8 benefits of virtual debit and credit cards in 2024

David Beach

Senior Editor | Payments, banking, financial technology, and global commerce - EMEA

Virtual payment cards can revolutionalise the way your businesses manage and make payments, saving teams thousands of pounds in excessive fees and countless hours in admin. As UK businesses continue to grow their digital presence, security, flexibility and team empowerment have never been more important. Let's review the core benefits of virtual debit cards and the impact they can have on your business.

What are virtual payment cards?

As the name suggests, virtual payment cards are debit or credit cards that are created entirely online and are not issued as a physical card that you can hold in your hand. They’re randomly-generated 16-digit numbers, complete with a card verification number and expiry date. They act in the same way traditional credit and debit cards do—without the need for a physical card. They’re issued by Mastercard, Visa, or American Express, and are accepted anywhere credit cards are usually accepted.

But how these cards differ from their physical cousins is in their operation, and ease of use.

Instead of relying on your bank, you’re in control. You’re able to choose the currency you need, set a spending limit for the card, and define the merchant types where the card can be used.

Virtual payment cards are streamlining the way payments are made for both suppliers and vendors, and there are a number of compelling benefits for your business.

8 big ways virtual debit cards can benefit your business in 2022

Considering switching to virtual cards or adding them to your business' payment stack? Here are the 7 key benefits your team can reap from making the switch. Trust us, you won't be disappointed.

Staff empowerment

Virtual cards can be issued to multiple team members who are required to make payments for their business on a daily basis. So instead of hounding your manager or accounts department for access to the one single physical card to make a payment (or going through the onerous paperwork to get a corporate card yourself), staff can be issued with individual virtual payment cards that are unique to them.

As a manager, you can set the spending limits on each virtual card, which means you keep a firm hold on your budget when making business payments, and your teams know exactly how much they have available to spend.

Eliminating payment bottlenecks means your business can move at a much faster pace by allowing the purchasing of new software and equipment without delays. When executed correctly, purchase requests no longer need to sit in pending for weeks while your staff sit idle awaiting the green light to make the purchase. With their own virtual payment card, they can do so instantly, while you maintain full control.

Access new debit cards instantly

One of the biggest pain points with opening new card accounts is waiting for them to arrive in the mail. You usually need to wait for the physical card to arrive which could take weeks, especially with the shipping delays in a post-pandemic world. For businesses with remote teams, this normally means then having to mail the card back out to your employees. Virtual cards on the other hand can be activated and used for online purchases pretty much instantaneously, meaning you can get access to your funds faster.

For those of us that require in-person purchases, most card issuers enable virtual cards to be linked via Google Pay & Apple Pay, enabling contactless purchases by linking your card to a mobile device. Handy for getting new cards out to employees instantly!

Improved accountability

Another virtual debit card benefit is the improved oversight and accountability you receive over your business’ money. As you’re able to assign virtual payment cards to specific suppliers or vendors, you always know exactly where your money is going, and why. Purchases made against this card are then automatically logged into your card management system. Everything is neatly processed, labelled, and accounted for—no more mystery payments.

There's a huge opportunity here to also reduce the number of hours spent chasing expense receipts by your accounts department. With each payment being allocated to the exact staff member who made the purchase, it's easy to trace back and reconcile the transaction. Your accounts team can go back to what they do best, forecasting and providing financial advice on the future of your business.

Added payment security

Perhaps the biggest virtual debit card benefit is the improved level of security you receive. Virtual payment cards are ideal for making safe, secure online payments.

As virtual payment cards aren’t physical things, this makes them practically impossible to be cloned. There’s no physical item to be stolen. They can even be set as single-use cards, so they expire directly after they’re used, and there’s no issue with future fraudulent payments from your card.

However, while the online nature of these payments has boosted their security, it’s important to treat virtual card payments with the same level of rigour as a physical card payment. Although the virtual vs physical card can feel considerably different, it is still real money, and so the appropriate security measures should be taken just as if it was a physical payment card.

Quality virtual cards are usually issued by trusted card providers like Visa and Mastercard, so payments are offered the same fraud checks and security features as the rest of their card network as well.

Easy to create and use

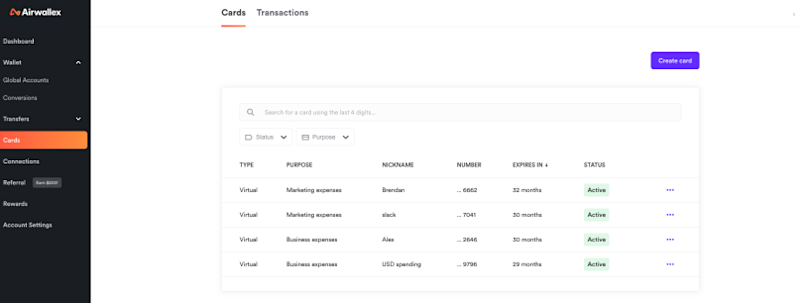

Typically virtual cards were only available to large enterprises, but with the recent advances in fintech, these products are now available to everyday businesses as well. Companies like fintech unicorn Airwallex allow businesses to create virtual cards within seconds. All you need to do is set up an account (which you can do completely online) and you can start creating them for your business.

New virtual cards can be created instantly from within your Airwallex. No need to wait for a physical card - you can start using our cards right away on Apple Pay or Google Pay™️.

Ease of reconciliation

Let’s face it: No one in finance enjoys chasing up multiple people to know why a purchase was made. But reconciling expenses to the right account is a must for any business. With virtual payment cards, you can assign ownership to a specific person, department or expense code to make month-end a breeze.

Some cards (like ours) come loaded with expense management features to turn the back-and-forth into one accurate, zero-touch accounting experience. Custom rules and spend limits add an extra layer of control over your card spending, letting you review and approve purchases in real-time. Plus, with our handy AI receipt matching, automatic categorisation and accounting software integrations, you’ll never have to chase a missing receipt again.

Lower cost per card issued

How much are you currently paying per annual fee on your company credit card? £200? £300? Compound that cost with the additional cardholder fees per employee card and this fee can quickly grow into a sizeable line item on your business' budget. Virtual cards are usually available without an annual fee or signup fee, meaning you're able to create cards to match your ideal business structure. The trade-off here is the line of credit, but if your business can do away with this feature - virtual cards can save you thousands of pounds per year.

Create and distribute multiple virtual cards at once

One of the most tedious aspects of creating payment cards for your business is creating multiple cards. Forms are required to be filled, signed and approved for a single card with additional cardholders normally requiring a similar amount of admin, and that's before the card has even been sent out. A key benefit of virtual cards is that you can create multiple cards simultaneously, usually through an easy-to-use interface. In summary, you can set up your entire team with virtual debit cards in just a matter of clicks, saving you countless hours in admin.

Create Airwallex virtual cards for your business today

Airwallex is an Australian fintech that gives everyday businesses access to these virtual cards (and more). Best of all, Airwallex’s international business debit cards also have zero international transaction fees, so you can use these for all types of payments. There are no monthly fees and a business account can be set up online in a matter of minutes.

Related articles about cards:

View this article in another region:Australia

David Beach

Senior Editor | Payments, banking, financial technology, and global commerce - EMEA

David manages editorial content for the Airwallex community. He specialises in content that helps EMEA businesses navigate global and local payments, treasury, and banking.

Posted in:

Corporate cardsShare

- What are virtual payment cards?

- 8 big ways virtual debit cards can benefit your business in 2022

- Staff empowerment

- Access new debit cards instantly

- Improved accountability

- Added payment security

- Easy to create and use

- Ease of reconciliation

- Lower cost per card issued

- Create and distribute multiple virtual cards at once

- Create Airwallex virtual cards for your business today