The best possible way to receive payment from Japanese customers

Ben Wang

Senior Product Manager

Japan is the world’s third largest economy, with a storied culture, world-class consumer brands and a digitally-savvy population. Quickly catching up on the fintech revolution, Japan offers boundless opportunities for expanding digital businesses.

So why are so many business owners still reluctant to expand into Japan given its notable market size and appetite for foreign investment and technology?

The short answer to this million-dollar question is that it hasn’t always been viable. Until now.

Our modern technology now allows you to instantly receive JPY into a dedicated JPY global business account, without the hassle of setting up a local bank account yourself.

Good news if you’re operating an eCommerce store on marketplaces like Amazon and Rakuten, an app on Google Play or Apple AppStore, or a digital platform provider.

Unlock global growth

How does an Airwallex Japanese business transaction account work?

With our upgraded JPY collection capabilities, you can now:

Collect without restrictions from any use case, including eCommerce marketplaces, payment gateways, and digital platforms.

Receive funds instantly (T+0)

Accept funds from both businesses and individuals

Set up compatible savings (futsū yokin) accounts from anywhere in the world

Business is easy when you’re big in Japan

If you sign up for a borderless Airwallex account, you can skip the bank queues and excessive paperwork and divert more time and energy into your business expansion strategy.

In fact, you start accepting payments from customers in Japan in just a few short clicks, no matter your geographical distance. It’s that easy. As always, an Airwallex Global Account is fee-free to open and maintain.

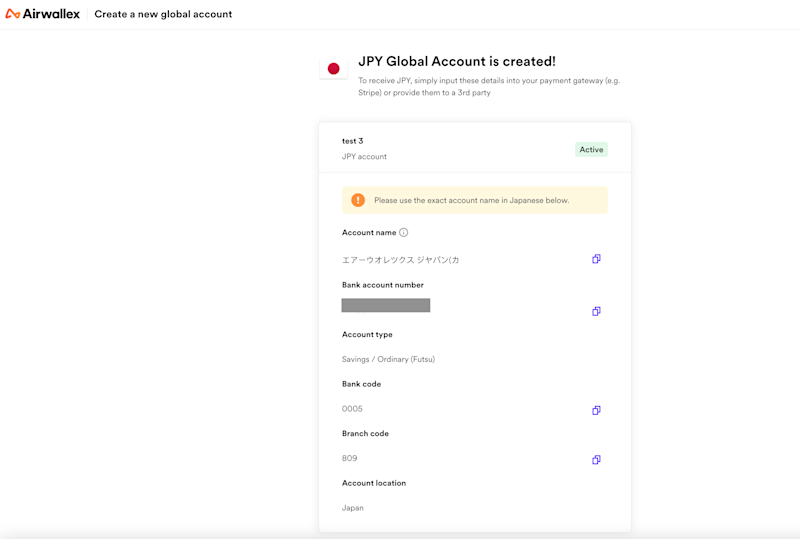

Once you’ve signed up, our team can get you set up with a local JPY savings (futsū yokin) account: this is the most common and compatible account type in Japan.

Just enter the account details into your eCommerce marketplace or 3rd party account and wait for your funds to arrive.

Once your business is up and running in Japan, you can then hold or convert Japanese Yen into your preferred currency without getting stung with international transaction fees.

Don’t just take our word for it. Put Airwallex to the test.

Streamline your financial operations

Ben Wang

Senior Product Manager

Ben is a Senior Product Manager at Airwallex, where he works primarily on client treasury and regulated markets.

Posted in:

Online payments