Offshore account: what is it and how to open one in Hong Kong

Kirstie Lau

Brand Content Marketing Manager

What are offshore accounts?

Offshore bank accounts are specialised accounts opened in foreign banks or financial institutions. There are two types of offshore accounts: personal and business offshore accounts.

Personal offshore accounts are accounts opened in countries or regions outside of one's country of residence, and are solely for personal use. On the other hand, business offshore accounts are accounts opened in regions outside the company's registered location.

This article will give you a better understanding of offshore accounts by exploring their advantages, target users, and the steps to open such accounts.

How does offshore banking work?

Offshore banking involves opening a bank account in a foreign country to conduct financial transactions, receive payments, hold funds, and manage savings and investments in multiple currencies.

Offshore accounts offer various benefits such as tax advantages, privacy protection, and capital mobility. However, they must comply with laws and regulations designed to combat money laundering and tax evasion.

What are the differences between offshore bank accounts and local bank accounts?

The table below highlights some key differences between offshore and local bank accounts in terms of account opening requirements, deposits requirements, and protections, and account services. In general, offshore accounts are ideal for international businesses, expatriates, and asset protection, while local accounts are more suitable for daily transactions and local financial needs.

Features | Offshore bank accounts | Local bank accounts |

|---|---|---|

Account opening requirements | Visit your local branch. Certain banks also offer online account opening | Visit a branch or open an account online |

Deposit requirements | Higher minimum deposit, ranging from no minimum to several million Hong Kong dollars (HKD)* | Lower deposit requirements* |

Banking costs | Higher fees for maintenance and transactions | Lower fees for domestic banking |

Account services | Online banking, deposits and withdrawals, transfers, investments, credit and debit cards | Online banking, deposits and withdrawals, transfers, investments, credit and debit cards |

Deposit protection | Subject to local legislation | Protected by the Scheme of Hong Kong Deposit Protection Board, with a compensation up to a limit of HK$500,000 |

*Varies depending on individual banks and account tiers.

Why offshore accounts?

Offshore accounts are becoming more popular among individuals and businesses looking for financial advantages beyond their home countries. Here are a few reasons why you should consider opening an offshore account.

You are currently or planned to live, work and retire abroad

You are an international assignee who frequently travels or relocates for work

You get paid in foreign currencies

You own foreign assets, like investments or property

You provide financial support to family members abroad, such as covering a child's school fees.

Benefits of offshore accounts

Tax benefits

Offshore accounts in certain jurisdictions may provide opportunities for tax optimisation and reduction. Individuals or entities can benefit from lower or zero tax rates on interest income, capital gains, or inheritance in offshore locations. Additionally, some offshore jurisdictions offer tax incentives for foreign investors, encouraging investment and wealth preservation.

Security

Many offshore banks have stringent privacy laws and banking regulations that safeguard account-holder information from unauthorised access or disclosure. This heightened level of privacy can be advantageous for individuals seeking to protect their financial assets from potential legal disputes, political instability, or other risks. However, it is essential to consider deposit protection schemes when choosing an offshore bank account for your business. For example, the Financial Services Compensation Scheme (FSCS) in the UK provides protection for bank deposits up to £85,000 per eligible person, per bank, building society, or credit union. Offshore accounts may not offer the same level of protection, meaning funds held in foreign savings accounts could be at greater risk in case of a bank failure.

Diversify assets across different jurisdictions

By holding funds in different countries and investment accounts, individuals and businesses reduce their exposure to risks such as currency fluctuations, banking crises, or economic downturns in their home country. This diversification strategy enhances financial stability and ensures better protection against unforeseen legal or economic challenges.

Diversification of financial services

Companies with international operations can benefit from a range of financial services such as foreign currency hedging, investments, or even borrowing in foreign currency. To access these services, it is often advantageous to have an offshore bank account.

Access to a broader range of investment opportunities

Offshore accounts can facilitate investments in foreign markets, currencies, and assets that may not be available through local banking institutions. This diversification can help spread risk and enhance returns by tapping into global markets and emerging economies.

Flexibility in currency holdings

Offshore banking allows businesses to hold funds in multiple currencies, reducing exposure to exchange rate fluctuations and providing a hedge against currency risks. This flexibility can also facilitate international trade, cross-border transactions, and efficient wealth management strategies.

Key features of offshore bank accounts

Offshore bank accounts offer businesses access to international banking services, enhanced financial flexibility, and global transaction capabilities. These accounts are particularly useful for those who frequently deal with multiple currencies, travel often, or manage international business operations. Below are some of the most significant features of offshore banking.

Multi-currency accounts

Offshore banking allows businesses to hold multiple currencies within a single account. Unlike local banks, which typically focus on a single national currency, offshore banks allow account holders to maintain balances in various currencies.This feature is particularly beneficial for businesses engaged in international trade, as it eliminates the need for frequent currency conversions and reduces exposure to exchange rate fluctuations. Individuals who travel frequently or live in multiple countries also benefit from this feature, as they can easily manage their finances without being affected by unfavourable exchange rates. Additionally, offshore banks often provide better foreign exchange services, including competitive rates and lower transaction fees, making it more cost-effective to conduct international transactions.

Remote account management

One of the most convenient features of offshore banking is the ability to manage accounts remotely. Most offshore banks offer secure online banking platforms, mobile applications, and dedicated customer service teams that allow account holders to conduct transactions, monitor balances, and access banking services from anywhere in the world. This is especially useful for business owners and investors who frequently travel and need instant access to their funds without visiting a physical branch. Remote account management also enhances financial security, as offshore banks implement advanced cybersecurity measures such as multi-factor authentication, encrypted transactions, and fraud monitoring systems. These digital banking features ensure that account holders can efficiently manage their finances while maintaining high levels of security and convenience.

Global payments

Offshore banks are equipped to handle cross-border payments efficiently, allowing businesses to send and receive funds internationally with minimal restrictions. Unlike some local banks that impose limitations on foreign transactions, offshore banks specialise in global financial operations and offer faster processing times for international payments. This feature is particularly valuable for businesses engaged in international trade. Additionally, offshore banks often provide flexible payment solutions, such as multi-currency debit cards and international wire transfer options, ensuring that account holders can conduct transactions smoothly across different regions.

Top countries for offshore banking

Banking services for offshore accounts in Hong Kong

Local banks in Hong Kong offer offshore account services. As a valued customer, you can open an offshore account at these banks.

Depending on the bank's specific requirements, you may have the flexibility to open an offshore account online, through their International Banking Centre (IBC), or by visiting a branch.

Banking services for offshore accounts in UK

In addition to overseas branches of local banks, non-UK residents can also open accounts with local traditional banks. Most international bank accounts have straightforward requirements. Typically, customers must provide copies of their passport (verified by a professional), proof of address, proof of income, and other necessary documents, and deposit the funds within a specified period.

Banking services for offshore accounts in the US

You can open an US offshore account with the US branches of your local banks. Customers can either schedule a visit to the US branch with the assistance from Hong Kong staff or apply for a US bank account online. It's worth noting that local banks also offer offshore account opening services, albeit with specific minimum requirements.

Banking services for offshore accounts in AU

Some Australian banks allow online applications for offshore account opening. To apply, customers must provide their passport details, Taxpayer Identification Numbers (TIN), and an Australian address, and phone number. It is also mandatory for the customer to visit Australia within one year. Nevertheless, not all Australian banks offer online account opening. In such cases, customers are required to physically visit a branch upon arrival in Australia to start the process.

Please note that the offshore account services mentioned above are specific to personal offshore accounts. For details regarding business offshore accounts, please refer to the information below.

Choosing the right offshore bank account

Consider your specific needs

For example, consider whether you need to make international payments to suppliers or employees. This clarity will help streamline the process and avoid unnecessary remittance fees.

Make sure you are eligible

Review the account opening requirements, along with the legal and tax regulations of the target country or region. Some banks only accept applications from local tax residents and registered companies, so those might have to be ruled out.

Legal regulations and security

Evaluate the level of legal protection and asset security provided in the local jurisdiction, including the bank's reputation, geopolitical situation, and any deposit protection limitations.

Costs

Consider the financial and time costs associated with opening an offshore account. Certain banks may have complex processes, require in-person visits, or impose service fees and minimum deposit requirements. Applicants should weigh the costs against the potential business value.

How do I open an offshore bank account?

Companies have the options to open offshore bank accounts directly with overseas banks or through local banks that have offshore branches.

Requirements and procedures for opening an offshore account with local bank assistance

While it is relatively convenient to open an account through local banks, not all banks offer offshore account services to corporate clients. Additionally, customers should consider whether the bank's branch network supports their overseas business operations.

While banks may assist with setting up offshore bank accounts, companies are still obliged to submit the necessary documents to meet local government and bank regulations for account opening.

Requirements and procedures for setting up an offshore account independently

Opening an offshore account requires a locally registered or offshore company, such as one in the British Virgin Islands, Cayman Islands, or the Bahamas. In the UK, corporate accounts are usually available to registered UK companies or offshore companies, with applicants generally needing tax residency, except in the Channel Islands and the Isle of Man.

Accounts can be opened by visiting a branch or contacting corporate banking, with some banks now offering online applications post-pandemic.

Required documentations

Applicants must provide company details, including address, and contact information. For limited companies and partnerships, a Companies House registration number (CRN) is needed, along with the estimated annual turnover. Personal details of shareholders and directors are also required, including their full names, date of birth, contact details, and residential address (plus previous addresses if they have lived at the current one for less than three years). For HSBC customers, an account number is necessary, along with credit and debit card information.

Airwallex: the alternative to offshore accounts

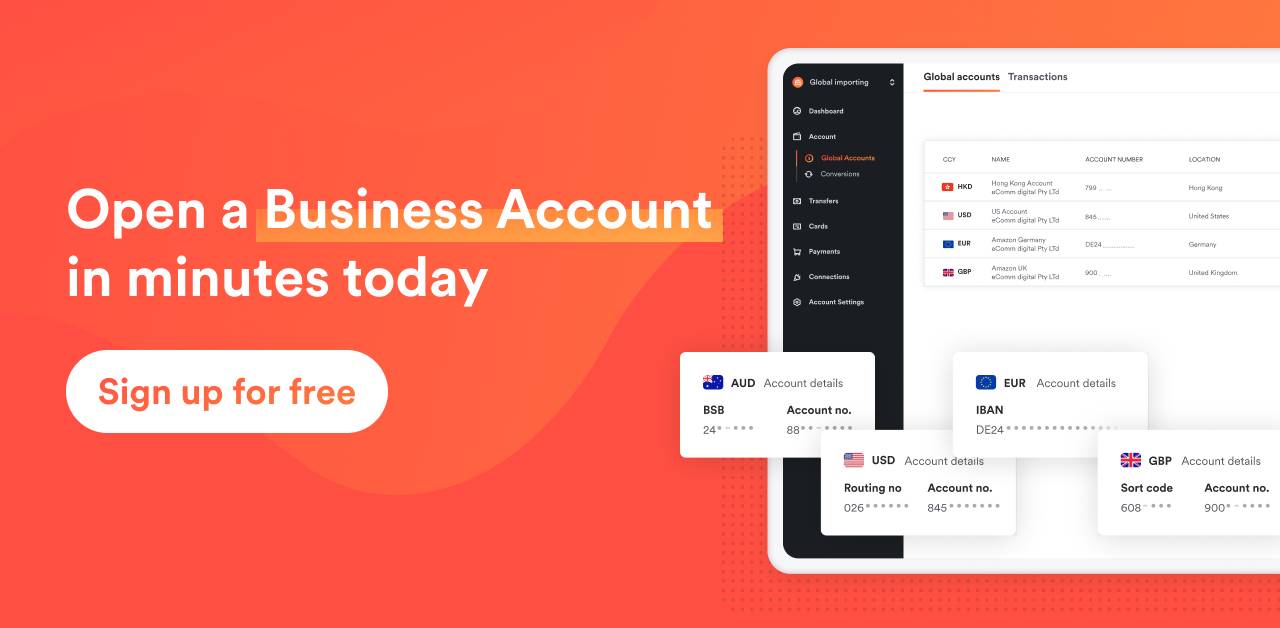

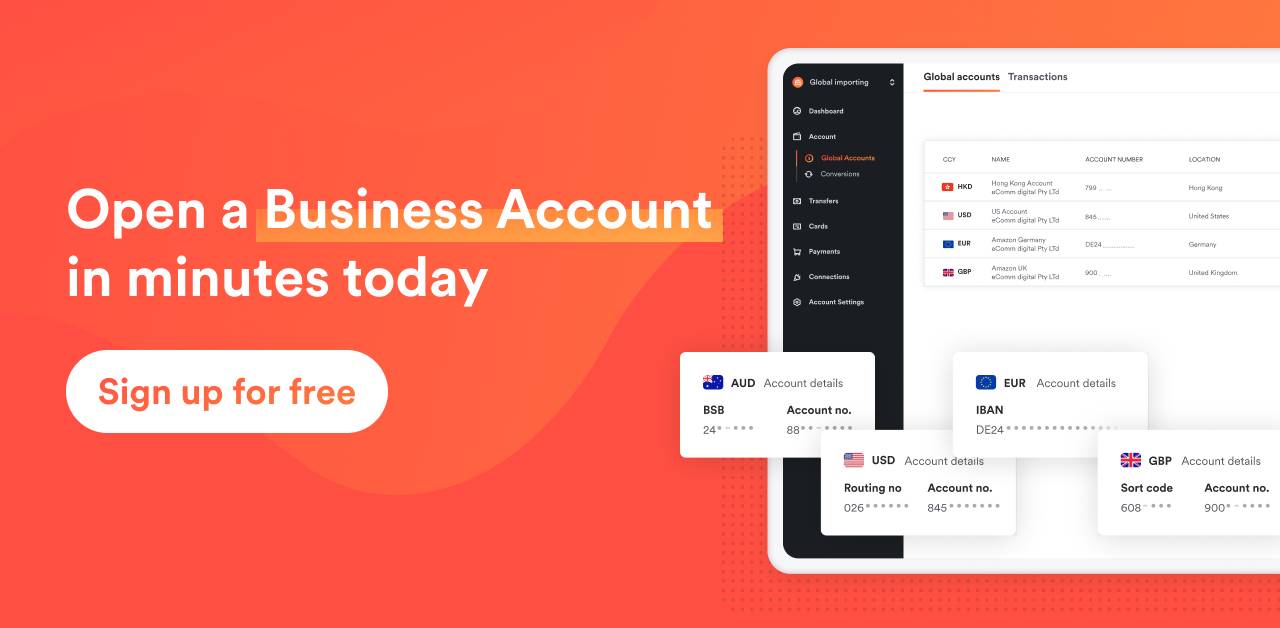

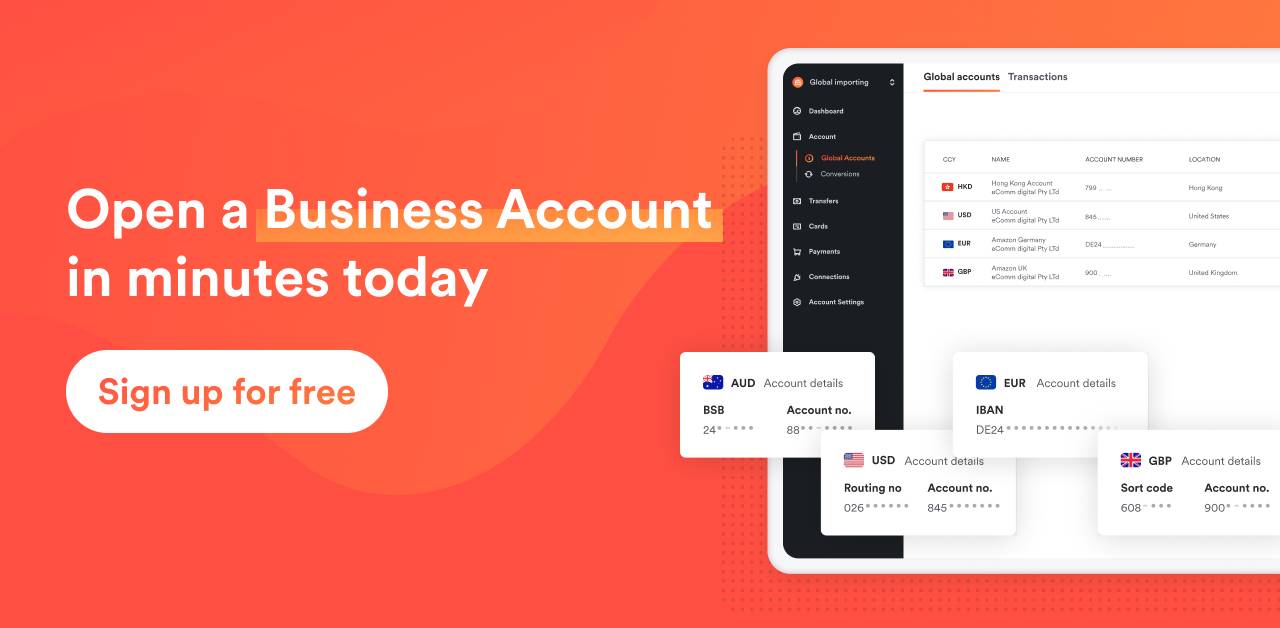

Many offshore banks restrict account openings to locally registered companies or tax residents, making it difficult for foreign businesses to apply remotely. At Airwallex, our Global Accounts offer a simpler, more accessible alternative.

Features

Airwallex Global Accounts are available in more than 21 countries, enabling businesses to operate in their local currency. Each Global Account includes local bank details for receiving funds. Opening a Global Account is quick and hassle-free. Simply complete the online application within minutes – no local registration or branch visits required, and your Global Account is ready to go. For instance, you can open an Australian dollar account with local bank details online, with 95% of transactions arriving within a few hours or the same day, all without transaction limits.

Security measures

Airwallex has implemented robust security measures to protect customer funds and data. We use SSL encryption to secure data in transit, ensuring it remains unreadable to unauthorised parties. Our compliance with PCI DSS guarantees the highest standards for handling cardholder data, including secure network architecture and strong access controls. Two-factor authentication (2FA) adds an extra layer of security by requiring both a password and a one-time code for login. As an ISO 27001-certified company, we follow strict international standards for information security management, regularly assessing risks and implementing protective measures. Additionally, regular security audits help us identify and address potential vulnerabilities, ensuring our platform stays ahead of emerging cyber threats.

Airwallex is also licensed in Hong Kong as a Money Service Operator by the Hong Kong Customs and Excise Department (licence number 16-09-01929) and regulated in countries such as Australia, Canada, China, Singapore, United Kingdom, United States, and more.

Sign up to grow your business beyond borders.

*Information as of March 2025. Please refer to the official websites of banks and payment platforms for the most up-to-date information.

View this article in another region:Hong Kong SAR - 繁體中文

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

Business bankingShare

- What are offshore accounts?

- How does offshore banking work?

- What are the differences between offshore bank accounts and local bank accounts?

- Why offshore accounts?

- Benefits of offshore accounts

- Key features of offshore bank accounts

- Top countries for offshore banking

- Choosing the right offshore bank account

- How do I open an offshore bank account?

- Airwallex: the alternative to offshore accounts