When it comes to looking for a new international money transfer provider it pays to shop around. There’s a balance between trust and value that you need to take into account, and just going with a name you know doesn’t necessarily guarantee the best service.

We’ve created a quick guide to help you when searching for a new provider. This should help you review and compare the different international money transfer providers available on the market, and get you thinking about which is best suited to your needs.

Here’s what you should be looking for:

Fees

When looking for an international money transfer provider, their openness and transparency can go a long way to positioning them as your top choice, particularly when it comes to fees.

FX fees. How does the provider charge their FX fees? While there is no concrete interbank exchange rate, some providers do put a markup on their FX rate. It might not seem like much, but every increase in their FX rate means you’re charged more per transaction, and they pocket more of this fee.

Transaction fees. If you’re making a high volume of transactions, even small transaction fees start to add up. If the fee is a percentage this can become particularly costly when you’re making larger international transactions. Look for a company that offers either a small, flat fee, or no fees at all.

Administration fees. Make sure to check any regular admin or management fees for each provider. Some may add on sign-up costs, account management, and other fees, that won’t always be explicitly stated when looking at their fee structure.

Speed of transactions

Speed is everything when you’re transferring money. These days, people expect things instantly—and international payments are no exception.

Look for a provider that offers quick transfers. Where banks can offer a typical 1-5 business day transfer, you’ll be able to find providers who provide same-day transfer, regardless of your geographical distance.

And when it comes to speed, the sign-up process needs to be easy, too. Look for a provider that offers clear and concise online sign-up, and doesn’t require you to submit page after page of financial information just to start using their service.

Security

You’re sending money internationally, so you want peace of mind that your platform is secure. It should go without saying, but check with your provider first to see how stringent their security protocols are.

Confirm that you’re always able to access your funds and that they’re never invested or lent to third parties.

Do their security procedures comply with international standards? PCI Level 1 is the highest international standard, so this is a good indication that your funds will be secure.

Check their registrations. Look for a provider who is registered in Australia with AUSTRAC and regulated by ASIC under an Australian Financial Services License.

When it comes to your data, two-factor authentication should be the standard, to ensure you’re kept abreast of any attempts to access your account.

True international reach

With the growing global market, it’s likely you’ll be needing to interact outside of the typical US dollar or Euro market. So when choosing an international money transfer provider, confirm how many currencies they support.

It’s also important to find out how many countries they’re connected to. You want to ensure you have the capability to actually send money to the country you need, prior to signing up.

Any additional features

Additional features aren’t just the cherry on top: they’re what can make the difference between a standard international money transfer provider, and a long-term business partner. After all, your provider exists to make your life easier, so the more value they can offer you, the better.

Look into features that extend beyond purely transferring money. Look at features like:

Virtual payment cards. Virtual payment cards act in the same way debit or credit cards do but without the need for a physical card. They’re ideal for controlling spend online in a safe and controlled manner and can be a useful resource for regular international spend.

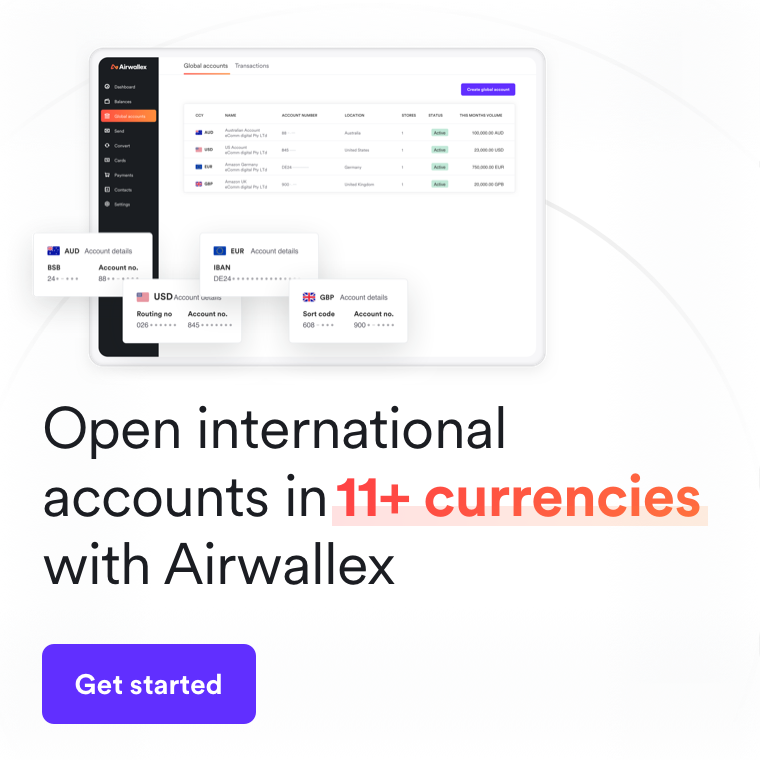

International currency accounts. A foreign currency account can enable you to send, receive, and store international currency, all from one account—just as though you opened a bank account in that country.

Platform versatility. A cloud-based platform is fantastic as you’re able to access your money wherever you go. But for serious banking, sometimes this isn’t enough. Check to see if your provider’s software is able to sync with external platforms, and how you’re able to integrate it into your business’ workflow.

Airwallex makes international money transfers easy

We’ve streamlined the way that businesses send and receive your money online.

With Airwallex, businesses can:

Create a business account, and get up and running on the same day.

Get limitless same-day international money transfers, whenever you need them.

Save on FX with low, transparent pricing. You pay a minuscule 0.3% or 0.6% margin on top of the interbank transfer rate—far better than you receive from the big banks.

Open business accounts in up to 23 currencies, with zero monthly fees.

Simplify your purchasing and accounting, by integrating your payments with global online marketplaces like Amazon, eBay, Shopify, and PayPal, or directly to your Xero account.

Empower your staff to take responsibility for their international budgets with Airwallex Borderless Cards.

So when searching for an international money transfer provider, it pays to do your research. Get in touch with Airwallex today to book a demo, and see how Airwallex can streamline your international transfers.

Related article: 6 surprising Reasons Why Your Bank Transfer Is Delayed

Our products and services in Australia are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221. Any information provided is for general information purposes only and does not take into account your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs. Please read and consider the Product Disclosure Statement available on our website before using our service.

Posted in:

Transfers