIs also allow for integration with other applications, services, or platforms.

What makes Airwallex’s issuing platform different

There are many fintech companies that offer API card issuing services partially or fully. However, it is crucial to select the right partner that has the expertise and experience to deliver solutions tailored to your specific needs. Don't settle for a one-size-fits-all approach – make sure you select a fintech that is the right fit for your use case.

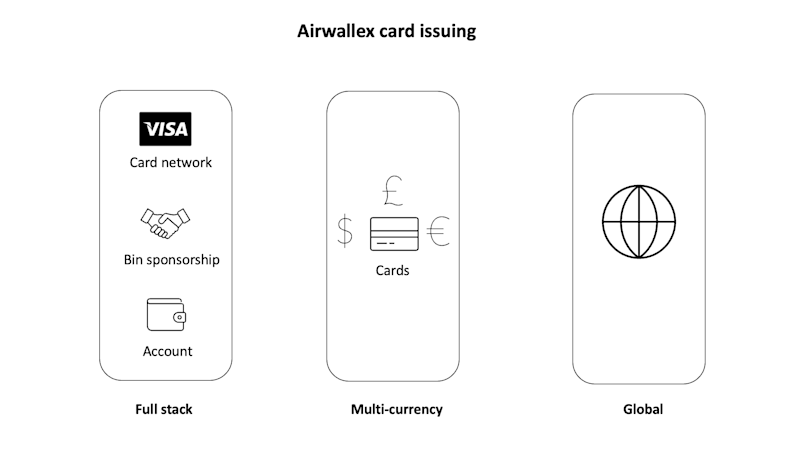

At Airwallex, we have established ourselves as a reputable payment business with a strong foundation of real-world use cases and continuous support for our customers. Our extensive experience in the payment industry and our partnership with global banks and the Visa card network, allows us to confidently offer our assistance to your business by our API card issuing solution. What sets Airwallex apart from the competition is the perfect blend of these three key elements.

Full stack – Thanks to our global licences and banking partnerships, we've got you covered for BIN (bank identification number) sponsorship, so you can create accounts and issue cards through Airwallex without the need to manage a banking relationship yourself. Our partnership with Visa means you take advantage of the extensive reach of the Visa network and complete transactions in over 200 countries and territories using our physical and virtual multi-currency debit cards. We also take care of KYC and compliance.

Global – Our products are available to companies across various geographic regions. For instance, if your business is based in the UK but you have offices in the US, you may want to consider setting up a US account with Airwallex instead of using your UK account to make transactions in that region. This way you can avoid incurring foreign exchange fees or transaction fees. Airwallex's global coverage enables you to set up accounts in multiple locations so you can issue local cards rather than international cards to your customers.

Multi-currency - Airwallex accounts offer multi-currency wallet functionality, enabling transactions in a variety of currencies, including USD, AUD, CAD, SGD, NZD, HKD, JPY, EUR, GBP, and CHF. Our expertise in Foreign Exchange (FX) allows us to provide seamless integration of various solutions, ensuring access to the best FX prices and transaction services that align with the specific needs of your business.

Go to market fast - Airwallex offers a tried and tested white label card solution that allows businesses to quickly bring their own branded cards to market. Once development is complete, businesses can test transactions in the demo environment and then go live in production by simply changing API keys and redirecting endpoints. Our APIs are flexible and have a data structure that can easily be integrated with various back-end systems. Airwallex is here to make the card issuing process easy for you. As a customer, you won't need to worry about BIN sponsorship, card production, transaction processing, or balance management.

Secure - Airwallex has achieved the highest level of PCI compliance (PCI-DSS Level 1) and will handle all PCI requirements on your behalf. We'll also handle all KYC and other compliance requirements, so you can focus on growing your business. Plus, we are fully compliant with Strong Customer Authentication (SCA) in the UK and PSD2 across the EU.

With flexible APIs, card issuers can instantly and securely work with API tokens, which replace sensitive card information such as a personal account number (PAN) or a personal identification number (PIN). API tokens can be securely stored online with merchants or directly in digital wallets for recurring and one-click payments.

The granular nature of open APIs allows businesses to maintain dedicated APIs that can actively use customer payment data to benefit the business and customers. For example, using Airwallex APIs, you can offer real-time spend tracking to your customers, helping them to better understand and manage their spending habits. Additionally, you can set custom spend controls on cards, which can be useful for corporate cards issued to employees. With Airwallex, you also have the opportunity to generate additional revenue through interchange fees.

How could my business use Airwallex card issuing?

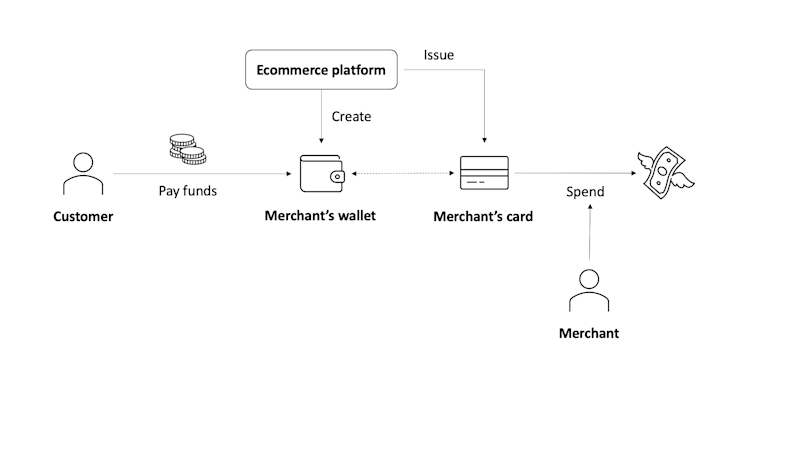

eCommerce

An eCommerce marketplace can create multi-currency digital wallets for their merchants and directly issue digital cards that are linked to those wallets. Merchants can then collect revenue from their product sales directly into their wallet, and can spend the funds right away using their cards.

By integrating Airwallex's APIs, an eCommerce marketplace can not only offer its customers the convenience of digital multi-currency wallets and linked cards, but also enhance the overall user experience with advanced fraud detection and the option to offer additional products such as lending or insurance based on the customer's spending data. This helps to create a more secure and personalised payment process for the eCommerce marketplace customers.

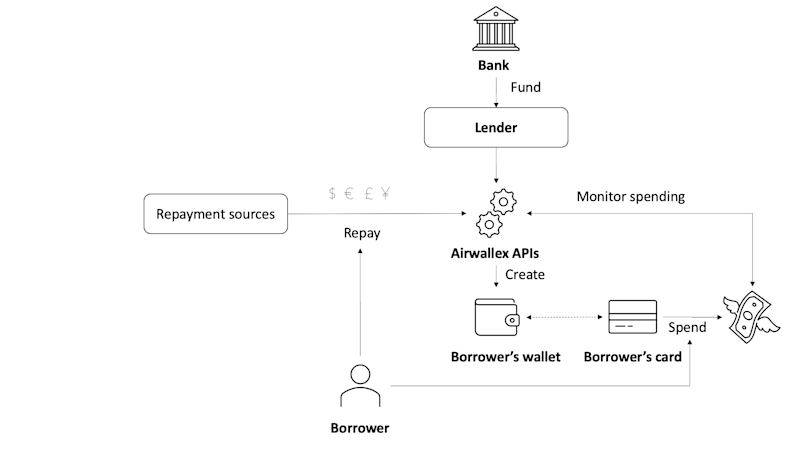

Capital as a service

A lending business can integrate Airwallex technology into their platform in a similar way by creating multi-currency digital wallets for each of their clients and issuing cards against these wallets. The business can then use the wallets to promptly deliver funds to the clients and collect repayments directly once funds are received from external sources. At the same time, the clients can use their cards to spend the funds. Using Airwallex APIs, the business can also gain real-time insights into the spending habits of their clients and adjust their funding offers accordingly. This allows them to offer more flexible, comprehensive, and user-friendly financial products.

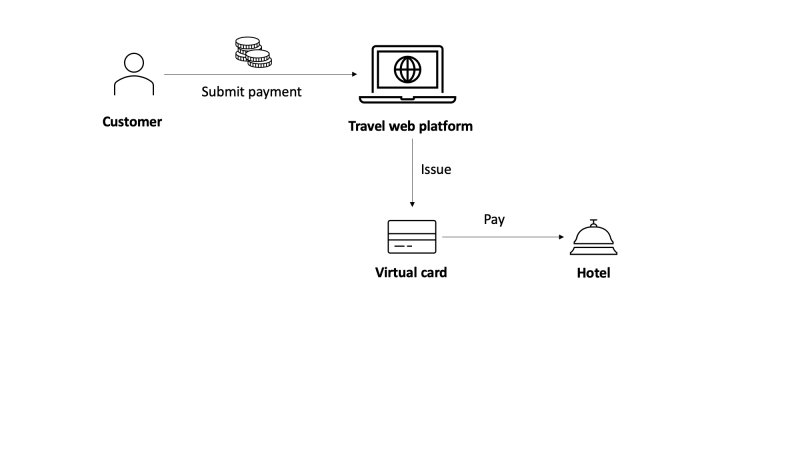

Online travel services

If you operate a hotel booking business, for example, you can use the Airwallex card issuing solution to process payments across multiple jurisdictions without incurring fees.

As an example, when a customer makes a payment on your digital travel platform, the platform can use Airwallex's APIs to issue a virtual card that is subsequently used to pay the hotel once the funds have been received. The global nature of Airwallex cards means you can avoid transaction fees when paying hotels around the world.

Get in touch to start your card issuing journey

There are many ways that API card issuing can benefit your business. The flexible and highly customisable nature of APIs can meet the majority of today's business requirements and provide a strong foundation for future developments in your industry.

By choosing Airwallex as your card issuing partner, you can deliver the best service to your customers today, knowing you can easily adapt your services for tomorrow’s market. Our customisable card issuing solution, backed by our global banking licences and extensive experience in business payment processing, can help you take your platform to the next level.

If you're interested in learning more, our team of experts are here to evaluate your specific requirements in more detail. Don't hesitate to get in touch.

View this article in another region:AustraliaEuropeHong Kong SAR - EnglishHong Kong SAR - 繁體中文United KingdomUnited States