The UK is one of Hong Kong’s largest trading partners in Europe. Along with an increasing number of people from Hong Kong immigrating to the UK, the demand for both commercial and personal remittances between the two places has grown. This article aims to guide readers through the different methods, fees, processing time, and tax implications of remitting from the UK to Hong Kong.

Methods to transfer from the UK to Hong Kong

Here are the options to transfer from the UK to Hong Kong.

British local banks (wire transfers): If you have a UK offshore account (also known as an overseas account) or a local bank account in the UK, you can visit the bank branches for wire transfer services to Hong Kong. Generally, the sender needs to provide the recipient's Hong Kong bank account number, name of the bank, branch number, the address, and SWIFT code.

Online Banking: You can use the online banking services from UK banks to make cross-border remittances to Hong Kong. After logging into your online banking account, select the remittance option. Enter the recipient's Hong Kong bank account number, name of the bank, branch number, address, SWIFT code, and pay the associated fees. It is important to note that each bank charges different international remittance fees and have varying cutoff times.

Money changers: Bureau de Change in the UK provides remittance services to Hong Kong. You can visit a money changer in person or use their online services to make international remittances. However, this method is usually suitable for small remittances and funds may take 2 to 3 days to arrive. Exchange rates may also be higher and multiple fees may apply.

Credit cards and debit cards: Some UK banks, Hong Kong banks, and third-party remittance platforms offer credit card and debit card services. Remitters can use their cards for the payments and remittances.

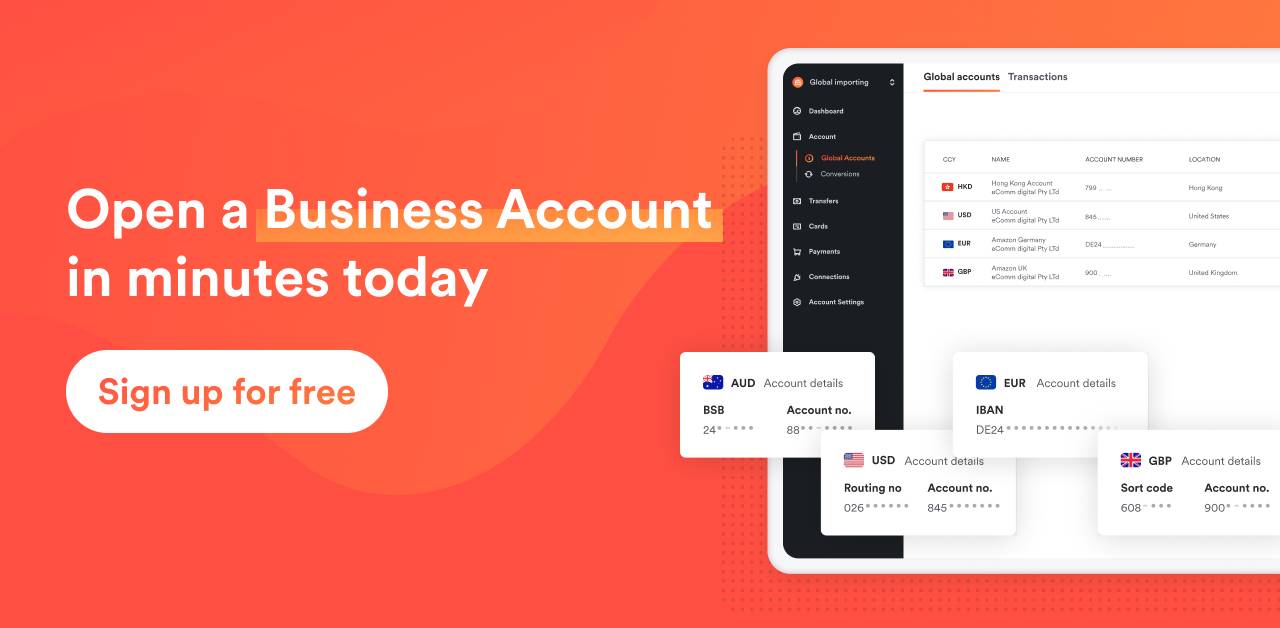

Third-party remittance platforms: Remitters can open accounts on remittance platforms anywhere, anytime, and transfer funds from the UK to Hong Kong. For example, the one-stop financial platform, Airwallex, provides a range of services for business accounts, including currency exchange, remittances, payment management, financial management, and expense management, and more. Airwallex’s Business Account supports 23+ currencies (including GBP) and charges zero account opening fee. Remittances can be directly deposited into the GBP account, avoiding mandatory currency conversion.

Comparing the cost of money transfer from the UK to Hong Kong

Money transfers from the UK to Hong Kong are commonly made through bank wire transfers, However, the remittance fees can vary significantly depending on the transferred amount and the type of transfer. Moreover, the exchange rates offered by banks tend to be less competitive. Receiving banks in Hong Kong may also further add to these expenses by charging their own remittance fees.

Although banks may occasionally offer exchange rates similar to renowned money changers, they still impose additional fees and enforce strict cutoff times for processing different currencies. For instance, Barclays Bank charges a minimum of £25 for branch transfers and £6 for overseas transfers. Consequently, bank transfers still generally turn out to be the costlier option.

On the other hand, third-party financial and transfer platforms like Airwallex not only offer attractive exchange rates, which are usually lower than those of banks, but they also have no potential fees, no cutoff times, and no remittance limits. This makes them a convenient and cost-saving method for remittances.

Processing time for money transfers from UK to Hong Kong

International remittances typically take 1 to 5 business days to complete, depending on factors such as the amount being transferred and the accuracy of the provided information. With third-party financial platforms like Airwallex, 70% of the transactions can achieve same-day completion. It's noteworthy that some banks have cut-off times, which can cause delays for remittances processed beyond these periods. In these scenarios, utilising online banking proves to be significantly more efficient than conducting the transaction in person at a UK bank branch.

| Third-party remittance platforms | Through British banks (wire transfers) | Online banking | |

|---|---|---|---|

| Processing time | As fast as same-day arrival | As fast as 1 day in general, but it can take up to 8 days | Same-day or in 1 business day |

Are there any restrictions when remitting from the UK to Hong Kong?

There are no specific restrictions on the remittance amount or remittance methods when sending money from the UK to Hong Kong. However, in special occasions such as large remittances, banks or the service providers may require additional documentation or information to ensure the legality and compliance with relevant regulations. This may involve providing identification documents, proof of the purpose of the remittance, proof of the legitimacy of the transaction, and more.

Do I have to pay taxes when remitting from the UK to Hong Kong?

Remittances from the UK to Hong Kong are not subject to taxation. However, there is a possibility of taxation when importing funds into the UK.

According to the Remittance Basis 2021, if you are a UK Tax Resident but claim that your residence is still in Hong Kong (not domiciled in the UK), you can apply for the Remittance Basis for alternative tax treatment. This allows you to declare taxes for overseas income and gains only if they are remitted to the UK, and you are only liable to UK tax on those you remit to the UK.

Things to consider when sending money from the UK to Hong Kong

It is recommended to pay attention to the GBP/HKD exchange rate, as well as the processing time, and potential fees associated with bank branches, online banking, and third-party remittance platforms. Additionally, banks or remittance providers may require the remitter to provide proof of the remittance’s purpose and contract, along with invoices or other supporting documents.

Typically, third-party remittance services provide more advantageous exchange rates than those offered by British banks or money changers. They also tend not to impose intermediary or hidden charges. For regular or substantial transfers, opting for a third-party remittance provider can lead to significant savings. It is recommended to take some time to compare the most recent exchange rates and fees across various remittance options before making a transfer.

Advantages of Airwallex compared to traditional bank remittances

Airwallex is a one-stop financial and transfer platform, offering a significant advantage over traditional banking services with its round-the-clock account opening capabilities. Notably, the platform charges zero account opening fee.

Upon opening a business account with Airwallex, companies can access a global account that supports payments in local currencies through the local bank network, thus avoiding the high costs associated with mandatory currency conversions. For international transfers, Airwallex offers more favourable interbank exchange rates. This feature simplifies the management of global payments and finances, significantly enhancing profitability.

FAQs

Is there a limit on the amount when sending money from the UK to Hong Kong through online remittance?

Yes, the maximum amount varies depending on the policies set by different banks. For example, Barclays Bank has a daily transfer limit for online transactions. Therefore, if you intend to make large remittances, it is best to directly contact your bank.

Are third-party remittance platforms safe and reliable?

Yes. For commercial transfers, using licensed platforms is strongly recommended for ensuring the safety, reliability, and security of both funds and processes. Take Airwallex, the one-stop financial platform, as an example, it operates under the regulation of the Hong Kong Customs and Excise Department and holds a Money Service Operator license (MSO License No. 16-09-01929). Additionally, Airwallex is either registered or holds authorised licenses from regulatory bodies in several overseas countries, including the UK, US, Australia, and Canada, further solidifying its credibility and trustworthiness.

What are the options to collect money from the UK to Hong Kong?

There are multiple ways to collect money from the UK in Hong Kong, including traditional bank, offshore accounts of Hong Kong banks, and third-party platforms. Among these, third-party financial platforms like Airwallex can be opened with $0, and the sign-up procedures can be completed within a few minutes.

*As of 14 April 2024. Information provided is for reference only. Please refer to the official websites of banks, money changers and remittance platforms for the most up-to-date details.

View this article in another region:Hong Kong SAR - 繁體中文

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

TransfersShare

- Methods to transfer from the UK to Hong Kong

- Comparing the cost of money transfer from the UK to Hong Kong

- Processing time for money transfers from UK to Hong Kong

- Are there any restrictions when remitting from the UK to Hong Kong?

- Do I have to pay taxes when remitting from the UK to Hong Kong?

- Things to consider when sending money from the UK to Hong Kong

- Advantages of Airwallex compared to traditional bank remittances

- FAQs