How to connect your purchase orders to a seamless procure-to-pay process

Ross Weldon

Contributing Finance Writer

Key takeaways

Purchase orders mark the start of the entire procure-to-pay process, not a one-off task.

Disparate tools slow down reconciliation, create blind spots, and increase the risk of overspending.

Airwallex helps you manage purchase requests, approvals, bills, and payments in one place, eliminating manual handoffs and fragmented workflows.

You’ve signed off on 10 PO (purchase order) requests this week, but the real work hasn’t even started. Approvals are sitting in email threads, line items still need matching, and your team is piecing together spend data from three separate systems.

This is where most purchase order tools fall short. They handle the front end well enough but leave you chasing context when it matters most – during reconciliation, reporting, and month-end.

If you’re evaluating PO solutions, it pays to think beyond the document. What you need is end-to-end control. That starts by connecting your purchase orders to every step that comes next.

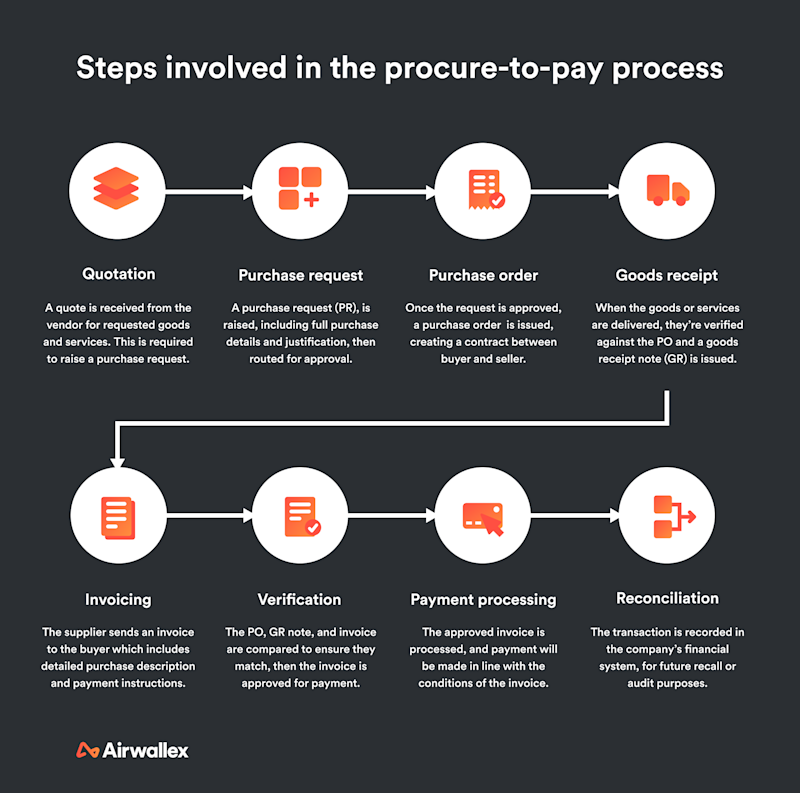

Steps involved in the procure-to-pay process

Why your purchase order tool is breaking your workflow

Purchase orders are meant to bring clarity to company spend by providing visibility into what's been approved. They make cash flow forecasting easier. But when they sit in isolation, they end up creating more work, not less.

The problem with standalone PO systems

A purchase order isn’t the finish line. It’s the first stitch in a much longer process. That includes invoice approvals, accounting coding, payments, and accounting reconciliation. But when every piece is managed in a different tool, finance is left patching the seams by hand, trying to hold it all together.

It usually looks something like this. POs are created in one platform. Invoices are approved in email. Payments made through your business banking system. Budget tracking is held together by a spreadsheet. Nothing talks to anything else. This is how you end up with a Franken-stack of spend management tools. A tangled mix of tools built up over time, each solving a narrow need but breaking the flow of information. There’s no single view of what’s been approved, billed, or still in flight.

A disjointed stack creates disjointed data

Disconnected tools cost time and erode accuracy and trust in the numbers. Without real-time visibility into committed spend, budget owners make decisions based only on what they can see. Not what’s been committed.

These gaps can cripple forecasting. You’re working with stale data scattered across systems and relying on manual updates to tie it together. Meanwhile, approvals get delayed, vendors wait for payment, and your finance team spends more time reconciling than reporting.

A standalone PO tool might tick the compliance box, but it only gives you the illusion of control. True control only comes when the entire procure-to-pay workflow is connected in one place.

What an integrated procure-to-pay process looks like

Fixing your workflow involves connecting every step so information flows cleanly from request to payment to reconciliation. When your PO tool lives inside a fully integrated spend management system, approvals happen faster, manual data entry disappears, and reporting becomes a source of confidence, not friction.

Start with the request, not the invoice

In an integrated process, employees don’t wait until they receive an invoice, they start with a purchase request (PR). It might be for a SaaS subscription, a new laptop, or a one-off supplier cost. They fill in the details, attach supporting documents, and hit submit. From there, the request routes to the right approver automatically. You can build workflows based on department, spend threshold, or currency. Everyone gets notified at the right time, and the full approval trail is logged for audit.

Once approved, a purchase order is generated with no extra steps. Line items and vendor details carry over automatically. The PO is sent to the supplier, and the requestor gets full visibility of status and next steps.No chasing. No rekeying. No loose ends.

Connect every step of your procure-to-pay process

With a fully connected platform, every action feeds the next. When the invoice comes in, it’s uploaded or emailed into the system. OCR technology extracts the key details automatically, and AI matches it to the correct PO and vendor. Any mismatch is flagged before payment is approved.

Invoices, POs, and approvals are all visible in one place. That means finance can check line items and push the invoice to payment in just a few clicks.

The final step is payment. With native transfers built in, finance teams can pay vendors in multiple currencies directly through the same platform. Additional payout approvals can be added for better control. And because everything syncs with your accounting system, whether it’s NetSuite, Xero, or QuickBooks, there’s no double-handling. Just clean data, faster closes, and full spend visibility from start to finish.

What finance teams gain from unifying the procurement workflow

When your procure-to-pay workflow is fully connected, finance teams gain more than speed. You get visibility, control, and the confidence to make strategic decisions.

Total visibility, real-time control

You can track every PO from request through to final payment. As soon as a request is approved, it feeds into a live view of committed spend. With this visibility, you can step in before budgets are blown. Department leads can track spend as it happens, not weeks later. Everyone works from the same source of truth, and you can drill into line items, billing status, or vendor-level detail in seconds.

This builds trust across the business. Teams follow the process because it’s easy to use, and finance can stay focused on decisions, not firefighting.

Faster reconciliation, smoother closes

When all the steps are linked together, reconciliation happens naturally along the way. You don’t need a separate clean-up sprint at month-end. Invoices are already matched. Approvals are already logged. Instead of piecing things together at the last minute, you can move straight into reporting. This saves hours every month. It also sharpens your forecasts, strengthens your accruals, and makes it easier to explain the numbers to anyone who needs to know.

With the busywork gone, your team can focus on what comes next, not what’s missing.

Why Airwallex purchase order system is different

At Airwallex, we’re rethinking the whole spend management process, from PO to payment and everything in between. Purchase Orders now sit inside the same platform used to issue expense cards, manage business expenses, pay bills, and reconcile accounts.

One platform for integrated spend management, from intake to pay

Airwallex connects your entire procure-to-pay workflow. Employees submit a request which is approved based on multi-layer conditions. A PO is generated automatically. The invoice is matched and verified using OCR and AI technology, then it’s paid in the same platform, providing access to local payment rails in 120+ countries, for fast, cost-effective transfers. Every step is visible. Every payment links back to the original request. You can export to NetSuite, Quickbooks or Xero in one click with no missing context.

This is what modern spend management looks like. One workflow. One system. One global source of truth.

You get:

A single place to manage purchase orders, approvals, bill payments, expenses, reimbursements, and corporate cards

A global payments engine that reaches 200+ countries, giving access to interbank FX rates on global transfers

Built-in controls that scale with your business, from simple card limits to complex, multi-entity approval chains

Fewer systems to maintain, fewer licences to manage, and a full audit trail across every transaction

If your current setup means one team is paying for software in Melbourne and another is paying for the same tool in London, Airwallex helps you fix that. You gain visibility across all entities. You can standardise vendor approvals, consolidate duplicate tools, and reduce FX leakage by routing everything through one platform.

Trusted by over 150,000 businesses

Airwallex powers spend for companies of every size, from startups with a handful of cards to global teams managing multi-entity approvals across currencies and markets.

By consolidating spend management into one platform, teams save time and reduce costs. Mobile and cloud consultancy Bilue cut accounting fees by 20% and saved days each month on reconciliation after switching from a patchwork of tools.

Finance should flow, not fight fires

At a minimum, a smarter PO tool will speed up approvals. But the real value comes when you connect every part of the process. From the moment someone requests spend, through to final payment and reconciliation, every step becomes visible, trackable, and easy to manage.

This is where finance moves from firefighting to forward planning. You reduce errors, close faster, and get to focus on strategy instead of spreadsheets.

With Airwallex, your purchase orders are no longer an isolated document. They are part of a global platform built to manage every dollar your team touches.

FAQs

What is a purchase order tool and how does it help?

A purchase order tool lets businesses formally approve spend before it happens. It creates a digital record of what’s been approved, which helps prevent surprise invoices and makes reconciliation easier.

What’s the difference between a standalone purchase order system and a connected P2P workflow?

A standalone purchase order system handles the initial PO step. A connected procure-to-pay (P2P) workflow links that PO to the full process – from request to invoice, payment, and reconciliation – so you can see and control every step in one place.

How does integrated spend management reduce costs?

By consolidating procurement software, bill pay, cards, and global transfers into one system, businesses save on software licences and reduce time spent on manual tasks. It also avoids FX leakage by routing payments through a global infrastructure with market-leading rates.

Ross Weldon

Contributing Finance Writer

Ross is a seasoned finance writer with over a decade of experience writing for some of the world's leading technology and payments companies. He brings deep domain expertise, having previously led global content at Adyen. His writing covers topics including cross-border commerce, embedded payments, data-driven insights, and eCommerce trends.

Posted in:

Accounts Payable