More and more professional remittance companies have entered the international market, such as Airwallex, Wise, OFX, and XTransfer – but what sets remittance companies apart from banks? This article compares remittance platforms across five key areas: fees, processing time, FX rate, currencies, and reliability, to help you choose the most suitable remittance platform and save on operating costs.

What are remittance platforms? And what sets them apart from traditional banks?

Historically, remittance platforms have been known for their lower fees compared to banks, yet concerns lingered about their reliability. However, these platforms have expanded to offer a wider array of services beyond international remittance. Some now offer specialised services like multi-currency accounts, fast international transfers, borderless Visa cards, expense management, and online payment collection. These services can better serve the needs of small and medium-sized enterprises (SMEs) and provide a more convenient and cost-effective option for business operations.

While remittance platforms are not traditional banks and do not participate in Deposit Protection Schemes (DPS), a reputable platforms such as Airwallex is regulated by the Hong Kong Customs and Excise Department (C&ED), and operates as a Licensed Money Service Operators (MSO) with a Money Service Operator License (MSO License No. 16-09-01929). Furthermore, Airwallex is authorised by regulatory bodies in multiple countries worldwide, including the Financial Conduct Authority (FCA) in the United Kingdom (UK), the Australian Prudential Regulation Authority (APRA) in Australia, and the Monetary Authority of Singapore (MAS), ensuring the secure provision of remittance services to its clients.

Why do you need a remittance platform? Limitations of traditional bank remittances

Opening a commercial account with traditional banks is not easy for SMEs, as SMEs are required to submit various business documents and the process involves a lot of restrictions. Even if an account is successfully opened, frequent international remittances can lead to higher FX rates and costly remittance fees, adding unnecessary costs to the operations.

Limits on remittance amount

Small remittances: Traditional banks set daily limits on wire transfers to safeguard customer accounts. These limits usually fall into two categories: non-registered payees and registered payees. For non-registered payees, the daily limit is relatively low, typically ranging from HK$100,000 to HK$400,000.

Large remittances: For remittances exceeding the aforementioned limit for small remittances, banks mandate customers to register recipient information. Registered payees can enjoy substantially higher limits, ranging from HK$500,000 to $3,000,000 per day. However, it's important to note that it takes time for the banks to process the registration of payee details. For larger-scale wholesalers intending to make big transfers, it is recommended to register the recipient details with the bank in advance.

As for remittance fees, banks may charge fixed fees based on the transfer amount, along with additional fees such as agent bank fees, cancellation fee, payment termination, or modification of payee information. Funds are received within 1-5 working days rather than instantly regardless of the remittance amount, so it's important to thoroughly inquire about these details with the bank before sending money abroad.

Restrictions on overseas remittances

Overseas remittance restrictions vary by country and local regulations. In general, there are no restrictions when sending funds to major countries like the United States (US), Canada, and the UK. However, when remitting funds to mainland China in Chinese Yuan (CNY), Hong Kong residents are limited to a maximum of CNY$80,000 per person per day, and the funds can only be transferred to a mainland personal account under the same name.

Applying for and opening a bank account

The process of applying for and opening a corporate bank account is similar to that of opening a personal account. Start by reviewing the steps and required documents for opening a corporate account online. Next, provide the company's information and complete the application forms, along with uploading the necessary documents. After that, submit the payment for the application fees.

After completing these steps, the bank will verify the application, including identity authentication. Finally, deposit the funds on the specified date following the account opening to finalise the process.

Benefits of using a remittance platform for transfers

As mentioned earlier, reputable remittance companies can offer more competitive rates, waive transaction fees for currency exchange with no minimum remittance requirement.

You might wonder how these companies can provide all those benefits. Simply put, professional remittance companies maintain bank accounts globally and utilise their networks to facilitate international transfers for clients. This allows them to save on SWIFT network charges (typically incurred in bank wire transfers) and various intermediary bank fees. As a result, most remittance companies can offer real-time preferential FX rates with no minimum transaction amount and favorably lower fees compared to those charged by banks.

How to choose and compare remittance platforms?

When choosing a remittance platform, it's important to consider five key factors: remittance handling fees, processing time, FX rates, variety of currencies, and security.

Handling fees: Various remittance platforms have different handling fees. It is essential to be mindful of any additional or hidden charges such as transaction fees, transfer fees, etc., as these expenses directly impact the overall remittance cost.

Processing time: Cross-border trading companies often require swift remittance, so it's wise to choose a service platform capable of completing single or batch remittances within a short timeframe to ensure seamless business operations. The majority of remittance companies in the market are capable of achieving real-time transfers.

FX rates: Cross-border remittances involve multiple currencies, so it's crucial to select a remittance platform that supports various currency conversions with lower exchange rates to save costs

Variety of currencies: Each country has its own currency so it's important to ensure that the remittance platform supports the required currencies. You should also consider whether certain currencies entail any potential transfer fees.

Security: Opt for a reputable and highly reliable remittance service platform that holds a valid operating license. This not only ensures the security of funds but also protects the interests of both the company and its clients.

Comparing the 4 major remittance platforms: Wise, Airwallex, XTransfer, and OFX

| Remittance platforms | Airwallex | Wise | XTransfer | OFX |

|---|---|---|---|---|

| Fees | $0 account opening fee and monthly fee | $0 account opening fee | $0 maintenance fee, transfer fee | $0 account opening fee, monthly fee |

| FX rate | As low as 0.2% above interbank FX rates | From 0.42% above interbank FX rate | Real-time preferential FX rate | Preferential FX rate |

| Processing time | 70% of the transfers can be credited the same day | 80% of the transfers can be credited the same day | 1 - 3 working days | 80% of the transfers can be credited the same day |

| Currencies | 60+ | 40+ | 14 | 55 |

| Reliability | Holds the MSO Licence and is under the regulation of the C&ED | Holds the MSO Licence and is under the regulation of the C&ED | Holds the Stored Value Facility Licence and is under the regulation of The Hong Kong Monetary Authority | Under the regulations of Hong Kong Customs and Excise Department |

*As of 13 March, 2024. All information is for reference only. Please refer to the official website of the remittance platforms for the most up-to-date information.

General steps and required information for opening an account on remittance platforms

Visit the website or mobile app (if applicable) of the remittance platform, and prepare the following documents: Certificate of Incorporation, Business Registration Certificate, and the authorised agent's identification documents. Submit the required documents and the account verification will usually be completed within 24 hours or up to 3 days. Once the verification is completed, you can start using the remittance service.

Why should you choose Airwallex?

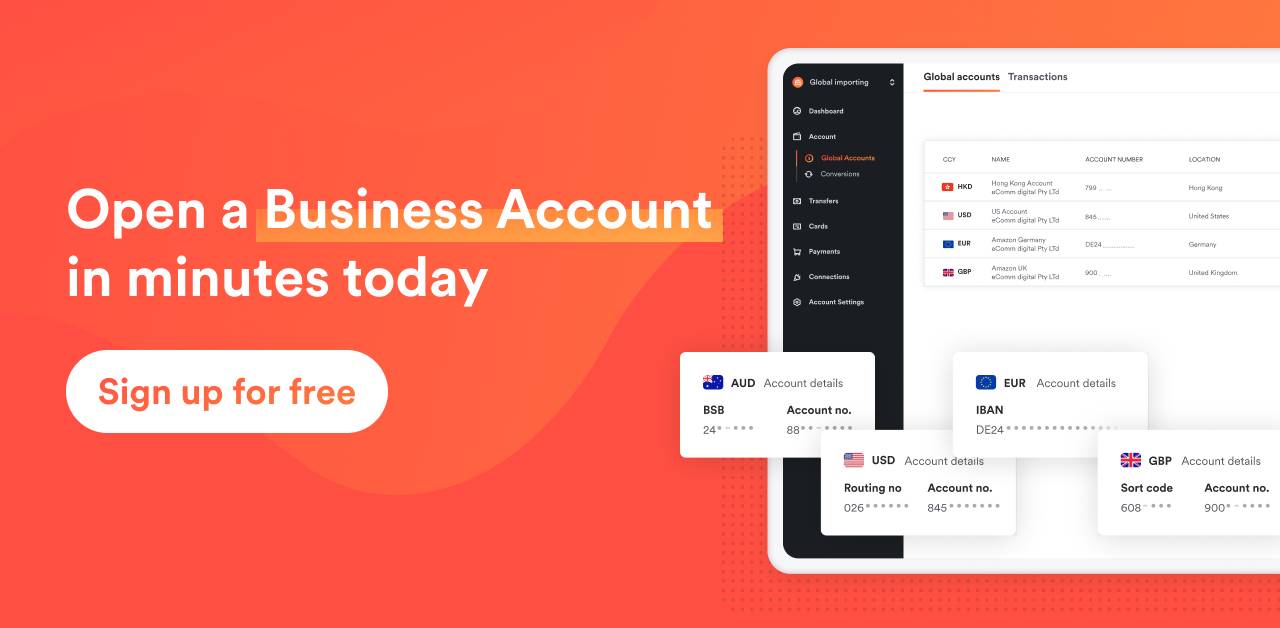

Airwallex is regulated by the Hong Kong Customs and Excise Department and holds a MSO License. Airwallex is also registered or authorised by regulatory authorities in multiple countries overseas. Currently, you may register for an Airwallex Business Accounts without any account opening, and there are no minimum balance requirements.

Airwallex supports over 60 currencies, including USD, GBP, CNY, EUR, JPY, KRW, and more. Enjoy real-time favourable exchange rates with no minimum transaction amount, and receive funds as quickly as one business day, and full amount credited upon arrival.

Furthermore, Airwallex offers additional services and products, such as Borderless Visa Cards, Expense Management and Payments, all of which support the operation of your company. For example, Airwallex's exclusive Borderless Visa Card can be issued for employees and companies within minutes at no cost. It can be used for payments at any Visa-accepting location, online or in-store. This allows for direct payment of global expenses from multi-currency accounts, eliminating unnecessary FX conversion fees, and featuring $0 overseas transaction fees. Companies can have real-time visibility of major corporate expenses, thereby saving operational costs.

FAQs

Are there any restrictions from remittance platforms?

Yes. Different remittance platforms may impose limits on transaction amounts or daily remittance totals, as well as restrictions on remittances to specific countries or regions. Some platforms may also temporarily restrict services to commercial clients only. Therefore, it's recommended for everyone to compare remittance platforms to find the best fit for their needs.

Are remittance platforms in Hong Kong regulated?

Remittance platform companies in Hong Kong are regulated by the Hong Kong Customs and Excise Department, and are required to hold a MSO License in order to conduct remittance and currency exchange services.

View this article in another region:Hong Kong SAR - 繁體中文

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

TransfersShare

- What are remittance platforms? And what sets them apart from traditional banks?

- Why do you need a remittance platform? Limitations of traditional bank remittances

- Applying for and opening a bank account

- Benefits of using a remittance platform for transfers

- How to choose and compare remittance platforms?

- Comparing the 4 major remittance platforms: Wise, Airwallex, XTransfer, and OFX

- General steps and required information for opening an account on remittance platforms

- Why should you choose Airwallex?