What is an online remittance?

Online remittance refers to the process of sending money electronically from one person or entity to another through online platforms or digital channels. This method allows individuals or businesses to transfer funds across borders or domestically without the need for physical cash transactions. Online remittance is commonly used for various purposes, including sending money to family members in different countries and making international business payments, and more.

How can remittance be done online?

Online remittance services are typically provided by specialised money transfer companies, banks, or online payment platforms. Users can initiate transfers through websites, mobile apps, or online banking portals, providing details such as the recipient's information and the amount to be transferred.

These services offer a convenient and efficient way to send money globally, often with lower fees and faster processing times compared to traditional methods like wire transfers or physical cheques.

Popular local remittance options and transfer services in Hong Kong

1. Traditional banking services

For years, traditional banks have earned our trust with their secure remittance services. When sending international remittances through traditional banks, the process often involves multiple intermediary banks and clearing systems, resulting in longer processing times. It may take several business days or even longer for the funds to be credited to the recipient's account.

Remittance fees are typically charged by banks on a per-transaction basis. It is crucial to be mindful of any additional fees imposed by intermediary or receiving banks. While some banks have introduced fee waivers for overseas remittance in recent years, these waivers are usually limited to a few major currencies or designated countries, and may require the recipient to have a local account with the same bank.

In general, traditional banks do not impose a limit on the amount of remittance, although larger transfers might lead to specific approval procedures or the submission of relevant documents for completion.

2. Online banking remittance and transfer

With the rise in popularity of online banking, businesses now have the convenience of remitting and transferring funds online. The advantages and disadvantages of online remittance are outlined below.

Advantages

Highly convenient: Customers can conveniently process remittance transactions using online banking anywhere, anytime, as long as their computers or mobile devices are connected to a stable network. By eliminating the need to physically visit a bank branch, online banking saves valuable time.

Low transaction fees: In general, online banking offers significant advantages for cost control as the transaction fees are lower than physical banks.

Enhanced security: Multiple encryption technologies and identity verification methods ensure the utmost security of transactions.

Disadvantages

Limit on transaction amount: Some banks may set daily or per-transaction limits for online remittance.

Requirement on internet connectivity: While online banking is not restricted by location and time, it relies heavily on a stable internet connection to complete transactions successfully.

Technical issues: In the event of occasional system maintenance or platform failures can hinder users' ability to make remittance, even if the downtime is just a few hours

3. All-in-one financial and transfer platform

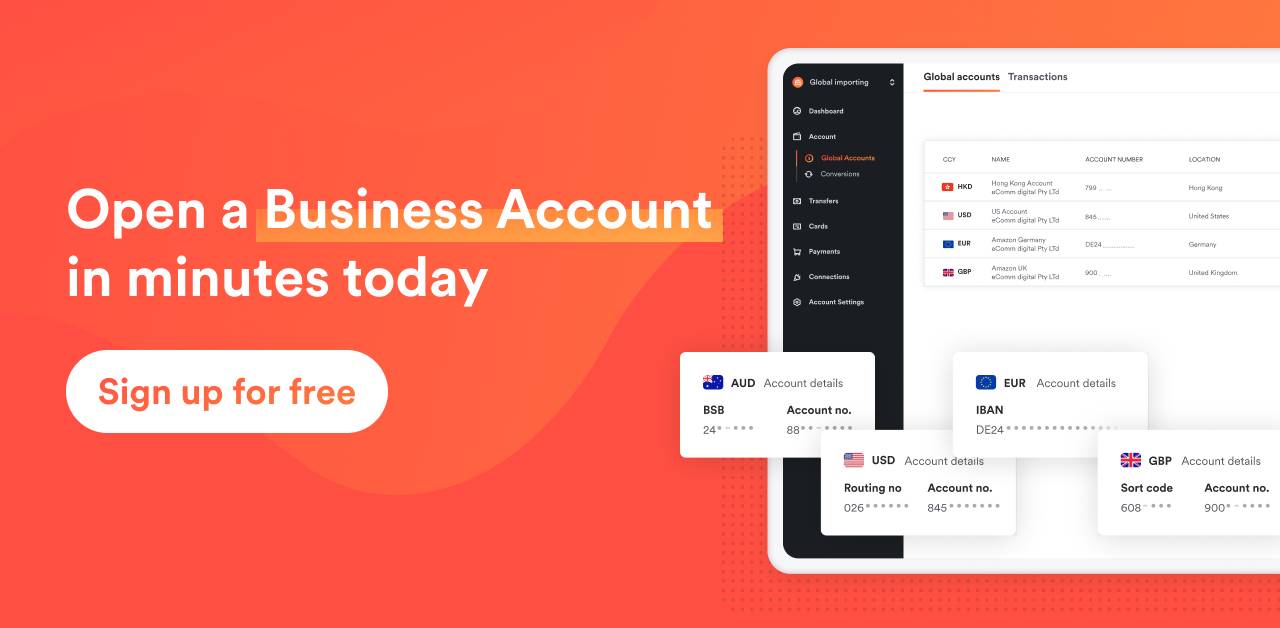

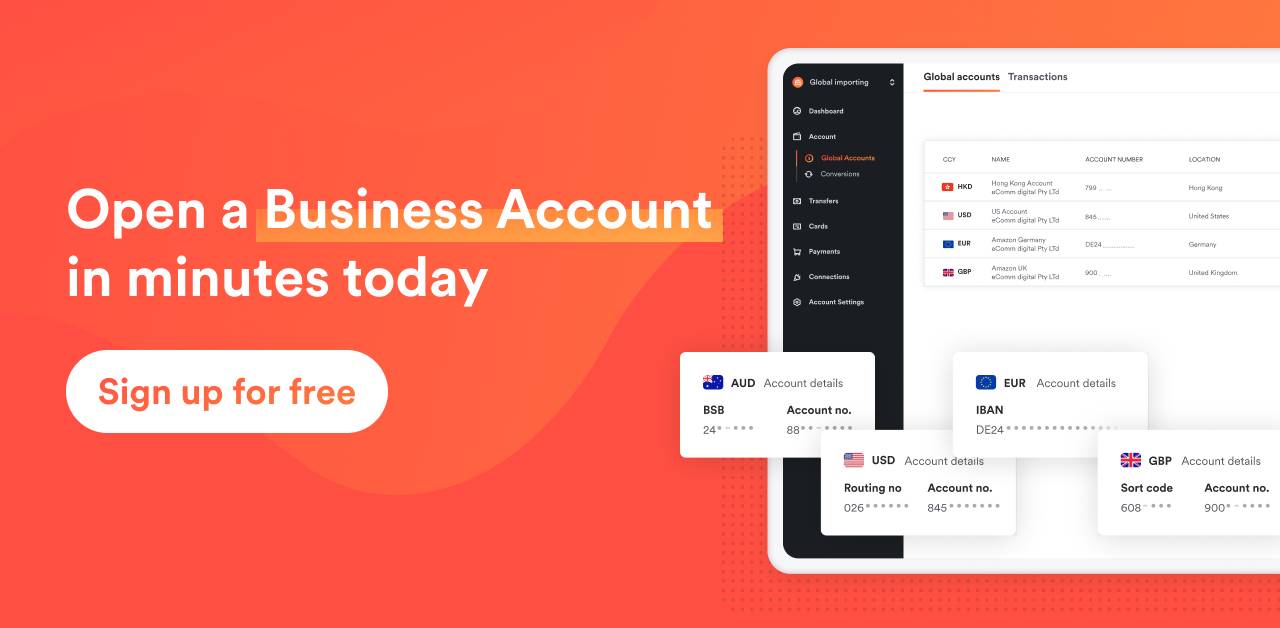

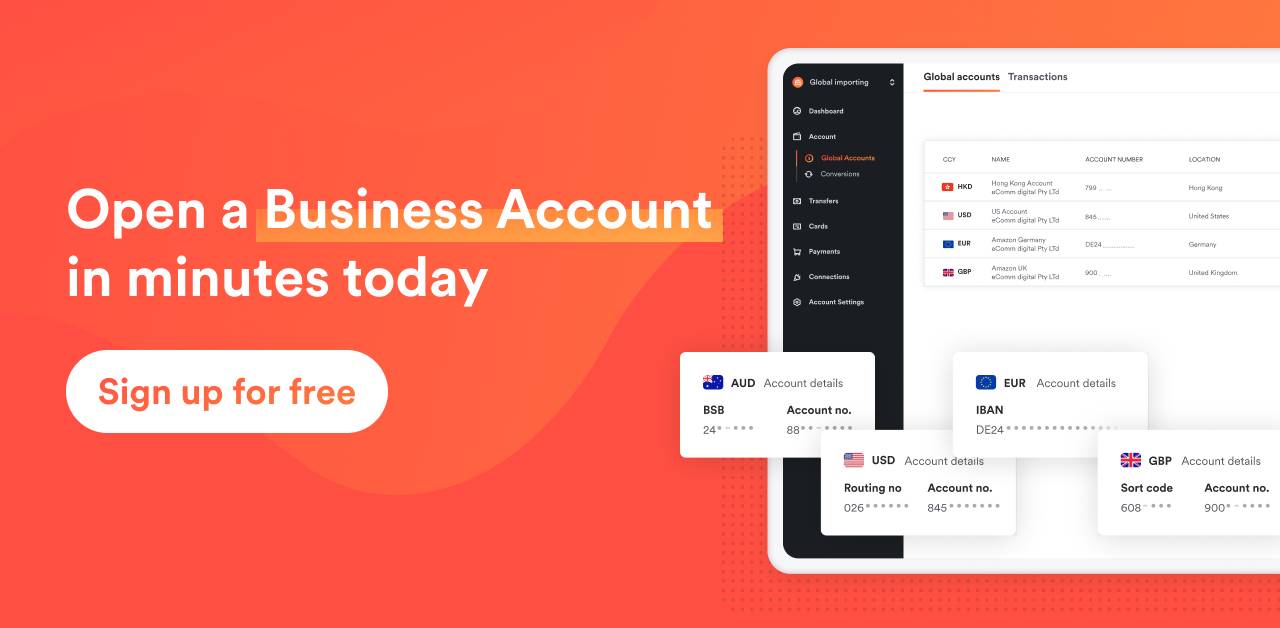

Airwallex serves as a convenient and efficient alternative to send money online. These providers act as intermediaries between senders and recipients, facilitating digital transactions securely and quickly. Here are some key advantages of using Airwallex for online money transfers:

1. Convenience: Airwallex offers easy-to-use platforms and mobile apps that enable users to initiate money transfers from the comfort of their homes or offices. This convenience is particularly beneficial for individuals who need to send money internationally or make regular payments.

2. Global reach: Airwallex has a wide network that allows users to send money to 150+ countries around the world. This global reach makes it easier for people to transfer funds to business partners in different locations.

3. Speed: Online money transfers are often processed quickly, with funds reaching the recipient within minutes to a few business days, depending on the destination and the transfer method chosen. Approximately 85% of funds arrive within the same day using Airwallex.

4. Cost-effectiveness: With Airwallex’s competitive exchange rate and lower fees compared to traditional banks or wire transfer services, you can save on every transaction. There is no account opening fees.

5. Security: Airwallex conforms to the highest global security standards, including PCI DSS Level 1, SOC 1, and SOC 2.

Can I open an offshore account online and make local remittance?

Different banks offer various foreign currency exchange services, but not all of them facilitate online currency exchange for overseas remittance. As a result, cross-border businesses have turned to opening offshore accounts as an alternative.

This approach minimises the need for currency exchange, reduces the cost per remittances, and mitigates the risk of foreign exchange exposure. However, not all banks are equipped to handle offshore accounts, and in some cases, it may be necessary to personally visit the local area to open an account. Even if your local banks can provide offshore account services, it is important to consider the following application and account opening requirements.

Account opening deposit and minimum balance: Each bank has specific requirements regarding initial deposit and minimum balance. It is crucial to ensure that the minimum balance can be maintained while also managing the company's cash flow before opening an account.

Bank charges: Opening an offshore account may involve certain fees that should be understood and considered in advance.

Time required for remittance: If you need to transfer funds from an offshore account to another country or back to a local account, it is important to note that the time involved in cross-border remittance may vary based on the banks and financial institutions of different countries.

Taxation: Tax implications for opening an offshore account and conducting cross-border remittance should be taken into account.

Multiple accounts: If a company requires frequent business transactions in multiple countries, it may be necessary to open multiple offshore accounts to meet the demands. Managing those accounts might lead to additional administrative work and pose challenges for financial management.

How can I transfer corporate funds to other countries?

Transferring corporate funds to Mainland China

While remitting from a Hong Kong (HK) company to Mainland China does not entail foreign exchange control, different requirements and procedures are still required based on the currency involved.

For Chinese Yuan (CNY), Mainland companies must undergo a one-time registration in the Renminbi Cross-Border Receipts and Payments Information Management System (RCPMIS) before they can receive overseas remittances in CNY.

For other foreign currencies such as US Dollars (USD), Hong Kong companies can make direct remittance as long as the Mainland China company's account supports the currency. However, if the amount exceeds US$50,000, HK companies will need to provide contracts, invoices, or other transaction documents for processing.

Transferring corporate funds to US

Currently, the US does not impose any foreign exchange controls. This means that funds can freely flow in and out without the need for declaration. However, it is important to note that remittances must be made directly to a checking or savings account, and it is not permissible to send USD to a brokerage or intermediary bank.

Transferring corporate funds to Europe

Each European country has its own unique set of regulations governing remittance, which are tailored to match with their specific financial system and regulatory needs.

Transferring corporate funds to Japan

Japan has strict regulations governing international money transfers and foreign exchange transactions. Ensure compliance with the Foreign Exchange and Foreign Trade Act and other relevant laws to facilitate smooth fund transfers.

Transferring corporate funds to Thailand

To combat fraud and money laundering, the Bank of Thailand mandates that specific reasons for fund transfers must be provided before the funds are credited into Thailand. These purposes can range from purchasing goods, acquiring property, investing in businesses, to covering living expenses.

How do I choose the right corporate remittance service?

In addition to remittance services from traditional banks, remittance platforms present an alternative solution that offers advantages in terms of cost, remittance speed, and supported currencies. To make an informed decision, it is advised to take the following six key factors into account:

Fees: Service charges directly impact the cost of remittances. Please be aware that different platforms charge differently so take note of any additional or hidden fees such as transaction fees and charges for transfer or receiving funds.

Remittance speed: For cross-border trading companies, fast remittance services are often necessary. It is advisable to choose a platform that can process both single and batch remittances quickly to ensure smooth operations.

Reliability of the platform: Choosing a reputable and reliable remittance platform is of utmost importance. This ensures the security of funds and safeguards the interests of the company and its customers.

Customer service: The customer services team of the remittance platform plays a vital role in delivering prompt and efficient assistance to address any technical issues or challenges. that may arise. Their role is crucial in ensuring timely support and effective solutions.

The support of currency conversion: For companies operating in multiple regions and countries, it is essential for the remittance platform to support multiple currency conversions, as this sets the stage for future business expansion and growth.

Network security: Ensuring the security of online remittance services is paramount, particularly in light of the escalating cyber threats. Therefore, it is vital to select a remittance platform that offers robust network security and cutting-edge financial technology to avoid monetary loss and data breach.

Airwallex — the all-in-one platform for corporate and online transfer services

Airwallex is a professional financial platform that supports all walks of businesses. Our wide range of features allow businesses to streamline global payments and transfers. Whether you're a small business, a freelancer, or a large corporation in need of bulk international transfers, Airwallex offers fast, efficient, and cost-effective solutions for all your business needs.

Airwallex's user-friendly online transfer platform currently supports over 60 currencies worldwide. Exchange rates are transparent, and often more competitive than traditional banks. Corporate account holders can effortlessly conduct transactions at affordable fees, without any hidden costs, from virtually anywhere and at any time.

Additionally, Airwallex has forged partnerships with over 60 global banking partners and is regulated by the Hong Kong Customs and Excise Department. Our security system includes the global's highest level of security certification, multiple encryption, and identity verification technologies.

Click here to learn more about Airwallex's Business Account.

View this article in another region:Hong Kong SAR - 繁體中文

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

TransfersShare

- What is an online remittance?

- How can remittance be done online?

- Popular local remittance options and transfer services in Hong Kong

- Can I open an offshore account online and make local remittance?

- How can I transfer corporate funds to other countries?

- How do I choose the right corporate remittance service?

- Airwallex — the all-in-one platform for corporate and online transfer services