Payoneer vs Airwallex: compare on fees, features and benefits

David Beach

Senior Content Marketing Manager - EMEA

Airwallex and Payoneer both offer these services, but which is the better choice for your business? We’ve created this blog to help you evaluate the two providers.

What is Payoneer?

Payoneer is a payment platform that enables businesses to collect, hold and payout funds in multiple currencies. The platform can also convert funds from one currency to another, offers prepaid debit cards, and integrates with marketplaces such as Airbnb, Amazon and eBay for easy payment acceptance.

Payoneer’s transaction and FX fees are relatively cheap when receiving and paying funds from another Payoneer account. However, fees are considerably higher for transactions to and from other accounts.

What is Airwallex?

Airwallex is a multi-currency business account and payment solution. Like Payoneer, we allow businesses to receive, hold and send funds in multiple currencies. But unlike Payoneer we do not charge transaction or withdrawal fees. That means you can manage your money across borders and currencies for less. Airwallex FX rates are also more competitive than Payoneer.

Airwallex and Payoneer share many of the same features, including the ability to open multiple foreign currency accounts, exchange currencies, and transfer and accept payments internationally. Airwallex also offers virtual debit cards as well as various online payment solutions.

Compare Payoneer vs Airwallex

Airwallex | Payoneer | |

|---|---|---|

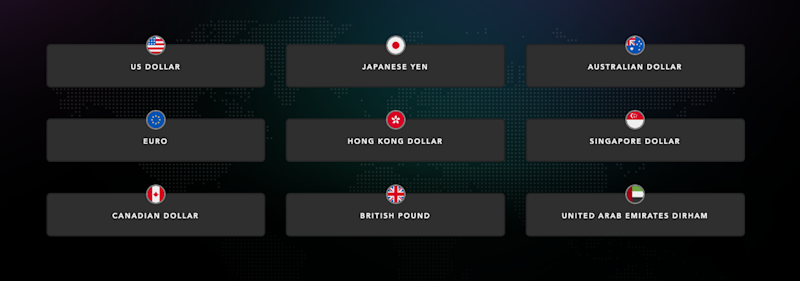

Multi-currency account | 23+ currencies | 9 currencies |

0% domestic transaction fees |

| |

0% international transaction fees |

| |

0 withdrawal fees |

| |

FX rate | 0.5-1% | 0.5-3% |

Batch payments |

| |

Employee debit cards |

| |

0% international card transaction fees |

| |

Dedicated account manager |

|

Compare key features between Payoneer and Airwallex

When choosing a payment platform for your business, we know that price is top of mind, which is why Airwallex is committed to providing businesses with the best rates on the market.

But price is not the only consideration. You also need to ensure that your chosen payment solution suits your business’ needs. With that in mind, let’s take a look at how the Airwallex and Payoneer platforms compare on features and benefits.

Currency accounts

Airwallex

Open local accounts in 23+ currencies.

We're constantly adding new currencies. Check out here for the latest information.

Payoneer

Open local accounts in 9 currencies.

Transfers & FX

Airwallex

Transfer funds to 150+ countries

No transaction fees when sending money to 110+ countries by local rails

0.5 - 1% FX rate

Batch payments

Flexible transaction limits

Payoneer

Transfer funds to 195 countries

3% transaction fee unless sending to another Payoneer account

0.5 - 3% FX rate

Batch payments up to 200

1.5 USD / EUR / GBP flat fee for same currency payments below a limit of 50,000 USD / EUR / GBP in a single calendar month. 0.5% of total transaction for same currency payments above the limit of 50,000 USD / EUR / GBP in a single calendar month

Payment acceptance

Airwallex

Free multi-currency collection from platforms including: PayPal, Stripe, Shopify, WooCommerce, Afterpay, Klarna and Amazon.

Free payment collection via bank transfer.

Send multi-currency Payment Links to customers for faster payment at competitive rates (see pricing here).

Integrate Airwallex with your eCommerce store for cost-effective global payment collection.

Payoneer

Collect funds directly from eBay, Amazon, Klarna, Wish, Airbnb, Lazada, Fiverr and 20 other marketplaces (rates vary by market).

Send multi-currency payment requests to customers (3% fee for cards, 1% fee for local bank transfers, unless your customer has a Payoneer account, in which case collection is free).

Cards

Airwallex

Borderless Visa debit cards

No transaction fees

Pay directly from your multi-currency balance at no cost

0.5 - 1% FX fee applies when converting currencies

Issue virtual and physical Employee Cards to your team, upload and approve receipts in a tap and automatically sync your expense data with Xero and NetSuite for an easier way to manage team expenses.

Track spending on a card level in the app

Use anywhere Visa is accepted

Payoneer

Pre-paid MasterCard debit card

Annual fee of $29.95

3.5% fee for transactions involving currency conversion

Up to 1.8% for cross-border fee (where merchant country is different from card-issuing country)

3.15 USD / 2.50 EUR / 1.95 GBP ATM withdrawal fee

1 USD / 0.87 EUR / 0.65 GBP for balance enquiry

12.95 USD / 9.95 EUR / 9.95 GBP for card replacement

Use anywhere MasterCard is accepted

Accounting software integration

Airwallex

Integrates with Xero, NetSuite and Quickbooks.

Payoneer

Integrates with Quickbooks.

Payoneer fees, explained

Transaction fees

Payoneer offers free transactions to and from other Payoneer accounts. For all other transactions, they charge a fee. So, unless your clients and suppliers also use Payoneer, you will be charged whenever you collect or send money from your account.

Paying in: If your clients pay by credit card, Payoneer will charge you 3% of the transaction value. If your clients pay by local bank transfer (or ACH bank debit in the US), you’ll be charged 1%.

Payoneer has a relationship with companies including Fiverr, Upwork and Airbnb. The cost of accepting payments from these companies varies depending on each marketplace. You can check their websites for more details.

Paying out: Payoneer charges a 2% fee unless you’re sending money to another Payoneer account. If you only withdraw 50,000 USD, GBP or EUR in a single calendar month, you will be charged an additional fixed fee of £1.50 to make a USD, GBP or EUR payment:

in the same currency as your balance

to a country which has the same local currency as your balance

to an account in the same country where your Payoneer account is registered

If you withdraw more than 50,000 USD, GBP or EUR in a single calendar month, you will be charged 0.5% of the total withdrawal amount.

Example 1: If you withdraw $40,000 USD on 5th of January you’ll pay a flat fee of $1.50. On 10th January you make a payment to a recipient’s bank account for $10,000 and pay a flat fee of $1.50 ($50,000 cumulative month-to-date). On the 20th January you withdraw $1,000 and pay a $5 fee (at the new rate of 0.5% for transactions above $50,000 in a calendar month). At the beginning of the next calendar month, the threshold resets.

Example 2: If you withdraw $100,000 USD in a single calendar month from your Payoneer account, you will be charged $500.

Withdrawal fees

Payoneer will charge you to withdraw funds from your account into an external account like your business bank account.

If you’re withdrawing funds into a bank account of the same currency, i.e GBP into a pound sterling account, Payoneer charges a fixed fee of £1.50.

If you’re withdrawing funds into an alternative currency account, i.e. USD into a pound sterling account, Payoneer charges 2% of the transaction value. You will have to pay this fee in addition to the FX rate.

FX & Transfer fees

Payoneer charges a currency exchange fee of 0.5 - 3% above the mid-market rate. The 0.5% rate applies only if you’re converting funds from one Payoneer account to another. For all other transfers, the higher rate of up to 3% applies.

Card fees

Payoneer charges an annual fee of $29.95 for their prepaid MasterCard debit cards. They also charge ATM withdrawal fees (3.15 USD / 2,50 EUR / 1.95 GBP), and balance enquiries will be an additional 1 USD / 0.87 EUR / 0.65 GBP per enquiry.

Additional fees

Payoneer charges a 0.5% fee to move funds between your currency balances. That’s on top of the FX fee.

If your account is inactive for 12 months, you will be charged a $29.95 fee.

Airwallex fees, explained

Transaction fees

Airwallex has built its global infrastructure on local payment networks. That means we don't charge transaction fees to the 120+ countries where we have access to local payment networks; over 90% of all payouts on the Airwallex platform are routed through local payment networks. This means you can use your Airwallex account to collect, hold and send multiple currencies at no or low cost.

We also don’t charge withdrawal fees, meaning you can move funds from your Airwallex account to another bank account for free.

FX rate

Airwallex charges 0.5 - 1% above the interbank rate for currency exchange.

The 0.5% rate applies to Euro, USD, AUD, HKD, CNY, JPY, CAD, CHF, NZD, SGD. The 1% rate applies to other currencies.

Card fees

Airwallex Employee Cards are free for the first 5 cardholders, then come at a cost of £5 per month for each additional card holder. Employee Cards come with the Airwallex Expenses feature, which allows you to easily track, approve and reconcile your expenses online. Airwallex company cards are free and unlimited. You can use Airwallex cards to spend in multiple currencies at home and abroad with 0% transaction fees.

Create new cards in a tap, set spending limits and track spending at a card level in the app.

Payment acceptance

With an Airwallex account, you can accept direct transfers from customers and collect funds from platforms such as PayPal, Shopify and Stripe in multiple currencies at zero cost.

If you have an eCommerce store, you can integrate Airwallex with your checkout for cheaper Online Payments. You can also create multi-currency Payment Links that allow your customers to pay you securely in a click. Airwallex charges a competitive fee for Online Payments and Payment Links, making this a cost-effective way to accept card payments.

1.3% + 20p for UK cards and Wallets

2.4% + 20p for EEA cards and Wallets

3.15% + 20p for international cards and Wallets

2.4% +20p for American Express cards and Wallets

Final thoughts: Airwallex offers a flexible global financial platform

Payoneer offers its customers good value transfers and FX rates when sending and receiving money from another Payoneer account. But when dealing with clients and suppliers who don’t use Payoneer, things can quickly get expensive.

Airwallex offers a complete global financial platform for businesses who want the flexibility to collect, manage, convert and send money around the world. Coupled with competitive FX and payment processing rates, Airwallex can be an efficient money management system for businesses with multiple entities.

For alternative payment providers, visit this page on Payoneer alternatives, for other global financial platforms that might be right for your business

If you’d like to learn more about Airwallex, sign up for an account today or click below to watch a 3-minute demo.

Disclaimer:

We wrote this article in Q2 2024. The information was based on our own online research and we were not able to manually test each tool or provider. The information is provided for educational purposes only and a reader should consider the specific requirements of their business when evaluating providers. If you would like to request an update, feel free to contact us at [email protected].

Related articles about payment services and solutions:

View this article in another region:AustraliaHong Kong SAR - EnglishHong Kong SAR - 繁體中文SingaporeUnited States

David Beach

Senior Content Marketing Manager - EMEA

David is a fintech writer at Airwallex, specialising in content that aids EMEA businesses in navigating global and local payments and banking. With a rich background in finance, business, and accountancy journalism, David brings over a decade of experience. Previously, he was the Head of Content and Press at a leading financial services company and trade journalist at a media group specialising in business and finance.

Posted in:

Business banking