How to calculate and improve ROI in easy steps

Evan Dunn

Growth Marketing Lead, US

Most people in the US have heard and even used the term ROI. Most likely, you know that it stands for “return on investment.”

But could you explain exactly what return on investment entails?

Let’s take a look at what ROI is and how to calculate ROI for your business and marketing. To make things easy, we’ll even provide you with a simple ROI calculator.

What is return on investment?

ROI measures the financial return you’ll receive from an investment. It estimates how many dollars you’ll get back for every dollar you invest.

As a result, people use ROI to determine whether an investment is worthwhile.

It’s important to note that ROI and profit are not the same thing. Profit is the number you get by subtracting your expenses from your income. ROI, on the other hand, allows you to measure the effectiveness of your potential investment.

Calculating ROI is actually pretty simple. As such, it has become a universally understood measurement of the profitability of your potential investments.

What is a good return on investment?

There is no single number that represents a “good” return on investment. The investments that your business is considering and what you’re hoping to achieve with them play a big role.

Nevertheless, if you calculate your ROI and it comes back with a positive figure, then it’s likely a good investment to consider. You can use this figure to compare different investments and see which is likely to deliver the better return.

Similarly, ROI calculations that return a negative result imply that the investment is going to be a loss for your business. In this case, it’s better not to move forward.

Limitations of ROI

Calculating ROI is an easy way to get a quick idea of the value of an investment. However, it’s not appropriate in all circumstances.

For example, say that you perform free marketing activities, such as by running a free online webinar or through an organic social media post. In these cases, your ROI is effectively 0%. This would usually be a bad ROI, but in this case, it doesn’t portray the full picture.

So ROI is typically reserved for investments with clear monetary sums.

How to calculate ROI

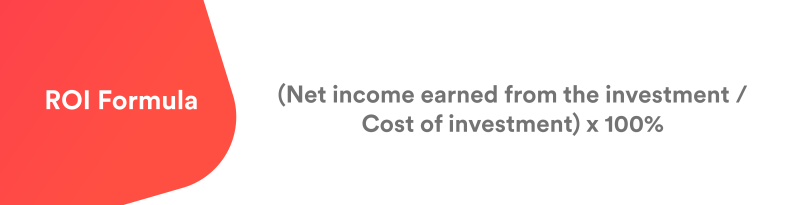

There are a few different formulas you can use to easily calculate the ROI of purchases for your business. However, we’ve included the one that’s easiest to use and to understand.

ROI = (Net income earned from the investment / Cost of investment) x 100%

How to calculate ROI on your marketing spend

Marketing spend is one of the most common ROI calculations used for businesses. So let’s look at an example:

Say your business spends or is looking to spend $1,000 per month on marketing across your social and online channels. This includes social media ads, pay-per-click ads, and the like.

From this $1,000 spend, your monthly campaign ends up generating $10,000 in revenue.

Using the ROI formula — ($10,000 / $1,000) x 100% — you find that your ROI is 1,000%.

So for every dollar you spend on your marketing, you’re seeing $10 in profit.

But what if you’re looking at the ROI on marketing leads? For example:

You spend $1,000 on a lead generation campaign. During this campaign, you generate 100 new leads. This means that you’re spending $10 for every lead.

Your business makes an average of $2,000 from each customer.

If you convert 3% of these new leads into customers (which is admittedly just three new customers), at $2,000 income each, that’s a return of $6,000.

Using the ROI formula — ($6,000 / $1,000) x 100% — you get an ROI of 600%.

How to improve ROI

Choosing the right assets and avenues for investment is important. However, improving your ROI really comes down to refining how and what you sell.

Review your sales processes

Your first step is to determine if and/or how your marketing processes are holding you back. To this end, you’ll want to review your sales pipeline from start to finish.

Updating your marketing processes doesn’t necessarily have to be a major overhaul. For example, maybe you just need to add a new CTA to a landing page. This may not seem like a significant change, but well-targeted CTAs have been proven to convert 202% better than generic “buy now” language.

Or maybe you do need to overhaul your entire sales funnel and consider how you’re using your marketing spend. For example, paid channels such as Google and Facebook are typically the platforms with the best ROI. Is your business taking advantage of these channels as much as possible?

Optimize your sales content

One of the best ways to optimize your sales process is to ensure you have the right sales content in place.

And we’re not just talking about written content. These days, video is just as — if not more — important.

A 2020 study found that:

Video content helped 83% of the marketers surveyed to generate leads.

A well-produced brand video had persuaded 84% of the consumers surveyed to buy a product.

The takeaway: Don’t underestimate the difference that your sales content (and particularly the type of content you use) can make to your ROI.

Remove unnecessary costs from your budget

One of the best ways to boost your ROI is also the simplest: Remove unnecessary costs from your budget.

Auditing your budget will likely take some time, but we can assure you that it will pay off (literally).

For instance, maybe you’re spending more than you need to on your internet provider or your sales platform. Or maybe it’s as simple as looking for a more affordable provider for the product you sell.

How you make your payments and purchases can also eat into your ROI – often without you even realizing it. Your banking alone may be burdening you with unnecessary and excessive costs such as FX rates, international transaction fees, and high bank accounts fees, which can quickly add up.

Fortunately, we have a way to eliminate these costs for good.

Airwallex uses better banking to boost your ROI

Airwallex makes it easy to reduce the fees you pay for your banking, giving you a much better ROI when you make your payments. For example, our products enable you to:

Create individual wallets for 11+ currencies with our Foreign Currency Accounts. Hold, send, and receive international currencies without the associated fees and avoid double conversion.

Make international payments to 130 countries in over 34 different currencies, with no minimum transfer fees.

[COMING SOON] Instantly create physical and virtual borderless cards for your business as soon as your account is approved. Be ready to make payments as soon as you need to.

What’s more, we don’t charge any monthly account fees, withdrawal fees, or international fees — ever. You’ll also enjoy some of the best FX rates available. We only ever charge 0.5% to 1% above the interbank FX rate, so you get the best rate possible and can make a better return on your payments.

Now that’s a winning ROI formula.

Watch a demo of our Global Accounts or sign up today to see how we can help you streamline your banking and boost the ROI on your marketing spend.

Related article: Break-even analysis: the formula to calculate break-even point

View this article in another region:AustraliaSingaporeGlobal

Evan Dunn

Growth Marketing Lead, US

Evan Dunn manages the growth of Airwallex's SMB business in the US through marketing avenues. Evan is a generalist with expertise in SEO, paid media, content marketing, performance marketing and social selling. He also enjoys slam poetry and waffle making.

Posted in:

Accounting