Fintechs and financial services

Tap into new markets for your financial solutions

Reach new customers around the world. Build your financial products using Airwallex's unified, global infrastructure, APIs, and licensing.

Global financial infrastructure for leading fintechs across a variety of use cases

Payroll

Expand your payroll offerings globally by tapping into Airwallex's local payout network in 60+ currencies, with payroll disbursed in as little as one business day.

Lending

Lend funds to borrowers globally using multi-currency wallets, or issue branded cards with spend tracking.

Wealthtech

Enable clients to fund investment accounts from their bank account or other sources, convert funds, and access their earnings via branded cards.

Offer your customers more financial solutions through your platform

Let customers to transfer funds globally on your platform

Customers can collect and hold funds in multi-currency accounts, and remit funds around the world for employee reimbursements, vendor payouts, payroll, and more.

Allow customers to accept online payments on your platform

Your customers will be able to accept card and local payment methods from customers around the world in their preferred currencies with our global payment solutions.

Expand your financial services to new international customers

Offer a complete suite of global financial services to your customers, including multi-currency wallets, branded virtual and physical card issuing, lending products, and more.

Robust infrastructure to expand your product offering

Quickly take your value proposition global

Enable your teams to build quickly and effectively by using Airwallex’s unified layer of 80 licenses, compliance expertise, and developer tools

Simplify onboarding and compliance

We take care of global KYC, AML, sanctions screening, and identity verification requirements, so you can focus on the user experience.

Choose your monetisation model

Customise revenue models across transaction types to monetise your offering. Programmatically deduct fees from customer accounts and settle them into your Platform account.

Easily customise for your brand and UI

Get started quickly with our pre-built flows and customise your own UI. We offer everything you need to embed a bespoke payments and finance experience within your platform.

Financial Services Case Studies

"A huge time release": How RiseUp streamlined operations with Airwallex

The Challenge

RiseUp is a financial wellbeing app that helps customers take positive actions to manage their finances. RiseUp now services over 100,000 members globally and recently expanded to the UK. However, a critical part of their strategy was to set up a UK bank account, which proved to be quite challenging and time-consuming. As a result, expenses became a complicated process when UK-based employees needed to make small but important disbursements to support the company's growth. RiseUp needed a solution that would enable the UK team to be agile and independent.

The Solution

With Airwallex, RiseUp can now manage its financial operations between Israel and the UK more easily. Global Accounts allow RiseUp to quickly and easily transfer funds between different currency accounts, and using Airwallex's Corporate Cards allows RiseUp to centrally manage all expenses from a single interface, saving considerable time and streamlining a once highly complicated task.

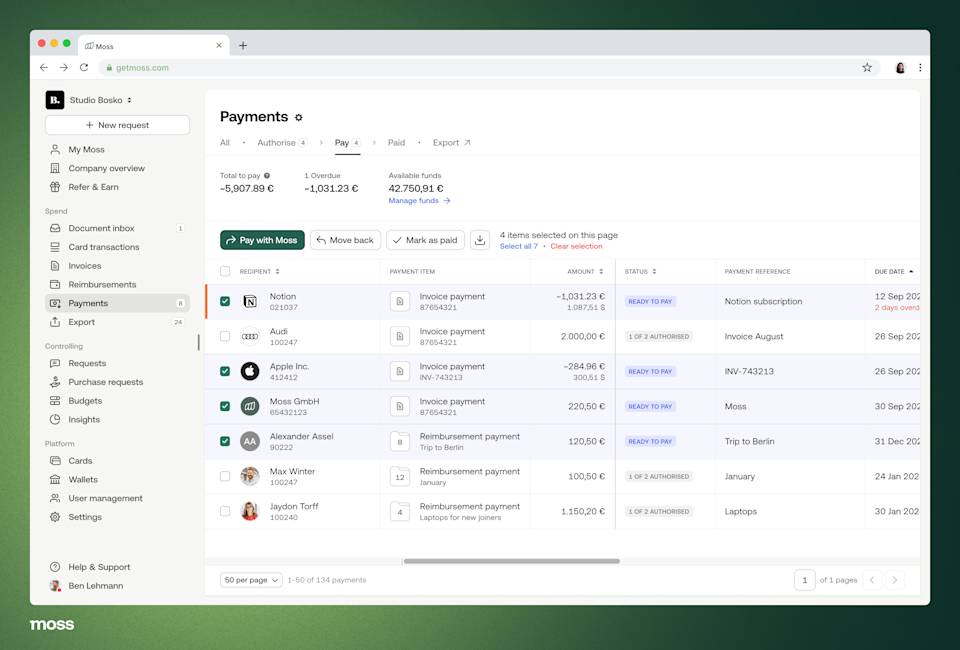

How Moss built global bank transfers, powered by Airwallex infrastructure

The Challenge

Moss aims to transform financial management for small and mid-sized companies, freeing them to focus on what drives their success and unlocks their full potential. As they grew, Moss wanted to give their customers better bill pay coverage and a way to effectively manage multiple currencies, all packaged within the Moss platform. As Moss expanded, the need for a robust embedded finance solution became evident.

The Solution

With Airwallex, Moss has been able to offer their customers with accounts to hold funds for card payments and domestic and international transfers. Moss has significantly enhanced its global coverage, offering its customers a more complete solution. The partnership has enabled Moss to provide global accounts, attractive FX rates, and local payouts globally, supporting all of Moss's use cases across different regions.

Brex expands their global footprint

The Challenge

Brex is a fintech company with the mission to empower employees anywhere to make better financial decisions. They aim to revamp the business banking experience by providing a modern, tech-driven alternative to traditional banks. To fuel their growth, Brex needed a partner with international reach who could help them unlock new markets, and allow them to service multinational customers.

The Solution

With Airwallex’s Global Treasury solution, Brex has been able to accelerate its global growth and meet the needs of their multi-entity customers. Through a single API integration, they’ve made it straightforward to collect top-ups locally in multiple markets and to seamlessly convert currencies at competitive rates. Their customers can then pay supplier invoices and employee reimbursements at scale through fast, cost-effective local payment rails.

PARTNERSHIPS

Partner with Airwallex to accelerate your clients' growth

There are many ways to partner with us to ensure your clients' success. We offer solutions that you can embed fully onto your platform, as well as integrated offerings to enhance the customer experience. Work with us to design a partnership that fits your needs.

Ready to get started?

Talk to our team to design the right solution for your business.