This month, we’re giving businesses more ways to optimise cash flow and control spend with limit orders, 37 additional SWIFT currencies, HRIS syncing, and PayTo payments.

Business Accounts

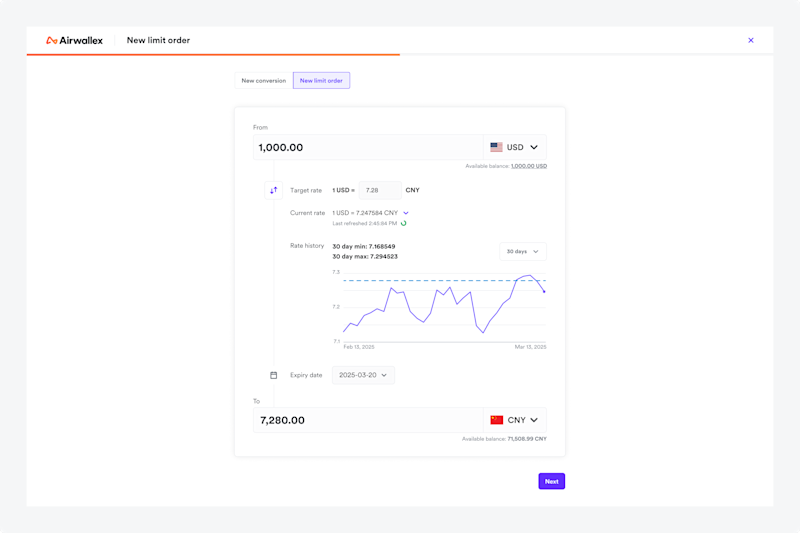

Early accessLock in better FX rates with limit orders

Limit orders let you create conversions that automatically execute when your target FX rate is reached. This helps you convert at a preferred rate without needing to monitor the market. Orders can remain active for up to 90 days and can be edited or cancelled at any time before they’re filled. This feature is available in early access for select customers in Australia and Hong Kong. Learn more in our Help Centre.

Expanded SWIFT transfer currency coverage

SWIFT transfers are now supported in 37 additional currencies, expanding total coverage from 25 to 62 currencies. This enhances global reach and flexibility for international payouts. Learn more here.

Spend

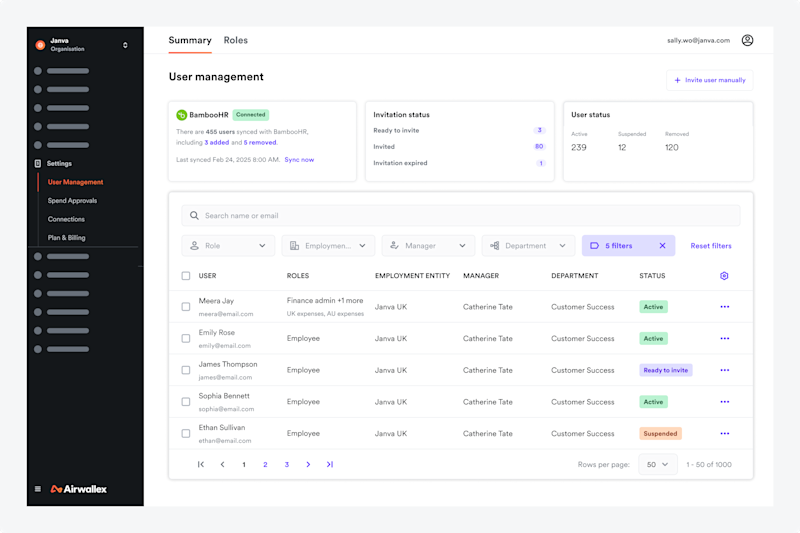

Early accessAutomate user onboarding and management with HRIS

Easily sync users from your HR system to Airwallex and keep employee data up to date automatically. With our new HRIS integrations, you can onboard users and update key details like manager, department, and location through automated daily syncs. When an employee leaves, their Airwallex access is automatically revoked.

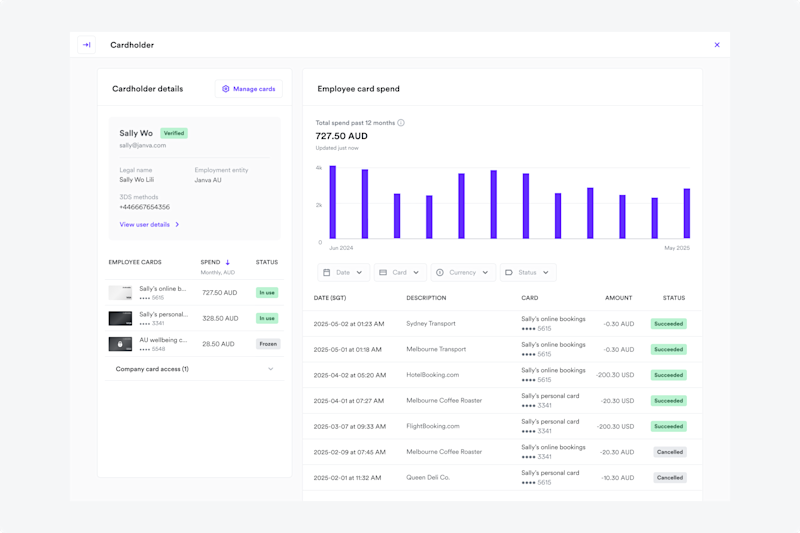

Real-time visibility with card analytics

Track card spend with greater clarity using visual analytics. View spend by individual card or get a consolidated view per cardholder, helping you spot trends, monitor activity, and understand where spend is happening – all from the card or cardholder details page.

Payments

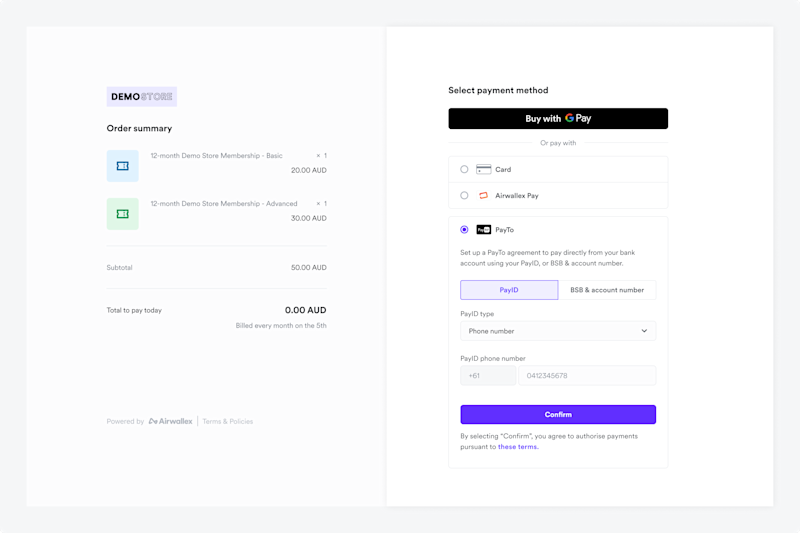

Early accessBetter Australian direct debits with PayTo

If your business is registered in Australia, you can now accept PayTo at checkout. PayTo lets your customers pay directly from their bank account and allows you to set up direct debit mandates. It offers faster confirmation and settlement than traditional BECS Direct Debit, along with significantly lower fees than card payments. It’s ideal for recurring billing, subscriptions, or high-value payments that benefit from instant verification and minimal dispute risk. This feature is in early access for select Australian merchants. Learn more in our product documentation.

If you’re interested in learning more about our early access features, please reach out to Airwallex Support or your account representative.

View this article in another region:EuropeUnited Kingdom

Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.