2025 Report: How late payments are costing businesses more than you think

Airwallex Editorial Team

For small business owners, late customer payments have become more than just a routine nuisance, they've become a systemic issue that chips away at the cash flow essential for running a business.

Small businesses represent over 99% of all UK companies and contribute to three-fifths of national employment. Therefore, any issue affecting them inevitably has a ripple effect on the broader economy.

When businesses face cash shortages, they often resort to alternative means to keep operations going, often stretching their already thin cashflow chains to breaking point. Beyond the financial strain, these ongoing delays can take a toll on the team’s morale, inhibit growth opportunities and create a cycle of administrative overload.

Additionally, these late payments make it harder to monitor and manage expenses, again disrupting the cashflow chain and squeezing the profit margins.

To understand the scope of this issue and spotlight its everyday impact on UK businesses, we conducted an in-depth survey exploring the current state of cashflow among small and medium enterprises.

In this article, we’ll share our findings, identify the leading causes behind the cashflow crisis and reveal how businesses are adapting to these challenges to survive in today’s landscape.

About the research

We surveyed 500 SME owners and decision-makers across the UK to better understand the financial pressures they face, particularly around cashflow and how they’re navigating a landscape that’s increasingly being crippled by delayed payments.

What are the main reasons for cashflow crisis among the small business?

A consistent cashflow is the backbone of any business. When a company works to produce the product or service, it expects timely payment in return. That income is then used to pay suppliers, staff and operational costs. However, when payments are delayed or unexpected costs arise, the entire chain gets disrupted, forcing business owners to divert funds, delay investments or seek external financing just to keep the business running.

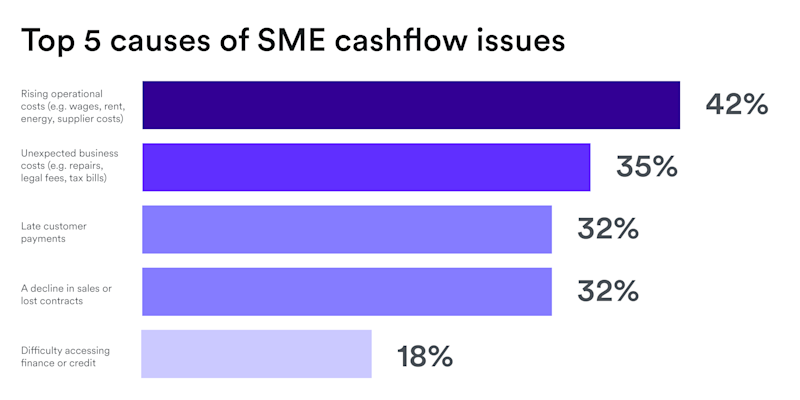

Of those surveyed, 42% admitted to experiencing a ‘cashflow crisis’ due to rise in operational costs such as wages, rent, energy bills and supplier fees.

Late customer payments were reported by almost a third (32.2%) of respondents as a key contributor to their cashflow issues, while 18% said difficulty accessing finance or credit has made them experience the cashflow shortage in running their businesses.

How are SME owners managing the cashflow shortfalls?

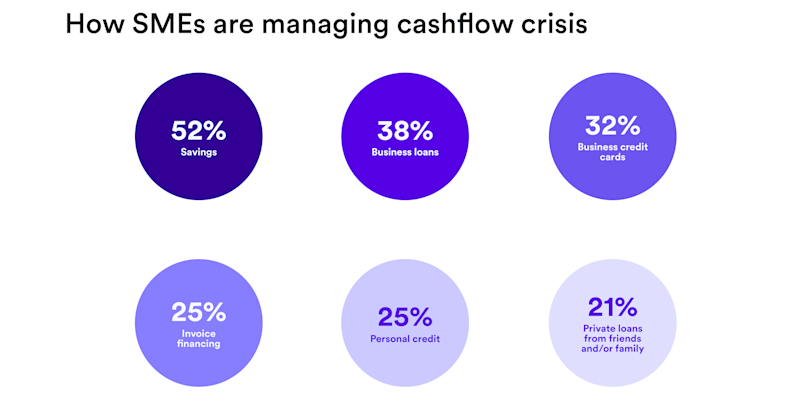

When it comes to managing these cashflow shortfalls, businesses are turning to methods that, although may get them out of the current situation, are unsustainable in the longer run. Over half of SME owners (52.4%) reported dipping into their savings to stay running, indicating how personal and business finances are increasingly being intertwined.

Among businesses earning less than £10,000 annually, this figure jumps even higher, with almost three in five (57%) saying they rely on their own savings to keep going.

Over 38% of businesses said they’ve taken out business loans to cover gaps, while nearly a third (31.8%) are relying on business credit cards, often with high interest rates.

Others have turned to invoice financing (25%) to access cash tied up in unpaid invoices. However, the pressure is also being felt on a personal level, 24.6% have resorted to personal credit, such as loans or credit cards, and one in five business owners have even borrowed money from friends or family to maintain operations.

How much financial loss are late payments causing the businesses?

Late payments have become a costly issue with businesses having to fill the gaps from their own pockets, often amounting to thousands of pounds each year.

According to the data, the average loss reported due to late payments is £2,077 every month – equating to nearly £25,000 annually. Worryingly, more than one in 10 (12%) businesses reported losing over £4,000 monthly because of delayed invoices, which means almost a £50,000 loss for those SME owners.

For businesses with a monthly revenue between £50,000 and £100,000, the average monthly loss climbs to £2,279, while for those earning between £100,001 and £250,000, it’s an average of £2,143 per month.

When it comes to invoices, only 19% of respondents said that all their invoices are paid on time. The rest are regularly chasing payments, with nearly 32% saying up to 10% of their invoices are paid late and a further 29% reporting delays on 11–25% of their invoices. On average, SMEs report that 15% of all invoices are paid late.

What are SMEs doing to tackle the issue?

To manage the growing burden of late payments, SMEs are having to become increasingly proactive. While 14% of respondents said they never face overdue invoices, the vast majority do. Over a third (34%) said they occasionally need to chase a few overdue invoices each year and almost a fifth (19%) deal with at least one late payment every month.

Time is another hidden cost. On average, SMEs spend over three hours per month chasing payments. A majority, almost three in five (58%), of the respondents reported spending one to five hours monthly on this task, while nearly one in five (18%) said it takes them six–10 hours per month.

When it comes to the strategies businesses use to recover overdue payments, the most common approach is a polite but persistent follow-up, with nearly 58% saying they send reminders and follow-up with calls or emails. Around one-third (34.6%) offer payment plans or revised terms and 33% enforce late payment fees or interest charges to encourage faster settlement. More serious action is also taken in some cases, with nearly almost a quarter (23%) resorting to legal action and 22% using collections agencies. Worryingly, 14% end up writing off unpaid invoices, while 5% admit they don’t have a formal process in place at all.

How Airwallex offers a solution to solve the cashflow crisis due to late payments?

For SMEs struggling with late payments and tight cashflow, Airwallex offers a practical solution. By providing multi-currency accounts, Airwallex enables businesses to receive and make payments in local currencies, helping them sidestep FX fluctuations and reduce unnecessary conversion fees. This is especially beneficial for companies with international clients or suppliers, allowing them to maintain smoother cashflow across borders.

In addition, Airwallex’s real-time expense tracking, borderless payment capabilities, and automated reconciliation tools help finance teams stay in control, freeing up time spent chasing paperwork and improving visibility over outgoing payments. For SMEs navigating delayed income, having a centralised platform to manage spend and pay suppliers efficiently can make a meaningful difference in preserving margins and keeping operations running smoothly.

Methodology

The research was conducted by Censuswide, among a sample of 500 UK SME business owners/leaders (aged 18+). The data was collected between 11.04.24 -14.04.25.

Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

View this article in another region:AustraliaHong Kong SAR - EnglishHong Kong SAR - 繁體中文

Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

Share

- What are the main reasons for cashflow crisis among the small business?

- How are SME owners managing the cashflow shortfalls?

- How much financial loss are late payments causing the businesses?

- What are SMEs doing to tackle the issue?

- How Airwallex offers a solution to solve the cashflow crisis due to late payments?