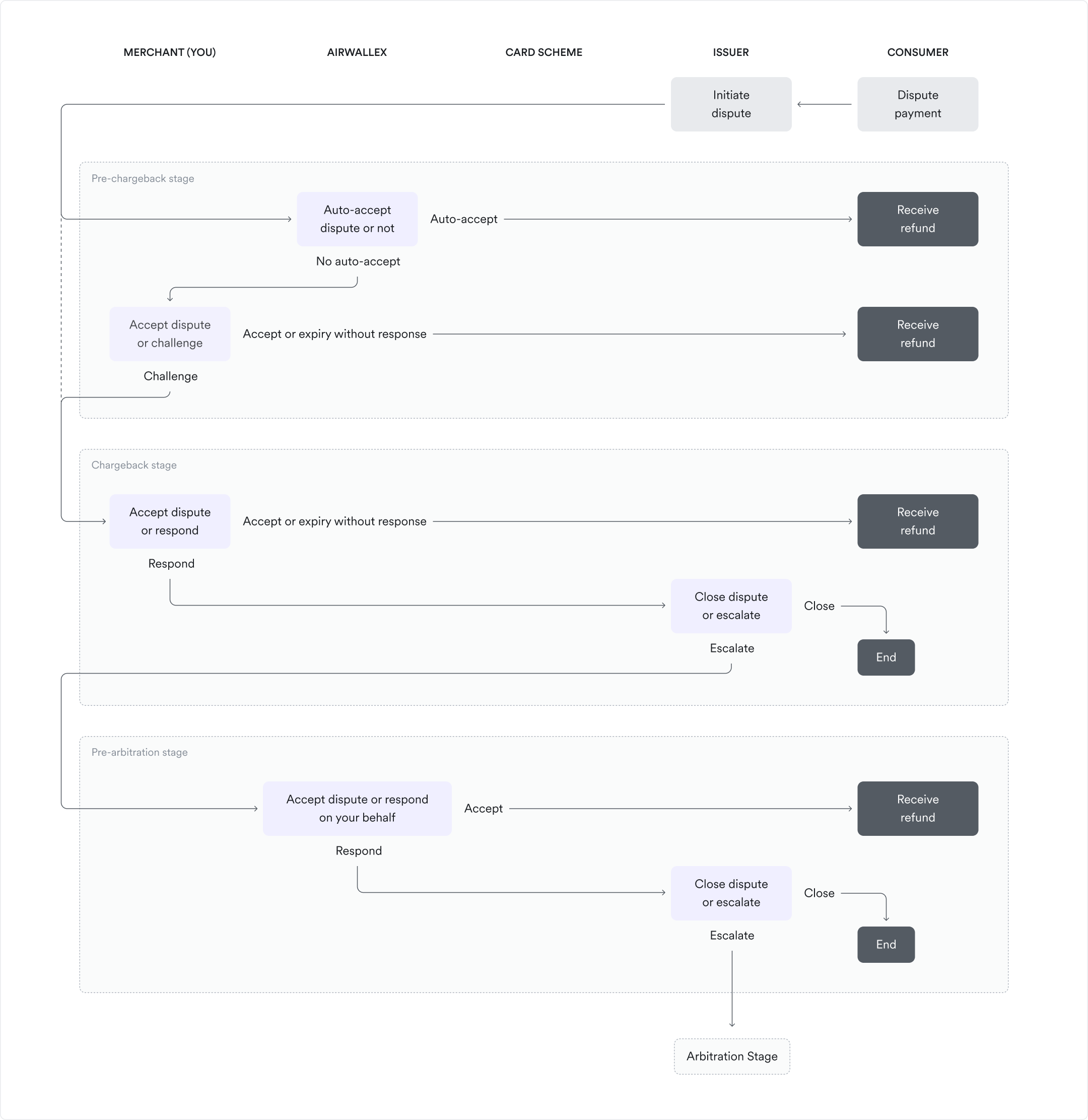

Dispute flow

Disputes on card-based payment methods can go through different stages and statuses. The process can vary slightly for different card schemes or scenarios, but most commonly will follow the flow below.

Pre-chargeback stage

Airwallex auto-accepts the dispute on your behalf before it enters the chargeback stage. Learn more about pre-chargeback programs.

Applicable only if your account is enrolled in pre-chargeback programs.

Please note that not all disputes go through the pre-chargeback stage. You may find disputes directly entering the chargeback stage, such as Visa disputes above a predefined threshold value (the auto-accept threshold) or disputes from card schemes or issuing banks who don’t support pre-chargeback programs.

The table below describes the dispute statuses during the pre-chargeback stage.

| Status | Description |

|---|---|

| Requires response | You can accept or challenge the dispute. |

| Accepted | The dispute has been accepted and the payment will be refunded to the shopper. A dispute can be in this status if you accepted it via web app or API, Airwallex auto-accepted it based on pre-chargeback thresholds configured for your account (accept reason: "Auto-accepted by Airwallex"), or it expired without a decision (accept reason: "Expired"). This status is final and cannot be overturned. |

| Challenged | Airwallex has informed the issuing bank that you would like to challenge the dispute. The issuing bank will escalate the case to the chargeback stage in the coming days. When this happens, the case will reappear in your dispute response queue, where you can submit supporting evidence. |

| Reversed | The pre-chargeback has been reversed by the issuing bank. No further action is required. |

Chargeback stage

When a dispute enters chargeback stage, the card scheme will immediately debit Airwallex for the disputed amount and related dispute fees. Airwallex in turn will deduct the disputed amount, plus a chargeback fee, from your next settlement. You can then choose to accept the dispute or challenge it by responding with supporting evidence.

The table below describes the dispute statuses during the chargeback stage.

| Status | Description |

|---|---|

| Requires response | You can accept or challenge the dispute. |

| Accepted | The dispute has been accepted and the payment will be refunded to the shopper. A dispute can be in this status if you accepted it via web app or API or it expired without a decision (accept reason: "Expired"). This status is final and cannot be overturned. |

| Challenged | Airwallex will respond to the issuing bank with evidence provided by you. The issuing bank will review your evidence and decide whether to further escalate. The issuing bank has up to 115 days after your response to escalate the dispute. |

| Won | The issuing bank has accepted your response by not further escalating within 115 days. No further action is needed; this status is final for all participants. The chargeback fee remains non-refundable. |

| Reversed | The chargeback has been reversed by the issuing bank. No further action is required. The transaction amount will be credited back to you in the next settlement batch if you hadn’t previously responded to the dispute. |

Pre-arbitration stage

When a dispute enters pre-arbitration stage, card schemes will debit Airwallex when pre-arbitration is accepted with the exception of JCB - JCB will immediately debit the acquirer and related dispute fees. Airwallex in turn will deduct the disputed amount, plus a pre-arbitration fee, from your next settlement.

The table below describes the dispute statuses during the pre-arbitration stage.

| Status | Description |

|---|---|

| Pending Closure | The issuing bank has escalated the dispute to pre-arbitration and Airwallex is reviewing it. Airwallex will decide whether to accept the dispute or respond on your behalf and may reach out for more information. In most cases, Airwallex will accept on your behalf to help you avoid further fees (up to 500 USD). There is no movement of funds at this point. |

| Accepted | The dispute has been accepted by Airwallex on your behalf and the payment will be refunded to the shopper. This status is final and cannot be overturned. Funds will be debited from your wallet in the next settlement batch. |

| Challenged | Airwallex has responded to the dispute with additional evidence on your behalf. The issuing bank will review the evidence and decide whether to accept the response or not. |

| Won | The issuing bank has accepted the response provided. The disputed transaction amount will be credited back to your wallet with your next settlement. No further action is needed; this status is final for all participants. The pre-arbitration fee remains non-refundable. |

| Reversed | The pre-arbitration has been reversed by the issuing bank. The disputed amount will be credited back to your wallet with the next settlement. No further action is required. |

Other dispute stages

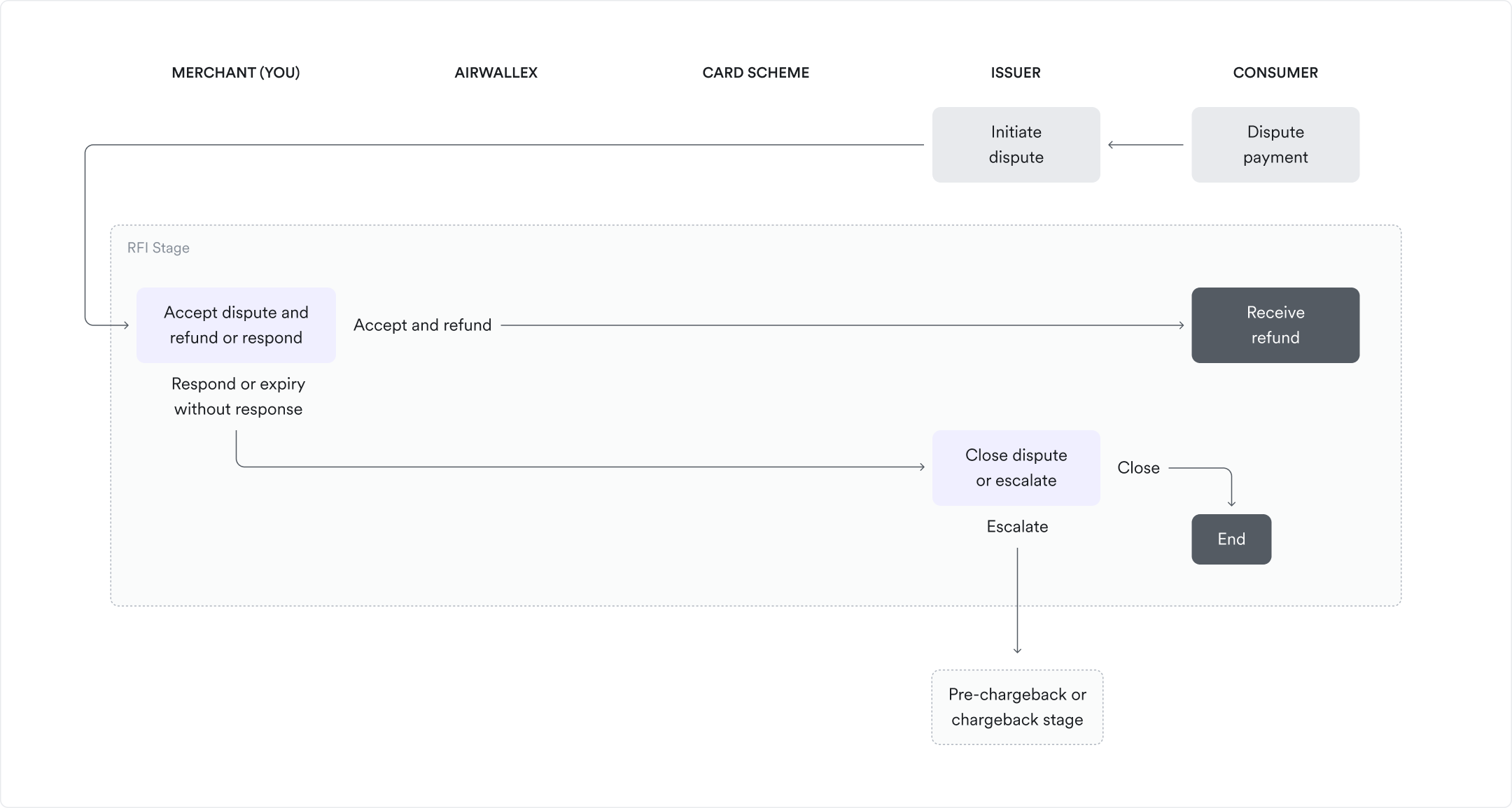

Request for Information (RFI) stage

The RFI stage precedes the pre-chargeback/chargeback stages. It is no longer used by Visa/ Mastercard, but for transactions on other card brands you may still receive RFIs.

You will receive an RFI when the shopper cannot recognize the payment or does not agree to be charged, seeking further information about this payment. In order to help the shopper recognize the payment and avoid further disputes, you should provide sufficient information about this payment to claim the legitimacy of the payment.

The table below describes the dispute statuses during the RFI stage.

| Status | Description |

|---|---|

| Requires response | You can accept and refund the payment transaction or provide the issuer with complete detail of the transaction to avoid further escalation into pre-chargeback or chargeback stages. |

| Challenged | Airwallex will respond to the issuing bank with evidence provided by you. The issuing bank will review your submitted evidence and decide whether to escalate the dispute or not. |

| Accepted | Airwallex will let the issuing bank know that you will refund the transaction. Please note that the transaction is not automatically refunded and that you will need to initiate the refund yourself. If the refund is not completed or only a partial amount is refunded, the issuing bank may still escalate the dispute to pre-chargeback or chargeback stage. |

| Expired | The RFI event has expired as you have not responded to the request within 15 days. The issuing bank may escalate the dispute to the pre-chargeback / chargeback stage; in such cases, you will see this case re-appear in your dispute response queue. |

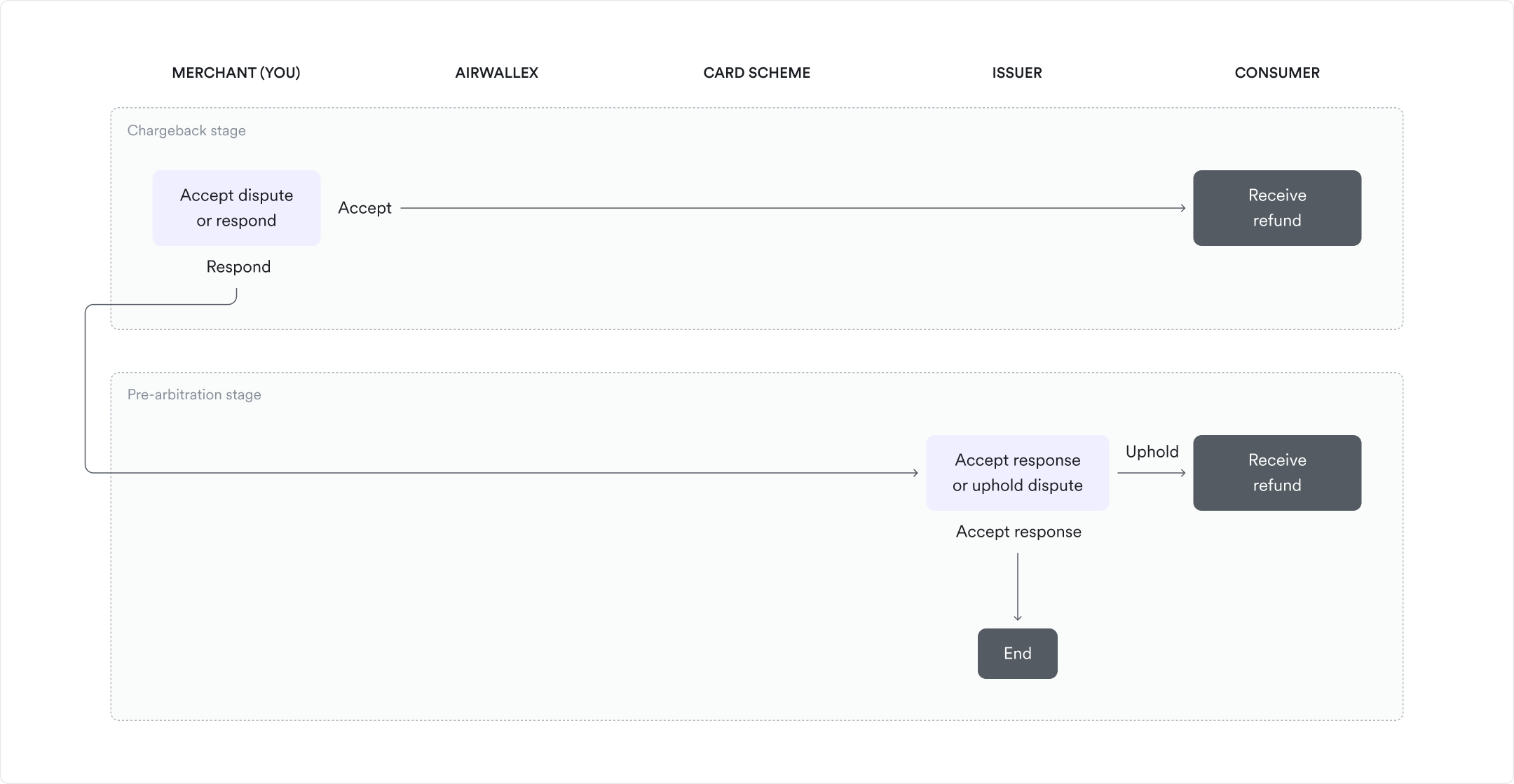

Pre-arbitration stage initiated through chargeback response

In some cases, responding to a dispute in chargeback stage may directly escalate the dispute into pre-arbitration stage. This is applicable to disputes where the card scheme is AMEX, UPI, or Visa (and the dispute reason is fraud / authorization related).

In such cases, when you respond to the chargeback, Airwallex will not immediately credit the disputed amount back to your wallet, but will instead wait for the response of the issuing bank to the pre-arbitration. You will also only incur a pre-arbitration fee if you lose the dispute during this stage.

The table below describes the dispute statuses for pre-arbitration initiated through chargeback response.

| Status | Description |

|---|---|

| Pending decision | Airwallex has responded to the issuing bank with evidence provided by you during the chargeback stage or pre-arbitration stage (applicable only when card scheme is AMEX). The issuing bank will review your submitted evidence and decide whether to accept the dispute or not. The issuing bank has up to 15 days after your response to decide. |

| Won | The issuing bank has accepted the dispute based on the evidence you provided. The disputed amount will be credited back to your wallet with the next settlement. No further action is needed, as this status is final for all participants with the exception of payments collected with AMEX card. For the AMEX card scheme, a dispute can be reopened upon further feedback from the shopper. The dispute will then move to Requires response status. |

| Lost | The issuing bank has not accepted the evidence provided by you. The payment will be refunded to the shopper. You will be charged a pre-arbitration fee. This status is final and you won't be able to overturn the dispute. |

| Requires response | This status is applicable only when the card scheme is AMEX. In this status, the issuing bank has not accepted the evidence provided by you in the chargeback stage. The payment amount will be debited again in the next settlement batch. |

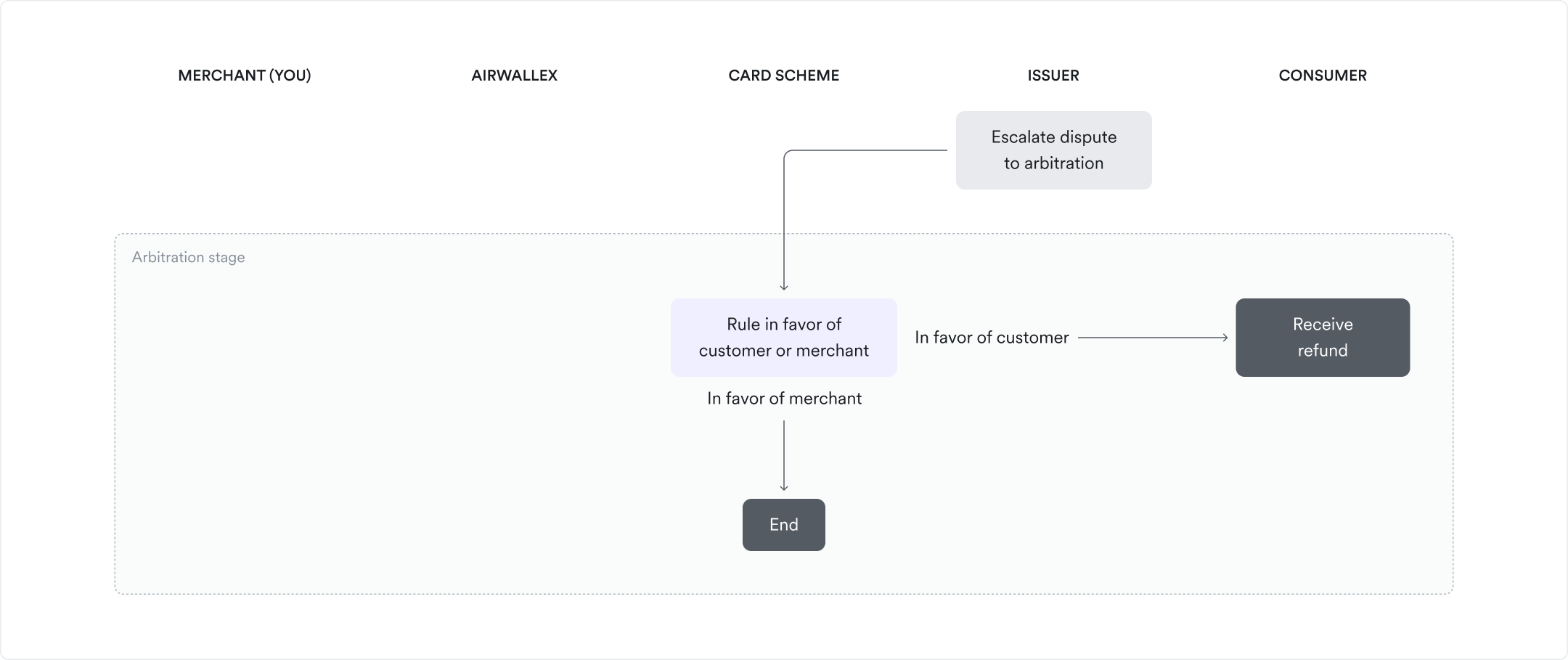

Arbitration stage

A dispute may enter arbitration stage if the issuing bank decides to escalate the dispute despite the evidence provided during chargeback and pre-arbitration stage. At this stage, the card schemes will evaluate all the evidence provided in the dispute exchanges and arrive at a ruling which has to be followed by all parties.

Generally Airwallex will help you avoid this stage, as fees charged to the losing party can go up to 500 USD.

The table below describes the dispute statuses during the arbitration stage.

| Status | Description |

|---|---|

| Pending decision | You are notified that the issuing bank has escalated the dispute to arbitration stage. No further action is required from you; the card schemes will decide based on the information that was previously provided. |

| Won | Card schemes have ruled the dispute decision in your favor. You will receive the principal amount in the next settlement batch. No further fees will be charged to your account. |

| Lost | Card schemes have ruled the dispute decision in issuer's favor. Airwallex will pass on the arbitration fees charged by the card schemes to you. These can be up to 500 USD. |

Financial impact of a dispute

A dispute can go through a series of transitions due to different combinations of stages and statuses. The financial impact on your wallet may vary depending on the dispute stage and status combination. Use the table below to quickly understand when your wallet will be debited or credited for the principal amount and various dispute fees.

| Stage | Status | Dispute amount | Fees |

|---|---|---|---|

| RFI | Accepted | Your wallet will be debited with the amount specified for refund. When accepting a dispute during the RFI stage, you can specify the amount to be refunded. | N/A |

| RFI | All other statuses | No financial impact on your wallet. | N/A |

| Pre-chargeback | Accepted | Your wallet will be debited with the dispute amount. | Your wallet will be debited with the pre-chargeback fee. |

| Pre-chargeback | Reversed | Your wallet will be credited with the dispute amount. | N/A (note that pre-chargeback fees will not be reversed). |

| Pre-chargeback | All other statuses | N/A | N/A |

| Chargeback | Requires response | Your wallet will be debited with the dispute amount. | Your wallet will be debited for the chargeback fee. Visa will charge an additional un-secure fraud fee on Visa dispute if the dispute reason is "Fraudulent", which will be debited from your wallet. |

| Chargeback | Challenged | Your wallet will be credited with the dispute amount. | N/A |

| Chargeback | Reversed | Your wallet will be credited with the dispute amount. | N/A (note that chargeback fees will not be reversed). |

| Chargeback | All other statuses | No financial impact on your wallet. | N/A |

| Pre-arbitration | Accepted | Your wallet will be debited for the dispute amount. | Visa/AMEX/JCB/UPI: N/A. |

| Pre-arbitration | Won | Your wallet will be credited with the dispute amount. | N/A |

| Pre-arbitration | Requires response | Your wallet will be debited for the dispute amount. This status is applicable for the AMEX card scheme only. | N/A |

| Pre-arbitration | All other statuses | N/A | N/A |

| Arbitration | Won | If the dispute amount wasn’t credited back to your wallet when you challenged the dispute (for example, because pre-arbitration was initiated by your response), then your wallet will be credited with the dispute amount. | N/A |

| Arbitration | Lost | Your wallet will be debited with the dispute amount if the dispute amount was previously credited back to your wallet when you challenged the dispute. | Your wallet will be debited with the arbitration fee. |

| Arbitration (collaboration mode) | All other statuses | N/A | N/A |