Accept SWIFT bank transfers

Understand SWIFT bank transfers

SWIFT bank transfers support international payments, but involve longer processing times and higher fees compared to local bank transfers. Because of this, SWIFT requires additional configuration to avoid delays and unnecessary fees.

Slower payment timing

Unlike local bank transfers, which are typically completed instantly or within a few hours, SWIFT transfers can take up to three business days to arrive after your customer sends the payment.

We recommend not using SWIFT when payment collection needs to be immediate or has a short timeline. To account for potential delays, we recommend allowing your customers at least five business days to complete SWIFT payments.

Higher and less predictable fees

SWIFT transfers may involve fees charged by your customer's bank and intermediary banks. To reduce deductions, customers should select the OUR fee option when making the transfer. However, this is not guaranteed.

In some cases, customers may believe they have paid the full amount, while you receive less than expected due to fees deducted during the transfer.

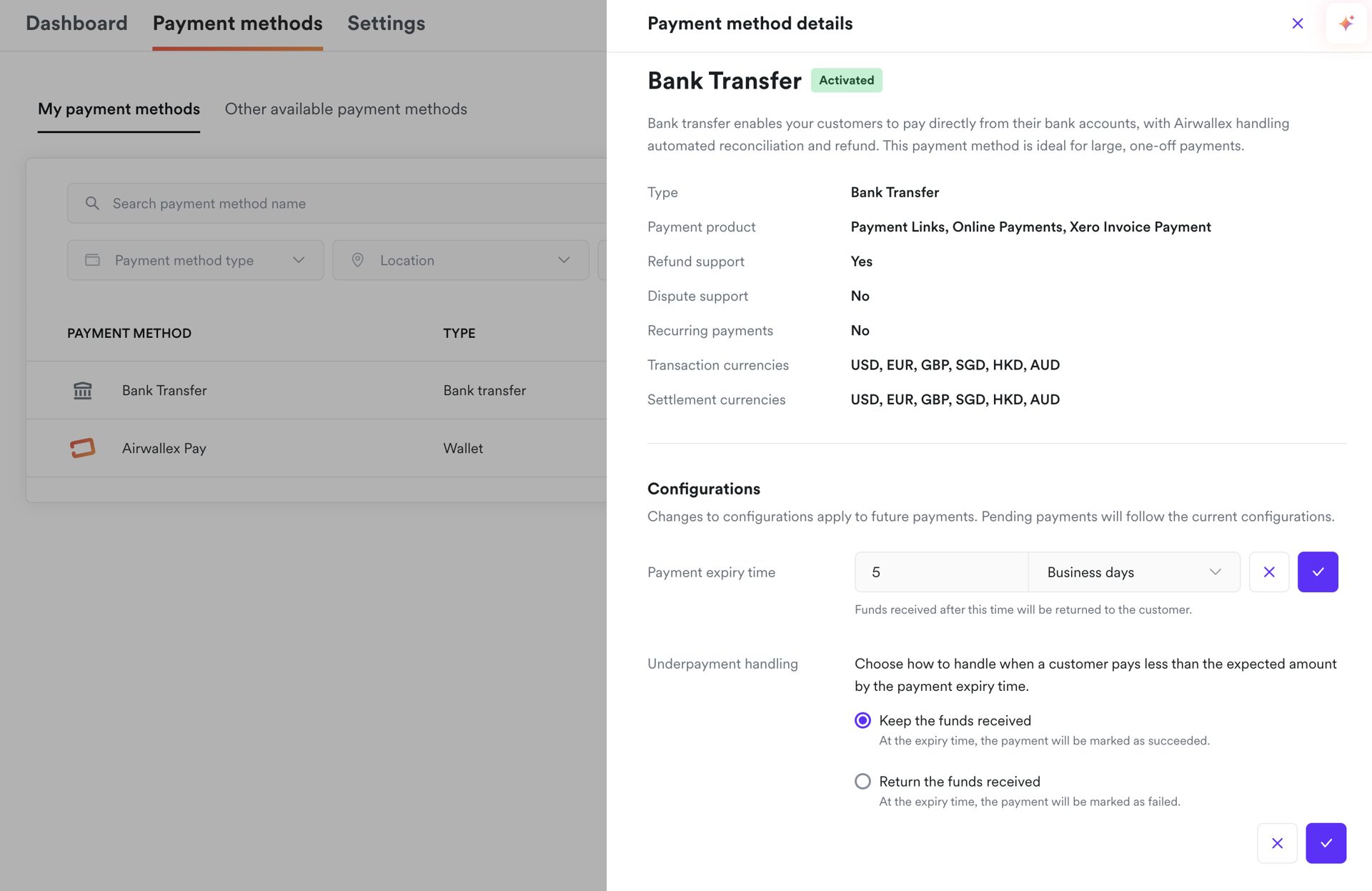

To avoid costly returned payments and extra fees for both you and your customers, we recommend choosing Keep the funds received for the underpayment configuration. This allows you to keep the funds you receive and request the remaining balance separately, rather than having the transfer returned.

You can update your preferences in the web app at Payments > Payment Methods > Bank Transfer > Configurations.

Over and underpayment handling

When a payment amount does not match the expected amount, how the funds are handled depends on your selected preference and the applicable SWIFT return fees.

Underpayments

If you choose Return the funds received for underpayments, Airwallex will first compare the received amount with the SWIFT return fee.

If the received amount is less than the SWIFT return fee (for example, around USD 20 per transaction on average), the funds will not be returned.

Instead, the funds will be settled to your Airwallex balance, as returning them would result in higher costs than the amount received.

Overpayments

For overpayments, Airwallex applies the same logic when returning excess funds:

If the excess amount is less than the SWIFT return fee, the excess funds will not be returned to your customer.

Instead, the excess amount will be settled to your Airwallex balance.

Refund fee option

There are two refund fee options:

- SHARED. The fee is shared between you and your customers. We apply this fee to returns caused by customer-initiated transfer issues, such as:

- Payment received after the expiry time.

- Underpayment due to incorrect transfer fee selection.

- PAYER. The fee is borne by you. We apply this fee to all refunds initiated by you.