How to save money when collecting funds from your foreign Amazon account

Evan Dunn

Growth Marketing Lead, US

Businesses use multiple sales channels through various online marketplaces, in addition to their own, to reach larger audiences. But with Amazon being the largest online eCommerce platform in the world, it makes sense that companies of all sizes want to sell their products on it. Amazon is one of the best avenues on the market for boosting sales and generating profit.

The downside is that competition on Amazon is high, with hundreds of thousands of products available for online shopping. As a result, sellers need ways to increase their revenue and profit margins.

Selling private-label items, using Amazon-sponsored products for promotion, reviewing software, and using Fulfillment by Amazon are all ways to increase profit.

However, one of the most essential cost-saving considerations for US sellers on foreign Amazon marketplaces is payment methods. Specifically, collecting funds in a local currency can help you save big on foreign exchange (FX) rates.

Faster payments at lower costs

How to create an Amazon global selling account

But before we start collecting funds, let’s take a step back. US sellers who are interested in selling globally but haven’t started yet will need to create an Amazon Global Selling account.

Luckily, creating an Amazon global selling account isn’t as complicated as you might think.

You need to meet three eligibility requirements if you want to create a global selling account:

Be a resident of one of Amazon’s accepted countries for seller registration. (Don’t worry – the US is on the list.)

Have a valid phone number.

Have a credit card that can be charged internationally.

You may also need to provide some tax information.

There are also specific registration requirements for each market, including the US. If you meet these requirements, you can register your account through Amazon’s international marketplace hub called Seller Central.

When you’re ready to create an Amazon global selling account, you’ll find yourself on the login page.

Accessing your funds using Seller Central through Amazon Pay

After setting up your global selling account, you’ll need to follow several steps so you can start accepting payments through Amazon Pay:

Set up your checking account in Seller Central: You need to specify your Automated Clearing House (ACH)-enabled checking account before you receive any funds. An ACH-enabled account means that funds will be deposited directly into your bank account or other payment platform.

Have a valid credit card number in Seller Central: You can’t receive disbursements unless you have a valid credit card on file. Ensuring that your credit card number is valid will allow funds to be disbursed into your bank account.

Sell your products using the “Amazon Pay” buttons: After selling your products through Amazon, you need to ship them to the address specified by the buyer.

Get payments for your orders: You’ll need to collect payments from buyers before you can get paid.

You also need to capture the payment to collect your funds after shipping a buyer’s order. Amazon Pay APIs and the information provided from the buyer’s order will enable you to collect your payment. This is important, as you won’t get paid unless you click “Authorize & Capture.”

Save money by collecting funds in local currencies

Both B2B and B2C US sellers will face transfer and exchange fees when selling on foreign Amazon marketplaces, depending on their payout service.

Fees are highly variable when working with international payments. And if you use bank transfers to pay overseas suppliers or other global purchases, those fees will continue to add up. Some taxes and regulations apply to the countries in which you operate.

Fortunately, the US is on the list of countries that Amazon allows to collect funds in a local currency, which can help you save on FX fees.

To collect funds in a local currency, you’ll need to use the Amazon Currency Converter for Sellers (ACCS).

This is an international payment method that’s highly effective at transferring funds to the local accounts you want them in and getting you the best exchange rate. The exchange rate provided includes all charges related to ACCS as well as any Amazon fees relevant to the product and sale.

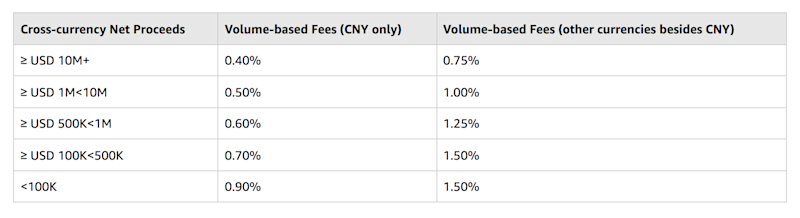

The table below shows the different tiers and fees associated with using ACCS:

Volume-based fees reflect the tier based on a seller’s total cross-currency (the change between the purchaser’s currency and the seller’s currency) net proceeds for the past year across all Amazon stores. Seller tiers are calculated monthly and are updated automatically. Essentially, you’ll have lower fees the higher your net proceeds are.

Your total net proceeds from Amazon are calculated from your total disbursed volume, whether you use ACCS or another payment service provider that'll deposit those funds directly into your bank. But to avoid high cross-border fees, you need to set up bank accounts in the countries where you sell your products.

How to reduce international Amazon Pay fees

You typically have to pay currency conversion fees as well as cross-border fees when you accept payments in foreign currencies from international customers. But there are a couple of ways to avoid these fees.

1. Set up a local bank account in any foreign location where you sell your products

For example, if you are based in the US and sell products in Amazon’s UK marketplace, you can open a bank account in the UK to avoid currency conversion fees as well as cross-border fees.

The only drawback to this method is that banks usually have high transfer and currency conversion fees. So if you sell products in the UK and want to send your money back to the US, you will likely be charged up to 3.5% above interbank rates plus applicable transfer fees.

2. Open an online global business account

If you want to keep your profit margins as high as possible, which certainly every seller will, you can open an online global business account.

Global business accounts allow you to collect funds in multiple currencies. For example, Airwallex accepts USD, Euros, Pound Sterling, and Hong Kong Dollars from your Amazon global selling account into a single bank account without any international money transfer fees.

Airwallex charges 0.4–1% above interbank in currency exchange fees, which is significantly cheaper than Amazon Pay’s 2.5% above the wholesale exchange rate and high street bank rates (2–3.5% above interbank FX rates).

This makes a drastic impact on your profit margins if you have a high volume of sales. For sellers associated with multiple international marketplaces, it’s also easier and much more convenient to manage your money through a central account rather than dealing with numerous foreign banks.

How to collect funds from your Amazon account with Airwallex

Airwallex’s Global Business Accounts make it easy to accept payments in a foreign currency and exchange them into dollars without excessive fees.

All you need to do is add your Global Business Account details into your Amazon global selling account as the receiving (or “assigned” in Amazon terms) bank account.

Once you’ve established your “assigned” bank account, log in to your Airwallex foreign currency account. Follow these steps to begin collecting your funds in your chosen foreign currency:

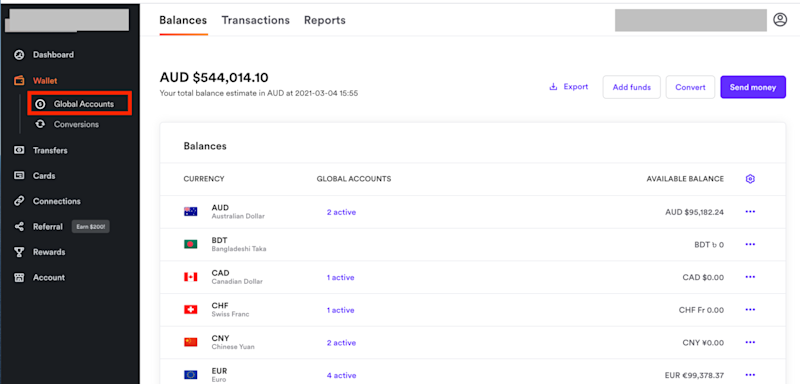

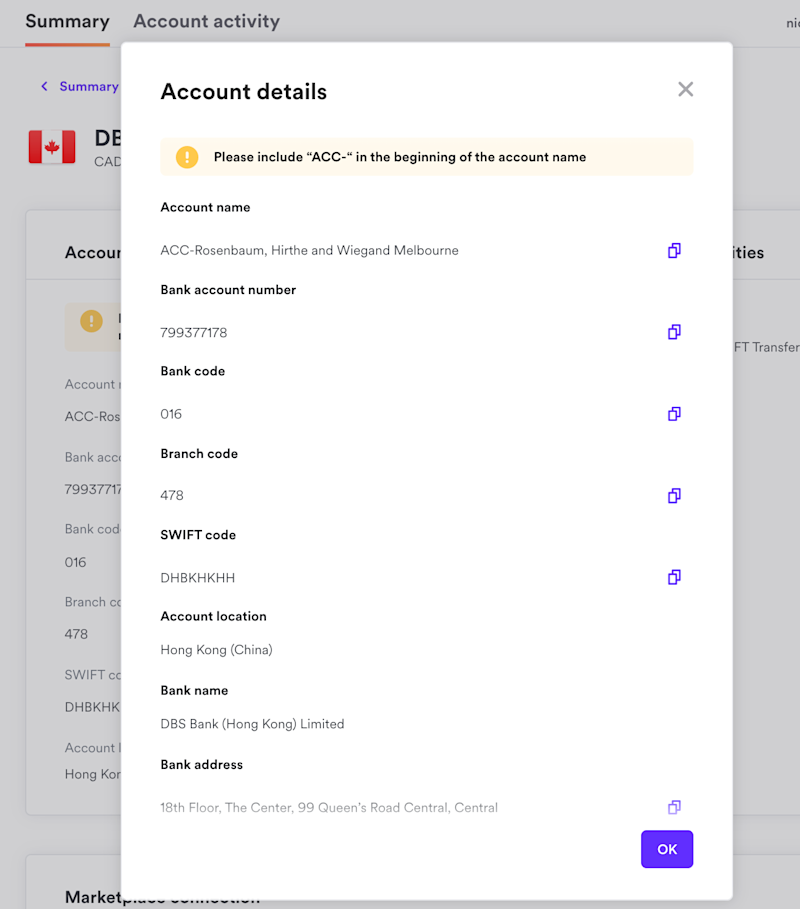

1. In the left sidebar, click Global Accounts. Your international business accounts will appear.

2. Select the Global Business Account you want to use for depositing your funds. For instance, select your GBP Airwallex account if you are depositing funds from your Amazon UK account.

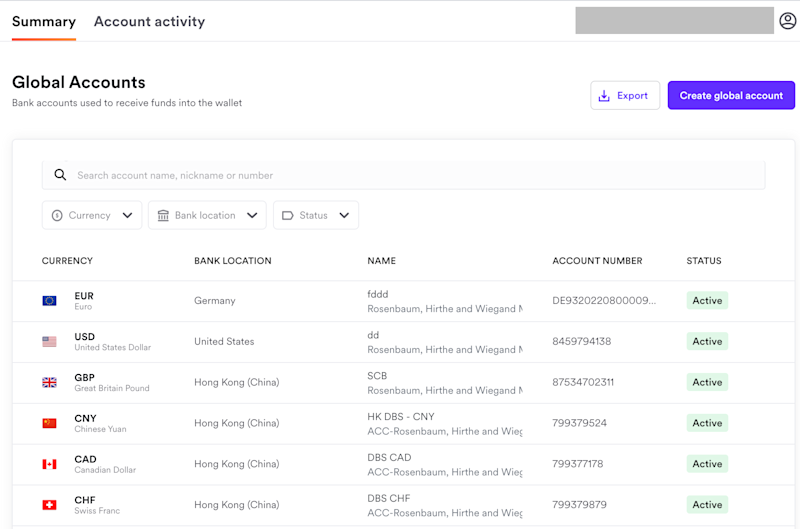

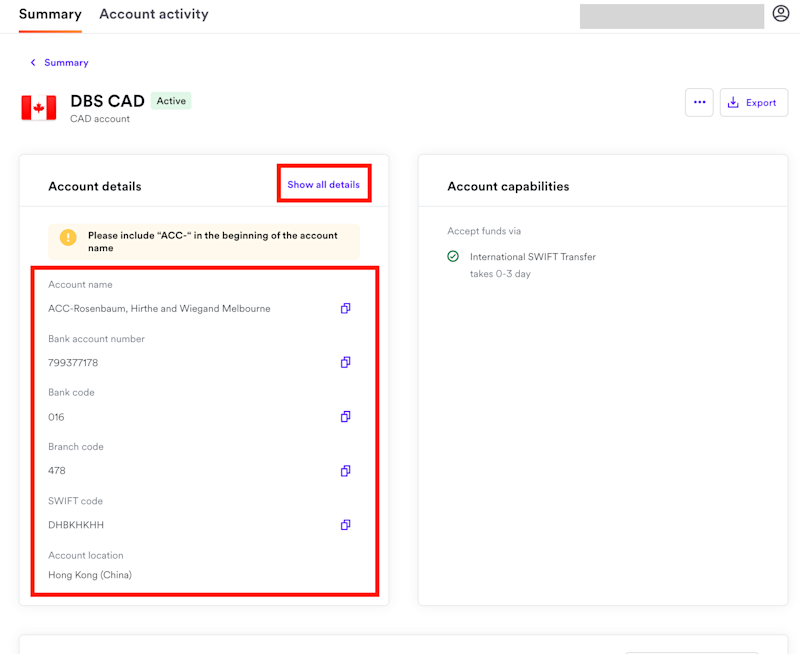

3. Click on the account and open up all details.

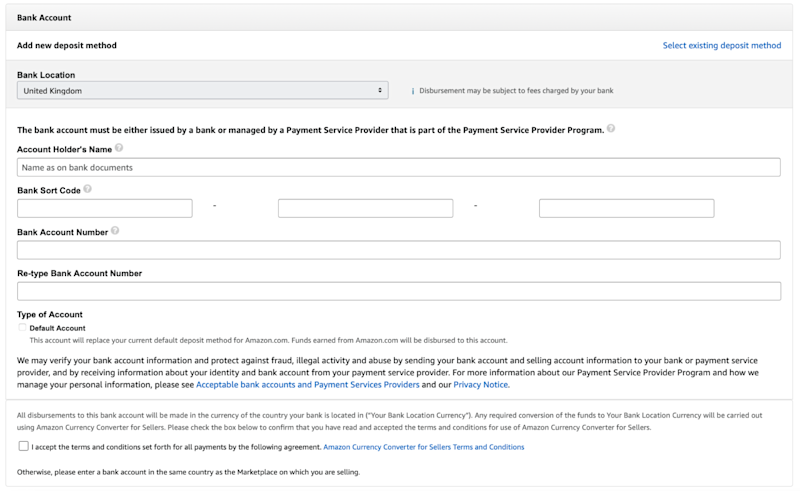

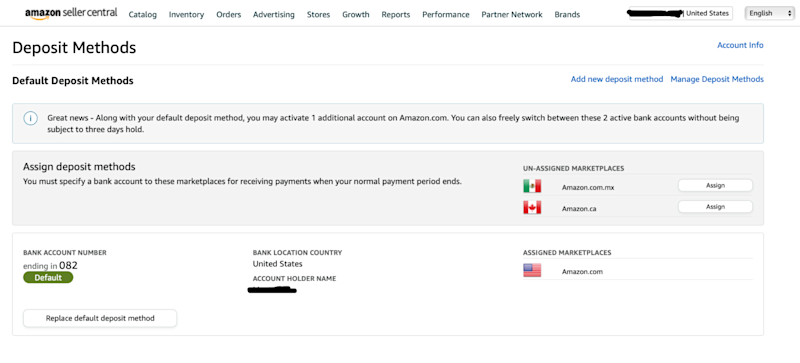

4. Visit Amazon Seller Central. Go to your Account Details page, then select "Deposit Methods."

5. Here, you can assign deposit methods to marketplace accounts by region. If you want to save on GBP revenues from Amazon, you’ll assign your Airwallex GBP account to your amazon.co.uk store. To do this, click “Add new deposit method” and enter your Airwallex GBP account details from step #3.

6. Once you’ve loaded the account details, save the account and assign it to your amazon.co.uk store.

7. You're done!

You can do this for GBP, as well as EUR, CAD, NZD, HKD, AUD, CHF, SGD, and CNY. And of course, you can use your Airwallex USD account for your amazon.com withdrawals as well.

Contact Airwallex to begin collecting your Amazon funds into an online global business account

Airwallex makes it easy to start using an online Global Business Account to transfer and deposit your foreign Amazon funds. You’ll save money on both exchange and transfer fees, and the stress of having to deal with traditional banks. Sign up now to learn more!

Evan Dunn

Growth Marketing Lead, US

Evan Dunn manages the growth of Airwallex's SMB business in the US through marketing avenues. Evan is a generalist with expertise in SEO, paid media, content marketing, performance marketing and social selling. He also enjoys slam poetry and waffle making.

Posted in:

Accounts PayableShare

- How to create an Amazon global selling account

- Accessing your funds using Seller Central through Amazon Pay

- How to reduce international Amazon Pay fees

- How to collect funds from your Amazon account with Airwallex

- Contact Airwallex to begin collecting your Amazon funds into an online global business account