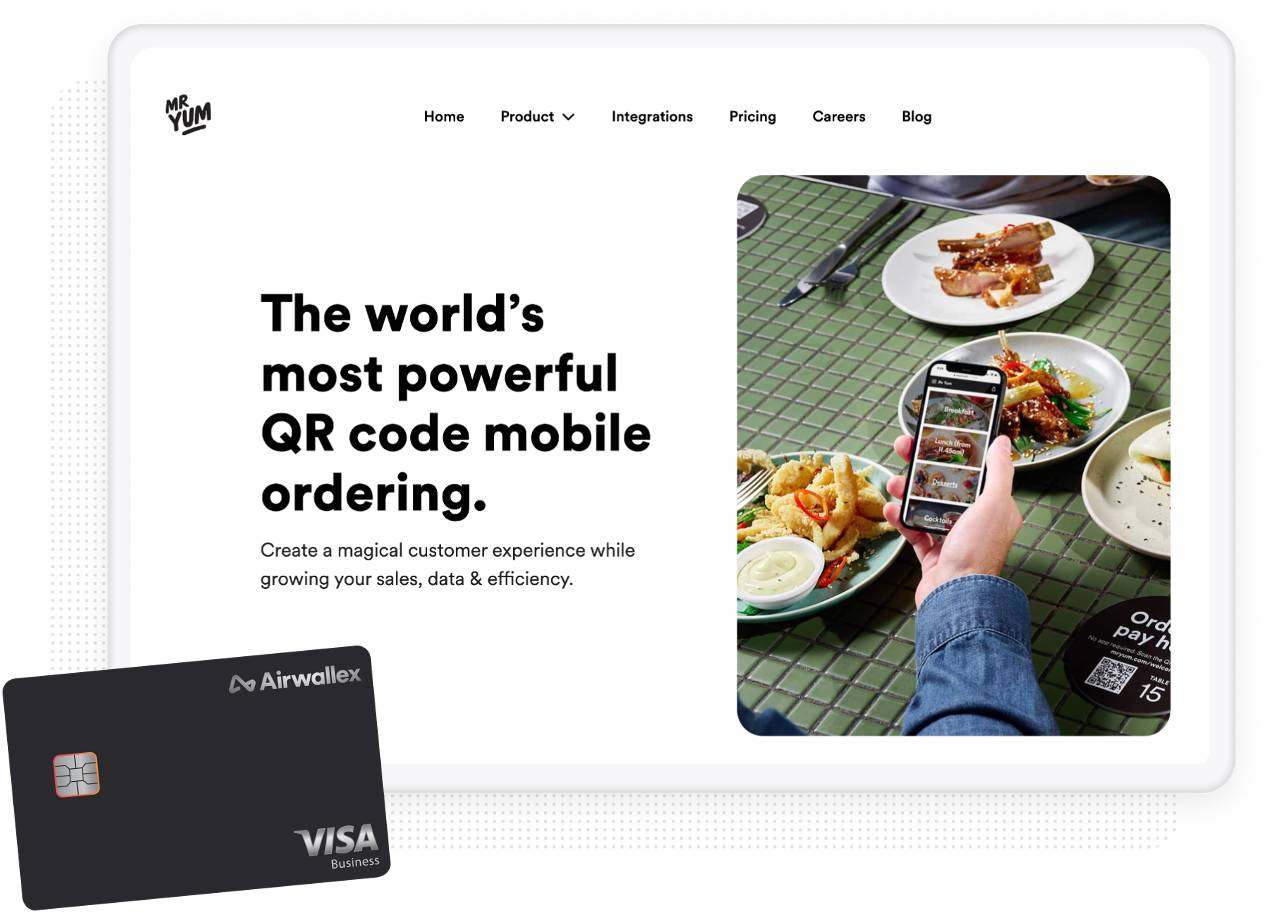

Tech Business Mr Yum goes global with Airwallex

How Mr Yum accelerated international growth by empowering their global team with Airwallex Borderless Cards.

3 months faster

to launch in UK with an Airwallex UK Global Account

$13,200+ AUD

saved per year on USD SaaS spend like Twilio and Cloudflare

70%

savings on international transfer fees for GBP payments

Mr Yum is a technology startup providing mobile menus for restaurants and bars to manage ordering, paying, delivery and pickup.

Industry

Technology

Location

Australia, United Kingdom, United States

Company size

150 – 200 employees

Corey Payne

Financial Controller at Mr Yum

"It is wild to see that kind of technology… it's just one of those ideas where you think, why has this not been done before?"

Helping Melbourne's hospitality industry was just the tip of the iceberg. Across the world, service-based businesses are shifting back towards growth and are looking for help to adapt to new ways customers want to interact with them.

That's why Mr Yum is taking their QR-based mobile menu and delivery technology global, starting first with the UK and US. As they started to set up international growth teams, they faced some challenges. Before meeting Airwallex, it was difficult to find an employee cards and payments infrastructure partner that could keep up with Mr Yum's high growth and big vision.

Airwallex provided a complete business account to seamlessly manage employee expenses with flexible spend controls, multi-currency collections and transfers at market-leading FX rates. To date, Airwallex has helped Mr Yum issue more than 30 cards in just a few clicks, launch in the UK 3 months faster, and save more than $50,000 on international transaction and FX related fees.

1. Empowered international teams to hit the ground running with virtual and physical cards

Problem: In the absence of a scalable employee cards solution, sales teams were out of pocket for ad-hoc expenses as they had to use their personal cards. To get reimbursed, sales teams ended up spending too much time submitting, reconciling expenses. To avoid the administration, some team members did not bother requesting reimbursements.

Corey Payne

Financial Controller

"There is a lot of informal spending like coffee and entertainment but staff were paying for things and then not bothering to claim because it was just too time consuming."

Solution: Mr Yum uses both our virtual and physical multi-currency cards for their sales team. 30+ virtual cards were created instantly and are managed from one platform cutting down issuing time from 2 weeks to 5 mins. Mr Yum's sales teams also have flexibility to request physical cards if they prefer. Corey sets up spending limits on the cards so that Mr Yum employees don’t need to request approvals for smaller expenses and hence reduces time on administration. This empowered sales teams to spend on developing partnership relationships without being out of pocket.

2. Avoid a 3% fee from forced FX conversions back to AUD when using Stripe to collect GBP

Problem: Mr Yum receives payments from customers in the UK in GBP. To receive GBP funds from their UK partners, Mr Yum selected Stripe as their payment gateway. To set up Stripe, Mr Yum needed to connect it to either a local UK bank account (which required a local director to be appointed) or a local AU bank account (which might incur unnecessary international transaction fees). As an Australian business, Mr Yum found it incredibly difficult to set up a local UK bank account.

Corey Payne

Financial Controller at Mr Yum

"To set up business banking in the UK, you must have EU or UK based directors. We don't have that, we've got Australian founders and directors. We are not going to draft in a director that has nothing to do with the story or brand just to open a bank account."

If Mr Yum opted to connect Stripe to a local AU bank account, they would be forced to convert their GBP funds back to AUD upon receiving (unable to hold GBP funds as GBP). This would have incurred forced FX conversion and international transaction fees. Mr Yum would then need to pay their UK partners in GBP, converting their AUD back into GBP. Again incurring FX conversions and international transaction fees.

Solution: Mr Yum was able to create an Airwallex UK Global Account online, in 5 minutes. Omitting the need for local staff and hours of time on admin. By having an Airwallex UK virtual account, Mr Yum could settle, receive and hold GBP funds from Stripe without being forced to convert these funds into AUD. Mr Yum could then use their UK funds, held in GBP to pay their local partners. This eliminated the need to convert AUD back into GBP for payments. Mr Yum saved 3 months and avoided appointing a full-time director to oversee the local UK account. Airwallex helped Mr Yum avoid $3,500 per month from double FX conversions and international transaction fees on all funds collected in the UK.

3. Saved $1,100+ AUD per month on SaaS, advertising, and payroll expenses charged in different currencies

Problem: To build a scalable technology platform and reach more hospitality partners, Mr Yum works with SaaS tools, spends on advertising and pays staff around the world. Some of the spend is charged in USD, and would have exposed Mr Yum to poor FX rates, and incurred hidden international transaction fees.

Yvia Magan-Parker

Account Manager at Mr Yum

"When you start to dig into the 3% fees, it all adds up, especially if you are doing large SaaS subscriptions monthly."

Solution: Using Airwallex, Mr Yum can use cards and make bank transfers to pay off international business expenses out of their Global Account. The Global Account pulls from Mr Yum’s USD wallet to avoid high FX conversion fees, and international transaction fees. This means that Mr Yum is saving $1,100+ per month.

See how our customers are finding Airwallex

"Airwallex have been a fantastic partner for Olsam Group as we grow our eCommerce brands to new channels and new markets. Their easy to use interface and integrations have been a joy for our finance team to use as we scale."

Sam Horbye

Co-Founder, Olsam

"For ME + EM, expanding into international markets such as the US has been our focus - and with Airwallex, we were able to use their local USD Global Account to collect from our Paypal US account, thereby allowing us to save 3% on each transaction. The process of working with Airwallex has been seamless - our suppliers get paid quickly, we have a dedicated Relationship Manager who has been really patient, helpful and quick to respond. I am keen to use their cards to pay for our ad spend in the near future to save further on our USD invoices."

Meera

Finance Manager, ME + EM

"We've had such a fantastic experience switching to Airwallex. Previously we were using a traditional bank to make all of our international transactions and they'd constantly lock us out of the account everytime we made a transfer, resulting in hours and hours of lost time on hold. Airwallex is secure, makes it super quick and simple to make and receive international payments."

Rupert

Managing Director, Perspective Pictures

“We used to pay Stripe between $5,000 and $10,000 a month in conversion fees because most of our customers pay in dollars. Now we funnel that money into our Airwallex US dollar account, we don’t have to pay commission. We’ve saved more than $100,000 so far this year”

Thomas Adams

Founder and CEO, Brandbassador

"We love Airwallex! It has considerably eased our invoicing and payments to contractors around the world. Sending and receiving money is much faster and cheaper than before."

Edle Tenden

Co-Founder, Mobile Transaction

“We are so glad that we have found Airwallex! There are no hidden charges, they are quick to respond to any queries and we had the smoothest transaction with amazing support from the team continually.”

Andreia Beja

Supply Chain Executive, Miss Patisserie

"Our water solutions company, Dropterra (go.dropterra.com) has partnered with Airwallex since inception and it has been the best banking and payment partner a company can think of. International transactions are easy, secure, and fast, the technology is incredible and their client service fantastic! We look forward to growing and deepening our relationship with Airwallex!"

Francois Schramek

Co-Founder, Dropterra

"Before using Airwallex, managing international payments was a time-consuming and fragmented process. We had to rely on multiple tools, each adding unnecessary complexity to our workflow. Since switching to Airwallex, we’ve streamlined our entire payments process, eliminating redundant steps and significantly improving efficiency."

Hans van Mourik

Founder, SurfaWhile