4 ways for Singapore businesses to send money to an international bank account

Shermaine Tan

Manager, Growth Marketing

In today's borderless economy, Singapore businesses send more international money transfers than ever before. Despite being located in a financial hub, many local businesses still struggle with the costs of sending and receiving money overseas via banks, which can eat into profit margins and affect a business’s bottom line.

Whether it's paying overseas suppliers, offshore teams, or partners, it’s important to find the most efficient and cost-effective way to send money internationally. Keep reading to discover options for remitting money to a foreign bank account, and an excellent alternative to international bank transfers.

4 ways to send money to an international bank account

Bank transfers via the SWIFT network

Most local business bank accounts are able to make international payments via the global SWIFT payment network.

SWIFT, or Society for Worldwide Interbank Financial Transactions, serves as the global standard for transferring funds across international borders. It assigns unique identifier codes to banks, ensuring that money transfers are accurately directed to their intended recipients. However, SWIFT transfers often carry hefty fees that differ across providers and may lead to unfavorable currency exchange rates. There is usually an international transfer fee between $10 to $30 and the payment can take between 2 to 5 days depending on your destination country.

On top of this transfer fee, you may also be required to convert your SGD into the desired currency prior to sending. Contrary to popular belief, the rate that you see on Google is not the same exchange rate that banks usually charge. They often charge an additional 3 - 5% above the interbank exchange rate, which is not always transparent when you’re booking a payment.

It’s important to understand how these fees are charged as they will impact the final amount that the recipient will receive on their end.

Bank transfers via real-time payment systems

Some banks support real-time payments to India and Malaysia via the new cross-border links PayNow-UPI and PayNow-DuitNow, respectively. Through these links, cross border payments are sent instantly from Singapore to participating banks at S$0 fees.

However, there is an S$1,000 daily transfer limit to these services, which is too restrictive for business payments. Not all Singapore banks support these cross-border links, either. Currently, PayNow-UPI is only available at DBS, while PayNow-DuitNow is available at Maybank, OCBC, and UOB.

P2P remittance services

Peer-to-peer (P2P) remittance was popularised by providers like Western Union, and is generally used by individuals to send money internationally to family, often with lower fees and faster transaction times compared to bank transfers.

As P2P remittance services rely on having matched funds in your country and currency pair of choice, the P2P market can impact your transfers, resulting in a different exchange rate or delays in transfers. However, it's important to note that while P2P remittance can be used for business transactions, it might not be suitable for larger transactions. Additionally, regulatory compliance and security concerns should be thoroughly evaluated before choosing a P2P remittance service for business purposes.

Fintech payment specialists

Finally, there are the fintech payment specialists like Airwallex, who specialise in transforming the way businesses make cross-border payments. While traditional banks and P2P remittance services rely primarily on the SWIFT network to make transfers, fintech firms such as Airwallex offer the option of partnering with local payment rails to process international transfers. This means you can avoid SWIFT network fees and process overseas transfers as though you were in the same country. This is a significant boon for businesses whose margins are greatly impacted by frequent international payments.

Fintech firms also offer a range of services that streamline financial operations for businesses, such as batch transfers, automated bill payments, and integrations with your accounting software. Some also offer solutions that improve payment processes, like payment gateways for online payments, and multi-currency digital wallets for holding and receiving international payments.

While cost-effective international payments are a significant draw, the real value of fintech lies in its ability to offer a comprehensive, user-friendly, and intelligent financial management system.

Tips for saving on international money transfers

International money transfers can be expensive, but a few smart strategies can lead to substantial savings. This section shares useful tips to help reduce costs on your international money transfers.

These tips include comparing exchange rates and fees, avoiding credit card payments, and sending larger amounts less frequently. We’ll further examine each of these tips to understand their potential in helping you reduce costs on your international money transfers.

Comparing exchange rates and fees

Comparing exchange rates and fees can significantly contribute to savings on international money transfers. Given the frequent fluctuations in exchange rates and different rates offered by various service providers, using tools like Exiap Currency Converter, Google Finance, and Xe Currency Converter for comparison before initiating the transfer is advised.

Also, keep an eye out for any undisclosed charges, such as concealed exchange rate expenses, additional fees, and upfront fees that can add up to the overall cost of the transfer.

Avoiding credit card payments

While credit cards may seem like a convenient option for making international money transfers, they often come with high fees and unfavourable exchange rates.

Instead, consider using other payment options such as direct bank transfers, debit card transfers, or online money transfer services. These methods often come with lower fees and more favourable exchange rates. Remember, every penny saved is a penny earned!

Sending larger amounts less frequently

Lastly, consolidating your transfers into larger amounts can be beneficial. Since most international money transfer services charge a flat fee per transaction, transferring larger amounts in fewer transactions can lead to long-term savings.

However, while this strategy can help you save on transfer fees, it’s important to note that many international money transfer service providers have transaction limits for sending money. For businesses that transact in large volume, finding a dedicated provider that specialises in supporting businesses in making cross-border payments will be useful.

Unlock fast, cost-effective international business payments with Airwallex

With Airwallex, we're transforming the way businesses move money globally by giving you:

Market-leading foreign exchange rates, with no minimum transfer amounts and zero transfer fees.

Local transfers with lower or no international transaction fees

Access to our global network of bank partners so your money transfers arrive fast and in full

Support on all your international payment needs from your dedicated account manager

Complete self-service with our digital platform, no paperwork or phone calls needed

On the flip side, receiving international transfers from overseas customers, wholesalers, or suppliers can also be slow and expensive. With Airwallex’s multi-currency Global Accounts, you can set up local bank details for over 23+ currencies, highlights include:

Share these local bank details with your sender to receive international transfers faster, with no international transaction fees.

For example, your customer based in the United States can make an international transfer to you with their local bank, in their local USD currency. The transfer can use the local Automated Clear House (ACH) method with zero transfer fees, with funds arriving as fast as one business day.

How to transfer money to an international bank account with Airwallex

Your business can transfer money to a foreign currency account with Airwallex to over 130 countries and in 30+ currencies. Here’s how it works:

Create an Airwallex account and verify your business, with no branch visits needed

Transfer money into your Airwallex wallet to fund your transfer

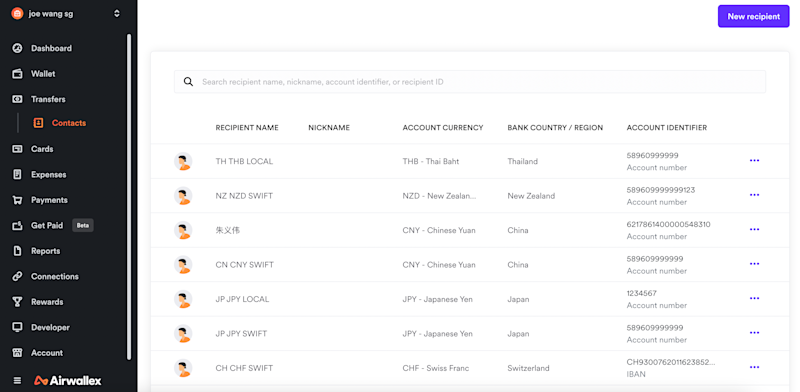

Enter in your recipient’s banking details and create them as a Contact

Check the real-time FX rate and fees to know precisely how much money it will cost

Confirm your transfer and track its progress on your desktop or mobile

This process usually takes anywhere from 1-5 business days, depending on your destination and the currency pair.

Are you looking for a fast, secure and cost-effective way to pay your suppliers? Learn more with our ultimate guide to paying overseas suppliers.

Information needed for an international money transfer

Sending money internationally can be confusing due to so many different names for all of the banking codes used throughout the world. That’s why we’ve made it simple with ‘Contacts’. Simply choose the country you are paying to and we guide you through exactly what information you need to provide so your transfer goes smoothly. Your recipient details are saved as a contact so all future transfers can happen in a few clicks.

In a nutshell, the details you need to collect from your recipient are:

Recipient details: Name, address, email

Recipient bank details: Routing number, bank name, account number & BSB for Australian recipients

Additional transfer information: Examples include proof of payment or order information for transfers when making transfers to China

Whether you need to submit SWIFT and IBAN codes or NCCnumbers, you can find information specific to your country in our Payout Guide. Our Singapore support team is available via email or online chat. They can also walk you through it all and address your questions.

Streamline and secure your international money transfers

When you need to make recurring international transfers, Airwallex has powerful built-in features to help your business manage this seamlessly.

Use batch payments to send money to multiple receipts, each with a specified amount. This saves hours from creating multiple, individual payments for each contact. Batch payments are especially useful for large, recurring international transfers such as paying your overseas staff.

Free up your time from making frequent international transfers by giving your accountant or team access with the right permissions. You can stay in control and secure your funds by having one team member draft the transfer, and another to approve it.

Eliminate manual reconciliation of international transfers for your bookkeeping by connecting Airwallex directly with Xero, our fully integrated partner for cloud-based accounting. Sync your multi-currency transfers to Xero for visibility of your global cash flow in a single platform.

Frequently asked questions (FAQs)

1. What constitutes an international money transfer?

An international money transfer is the process of transferring funds from one country to another, usually for a foreign bank account or cash pickup.

2. What factors affect the cost and speed of an international money transfer?

Factors such as exchange rates, fees, payment methods, and destination countries all play a role in determining the cost and speed of an international money transfer.

This publication does not constitute legal, tax, or professional advice from Airwallex, nor does it substitute seeking such advice, and makes no express or implied representations / warranties / guarantees regarding content accuracy, completeness, or currency. If you would like to request an update, feel free to contact us at [[email protected]]. Airwallex (Singapore) Pte. Ltd. (201626561Z) is licensed as a Major Payment Institution and regulated by the Monetary Authority of Singapore.

View this article in another region:Australia

Shermaine Tan

Manager, Growth Marketing

Shermaine spearheads the development and execution of content strategy for businesses in Singapore and the SEA region at Airwallex. Leveraging her extensive experience in eCommerce, digital payment solutions, business banking, and the cross-border industry, she provides invaluable insights that guide businesses through the complexities of global commerce. Specialising in crafting relevant and engaging content that resonates with business owners, her work is designed to drive growth and innovation within the fintech and business economy space.

Posted in:

Business bankingShare

- 4 ways to send money to an international bank account

- Tips for saving on international money transfers

- Unlock fast, cost-effective international business payments with Airwallex

- How to transfer money to an international bank account with Airwallex

- Information needed for an international money transfer

- Streamline and secure your international money transfers