Cross-border payment providers: Global players

David Beach

Senior Editor | Payments, banking, financial technology, and global commerce - EMEA

For businesses with global growth ambitions, effectively managing cross-border payments represents a treasure trove of new markets, customers and revenue streams. The key to this is choosing a cross-border payment provider that offers a convenient, cost-effective and compliant international payment solution with minimal risk to your business.

Cross-border payment providers play a pivotal role in facilitating international money movement across multiple currencies. Understanding exactly who does what will help your business overcome the four challenges of cross-border payments; high costs, slow speeds of settlement, limited access and a lack of transparency.

International money transfer services come in many shapes and forms and just as many names. Let’s look at the key players of today’s global payments system and their roles in facilitating international payments.

Issuer banks and acquirer banks

Issuers and acquirers are banks or payment institutions that are vital to making and receiving international card payments and bank transfers. Issuers issue accounts and cards, make and authenticate payments, and charge fees to customers.

On the other end of the spectrum, acquirers request and collect payments from issuers usually on behalf of merchants, deposit funds, and charge fees to merchants. Big banks are usually both an issuer and an acquirer.

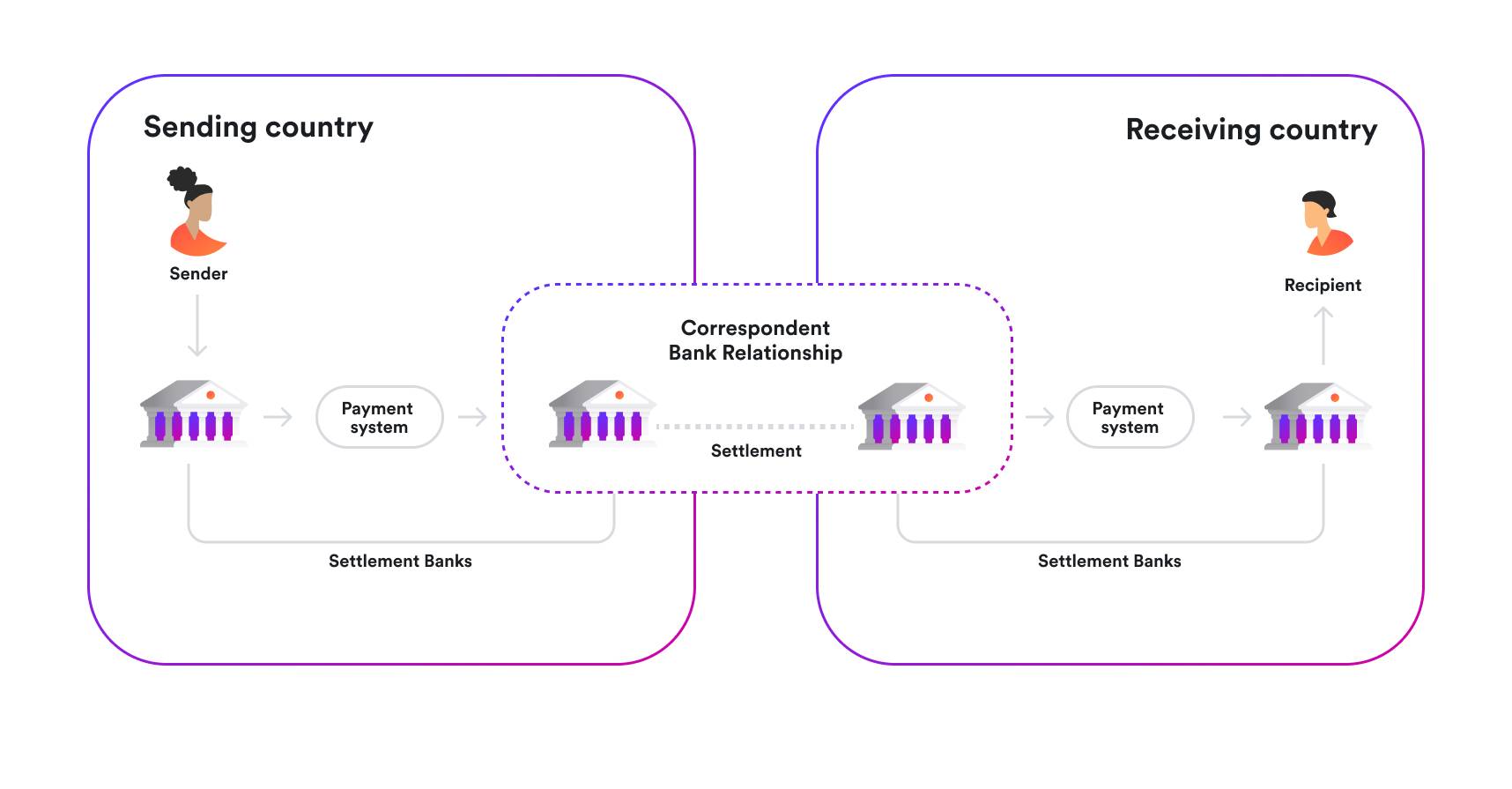

Correspondent banks

Correspondent banks act as intermediaries between financial institutions, handling transactions and settlements across different countries and currencies.

They facilitate the smooth flow of funds across borders, ensuring transactions between different banks and countries can be cleared, settled, and completed effectively.

Importantly, correspondent banks hold nostro and vostro accounts with local institutions around the world in those local currencies. This enables them (for a fee) to convert one currency into another.

Banks are at the traditional end of cross-border payment providers. But the combination of slowness, costly foreign transaction fees and lack of transparency make traditional banks a poor choice for businesses that need to conduct global commerce transactions at scale.

Payment Service Providers (PSPs)

The term Payment Service Providers (PSPs) is a broad description of any institution that provides a payment service, including cross-border payments.

Typically, PSPs allow merchants to accept electronic payments from customers sent through various methods including credit and debit cards, digital wallets and bank transfers; this is known as a payment gateway.

Sometimes called merchant service providers, PSPs also provide the infrastructure to facilitate B2B and B2C international money transfers cross-border payments in a secure way.

PSPs offer services that include payment processing, payment gateways, fraud prevention and foreign exchange services. This breadth of services make PSPs excellent cross-border payment providers.

Merchants most often use a PSP to:

create a faster, smoother payment process

automate the payment process to save merchants time

secure payment data

Your chosen PSP will depend on your business’ specific commercial needs, but some popular PSPs include Airwallex, PayPal, Stripe, Amazon Pay and Worldpay. You may know some of these as international money transfer companies. Check out our best business bank account article for more detail on how they differ.

Multi-currency providers

Multi-currency providers (sometimes known as multilateral platforms for cross-border payments) have the potential to reduce core frictions associated with international payment processing and typically replace correspondent banks as a business’ international payment provider.

They are typically fintech companies that specialise in offering accounts or services that allow businesses to hold, send, receive, or move money in multiple currencies.

This broad spectrum of capabilities has earned multi-currency providers a favourable position in the cross-border payment providers marketplace, heralded as a way to make low-cost international transfers for businesses.

Tools like global accounts allow businesses to collect payments in local currencies. Then later, they can use the proceeds to pay suppliers or settle bills in the local currency without the need to exchange currencies.

Some of the main business benefits of using multi-currency providers include:

Costs: More competitive exchange rates and fees than traditional banks or other international payment methods.

Simplicity: Money in different currencies can be managed in a single platform, making global treasury simpler.

Forex management: Avoiding cross-border fees means managing currency conversions in an optimal way.

Speed of settlement: Faster settlement of funds, ideal for your bill pay process.

Some well-known multi-currency providers are Airwallex, Revolut and Wise. Check out our comparison of business accounts.

What is Airwallex?

Airwallex, the global financial platform for business, can be classified as a payment service provider, a processor, a payment gateway, a card issuer and acquirer and a multi-currency provider. This is because Airwallex was designed for modern businesses who frequently move money internationally.

Find the right cross-border payments provider

Having a solid foundation of cross-border payment providers and how they can help your business will allow you to harness the opportunities of transacting globally. But with opportunity comes risk.

The key to avoiding the pitfalls of cross-border payments is choosing the best cross-border payment solution for your business. Whether you’re just starting out on your global journey or are already well established in foreign markets, having the right global payment infrastructure in place will help your business save time and money.

David Beach

Senior Editor | Payments, banking, financial technology, and global commerce - EMEA

David manages editorial content for the Airwallex community. He specialises in content that helps EMEA businesses navigate global and local payments, treasury, and banking.

Posted in:

Online payments