How accountants can support eCommerce clients in Q4 and beyond

Sophia Cheng

Senior Manager, Content Marketing

It’s the most wonderful time of the year, as the old song goes. And it’s a particularly wonderful time for eCommerce businesses, with Q4 sales totalling USD257.62 billion in the US alone in 2021 at a growth rate of 9.2% YOY.

But with steep targets, tough competition and ever-changing logistical challenges, this is also a stressful time of year.

What can accountants do to alleviate some of that stress and steer their clients towards success in Q4 and beyond? We sat down with Darren Buckley, Founder and Managing Director at Finzo, an accountancy advisory company that helps clients manage finance function leveraging technology, to find out.

Fail to prepare, prepare to fail

There are various global factors that have made planning for Q4 success more of a challenge in 2022.

One of them is currency volatility. For eCommerce businesses with international suppliers and/or customers, instability in the forex market can have a serious impact on profit margin. To mitigate the risk, Darren recommends his clients use a multi-currency account, such as Airwallex, to hedge against currency fluctuations.

“It comes back to having that control over how and when you convert currencies,” says Darren. “As opposed to using a system where payments are auto-converted and losing quite a bit depending on the volume of transactions.”

Another challenge comes from supply chain disruption caused by global headwinds including the price of fuel, worker strikes and rising freight container costs.

“Q4 is all about demand and being able to service that demand,” says Darren. “I think it’s about how businesses are planning ahead as opposed to being reactive. We have some clients who have been a bit more forward-thinking and invested in their manufacturing cycles and getting their stock in place, and they’re well prepared now. Not all businesses in the current climate have the cash flow to support that, but some have been lucky.”

Guiding clients towards global success

Despite the challenges, the opportunity for eCommerce businesses in today's market is huge, with annual global sales projected to reach USD7.4 trillion by 2025.

What makes that figure particularly exciting for ambitious entrepreneurs is the rise in cross-border shopping, which has opened up the growth potential of eCommerce businesses beyond their domestic market. An eCommerce business can now expand into the world’s fastest-growing markets without ever getting on a plane.

According to Darren, the opportunity here is twofold. eCommerce businesses can reach millions of new customers by scaling abroad and open themselves up to interest from international investors.

“What I’m finding at the minute is that the UK market is extremely anxious,” says Darren. “Whereas if you look at the US and Canada VCs, they are still looking to invest in businesses with strong trade links to other markets overseas.”

[Related: The top cross-border eCommerce markets businesses should expand into in 2022 and beyond]

Implementing industry-specific financial infrastructure

Accountants play a crucial role in building the financial infrastructure that enables eCommerce businesses to manage transactions across multiple currencies, platforms and countries. This is not always an easy feat. Whilst some clients are fully onboard with the latest tech from day one, others may need some coaching.

“For us it’s been about shifting our clients’ mindset away from this old-school way of accounting and introducing them to various levels of technology that can provide that finger-on-the-pulse relationship between us and them,” says Darren. “Then we allow ourselves to guide them through going into new markets and ensuring they’re making the right decisions.”

Darren stresses the importance of using industry-specific technology to better serve clients. With the right software in place, eCommerce businesses can step away from manual processes and spend more time on growth.

“We’re not your standard Xero and Quickbooks firm,” says Darren. “We have many finance applications which we use. When we source these products we look at the wider integrations, the wider App Marketplace, to see what else we can bring in to help these clients on an operational level. We look at where ops and finance overlap.”

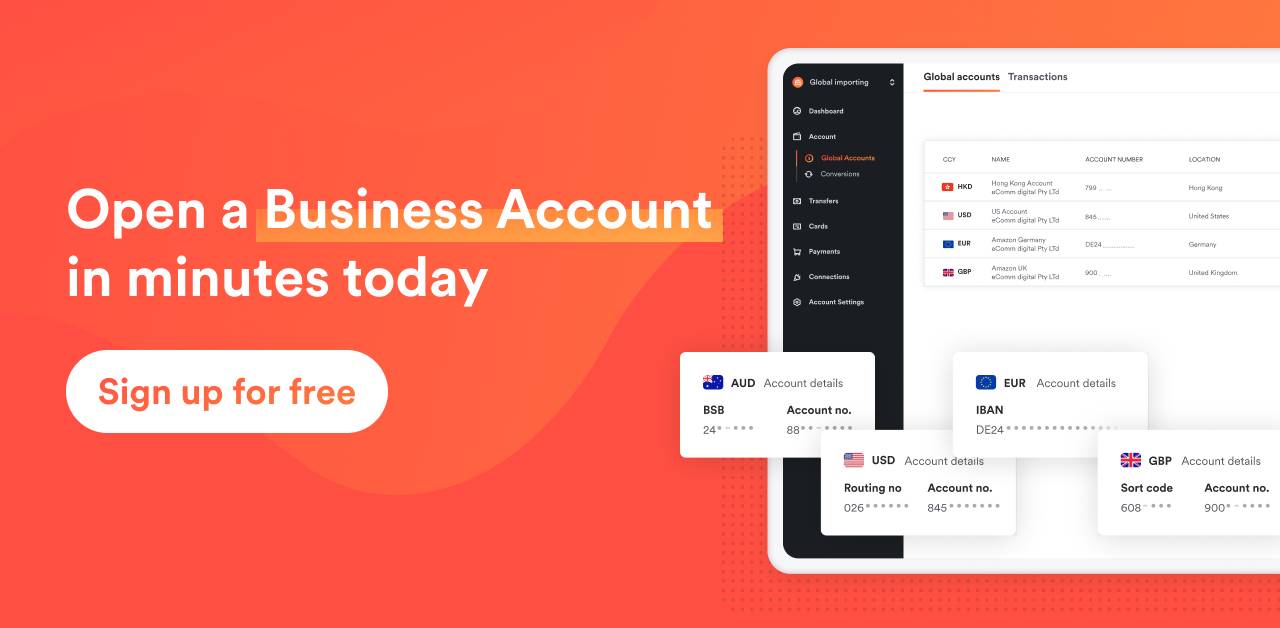

As an example of how the right technology can enable growth, Darren points to a client that has recently launched on a popular consumer platform in the US. The platform exists on the US app store and business owners need a local US foreign currency account to access it.

Using Airwallex, Darren’s client was able to set up a US domiciled foreign currency account from the UK at the click of a button. “You wouldn’t be able to do that with a high street bank,” he says.

The business account built for eCommerce

Airwallex provides financial infrastructure for high-growth eCommerce businesses.

Open 11 foreign currency accounts for free at the click of a button and collect, hold and spend in multiple currencies without high fees or forced currency conversions.

“If you have even a small bit of overseas expenditure, get Airwallex, it’s a no-brainer,” says Darren. “Being able to open a foreign currency account in many jurisdictions within seconds is so useful. Being able to hold a currency, for example, in USD and keep it in USD for future spend is great. It gives the business owner control over their finances. And given the market at the minute, being able to make a hedged bet when it comes to currency conversions is useful.”

Airwallex also offers Online Payments technology, multi-currency cards, and expense management, allowing eCommerce businesses to manage their entire financial ecosystem in a single platform.

Interested to be our accountant partner to help you support your eCommerce clients? Click here to learn more.

View this article in another region:AustraliaHong Kong SAR - 繁體中文United KingdomUnited StatesGlobal

Sophia Cheng

Senior Manager, Content Marketing

Sophia has a robust background in the fintech industry spanning investments to payments. Her background provides a holistic view of technology and finance, and how they can play a crucial role in streamlining financial operations for businesses.

Posted in:

Accounting