Western Union Business Account review: features, fees, and alternatives

Erin Lansdown

Business Finance Writer - AMER

Key takeaways

Western Union supports international payments and FX tools but lacks real business account features.

Pricing is complex, with hidden FX markups and short-term holding limits.

Airwallex offers multi-currency accounts, better FX rates, and full visibility over global payments.

You’ve got invoices to pay in Europe, contractors in Mexico, and a client who wants to be billed in Japanese yen. International payments are an integral part of your daily workflow, not a one-off administrative task. And if you’re exploring Western Union for business use, it’s important to know what you’re really getting.

Western Union formerly operated a business-focused division, Western Union Business Solutions, which was acquired by Convera in 2022. Today, Western Union continues to support international payouts and foreign exchange (FX) tools for small businesses and NGOs, but not through a traditional business account model.

You can still send payments to over 200 countries and access basic FX risk tools like forwards and market orders. However, it’s not a fully featured business account. You can’t hold funds long-term, set up local account details, or track payments across entities. Onboarding is a manual process, and costs vary depending on FX margins and bank fees.

This article breaks down what Western Union does well, where it falls short, and what to consider when you compare business bank accounts for global use. We’ll also demonstrate how Airwallex enables you to take control of global payments and financial operations, without adding more systems or complexity.

What is a Western Union business account?

While no longer branded under 'Western Union Business Solutions,' Western Union’s remaining business services are designed to help companies send international payments, manage currency exchange, and make mass payouts. You can also access FX risk tools like forwards, market orders, and options contracts.

One of Western Union’s strengths is its global footprint. You’ll find over 57,000 locations across the US alone where you can set up payments in person using cash. International transfers can reach nearly every country worldwide, although delivery options vary depending on where the funds are being sent and how the recipient collects them.

But despite the name, this isn’t a traditional business account. You won’t get local account details, multi-currency balances, or a dashboard to manage spend across teams. Instead, you’re using a payments platform that focuses on sending money out, rather than giving you control over how you manage funds globally.

Western Union business account features

Western Union’s business account offering includes a few key tools designed to support international transactions. These cover cross-border payments, currency risk management, high-volume payouts, and services tailored to specific industries.

Cross-border payments

You can send funds to over 200 countries in 130 currencies. For businesses making regular international transfers, that global reach can be useful. You’re also able to hold incoming funds temporarily before moving them on, which may support basic cash flow planning.

FX risk management tools

To help manage currency fluctuations, Western Union offers tools like forward contracts, market orders, and FX options. These let you lock in rates or set triggers to exchange when the market moves in your favour. It’s a practical option if you’re dealing with budgeted payments or long settlement cycles.

Mass payouts

Western Union supports mass payouts from a single platform. You can pay partners, contractors, or recipients in bulk across multiple currencies and countries. This feature is used by companies in sectors such as payroll, marketplaces, and entertainment to reduce manual work associated with global disbursements.

Industry-specific services

Some industry-focused solutions are available, including for education, NGOs, healthcare, and pensions. These services are tailored to support common challenges like sending aid, distributing stipends, or scholarship payments.

While not a complete business account, these services may suit companies with specific, outbound-focused payment needs.

Western Union business account fees

Western Union’s pricing can be difficult to pin down. You won’t find a clear fee schedule for business accounts, and the total cost of a transfer depends on three things: how you pay, where the money is going, and how the recipient gets it. What appears to be a zero-fee payment can end up costing significantly more once the exchange rate and third-party charges are factored in.

Let’s say you’re sending $10,000 to a supplier in Mexico. If you fund the transfer with a bank account and your recipient collects cash, the upfront transfer fee might be as low as $1.99. But that doesn’t tell the full story. Western Union also applies a markup to the exchange rate. In this case, the peso conversion rate could include a margin of 2% to 3%, which means your supplier receives up to $300 less.

Change the delivery method or payment route, and the outcome changes too. The same $10,000 sent to a European contractor via bank transfer might incur a $15 fee, but a lower foreign exchange margin. If your account is unverified, you may also encounter sending limits of just $3,000, which can add further delays and administrative costs.

Put simply, two businesses making the same $10,000 payment in different currencies or using different methods could end up paying very different fees. That lack of predictability makes it harder to manage costs, especially if you send money frequently or operate across multiple markets.

Western Union business account limitations

Western Union’s business offering supports outbound payments, but it lacks the infrastructure and tools that modern businesses need to operate globally with speed and control.

No multi-currency accounts: You can’t hold balances across different currencies or open local account details in the markets where you do business. That limits your ability to collect, hold, and pay in the same currency.

Limited real-time visibility and no unified dashboard for managing balances, currencies, and payments across entities: You’ll need to manage reporting manually, often after the fact.

No expense management or payment integrations: Western Union doesn’t offer corporate cards, automated bill pay, or integrations with accounting tools. That means more admin and less control over how money moves through your business.

Funds can only be held for up to 90 days in most cases: After that, you’ll need to transfer them out, even if the timing or FX rate doesn’t suit your business.

Pricing and onboarding are complex and time-consuming: You’ll need to speak with a sales representative to set up an account. Fees vary depending on the payment method and route, and foreign exchange markups are built into the exchange rate. That makes it hard to forecast costs or compare providers easily.

Western Union business account vs. Airwallex comparison

| Western Union | Airwallex |

|---|---|---|

Global Accounts |

| 23+ currencies |

Global transfer coverage | 200 countries¹ | 200+ countries |

0% Domestic transaction fees | ||

0% International transaction fees

|

| |

Free withdrawal

|

| |

FX rate

| Rates vary² | 0.5-1% |

Account fees

| Free² | Free with our Explore plan |

Corporate Cards

|

| |

Dedicated account managers | ||

Batch payments | ||

Physical locations | ||

API Integrations with accounting software | Xero, Hubspot, QuickBooks, and more | |

eCommerce integrations | Shopify, Amazon, WooCommerce, and more |

Comparing Airwallex and Western Union is an apples-and-oranges situation. Western Union is better suited for sending money abroad, often to individuals in cash-based economies. Airwallex is designed for businesses that manage global payments, accounts, and expenses in real time.

Western Union allows you to transfer funds to over 200 countries, with the option to pay in cash at one of its 57,000 locations across the US. That reach can be beneficial for NGOs or businesses that pay out to recipients in remote areas. However, you won’t be able to obtain a business account, local bank details, or the ability to hold multiple currencies. There are no tools for tracking spend or reconciling payments.

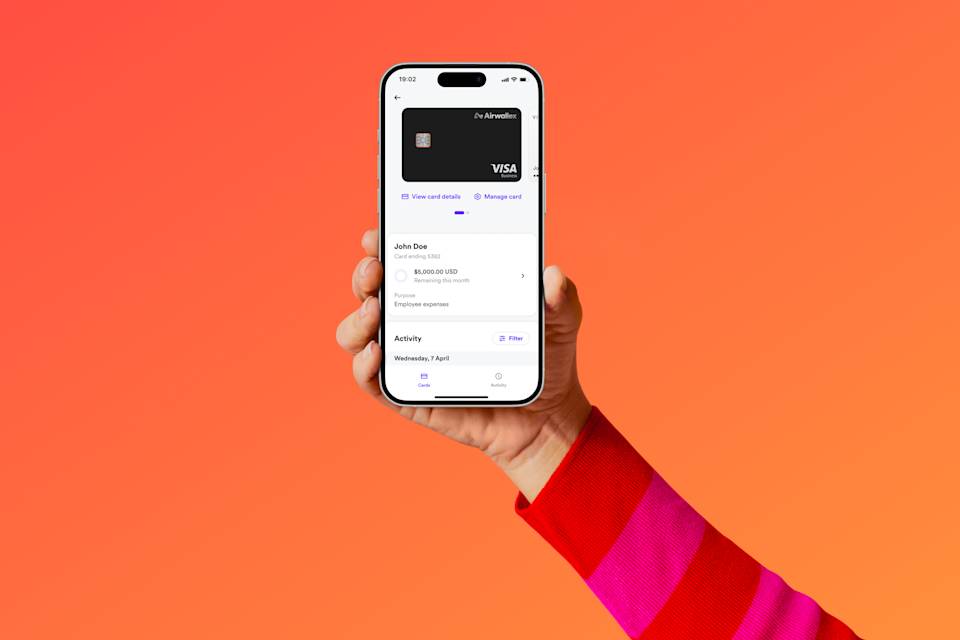

Airwallex offers a complete financial operations platform. You can open multi-currency accounts in minutes, access interbank FX rates with a 0.5% to 1% margin, and settle funds instantly in 14 currencies. Businesses use Airwallex to issue cards, automate bill pay, and connect directly to tools like Xero, NetSuite, and Shopify. That makes it easier to scale across markets without adding more systems.

Western Union helps you move money from point A to B. Airwallex helps you manage everything around that money, from how it’s received to how it’s held, spent, and reported. If you need visibility, control, and speed, Airwallex is the better fit.

Why consider an Airwallex Business Account

Sending international payments is only one part of what a finance team needs to handle. You also need to manage balances, track expenses, control foreign exchange costs, and maintain transparency across teams and entities. That’s precisely what Airwallex is built for.

With Airwallex, you can open multi-currency accounts, issue cards, automate payouts, and sync transactions directly into Xero or NetSuite. You get local bank details in 60+ countries and access to interbank FX rates with just a small markup. Payments settle faster, reporting is easier, and your team spends less time jumping between systems.

Western Union focuses on moving money. Airwallex business account gives you full control over how that money is held, spent, and managed across borders. If you’re expanding into new markets or looking to replace outdated financial workflows, Airwallex gives you the tools to move faster with clarity and confidence.

FAQs about Western Union Review

Can I open a business account with Western Union?

Western Union offers business payment services, but not a traditional business account. You can send international payments and access FX tools, but you won’t get local account details or multi-currency balances.

What are the fees for Western Union business accounts?

Fees vary depending on how you fund the payment, the currency, and the destination of the funds. Costs typically include an upfront transfer fee, an FX margin, and, in some cases, third-party bank charges.

How long can I hold money in a Western Union business account?

Funds can only be held for up to 90 days. After that, you need to transfer them out, even if the timing or exchange rate isn’t ideal.

Is Airwallex a better alternative to Western Union?

Airwallex may be a stronger fit for businesses that require more than simple transfers. It offers multi-currency accounts, competitive FX rates, faster settlement times, and greater visibility into global payments and expenses.

Sources

https://www.westernunion.com/us/en/home.html

https://www.westernunion.com/us/en/web/send-money/start

Erin Lansdown

Business Finance Writer - AMER

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

Posted in:

Finance operations