New at Airwallex: November Edition

Shannon Scott

Chief Product Officer

This month, we’re giving you more ways to control cash flow, expand globally, and simplify spend management. Lock in FX rates up to one year ahead and start earning returns on idle balances with Yield, now available in New Zealand. Display prices and accept payments in your customers’ preferred currencies with Multi-Currency Pricing (MCP). You’ll also find new tools to streamline vendor payments and improve visibility across company spend. Here’s what’s new:

Business Accounts

Airwallex Yield now available in New Zealand

Airwallex Yield is now available for all businesses in New Zealand. Earn up to 3.67% on USD and 3.33%* on AUD balances with no minimum lock-up period. Grow your multi-currency balances while maintaining full flexibility and move funds between cash and Yield accounts at any time. Learn more here.

*Target returns of Airwallex Yield are net of fees as of 4 November 2025 AEDT and indicate past 7-day annualised returns of the relevant underlying JPMorgan Liquidity Funds. Consult your advisor and read the PDS available here. All investments carry risk.

Lock in FX rates up to one year in advance

Customers wishing to create greater certainty over upcoming foreign currency needs can now schedule conversions up to one year (365 days) in advance. This feature allows customers to lock in the conversion rate with a small prepayment at the time of booking.

Scheduled conversions are available to existing customers in all supported regions (AU, HK, EU, UK), and US customers can now book future-dated FX conversions for the first time.

Additional:

Self-serve business address updates: Update your address from the WebApp settings page and track request status in real time.

Take action on pending requests within deposits and transfers: You can now view and respond to pending information requests (RFIs) from your Transfer and Global Accounts transaction details. Status labels and alert banners show when action is needed, while in-context drawers let you review and respond without leaving the page.

Spend

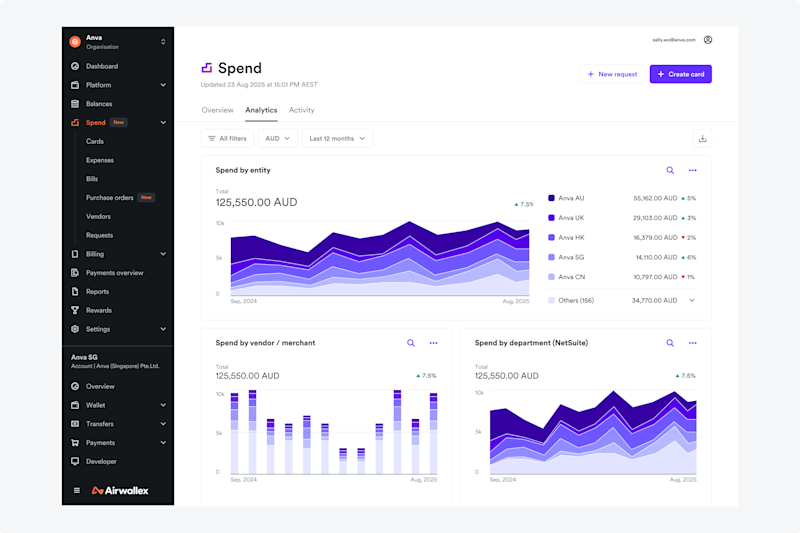

Get a clearer view of company spend

Spend Overview is the new home for managing spend in Airwallex. Quickly see how much you’re spending, what you’re spending on, and who’s spending over time to make better financial decisions and run your business more efficiently. As part of this rollout, you’ll also see a new Spend folder in the left navigation.

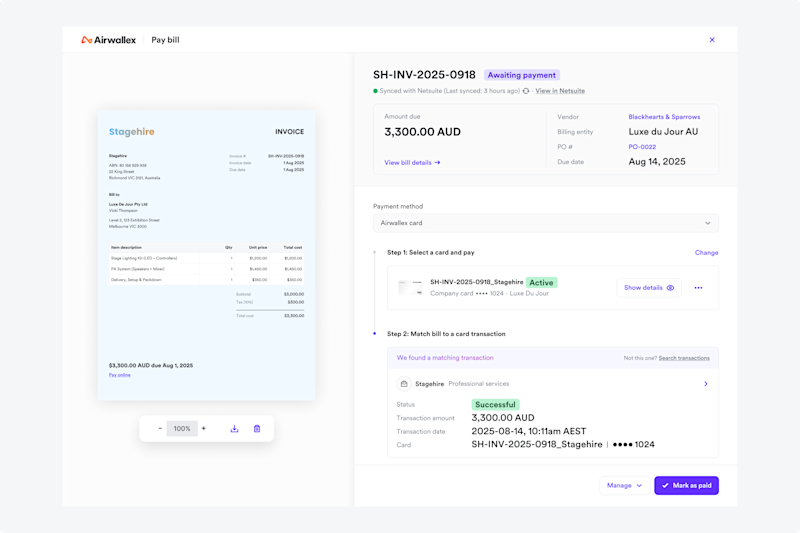

Pay vendors with company cards

Finance teams can now pay vendor bills directly using Airwallex company cards within Bills, Vendors, and POs — improving control, visibility and cashflow. Create or link company cards in Vendor and PO contexts, or generate a single-use card directly for a bill. Bills are automatically marked as paid when a matching card transaction is found, streamlining reconciliation and enhancing spend tracking.

Additional:

Review suspicious card transactions instantly: Card transaction verification is now available, so you can review suspicious transactions instantly. If we detect a potentially fraudulent transaction, you’ll automatically receive a push notification and email to review. Confirm whether the transaction is genuine or fraudulent with a single tap.

Payments

Improve checkout success with passkeys and biometrics

Boost conversion and reduce friction at checkout with Payment Passkeys, a device-bound authentication method integrated with Visa and Mastercard flows. Shoppers can set up a passkey when storing their card or at checkout, then authenticate future payments using their device biometrics (Face ID or Touch ID). This delivers faster checkout, fewer 3DS prompts, and liability shift to issuers for added protection. Available for businesses in HK, SG, AU, JP, MY, and NZ.

Improve checkout conversion with multi-currency pricing

The Multi-Currency Pricing API lets you display prices and accept payments in your shoppers’ preferred currencies, while also supporting local payment methods that may not be available in your default currency. This creates a smoother, more localized checkout experience and increases conversion. Learn more here.

Platform APIs and Embedded Finance

Gain visibility and control over connected accounts activating Payments

Earlier this year, we introduced the Connected Account Console to help platforms monitor and manage their connected accounts. We’ve now extended the console’s capabilities to cover the Payments activation process for platforms using Payments. From the Console, you can view KYB progress, payment method statuses, and reserve plans, and respond to RFIs in one place. These tools enable faster payment activation and reduce reliance on support or API calls helping your platform onboard merchants and start processing payments sooner. Learn more here.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

Interested in helping us build the future of finance? Join our Product team here

View this article in another region:AustraliaCanada - EnglishCanada - FrançaisChinaEurope - EnglishEurope - NederlandsHong Kong SAR - EnglishHong Kong SAR - 繁體中文IsraelNew ZealandSingaporeUnited KingdomUnited States

Shannon Scott

Chief Product Officer

Shannon Scott is the Chief Product Officer at Airwallex. Shannon is responsible for Airwallex's product strategy and roadmap, spanning financial infrastructure, business software, and embedded finance solutions.

Posted in:

Airwallex news