9 actionable tips to set up your eCommerce financials for success

Callum Armstrong

Airwallex Guest Contributor

The following article is an informative guest post provided by eCommerce accounting company A2X.

90% of eCommerce businesses fail after 120 days.

Running out of cash, poor inventory management, and price and costing issues are among the top reasons why.

Sadly, a lot of these eCommerce businesses might have survived had they set up their financials properly.

At A2X, we’re on a mission to take the hassle out of your eCommerce accounting. This fuels our fire to help more sellers understand their financials from the start and set them up for success.

To help your eCommerce business thrive (not just survive), here are some priceless tips to build solid financial foundations for robustness and resilience.

Simplify your financial operations

1. Use the accrual method of accounting

When it comes to eCommerce accounting, accrual accounting is king.

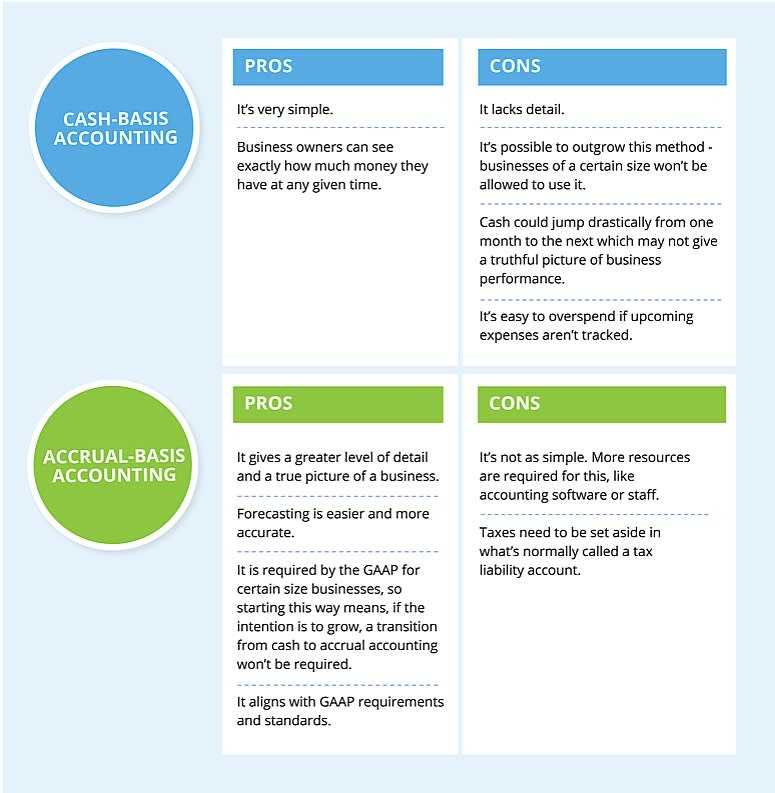

The accrual accounting method has many advantages over cash accounting in the world of online business.

In essence, accrual accounting records transactions at the time a sale or order is made, not when money changes hands. Conversely, cash accounting records transactions when money changes hands. It’s all about timing.

So why is accrual accounting best for eCommerce specifically?

Let’s take a closer look at that now.

Delays between orders and payments don’t misrepresent your business's financials if you use accrual accounting.

In eCommerce, there are often delays between when orders are placed and paid for.

Let’s look at a customer called Jack as an example:

Jack places a $200 order with you on the 5th of the month.

Amazon processes his payment and ships the item to him straight away.

Amazon pays out settlements fortnightly.

Amazon pays you on the 14th of the month for this sale less Amazon’s fees and any other deductions (totaling $50).

Using cash accounting: $150 would be recorded as revenue.

Using accrual accounting: $200 would be recorded as sales, and $50 would be recorded as fees.

It’s not always that simple, though. Sometimes, payouts can include transactions from two different months. And it’s likely that you’ll have more customers than just Jack.

When payouts are batched into settlements and exclude platform fees, it makes it difficult to accurately record your expenses if everything coming in is labeled as “revenue.”

With eCommerce accounting, the accrual method is the only option for accurate finances.

However, if Jack is eating out in downtown Manhattan, the restaurant he chooses for dinner may well be suitable for operating using cash accounting.

In this instance, the restaurant serves the customer and is paid the next day, and any transaction fees are charged at a later date. The cash going out and in has a minimal delay and the fee structure on payouts is simple, so cash accounting is easier to manage.

Because of the nature of transactions in eCommerce, accrual accounting provides a more accurate overview of your business. It also makes it easier to forecast your financials and avoid any surprises down the track.

If you’re new to eCommerce accounting, make sure you know the fundamentals.

Key takeaway: If you’re new to eCommerce, begin your journey correctly with the accrual accounting method. If you’re currently using cash accounting, talk to a specialist eCommerce accountant about switching to accrual accounting sooner rather than later.

2. Put your accounting in the cloud

Cloud-based accounting is best practice. This means your accounting system is stored online, instead of in Excel spreadsheets or desktop software, and saved on a specific computer.

“If you want your business to work smarter and faster, cloud accounting software is a wise investment.”

- Xero

Having your eCommerce accounting in the cloud means:

You can access your accounting information anywhere, at any time, and can easily provide access to other team members too.

It’s less risky because you are not relying on one device to store your entire accounting system. It’s up-to-date and automatically backs up.

The information is encrypted, just like your bank account, so you must log in to access your account. It’s secure.

Why is this something you want to get right?

Cloud-based accounting is not the end of the line. Moving your accounting online (or better yet, setting up online from the get-go) means you immediately have access to other useful apps at your fingertips.

That means automation and integration are within your reach, making your accounting even easier and less of a headache (we’ll recommend a few apps later).

Key takeaway: Setting up your accounting system in the cloud ensures its safety, security, and accessibility. It also allows you to customize it with other useful tools.

3. Simplify your payments by automating them

Now that you’re recording transactions using the accrual accounting method in your cloud-based accounting system… let’s take a look at your efficiency!

If you’re spending a lot of time processing transactions (paying your suppliers, your eCommerce platform fees, your personal business expenses), you don’t need to be.

You can automate payment flows across your entire business with Airwallex:

Integrating your vendor management system with Airwallex Payouts API lets you easily pay your suppliers, even if they’re in different countries and currencies.

Pay your employees and contractors accurately (if you’re not a one (wo)man band) without taking an admin day to do so.

The benefits of a digital bank account are similar to those of cloud-based accounting.

Key Takeaway: With Airwallex, you can store your money digitally, move it easily, and automate your payments so you can spend less time on administration.

4. Plan for sales tax and VAT from the beginning

Understanding your obligations surrounding sales tax and VAT from the start can prevent complications.

Too many entrepreneurs have overlooked this when starting their new businesses.

“Hartzog, who runs the cleaning service [Maids 2 Match] with his wife, got caught in the tax trap. ‘The biggest mistake: We didn’t take out sales tax, and it was a requirement in Dallas,’ Hartzog said. ‘We wish we’d hired someone to help us with our numbers early on. It would have saved us an extra $5,000 or $6,000 that first year.’”

- CNBC

Sales tax is a consumption tax on goods and services in the US and Canada (the UK and Europe have VAT instead, and Australia, New Zealand, and some other parts of the world use GST).

There are three classic types of eCommerce seller approaches to sales tax:

Register for a sales tax certificate in every state, just in case you need it (costly, and time-consuming).

Register in one state only and never think about sales tax again (dangerous for businesses that have economic nexus in different states — more on this next).

Register for one state to start with, and specific states as you expand (the best idea is to ensure you have what you need at the time and no more, no less).

Which one will you be?

Planning ahead and making a sales tax plan means you can limit your up-front costs and minimize your long-term risks at the same time.

Here’s a handy sales tax calculator from QuickBooks to get you started.

Once you’ve figured this out, there are apps to help you that automate the whole process!

Three good sales tax apps are Avalara, Taxjar, or Taxify (see them compared here). Remember, this is much easier when you use an eCommerce accountant.

Key takeaway: Knowing your sales tax obligations from the start and planning ahead with a tax automation app is going to save you time, effort, and potentially money in the long run.

5. Plan your Nexus and permit registrations

A nexus is a connection or link between things.

So in regard to your eCommerce business, the states you have “nexus” in are the states in which you do business.

However, there are different types of nexus:

Economic nexus refers to your business having an economic connection with that particular state, requiring you to pay sales tax in that state.

Physical nexus refers to you having a physical presence in a state (a warehouse, for example), which makes you liable to pay sales tax in that state.

Sales tax nexus refers to you having a strong enough economic (or physical) link with a state that it counts as nexus. Then you must register, collect, and remit sales tax in that state.

Some eCommerce platforms act as marketplace facilitators, meaning they take care of sales tax for you.

However, this varies between platforms and states, so it’s best to get a solid understanding of eCommerce sales tax yourself.

There are a few steps to ticking the nexus box:

Determine where you have an economic nexus.

Determine whether your products are taxable.

Get registered for sales tax in those states.

Collect sales tax (if your marketplace facilitator doesn’t — make sure you know!).

File your sales tax returns at the right time.

Key takeaway: Sales tax is easier when you understand what your obligations are. Get your head around Nexus and what your eCommerce platform does for you, and get registered in the necessary states.

6. Forecast your inventory to protect your cash flow

It can be easy to skip this part.

If you’re tempted to “just see how we go” and then revisit this step, resist the temptation!

It’s far better to make a business plan at the start and adjust it as you go than to start with no plan at all.

Forecasting covers many areas. We’ve already considered why financial planning is important, so let’s now focus on your stock.

Inventory forecasting has three main benefits: less overstocking, less understocking, and saving time.

Making purchasing decisions based on what you think you should buy is a bad idea. Without using data to inform your decisions, you can quickly run into cash flow problems.

Such a simple problem can mean the end of your business. Finito. But forecasting your inventory can usually avoid all of this strife (plus you’ll gain cash flow confidence!).

You can use a tool like StockTrim to accurately predict future stock requirements to conserve up to 40% of working capital.

This interview with StockTrim’s co-founder Dominic Sutton explains more about how inventory forecasting fits into the bigger picture, and at what point you should consider using a tool.

If you’re buying stock from overseas, Airwallex can simplify the process with multi-currency accounts and fast and cheap international transfers.

Key takeaway: Forecasting your stock and finances means you can make informed decisions based on data and have a better chance of success in the early stages of your business.

7. Join the eCommerce back office

The best thing to do when you’re learning something new is to dive into a supportive community.

That’s exactly what the eCommerce Back Office is: a Facebook community group where eCommerce sellers can connect.

Members usually ask questions about their challenges and have the chance to seek advice from those who have figured out the same thing.

It’s like an online forum with people like you navigating their way through eCommerce accounting.

Gaining this insight from others could be invaluable, and an interactive place to turn to when you get stuck!

Key takeaway: Join the eCommerce Back Office on Facebook now and start learning from your peers.

8. Know when to hire an eCommerce accountant

When is it time to get professional, outside help with your finances?

A good time to start looking for an accountant is when your eCommerce business brings in enough profits to become your full-time endeavor (i.e., earning at least $20,000-$50,000).

Here are a few tips from Xero about when is the right time to hire an accountant:

When you’re ready to step back and delegate specialist tasks to experts

When you have to deal with the government (primarily around tax filing time)

If you’re worried about getting audited and want some peace of mind

If you’re thinking about applying for a business loan

When your company is growing

If you’re thinking about expansion or selling

“That doesn't mean you always need to employ an accountant full-time or hire one on a retainer basis. Sometimes just a couple of hours of their time will be enough.”

- Xero

Key takeaway: If you’re in the position described above, or your business is your full-time endeavor, consider hiring an accountant to manage your finances.

9. Get a specialist eCommerce accountant instead of a regular accountant

When you reach the point where you’re thinking about hiring an accountant, it’s best to find one who understands eCommerce or even specializes in it.

This is because the accountant or bookkeeper you choose may need to be familiar with:

International sales tax

The cloud-based software and integration apps you’re set up with and using

The nature of eCommerce – it has a much larger volume of transactions and variable costs, which creates the need for more automation

They’ll also be able to assist you with other challenges of eCommerce accounting, such as tracking seller fees, handling returns, and manual data entry.

You’ll want to look at their experience and qualifications to ensure they’re familiar with selling online, as well as their fee structure (charging hourly or offering value-based pricing).

Key takeaway: Regarding eCommerce accounting, getting an accountant who understands the playing field is much better. Specialist eCommerce accountants will help you navigate the eCommerce world in a way that regular accountants might not be well-versed in.

Automate your eCommerce accounting with A2X

We hope these tips are helpful to you along your eCommerce journey.

A2X is an app that integrates your online sales channels and cloud accounting software to give you reliable financials on autopilot. It’s accurate eCommerce accounting, without the fuss.

To find out more and claim your free trial, head over to a2xaccounting.com.

Callum Armstrong

Airwallex Guest Contributor

Callum Armstrong leads the content marketing team at A2X - running campaigns around ecommerce, accounting, and ecommerce accounting. Outside of work, he volunteers for a range of local environmental projects protecting endangered wildlife and helping with their marketing.

Posted in:

Finance operationsShare

- 1. Use the accrual method of accounting

- 2. Put your accounting in the cloud

- 3. Simplify your payments by automating them

- 4. Plan for sales tax and VAT from the beginning

- 5. Plan your Nexus and permit registrations

- 6. Forecast your inventory to protect your cash flow

- 7. Join the eCommerce back office

- 8. Know when to hire an eCommerce accountant

- 9. Get a specialist eCommerce accountant instead of a regular accountant