New at Airwallex: September Edition

Shannon Scott

Chief Product Officer

In this update, we’re helping you increase flexibility with scheduled transfers and simplify reconciliation with fee netting. You’ll also find ways to streamline HR and expense management, gain clearer visibility into card transactions, and boost conversion with Shopify's All Payment Methods (APM) App. Here’s what’s new:

Business Accounts

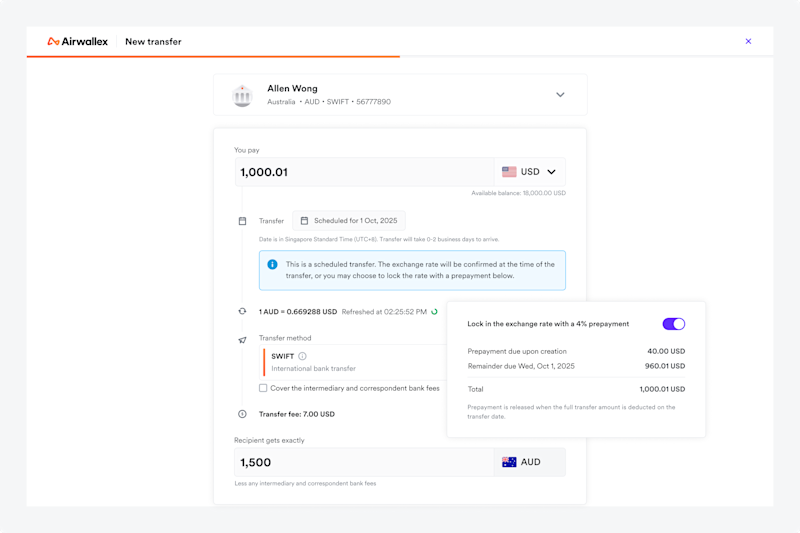

Schedule and cancel future-dated transfers

You can now schedule foreign and domestic transfers up to 180 days in advance – perfect for planning supplier invoices or other upcoming payments. Funds are deducted on the scheduled date, and you have the option to lock in the FX rate with a small upfront prepayment. And if plans change, simply cancel the transfer directly in the WebApp before it’s sent. Visit our Help Centre to learn more.

Enhanced security for transfers with UK Confirmation of Payee

Businesses transferring to a local UK bank account will soon be able to perform real-time verifications for account validity and name matching with account details, via integration with the UK’s regulated anti-fraud service. This increased security will result in lower user errors and reduce fraud when paying to UK accounts, and will be available both within the Airwallex WebApp and via a developer-friendly verification API.

Additional releases:

Seamless onboarding through Singpass (Singapore entities): Applicants in Singapore can now verify their identity through Singpass, the government-backed electronic ID system. By connecting to the Myinfo API, Singpass auto-fills and verifies key details in a few clicks to eliminate manual uploads, reduce errors, and enable faster onboarding.

Spend

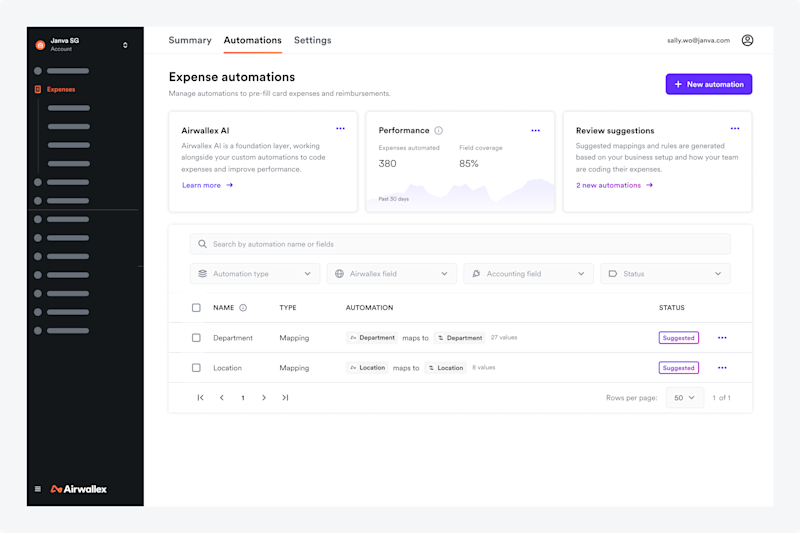

Early accessEliminate manual expense coding with custom automation rules

Make expense automation even easier using our new automation rules. Admins can now customise multiple automation rules, including mapping fields from user management directly to accounting fields, or coding rules based on the card used. These dedicated rules will take precedence over our general AI pre-filling algorithm.

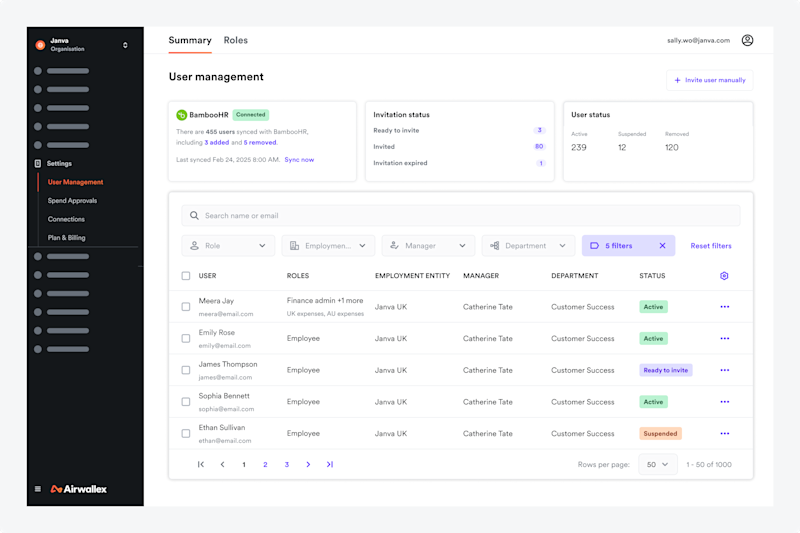

Automate user onboarding with HRIS

HRIS integrations are now generally available. Easily sync users from your HR system to Airwallex and keep employee data up to date. Onboard users, update key details like manager or department, and automatically revoke access when an employee leaves.

More control with advanced sync settings for expenses

Advanced sync options will soon be available for NetSuite, Xero, and QuickBooks, including:

Expanded locked period settings for QuickBooks and NetSuite

New “sync as” options (e.g., card expenses as cheque or bill, reimbursements as NetSuite expense reports)

Configurable date selection for expenses and reimbursements

Additional releases:

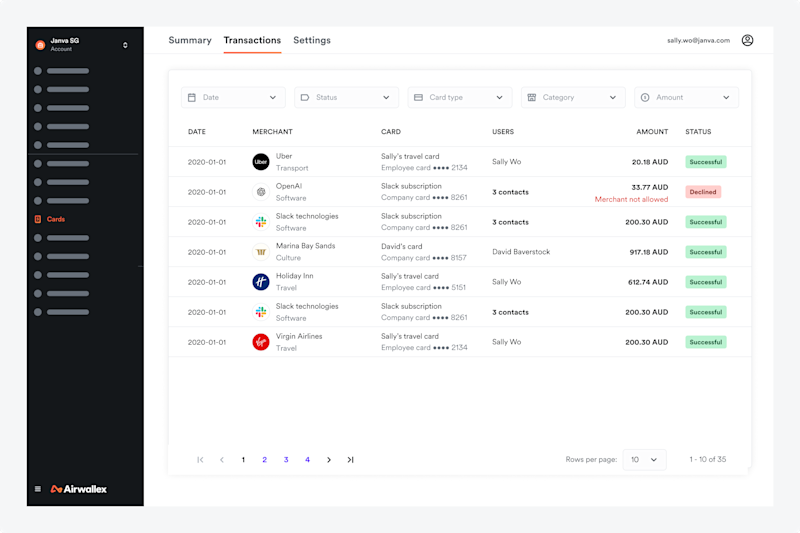

Clearer visibility with card transaction enrichment: Transaction enrichment improves card transaction data by displaying merchant names, logos, and categories. For example, *Google ADS3825252837 will now appear as Google Ads, categorised under Professional Services – Advertising and Marketing.

Payments

Early accessAirwallex Payments now available for Malaysian business entities

Businesses selling to Malaysian customers with a local entity can now use Airwallex Payments to collect payments from domestic and international shoppers. Local payment processing allows your business to benefit from lower transaction costs and higher success rates.

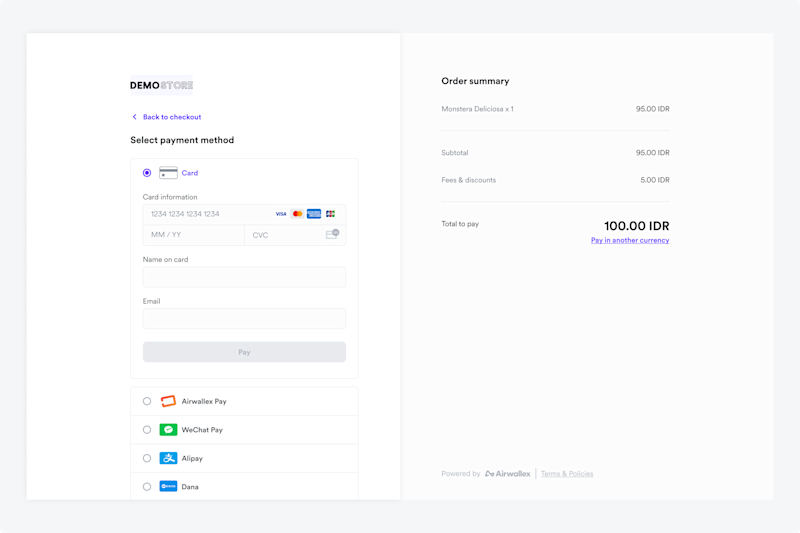

Early accessBoost conversion with local payment methods, even with your Shopify store in manual capture

The new Shopify All Payment Methods (APM) App lets you offer 160+ Airwallex local payment methods (LPMs) alongside existing manual capture workflows.The app supports manual capture for card, Klarna, and Afterpay, and auto-capture for all other LPMs, including Alipay, WeChat Pay, and Kakao Pay. This allows merchants to maintain manual capture for cards while increasing conversion with LPMs. Learn more here.

Additional releases:

Simpler fee reconciliation for your business: All fees are now automatically netted from payment transactions, with a single fee column in the Transaction Reconciliation Report and Financial Transaction API. Failed payment attempts are reported individually, and disputes have unique financial transactions for each stage, all linked by dispute and payment IDs for accurate reconciliation.

Bank Transfer payment option available on Magento (early access): Bank Transfer is available for early access on Magento. You can now enable payers to choose bank transfers as a payment method on the checkout page.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

View this article in another region:Canada - EnglishCanada - FrançaisChinaHong Kong SAR - EnglishHong Kong SAR - 繁體中文South KoreaUnited States

Shannon Scott

Chief Product Officer

Shannon Scott is the Chief Product Officer at Airwallex. Shannon is responsible for Airwallex's product strategy and roadmap, spanning financial infrastructure, business software, and embedded finance solutions.